Comprehensive Analysis of Leading US Giants in the Prepaid Cards Market

07-Oct-2024

The global prepaid card industry estimated to cross the mark of USD 61.46 billion by 2030, nearly doubling in value from 2024 to 2030. This anticipated growth is driven by several factors, including the rising adoption of digital payment methods as a secure and convenient alternative to cash, and the increasing emphasis on achieving financial inclusion through the use of prepaid cards.

Prepaid Card Market Overview

The prepaid card market refers to the sector that deals with financial cards that function similar to traditional credit or debit cards, but with a specific amount of funds pre-loaded onto them. These cards are used for a variety of transactions, including online purchases, in-store payments, and ATM withdrawals. They are favoured due to their convenience, security, and the ability to control spending by limiting transactions to the amount loaded on the card. Prepaid cards come in several forms, such as gift cards, travel cards, and payroll cards, and are increasingly used for both personal and business needs.

The market for prepaid cards is expanding due to the growing acceptance of digital payment methods and the rising need for financial inclusion. Integration with e-commerce platforms and online marketplaces is creating significant growth opportunities by enhancing the shopping experience. Prepaid cards facilitate global transactions and international purchases, helping to overcome currency barriers. Additionally, innovations such as contactless payments and mobile wallets are making prepaid cards more accessible and user-friendly, driving continued demand and innovation in the sector.

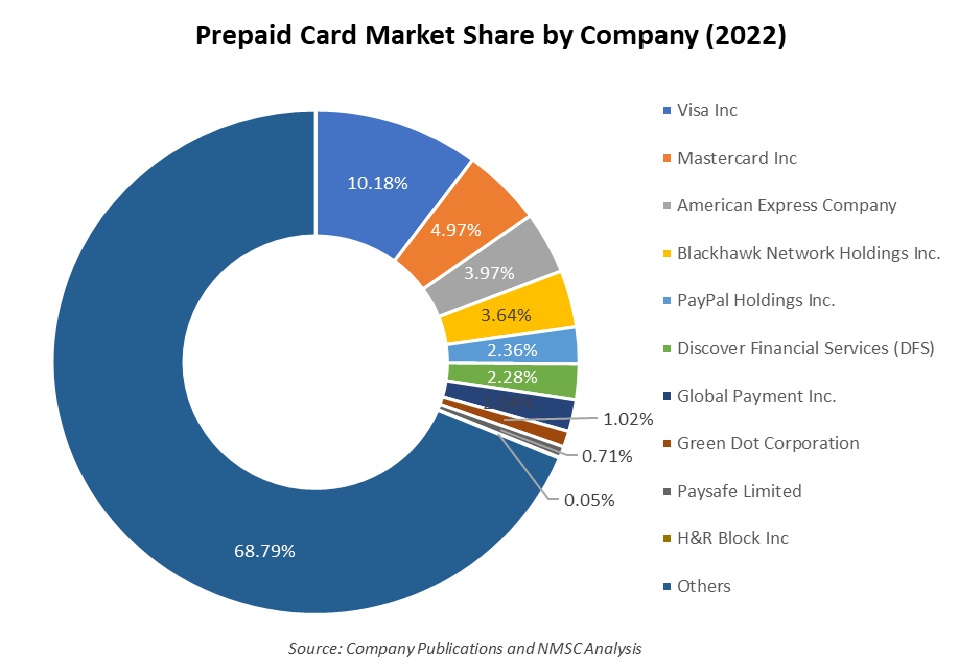

Top players in the prepaid card industry includes American Express Company, PayPal Holdings Inc., Mastercard Inc., Visa Inc., Global Payments Inc., Discover Financial Services (DFS), H&R Block Inc., Blackhawk Network Holdings Inc., Paysafe Limited, Green Dot Corporation, and others.

