Cone-Beam Computed Tomography (CBCT) Systems Market by Patient Position (Seated, Supine, and Standing), by Detector Type (Image Intensifier and Flat-Panel Detector), by Field of View (Small FOV Systems, Medium FOV Systems, and Large FOV Systems), by Application (Dental, ENT Applications, Orthopedic Conditions, Neural & Spine, Lung Cancer, and Veterinary) and by End User (Dental Clinics, Hospitals, and Others) – Global Opportunity Analysis and Industry Forecast, 2023–2030

Industry: Healthcare | Publish Date: 16-Aug-2023 | No of Pages: 375 | No. of Tables: 287 | No. of Figures: 256 | Format: PDF | Report Code : N/A

Market Definition

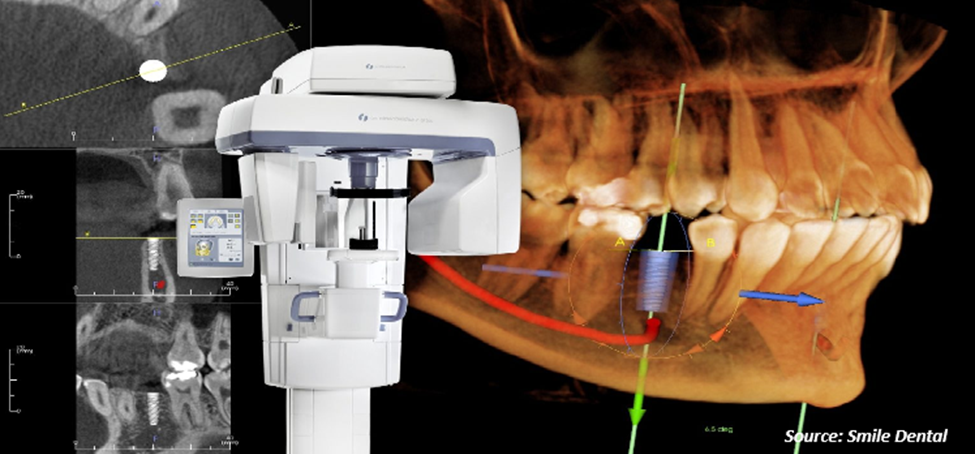

The global Cone-Beam Computed Tomography (CBCT) Systems Market size was valued at USD 1.34 billion in 2022, and is predicted to reach USD 3.45 billion by 2030, with a CAGR of 11.7% from 2023 to 2030. CBCT, also known as C-arm CT, cone beam volume CT, flat panel CT, or Digital Volume Tomography (DVT), is a specialized medical imaging technique used to create 3D images of various structures within the human body. It utilizes a cone-shaped X-ray beam that rotates around the patient, capturing a series of 2D X-ray images from different angles.

A computer then reconstructs these images to generate detailed 3D representations of the scanned area. CBCT technology is commonly used in dentistry, oral and maxillofacial surgery, and orthodontics, providing a comprehensive view of the teeth, jaws, facial bones, and surrounding tissues. By capturing images with high spatial resolution and minimal distortion, CBCT allows healthcare professionals to visualize anatomical structures with great precision and accuracy.

The advantages of CBCT over traditional medical imaging techniques, such as conventional X-rays or CT scans, include lower radiation exposure, shorter scan times, and the ability to produce high-quality 3D images. This technology enables healthcare providers to plan and perform complex dental and surgical procedures more effectively than before, facilitating accurate diagnosis, treatment planning, and evaluation of treatment outcomes. Thus, CBCT is an advanced imaging technique that employs cone-shaped X-ray beams and computer algorithms to generate detailed three-dimensional images of the human body for improved diagnosis and treatment planning.

Rise in the Occurrence of Oral Health Diseases Drives the Market Growth

The increasing prevalence of oral diseases such as dental caries, oral infections, and others leads to the adoption of CBCT in dental clinics. According to the World Health Organization (WHO) report published in March 2023, it is estimated that oral diseases affected nearly 3.5 billion people, with 3 out of 4 people affected were from the middle-income countries. Globally, it is estimated that nearly 2 billion people are affected by caries of permanent teeth and nearly 514 million children are affected by caries of primary teeth.

Thus, the rising cases of oral health have led individuals to seek advanced diagnostic and treatment solutions. CBCT technology, with its ability to provide detailed 3D imaging of the oral and maxillofacial region, has become an invaluable tool in dentistry. By offering enhanced visualization and assessment of dental structures, CBCT scans enable accurate diagnosis, precise treatment planning, and improved treatment outcomes. This has resulted in a growing demand for CBCT scans as oral health professionals recognize the value of incorporating this technology into their practice. The focus on oral health and the benefits offered by CBCT has thus contributed to the expansion of the CBCT market, driving its growth in recent years.

