Europe Tactile Sensor Market by Type (Resistive Tactile Sensors, Capacitive Tactile Sensors, Piezoelectric Tactile Sensors, Optical Tactile Sensors, and Others), by Application (Robotics, Computer Hardware, Security System, Touch Screens, Medical Devices, Handheld Devices, and Others), and by Industry Vertical (Automotive, Robotics and Automation, Aerospace and Defense, Consumer Electronics, Healthcare, and Other Industry) – Global Opportunity Analysis and Industry Forecast, 2024–2030

Industry: Semiconductor & Electronics | Publish Date: 20-Jul-2024 | No of Pages: 326 | No. of Tables: 218 | No. of Figures: 163 | Format: PDF | Report Code : N/A

Market Overview

The Europe Tactile Sensor Market size was valued at USD 716.7 million in 2023 and is predicted to reach USD 1225.7 million by 2030, with a CAGR of 7% from 2024 to 2030. In terms of volume the market size was 266 million units in 2023 and is projected to reach 567 million units in 2030, with a CAGR of 10.4% from 2024 to 2030.

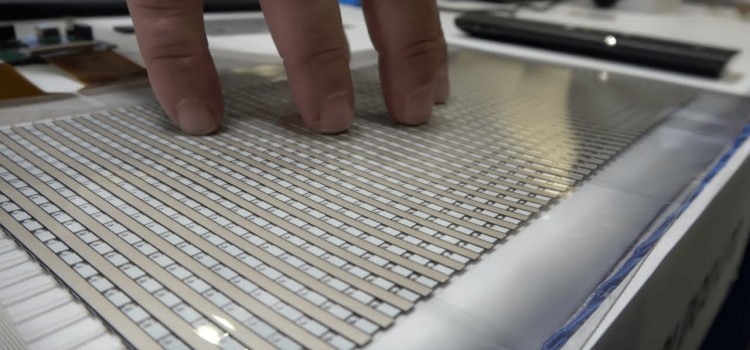

Tactile sensor is a specialized device designed to detect and measure physical interactions, such as touch, pressure, and force, with precision and responsiveness. These sensors are crucial in various applications across multiple industry verticals, including robotics and automation, healthcare, consumer electronics, automotive, and aerospace. They employ advanced technologies such as capacitive, resistive, piezoelectric, and optical sensing to provide detailed feedback on physical contact, thereby enabling improved control, safety, and functionality within complex systems.

The Rising Industrial Robot Installation Fuels the Demand for Tactile Sensors in Europe

The delta robots industry in Europe is driven by several key factors, one of which is the significant rise in the installation of industrial robots across the region. As industries increasingly embrace automation to improve efficiency and productivity, there is a growing demand for delta robots equipped with tactile sensors to enhance their capabilities.

These sensors enable robots to perceive and interact with their environment accurately, facilitating tasks such as pick-and-place operations and quality control in manufacturing facilities. The integration of tactile sensors in delta robots enables precise and responsive automation processes, driving the demand for such robots in various industries across Europe.

The Increasing Automotive Industry and Electric Vehicle Adoption is Driving the Europe Tactile Sensor Market Growth

Another driver for the delta robots’ industry in Europe is the expansion of the automotive industry, particularly the adoption of electric vehicles (EVs). With countries in Europe experiencing a surge in EV production, there is an increased need for advanced manufacturing processes to meet the growing demand for EV components.

Delta robots equipped with tactile sensors play a crucial role in automotive assembly lines, enabling precise and efficient handling of parts during the production of EVs. These robots contribute to improving safety, efficiency, and user experience in EV manufacturing, thereby driving the demand for delta robots equipped with tactile sensors in the automotive industry across Europe.

High Maintenance Costs Restrain the Europe Tactile Sensor Market Growth

Tactile sensors market necessitates regular calibration and maintenance to maintain their reliability and accuracy, which elevates the overall cost of ownership for businesses. Additionally, their sensitivity to environmental factors such as temperature and humidity presents challenges in maintaining consistent responsiveness and precision, particularly in harsh or variable conditions.

These issues add complexity to the operation of sensor and discourage potential users who require low-maintenance solutions or consistent performance in diverse environments. Consequently, addressing these limitations is essential for the broader adoption and sustained growth of the market.

Integration of Quantum Sensing Creates Market Opportunity in Europe

Quantum sensing methods incorporated into sensor technology leverage the unique traits of quantum mechanics, such as superposition and entanglement, for highly precise measurements. This integration enables sensors to detect even the smallest changes in pressure, force, or other physical attributes with unmatched accuracy.

This heightened sensitivity opens up opportunities across various fields. In scientific exploration, it allows researchers to study phenomena at incredibly small scales. In precision engineering, it improves the accuracy and efficiency of manufacturing processes and quality control.

In the realm of quantum computing, it aids in the advancement and operation of complex computational systems. As these applications expand, the integration of quantum sensing methods into sensors is expected to drive the Europe Tactile sensor market growth in the coming years.

Germany Dominates the Europe Tactile Sensor Market

The increase in the installation of industrial robots in Germany is driving the tactile sensor market in the country. According to the World Robotics 2023 report presented by the International Federation of Robotics (IFR), Germany stands as one of the leading countries in robot density, installing 415 units of industrial robots in 2022.