For the latest market share analysis and in-depth prepaid card industry insights, you can reach out to us at: https://www.nextmsc.com/prepaid-card-market/request-sample

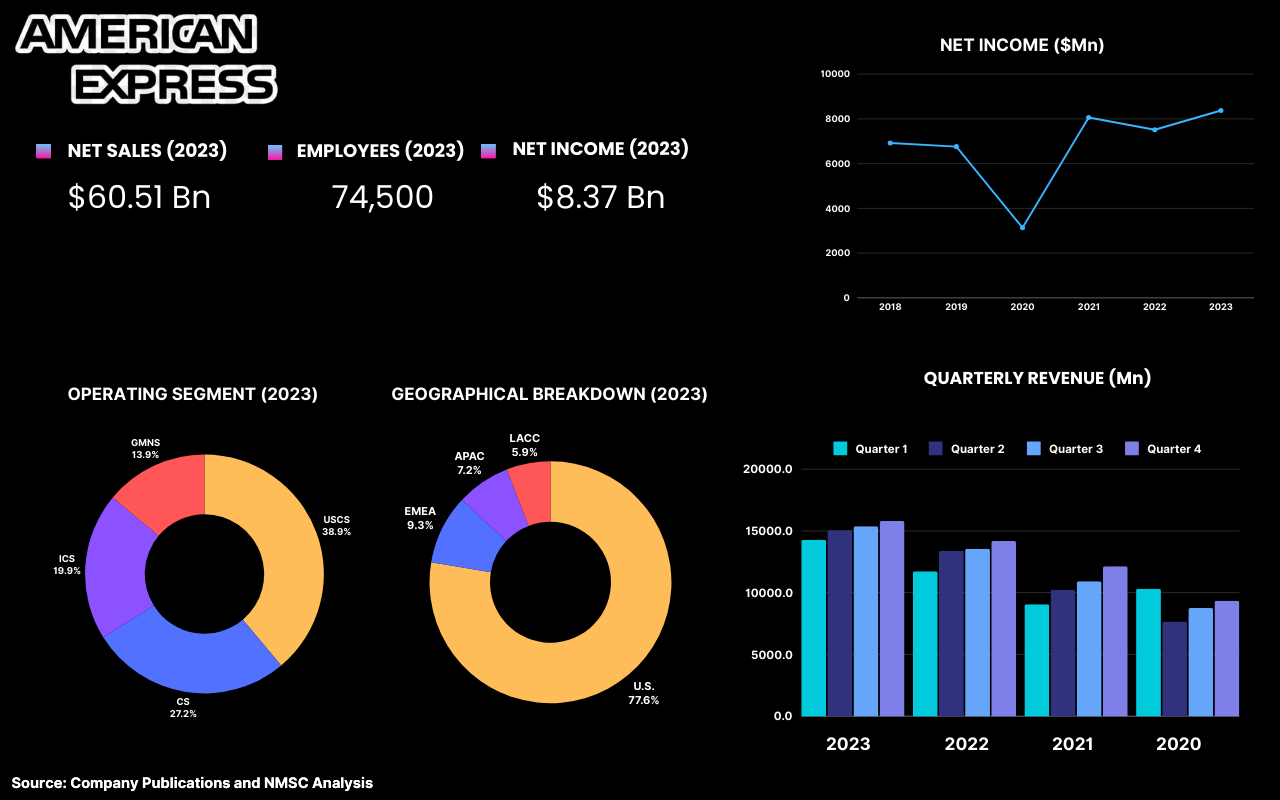

HIGHLIGHTS OF AMERICAN EXPRESS COMPANY

American Express Company (Amex) is an American multinational financial services corporation headquartered in New York City. The company issues and processes prepaid, charge, and credit cards to individuals, small businesses, and corporate consumers globally. Amex is the fourth-largest card network worldwide based on purchase volume, following China UnionPay, Visa, and Mastercard. As of December 2023, Amex had 141.2 million cards in force with an average annual spend per card member of USD 24.06 billion.

In 2023, Amex generated total revenue of USD 60.51 billion, up from USD 52.86 billion in 2022 and USD 42.38 billion in 2021, reflecting a 43% increase from 2021. Approximately 22% of the company's revenue in 2023 came from activities outside the U.S. The company is exposed to foreign exchange risk from its international operations subject to unpredictable fluctuations of the currencies that pose an adverse effect on its results. Net card fees received by the company were USD 7.26 billion, a 20% increase from 2022, driven by growth in premium card portfolios. This increase in net card fees reflects high levels of new card acquisition and card member retention. Additionally, income from operating activities was USD 18.5 billion in 2023, compared to USD 21.1 billion in 2022 and USD 14.6 billion in 2021. The company's continuous business momentum over the last few years resulted in an annual net income of USD 8.37 billion in 2023, an 11% increase from 2022. This above overview of the American Express Company, reflects the crucial role played by the company in the prepaid card industry.