Expanding Utilization of CBCT in Multiple Medical Conditions Leads to Market Growth

The application of CBCT in orthopedics, lung cancer, and brain tumors is rising significantly, which contributes to the increased demand for CBCT technology. Orthopedics carries out the diagnosis and treatment of musculoskeletal disorders, and CBCT has become an invaluable tool in this field as it allows orthopedic specialists to obtain comprehensive and accurate visualizations of the affected areas. For instance, CurveBeam introduced a cutting-edge bilateral weight-bearing CT imaging solution named the HiRise. This solution provides precise 3D images of the hip joint in a weight-bearing position. This innovative technology enhances diagnostic accuracy and improves patient care in orthopedics.

Moreover, the rising cases of lung cancer have significantly heightened the demand for CBCT in the medical field. According to World Cancer Research Fund International (WCRF), lung cancer ranks the second-most prevalent cancer globally, the leading cancer type among men, and the second-most common among women. In the year 2020, there were over 2.2 million newly reported cases of lung cancer. In addition, the rising application of CBCT in diagnosing a brain tumor is further boosting the growth of the market. For instance, Hitachi offers two advanced cancer treatment systems for diagnosing brain cancer. The Proton Therapy System PROBEAT Series uses high-energy protons to target tumor cells, while the Heavy-ion Therapy System HyBEAT utilizes charged nuclei to treat resistant cancers. These innovations aim to enhance cancer care globally.

Surge in the Geriatric Population Propels the CBCT Market Growth

The geriatric population refers to individuals aged 65 years and above. This demographic group is increasing in many countries due to factors such as improved healthcare, better nutrition, and advancements in medical treatments. According to the report published by the World Health Organization, in October 2022, the number of people above 60 reached 1.4 billion in 2020, which is anticipated to reach 2.1 billion by 2050.

With aging, dental and oral health issues, such as periodontal disease, dental caries, and oral cancers, increase. These conditions often require accurate and detailed imaging for diagnosis and treatment planning. So, the growing geriatric population worldwide and their oral health issues are driving the CBCT market growth.

High Cost of CBCT Machines to Hinder the Market Growth

The high cost of CBCT machines is a significant restraint for the CBCT market growth. The initial investment required for acquiring CBCT machines is substantial, which can be deterrent for healthcare facilities, particularly smaller clinics or practices with limited budgets. The high cost includes the purchase of the machine itself along with installation, maintenance, and training costs. The financial burden associated with CBCT machines can limit their adoption, especially in regions with resource constraints or healthcare settings with tight budget allocations. This can restrict the availability and accessibility of CBCT technology, hindering its widespread implementation in various healthcare facilities.

Integration of AI in CBCT Software to Create New Opportunities

The integration of artificial intelligence (AI) technology in CBCT software has the potential to revolutionize the field of imaging and significantly enhance the capabilities of CBCT technology. With AI algorithms, CBCT software can analyze and interpret images more precisely and efficiently than before. These algorithms can be trained to automatically detect and segment anatomical structures, lesions, and abnormalities. This factor will provide valuable insights to clinicians. By automating these tasks, AI integration can save time and improve diagnostic accuracy, ultimately leading to more effective treatment planning.

Additionally, AI-powered CBCT software can simulate and visualize treatment outcomes, enabling clinicians to plan better and communicate treatment options to patients. Integrating AI in CBCT software offers new possibilities for personalized and optimized patient care, whether it is virtual implant placement, orthodontic treatment simulations, or surgical planning. It holds the promise for streamlining workflows, reducing manual labor, and enhancing the overall efficiency and precision of CBCT imaging in various medical and dental applications.

Asia-Pacific is Projected to Dominate the CBCT Industry

The increasing dental healthcare expenditure in the region is due to the growth of the economy and rising disposable income. There has been a greater emphasis on oral health. This has led to surge in investments in dental healthcare infrastructure, including implementing advanced technologies such as CBCT. The presence of key players such as Hefei Meyer Optoelectronic Technology, Inc., LargeV Instrument Corp., Vatech Co., Ltd., Genoray Co. Ltd., and others in this region drives the growth of the CBCT industry. For instance, in October 2022, LargeV Instrument Corp. Ltd. launched its innovative Ultra3D dual-source ENT CBCT system. This advanced medical imaging device received approval from the National Medical Products Administration (NMPA) in China. The new innovative medical devices can be used for X-ray inspections in Ear Nose Throat (ENT), stomatology, and maxillofacial surgery applications.

