Field-Programmable Gate Array (FPGA) Market by Configuration (Low-End, Mid-Range, and High-End), by Technology (Static Random-Access Memory (SRAM), Flash, and Antifuse), by Node Size (=16nm, 20-90nm, and >90nm), and by End User (IT and Telecommunications, Consumer Electronics, Military and Defence, Automotive, Healthcare, and Others) – Global Opportunity Analysis and Industry Forecast 2024-2030

Field-Programmable Gate Array Market Overview

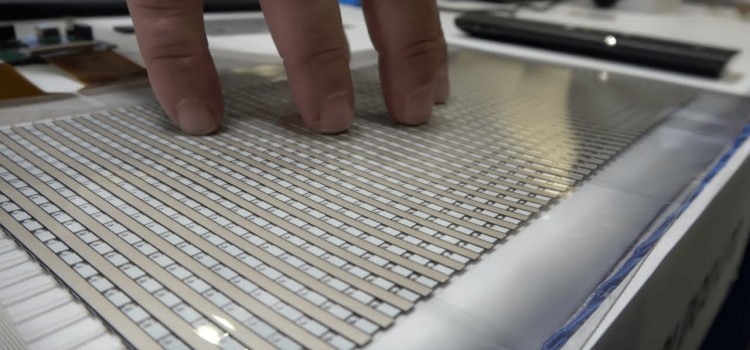

The global Field-Programmable Gate Array (FPGA) Market size was valued at USD 9.06 billion in 2023 and is predicted to reach USD 18.55 billion by 2030 with a CAGR of 10.5% from 2024-2030.Field-programmable gate array (FPGA), is a type of integrated circuit that users can configure post-manufacturing, unlike the fixed design of application-specific integrated circuits (ASIC). It consists of programmable logic blocks and interconnects that are vital in applications such as digital signal processing, telecommunications, automotive, aerospace, and data centers. It supports industrial automation and robotics by enabling the development of custom, easily modifiable control systems, thereby it enhances operational flexibility and efficiency in manufacturing processes. This versatility and performance make FPGAs essential in developing next-generation digital solutions across various industries.

Market Dynamics and Trends

The automotive industry's transition towards electric vehicles (EVs), autonomous driving and advanced driver assistance systems (ADAS) has increased the demand for FPGAs in automotive electronics. Due to its crucial role in processing sensor data, managing power distribution, and implementing safety-critical functionalities. As per International Energy Agency, EV market is witnessing exponential growth as sales exceeded 10 million in 2022. A total of 14% of all new cars sold were electric in 2022, up from around 9% in 2021 and less than 5% in 2020.

Moreover, the integration of Artificial Intelligence (AI) across sectors such as healthcare, finance, and autonomous vehicles demands high-performance computing solutions including field-programmable gate array that plays a key role in accelerating AI adoption in businesses. For instance, in February 2024, Intel announced the official launch of Altera to secure leadership across a USD 55 billion-plus market opportunity. It aims to expand the company's portfolio, including FPGA with AI built into the fabric, to help solve the mounting challenges of businesses.

Additionally, the adoption of Internet of Things (IoT) devices in applications such as smart homes, industrial automation, and healthcare necessitates efficient processing solutions, including FPGAs and ASICs. It offers tailored solutions for IoT edge devices, facilitating rapid prototyping and deployment of IoT applications, thus driving the field-programmable gate array market demand for the industry. According to the IoT analytics, the global IoT market to grow at a CAGR of 19.4% to reach USD 483 billion by 2027.

However, the high cost and complexity associated with the development of FPGA such as intricate design processes, specialized skill requirements, and integration challenges with existing systems hindering the growth of the market. On the contrary, the integration of advanced technologies such as, Artificial Intelligence (AI), edge computing, 5G, and others create ample growth opportunity for the field-programmable gate array market.

For example, in April 2024, AMD launched the Versal AI edge series aiming to deliver high performance, low latency AI inference for intelligence in automated driving, predictive factory and healthcare systems, multi-mission payloads in aerospace & defense, and a breadth of other applications.