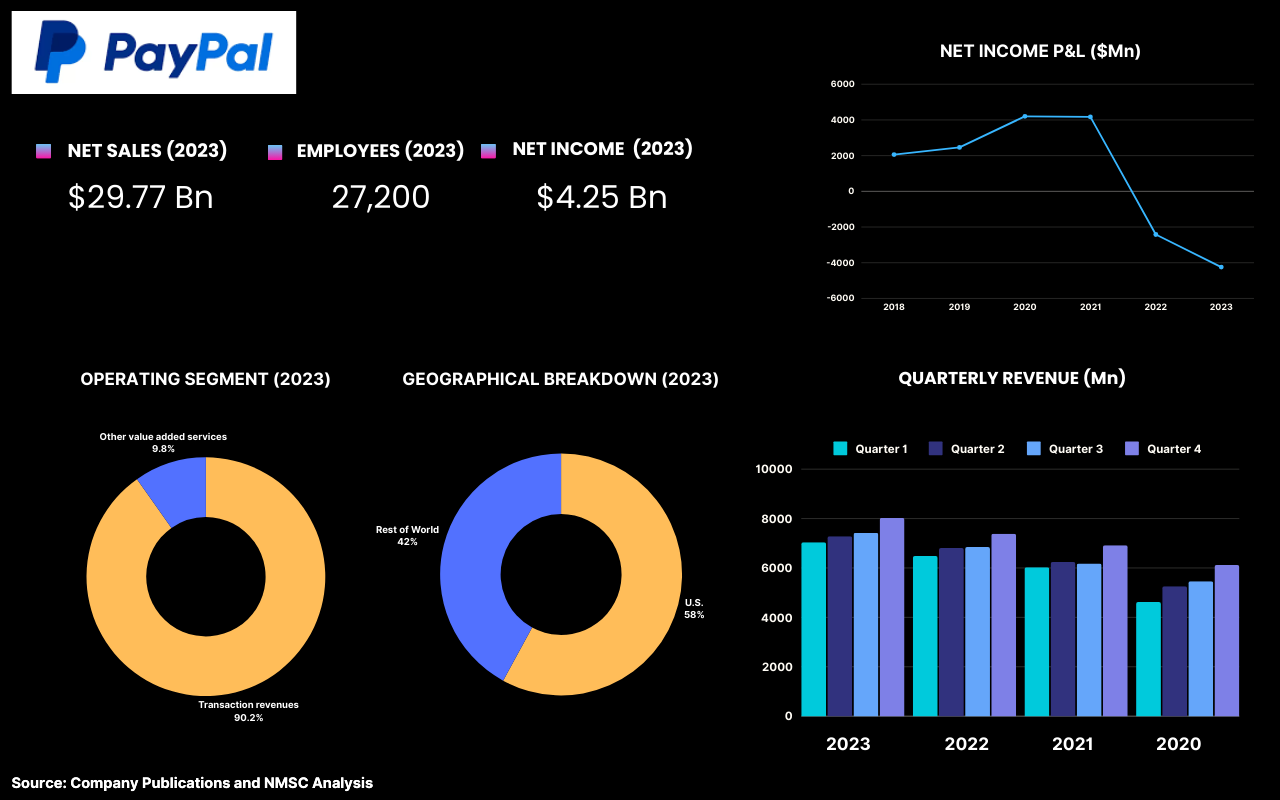

HIGHLIGHTS OF PAYPAL HOLDINGS, INC.

PayPal Holdings, Inc. is a global company that operates in approximately 200 markets around the world. As of December 31, 2023, the company employed around 27,200 people globally, with approximately 38% based in the U.S. and 62% based outside the U.S. As a digital payments company, PayPal offers a range of prepaid card products, including the PayPal Prepaid Mastercard and PayPal Prepaid Visa Card. These cards allow users to make purchases, withdraw cash, and manage their money digitally without needing a traditional bank account. PayPal's prepaid cards are particularly popular among the unbanked and underbanked populations, providing them access to digital financial services. The company is expanding its prepaid card offerings to drive financial inclusion and complement its core online payments business.