The aging population, which is more susceptible to oral and orthopedic diseases, is driving the growth of the market in this region. As people age, they are more likely to develop dental problems such as dental caries, gum disease, and oral cancer. CBCT scans can be used to diagnose and treat these conditions and improve the quality of life for older adults. For instance, in terms of the population of people aged 65 years and above, Japan holds the leading position globally with the total number of 36.21 million, constituting 28.9% of the total population. It surpasses Italy, which holds the second place with 24.1% of the total population. Finland holds the third place with 23.3%. The male elderly population in Japan amounts to 15.74 million individuals, constituting 26.0% of the total male population. Similarly, the female elderly population reaches 20.53 million, representing 32.0% of the overall female population.

North America to Witness a Substantial Growth in the Market

The rising government initiatives regarding dental health and high expenditure on healthcare propel the growth of the North American CBCT market. In addition, the key players such as Dentsply Sirona, Curve Beam AI, Dexis LLC, and others are introducing various products related to CBCT, further boosting the growth of the market. For instance, in October 2022, Dexis LLC announced the launch of its new intraoral scanning portfolio that includes three distinct scanning devices, each designed to cater to different clinical needs and preferences. These innovative intraoral scanners offer enhanced accuracy, ease of use, and advanced features. They enable dental professionals to streamline their workflows and deliver precise treatment planning and outcomes.

Moreover, the growing R&D activities in this region regarding dental implants are leading to an increased need for CBCT systems in the country. For instance, in November 2022, ZimVie, Inc. launched the TSX Implant in the U.S. This is the latest innovation in the company’s surgical, restorative, and digital dentistry solutions platform. TSX Implants involve rapid extraction and loading protocols, placement predictability, and primary stability in soft and dense bones.

In addition, the adoption of various business strategies among the key CBCT players, such as Dentsply Sirona, Curve Beam AI, and others, in this region propels the growth of the industry. For instance, in September 2022, CurveBeam, and StraxCorp Pty. Ltd. entered a definitive merger agreement to form CurveBeam AI Limited. In partnership with StraxCorp, CurveBeam implementing the resolution of its InReach cone beam CT imaging system to assess bone microstructure in distal extremities. The InReach HR-pQCT (high-resolution peripheral quantitative CT) offers a resolution up to 80 microns for determining trabecular density and cortical porosity. This solution takes HR-pQCT in the point of care setting for enhancing the bone fragility assessment.

Competitive Landscape

Various market players operating in the CBCT industry include Dentsply Sirona, Koninklijke Philips N.V.,Vatech Co., Ltd, Envista Holdings, Planmeca OY, J. Morita Mfg. Corp., Cefla S.C., Hefei Meyer Optoelectronic Technology INC, Xoran Technologies LLC, Acteon Group, Hitachi Ltd., Genoray Co Ltd, Asahi RoEntgen Ind. Co. Ltd., OSSTEM IMPLANT CO., LTD., Largev Instrument Corp. Ltd. These market players are adopting strategies such as collaboration and product launches across various regions to maintain their dominance in the global market.

For instance, in May 2023, Planmeca OY unveiled a range of product innovations at IDS 2023. The company showcased its latest advancements, including digital intraoral sensors, 2D and 3D imaging systems, dental chairs, CAD/CAM solutions, and software. These cutting-edge products aim to enhance the dental experience, improve diagnostic capabilities, and optimize workflow efficiency for dental professional.

CBCT Systems Market Segments

By Patient Position

-

Seated

-

Supine

-

Standing

By Detector Type

-

Image Intensifier

-

Flat-Panel Detector

By Field of View

-

Small FOV Systems

-

Medium FOV Systems

-

Large FOV Systems

By Application

-

Dental

-

ENT applications

-

Orthopedic Conditions

-

Neural & Spine

-

Lung Cancer

-

Veterinary

By End User

-

Dental Clinics

-

Hospitals

-

Others

By Geography

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

Denmark

-

Finland

-

Norway

-

Sweden

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Taiwan

-

Thailand

-

Singapore

-

Rest of Asia-Pacific

-

-

Rest of the World (RoW)

-

Latin America

-

Middle East

-

Africa

-

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2022 |

USD 1.34 Billion |

|

Revenue Forecast in 2030 |

USD 3.45 Billion |

|

Growth Rate |

CAGR of 11.7% from 2023 to 2030 |

|

Analysis Period |

2022–2030 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

Rise in the occurrence of oral health diseases Expanding utilization of CBCT in multiple medical conditions |

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

KEY PLAYERS

-

Dentsply Sirona

-

Koninklijke Philips N.V.,

-

Vatech Co., Ltd

-

Envista Holdings

-

Planmeca OY

-

J. Morita Mfg. Corp.

-

Cefla S.C.

-

Hefei Meyer Optoelectronic Technology INC

-

Xoran Technologies LLC

-

Acteon Group

-

Hitachi Ltd.

-

Genoray Co Ltd

-

Asahi RoEntgen Ind. Co. Ltd.

-

OSSTEM IMPLANT CO., LTD.

-

Largev Instrument Corp. Ltd

Speak to Our Analyst

Speak to Our Analyst