As industrial automation becomes more prevalent, there is a growing demand for tactile sensors to enhance the capabilities of robots in various applications. Tactile sensors enable robots to perceive and interact with their environment more effectively, improving precision, accuracy, and safety in manufacturing processes.

With Germany being a hub for advanced manufacturing and automation, the rising adoption of industrial robots fuels the need for tactile sensors, driving growth and innovation in the tactile sensor market in Europe.

Additionally, the expansion of medical technology in Germany is a significant driver behind the Europe tactile sensor market demand in the country. Tactile sensors play a crucial role in various medical applications, including surgical robotics, prosthetics, rehabilitation devices, and medical diagnostics, by providing precise tactile feedback and enabling more accurate sensing of pressure and force.

According to the International Trade Administration, Germany is the third-largest medical technology market globally, with an annual turnover of approximately USD 42 billion, constituting 25% of the total industry revenue in Europe.

As the adoption of medical technology expands in Germany, fueled by factors such as an aging population, increasing healthcare expenditure, and a focus on technological advancements, the demand for tactile sensors is expected to rise correspondingly.

Sweden to Witness Substantial Growth in the Europe Tactile Sensors Market with a Projected CAGR of 9.4%

In Sweden, the tactile sensor industry is being propelled by the increasing efforts of key market players such as FINGERPRINTS and FLYWALLET to develop biometric wearables. These wearables integrate tactile sensors to facilitate secure and convenient user authentication through touch-based interactions, such as fingerprint scanning.

With the expanding demand for wearable technology, particularly in fitness tracking, health monitoring, and contactless payments, there is a growing need for reliable and accurate tactile sensors. This trend is fostering the growth and diversification of the Europe tactile sensor market trends in Sweden as manufacturers respond to the escalating demand for tactile sensing solutions in the wearable technology sector.

For instance, in February 2023, Fingerprint Cards AB (Fingerprints) partnered with Flywallet, a biometric wearables technology startup, to develop and launch biometric wearable products for the European market. These wearable products leverage Fingerprints' biometric sensors, software, and algorithms, benefiting from their ultra-low-power consumption, leading performance, and expertise in secure biometrics innovation.

Furthermore, initiatives by companies such as fingerprints to integrate fingerprint sensors into smartphones are driving the tactile sensor market growth in Sweden. By incorporating fingerprint sensors into smartphones, these companies are enhancing the security and convenience of mobile devices, thereby increasing their attractiveness to consumers.

With the global surge in smartphone usage, the demand for tactile sensors for biometric authentication purposes is on the rise. Fingerprints' endeavors to develop and integrate advanced fingerprint sensor technology into smartphones are fostering innovation in the tactile sensor market, promoting the adoption of tactile sensing solutions not only in Sweden but also worldwide.

This trend is fueling growth in the Europe tactile sensor market landscape as companies strive to meet the evolving needs of smartphone users for secure and intuitive authentication methods. For instance, in May 2023, Fingerprints integrated fingerprint sensors into 700 different smartphone models globally, reflecting the increasing demand for mobile biometrics as customers seek more intuitive, versatile, convenient, and secure solutions. The Xiaomi Redmi K60, featuring Fingerprints' recently launched optical under-display sensor, the FPC1632, became the 700th mobile device to integrate the company's technology.

Competitive Landscape

Several market players operating in the Europe tactile sensor industry include Broadcom, Shenzhen Goodix Technology Co., Ltd., Synaptics Incorporated, ALPS Electric (Cirque Corporation), STMicroelectronics N.V., FocalTech Systems Co., Ltd., Elan Microelectronics, Pressure Profile Systems, AIS Global group (Touch International Inc.), Tekscan Inc., ForceN, Contactile, Sensobright, X-Sensors, Barrett Technology and others.

Europe Tactile Sensor Market Key Segments

By Type

-

Resistive Tactile Sensors

-

Capacitive Tactile Sensors

-

Piezoelectric Tactile Sensor

-

Optical Tactile Sensors

-

Others

By Application

-

Robotics

-

Computer Hardware

-

Security System

-

Touch Screens

-

Medical Devices

-

Handheld Devices

-

Others

By End User

-

Automotive

-

Robotics and Automation

-

Aerospace and Defense

-

Consumer Electronics

-

Healthcare

-

Other Industry

By Country

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Poland

-

Netherlands

-

Austria

-

Sweden

-

Czech Republic

-

Hungary

-

Belgium

-

Russia

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 716.7 Million |

|

Revenue Forecast in 2030 |

USD 1225.7 Million |

|

Growth Rate (Value) |

CAGR of 7.0% from 2024 to 2030 |

|

Market Volume in 2023 |

266 Million Units |

|

Volume Forecast in 2030 |

567 Million Units |

|

Growth Rate (Volume) |

10.4% |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

Countries Covered |

13 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

KEY PLAYERS

-

Broadcom

-

Shenzhen Goodix Technology Co., Ltd.

-

Synaptics Incorporated

-

ALPS Electric (Cirque Corporation)

-

STMicroelectronics N.V.

-

FocalTech Systems Co., Ltd.

-

Elan Microelectronics

-

Pressure Profile Systems

-

AIS Global group (Touch International Inc.)

-

Tekscan Inc.

-

ForceN

-

Contactile

-

Sensobright

-

X-Sensors

-

Barrett Technology

Speak to Our Analyst

Speak to Our Analyst