Net sales generated by the company stood at USD 29.77 billion, USD 27.52 billion, and USD 25.37 billion in 2021, 2022, and 2023, respectively. This represents an increase of USD 2.3 billion, or 8%, in 2023 compared to 2022, driven primarily by a 13% growth in total payment volume. Total operating expenses of the company increased by USD 1.1 billion, or 4%, in 2023 compared to 2022, mainly due to higher transaction expenses. The company witnessed an operating income of USD 5.02 billion, an increase of USD 1.2 billion, or 31%, in 2023 compared to 2022. Additionally, net income increased by USD 1.8 billion, or 76%, in 2023 compared to 2022. This substantial growth was primarily due to profits from strategic investments, contrasting with the losses and impairments experienced in the previous year. Furthermore, the company benefited from higher interest earnings driven by increased interest rates. This brief overview of PayPal highlights the important role played by it in the prepaid card industry.

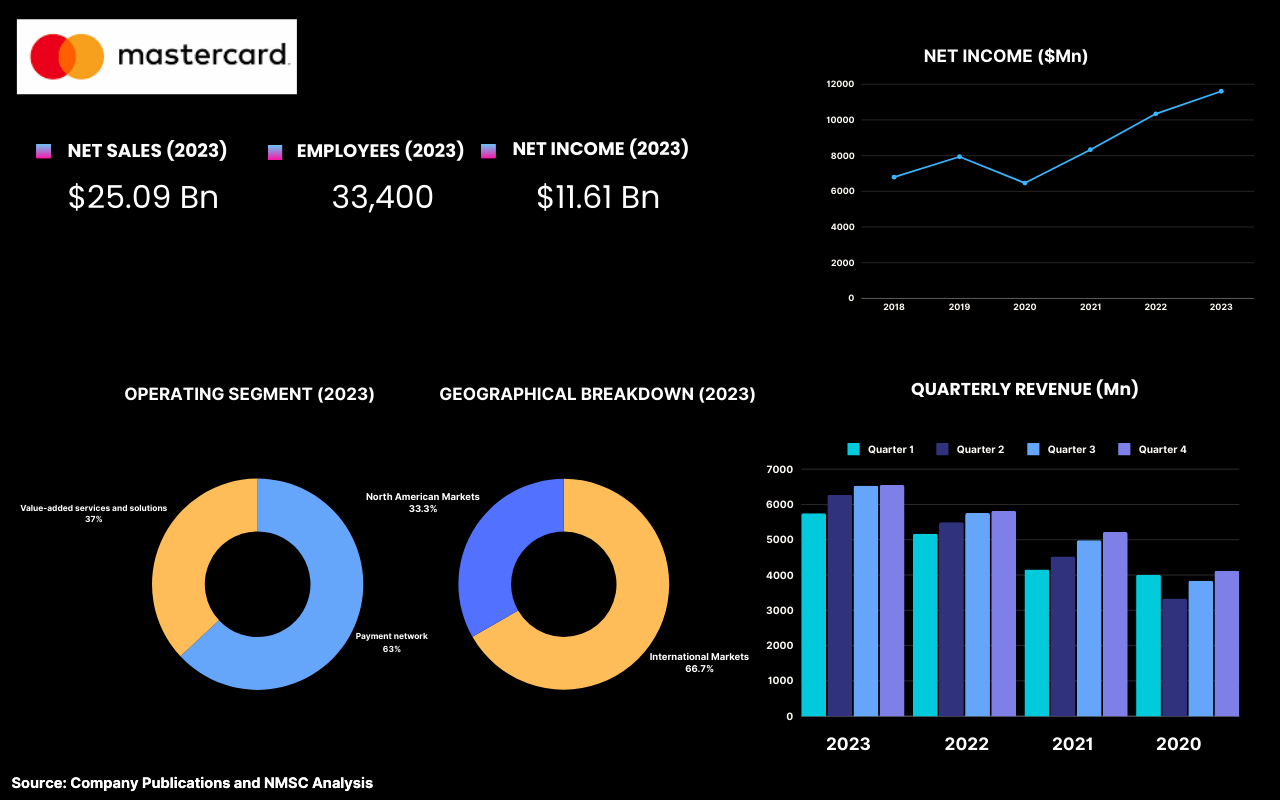

HIGHLIGHTS OF MASTERCARD INC.