Market Segmentation and Scope of The Study

The field-programmable gate array market report is divided on the basis of configuration, technology, node size, end user and region. On the basis of configuration, the market is divided into low-end, mid-range and high-end. On the basis of technology, the market is divided into static random-access memory (SRAM), flash and antifuse. On the basis of node size, the market is divided into =16nm, 20-90nm and >90nm. On the basis of vertical the market is divided into IT and telecommunications, consumer electronics, military and defence, automotive, healthcare, and others. Regional breakdown and analysis of each of the aforesaid segments includes regions comprising of North America, Europe, Asia-Pacific, and RoW.

Geographical Analysis

Asia-Pacific holds the dominating of field-programmable gate array market share at present and is expected to continue its dominance throughout the forecast period. This is attributed to factors such as government initiatives especially in the countries including, China, India, Japan, and others towards semiconductor industry. For instance, Japan invested USD 27.56 billion in support for its semiconductor industry from which is a greater proportion of its GDP than the U.S. or Germany during 2021-2023.

Also, the automotive sector's shift towards EVs, autonomous driving, and ADAS has spurred a heightened demand for FPGAs in automotive electronics. As per India Brand Equity Foundation, India is expected to become the largest EV market by 2030, with a total investment opportunity of more than USD 200 billion over the next 8-10 years.

On the other hand, North America is considered fastest growing region in the market owing to the factors such as integration of 5G networks, rise in internet of things (IoT) and Artificial Intelligent (AI). For instance, U.S. boasted nearly 162 million active 5G devices in 2022 that was nearly double the count from 2021. Remarkably, 5G devices comprised nearly one-third of all wireless connections. This field-programmable gate array market growth trajectory is anticipated to persist, with projections indicating that by 2028, 5G will encompass a staggering 91% of all wireless connections in U.S.

Moreover, the expansion of data centers and the growing demand for high-performance computing (HPC) are fuelling the market for FPGAs in North America Region. For Example, the data center industry in North America, especially in the U.S., is thriving and extensive, with more than 5,300 strategically located facilities throughout the country.

Competitive Landscape

Various key players in the includes field-programmable gate array industry includes Advanced Micro Devices, Inc., Intel Corporation, Microsemi, Lattice Semiconductor, Achronix Semiconductor Corporation, QuickLogic, Flex Logix, GOWIN Semiconductor Corp, Efinix Inc., Microchip Technology Inc., and others. These market players are opting various strategies such as product launch to maintain their dominance in the global FPGA market.

For instance, in March 2024, Advanced Micro Devices, Inc., launched the Spartan-7 series of field-programmable gate array. The Spartan-7 series comes with the increasing demand for customisable, high-performance, flexible computing hardware.

Moreover, in December 2023, Lattice introduced two new innovative mid-range FPGA devices, Lattice Avant-G and Lattice Avant-X. It aims to enable their customers to accelerate their designs with new levels of power efficiency and performance through their rapidly growing hardware and software portfolio.

Key Benefits

-

The report provides quantitative analysis and estimations of the field-programmable gate array industry from 2024 to 2030, which assists in identifying the prevailing market opportunities.

-

The study comprises a deep-dive analysis of current and future field-programmable gate array market trends to depict prevalent investment pockets in the industry.

-

Information related to key drivers, restraints, and opportunities and their impact on the field-programmable gate array market is provided in the report.

-

Competitive analysis of the players, along with their market share is provided in the report.

-

SWOT analysis and Porters Five Forces model is elaborated in the study.

-

Value chain analysis in the market study provides a clear picture of roles of stakeholders.

Field-Programmable Gate Array Market Key Segments

By Configuration

-

Low-End

-

Mid-Range

-

High-End

By Technology

-

Static Random Access Memory

-

Flash

-

Antifuse

By Node Size

-

=16nm

-

20-90nm

-

>90nm

By End User

-

IT and Telecommunications

-

Consumer electronics

-

Military and defence

-

Automotive

-

Healthcare

-

Others

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

- Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 9.06 Billion |

|

Revenue Forecast in 2030 |

USD 18.55 Billion |

|

Growth Rate |

CAGR of 10.5% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Key Players

-

Advanced Micro Devices, Inc.

-

Intel Corporation

-

Microsemi

-

Lattice Semiconductor

-

Achronix Semiconductor Corporation

-

QuickLogic corporation

-

FlexLogix

-

GOWIN Semiconductor Corp

-

Efinix, Inc.

-

Microchip Technology Inc.

Speak to Our Analyst

Speak to Our Analyst