Mastercard Incorporated is an American multinational payment technology company headquartered in Purchase, New York. Founded in 1966, the company processes electronic payments for credit, debit, and prepaid cards through its extensive network. Mastercard does not issue cards directly, instead, it partners with financial institutions and other organizations to provide payment solutions globally. The company is recognized for its innovative approach to digital payments and its commitment to enhancing financial inclusion worldwide.

In 2023, the company generated total revenue of USD 25.09 billion, a 33% increase since 2021. Approximately 70% of this revenue came from activities outside the U.S. This increase in net revenue is due to the growth of the payment network and the expansion of value-added services and solutions. Additionally, the company witnessed an operating income of USD 14.01 billion in 2023, USD 12.26 billion in 2022, and USD 10.08 billion in 2021.

In May 2024, Mastercard collaborated with Berhan Bank to launch a co-branded prepaid card designed to revolutionize online international transactions, enabling customers to perform digital payments anytime, anywhere. Furthermore, in the same month, Mastercard partnered with Bangladesh's Eastern Bank PLC (EBL) to introduce Bangladesh's first prepaid card for medical tourism, simplifying access to healthcare in India for Bangladeshi patients by offering a secure and convenient payment solution. This reflects the company's strong financial performance and its commitment to foster digital payment solutions in emerging markets.

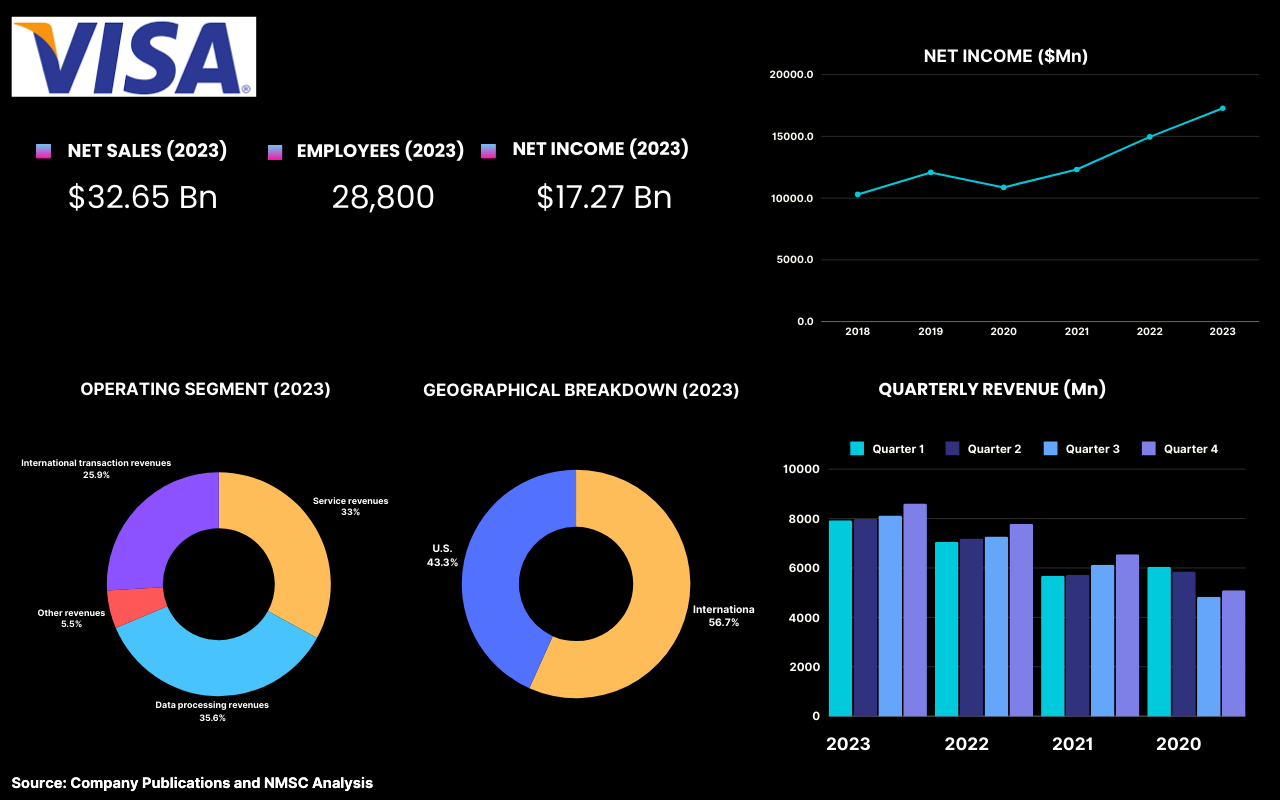

HIGHLIGHTS OF VISA INC.

Visa Inc. is an American multinational payment card services corporation based in San Francisco, California. The company provides a wide range of prepaid products, including gift cards, travel cards, and reloadable prepaid debit cards. These prepaid cards offer users a simple and flexible payment method, allowing them to make purchases online and in-store without needing a traditional bank account. Visa’s prepaid cards are globally accepted, making financial services more accessible to unbanked and underbanked populations.

The company experienced an increase in revenue from USD 24.11 billion in 2021 to USD 32.65 billion in 2023. This growth is driven by increasing payment volumes, processed transactions, and cross-border transactions facilitated by Visa’s extensive network. The company operates across more than 200 countries and territories, connecting consumers, merchants, financial institutions, and government entities through its innovative payment technologies.

However, external factors such as global health crises, political uncertainties, and climate-related events impacts its operations. For example, the ongoing geopolitical tensions, including the Russia-Ukraine war, have affected Visa's revenue, with a decrease in net revenues from Russia due to suspended operations. For fiscal 2022 and 2021, total net revenues from Russia, including revenues driven by domestic as well as cross-border activities, were approximately 2% and 4% of company’s consolidated net revenues. Despite these challenges, Visa experienced a notable increase in net income, rising from USD 12.31 billion in 2021 to USD 17.27 billion in 2023, marking a 40% surge compared to 2021. This reflects Visa’s strong performance and ongoing commitment to enhancing digital payment solutions and supporting financial inclusion worldwide.

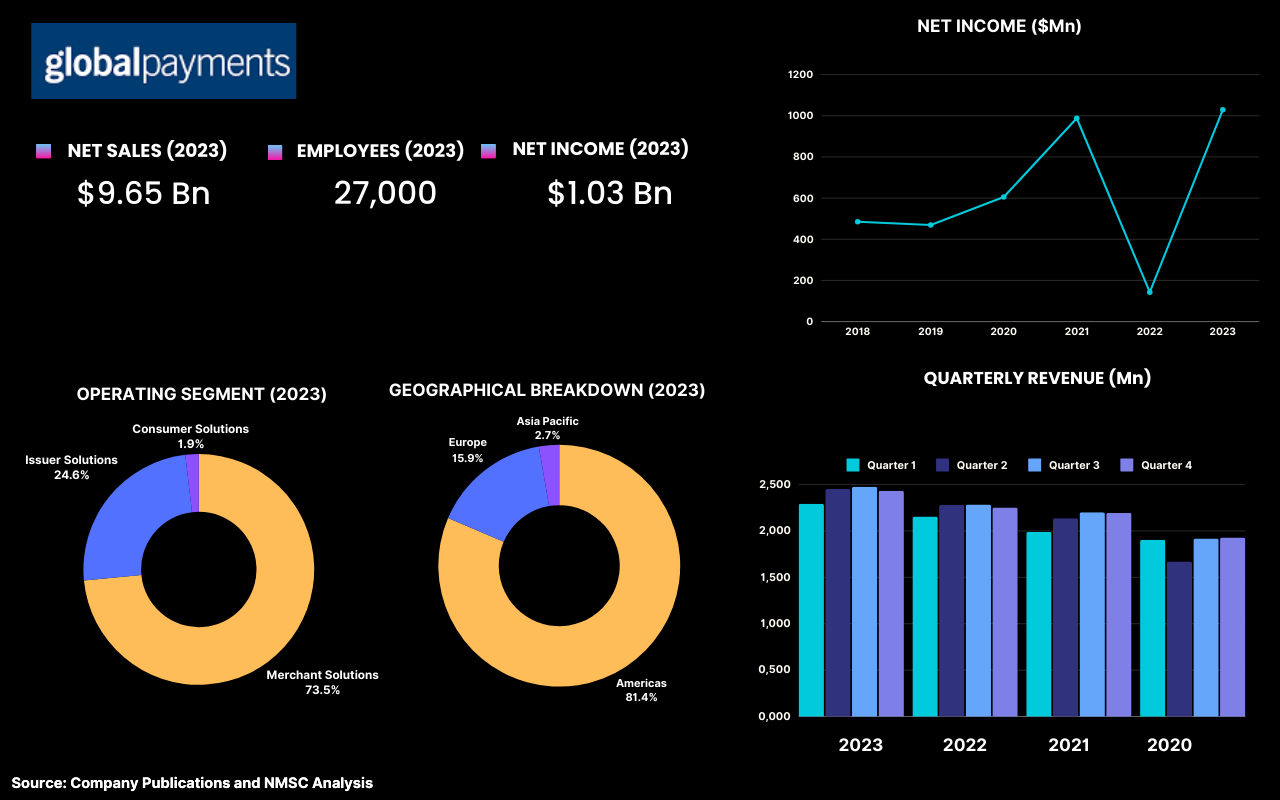

HIGHLIGHTS OF GLOBAL PAYMENTS INC.

Global Payments Inc. is a payment technology company delivering innovative software and services to customers globally. The company’s technologies, services, and team member expertise enable them to provide a broad range of solutions, helping customers operate more efficiently across various channels worldwide. Global Payments, headquartered in Georgia and employing approximately 27,000 team members, is a Fortune 500 company and a member of the S&P 500, with a reach spanning across North America, Europe, Asia Pacific, and Latin America. Global Payments is traded on the New York Stock Exchange under the symbol "GPN."

The company operates in two reportable segments, those are merchant solutions and issuer solutions. Through its merchant solutions segment, Global Payments provides payments technology and software solutions to customers globally. The issuer solutions segment offers financial institutions and other financial service providers tools to manage their card portfolios, reduce technical complexity and overhead, and deliver a seamless experience for cardholders on a single platform.

The company faces risks from interest rate or currency exchange rate changes, cybersecurity threats, and technological risks that harm its service delivery, reputation, and financial stability, leading to penalties, fines, liabilities, and legal claims. Additionally, these risks jeopardize its card network registration, membership, and financial institution sponsorship.

For the year ended December 2023, the company reported an operating income of USD 1.71 billion, compared to USD 640.2 million for the prior year. Net income figures from 2018 to 2023 stood at USD 485 million, USD 469 million, USD 605 million, USD 988 million, USD 143 million, and USD 1,029 million, respectively. This demonstrates the company's significant role and strong financial performance in the prepaid card industry.

Have questions? Inquire before purchasing the full report: https://www.nextmsc.com/prepaid-card-market/inquire-before-buying

SUMMARY OF PREPAID CARD INDUSTRY

The prepaid card market is characterized by a range of products designed to cater to various consumer needs, including gift cards, travel cards, and reloadable prepaid debit cards. These cards offer a convenient and flexible payment method, enabling users to make purchases and manage finances without necessitating a traditional bank account. The market is experiencing significant growth due to the rising demand for financial services among unbanked and underbanked populations. Despite challenges such as global health crises, political uncertainties, and geopolitical tensions, the prepaid card market continues to expand, driven by innovations in digital payment technologies.

About The Author

Sreeparna Das is a researcher with over two years of experience specializing in market trend analysis, trend forecasting, and competitive analysis across various industries. She has worked on many comprehensive reports while offering actionable recommendations that help businesses make informed decisions, ensuring clients stay ahead in their respective markets. With a keen interest in writing, she shares her insights through blogs and articles. She spends her time in reading, cooking and photography when not keeping up with industry news. The author can be reached at info@nextmsc.com

Sreeparna Das is a researcher with over two years of experience specializing in market trend analysis, trend forecasting, and competitive analysis across various industries. She has worked on many comprehensive reports while offering actionable recommendations that help businesses make informed decisions, ensuring clients stay ahead in their respective markets. With a keen interest in writing, she shares her insights through blogs and articles. She spends her time in reading, cooking and photography when not keeping up with industry news. The author can be reached at info@nextmsc.com

Add Comment

Related Blogs

Key Companies Holds the Market Share of Around 50 percentage in Electric Shaver Industry – Here is why

The global electric shaver market is growing at a compound a...

Discover How Allstate and AXA Are Powering the Growth of the Extended Warranty Industry

According to NMSC analysis, the global extended warranty mar...

Cutting-Edge Innovations Revolutionizing the Air Coolers Industry

Introduction In the ever-evolving landscape of home appli...