Hong Kong Travel Insurance Market by Age (Millennials, Generation X, and Baby Boomers), by Income Level (Low-income travelers, Middle-income travelers and High-Income Travelers), by Coverage (Medical Coverage, Trip Cancellation Coverage, Baggage and Personal Belongings Coverage, Accidental Death and Dismemberment (AD&D) Coverage), by Days of coverage (Short-Trip Insurance, Standard Trip Insurance, Extended Trip Insurance and Multi-Trip Insurance) by End User (Pilgrim Travelers, Education Travelers, Business Travelers and Family Travelers) by Distributional Channel (Insurance Companies, Banks, Airlines, Online Platforms, Insurance Aggregators & Comparison Websites, and Travel Agents & Tour Operators) – Opportunity Analysis and Industry Forecast, 2024–2030

Industry: BFSI | Publish Date: 01-Oct-2024 | No of Pages: 123 | No. of Tables: 90 | No. of Figures: 55 | Format: PDF | Report Code : BF1677

Market Overview

The Hong Kong Travel Insurance Market size was valued at USD 143.22 million in 2023, and is expected to reach USD 694.57 million by 2030, with a CAGR of 23.8% from 2024 to 2030.

Travel insurance is a specialized insurance designed to offer protection and coverage to travelers against a wide range of potential risks and unforeseen circumstances that occur before or during their journeys. It serves as a crucial tool in mitigating the financial impact of various travel-related emergencies, disruptions, and inconveniences, providing travelers with peace of mind and security throughout their trips.

The versatility of travel insurance extends beyond individual travelers to encompass families, corporate travelers, and group tours, catering to diverse needs and preferences within the travel industry. It offers a range of policy options, including single-trip, multi-trip, and annual policies, as well as specialized coverage for specific types of travel, such as adventure sports, cruises, or business trips. Its comprehensive coverage and range of benefits make it an essential investment for travelers seeking to safeguard their trips and ensure a smooth and hassle-free travel experience.

Increasing Number of Outbound Travelers drives the market growth

The increasing outbound travel from Hong Kong to several international destination for healthcare and medical purposes is a significant driver of growth in the travel insurance industry.

According to the latest report from the United Nations World Tourism Organization (UNWTO), the total number of outbound travelers from Hong Kong surged significantly in 2022, reaching almost 2,181,000 individuals. This figure represents a noteworthy rise from the preceding year, which recorded a total of 905,000 visitor.

Moreover, the surge in demand for comprehensive travel insurance coverage is propelled by a deep comprehension of the travel behaviors exhibited by Hong Kong citizens, particularly those who frequently journey during public holidays.

According to the International Trade Administration, Hong Kong residents tend to travel extensively during public holidays such as the Chinese Lunar New Year, Easter, and Christmas due to the limited annual leave allocation.

This trend highlights the robust travel insurance offerings to address the increased risks associated with growing travel activity during these periods.

Rising Initiatives by Global Key Market Players Boost the Market Growth

Moreover, the rising initiatives by global key market players, such as those in the travel insurance sector, signify a concerted effort towards enhancing customer experiences and providing comprehensive coverage.

For instance, in January 2024, Zurich Insurance collaborated with Hutchison Telecommunications Hong Kong (HTHK) aimed at bolstering digital service offerings.

This collaboration entails the integration of Zurich's insurance products into HTHK's latest service brand, Domain 5, with the objective of delivering streamlined operations and enhanced customer experiences.

Additionally in October 2023, bolttech Insurance partnered with Trip.com to allow Trip.com customers to purchase bolttech Insurance travel policies directly on Trip.com's mobile app.

This collaboration aims to enhance user experience by providing seamless access to relevant insurance products within the app, meeting the top priorities of convenience and user-friendliness for insurance app users.

Regulatory challenges hinder the market growth

Regulatory challenges in the travel insurance market include diverse and complex regulations imposed by governmental authorities across county.

Insurance providers operating internationally face significant administrative burdens and costs in ensuring compliance with these regulations, which cover aspects such as licensing, consumer protection, sales practices, and policy terms.

Meeting regulatory requirements involve establishing local entities, obtaining licenses, appointing legal representatives, and adapting products and marketing strategies to align with local laws

Integration of Blockchain Technology Creates Ample Opportunity for the Market Growth

Blockchain technology offers a significant opportunity for enhancing transparency and security within the travel insurance industry. By leveraging decentralized digital ledgers, insurers can establish immutable records of transactions, policies, and claims, minimizing the risk of fraud and ensuring data integrity.

Smart contracts, which automate contract execution based on predefined conditions, streamline processes such as policy issuance and claims processing, reducing administrative overhead and enhancing efficiency.

The transparency provided by blockchain technology empowers insurance providers to securely access and authenticate transactional data. This transparency builds a sense of trust between insurers and policyholders.

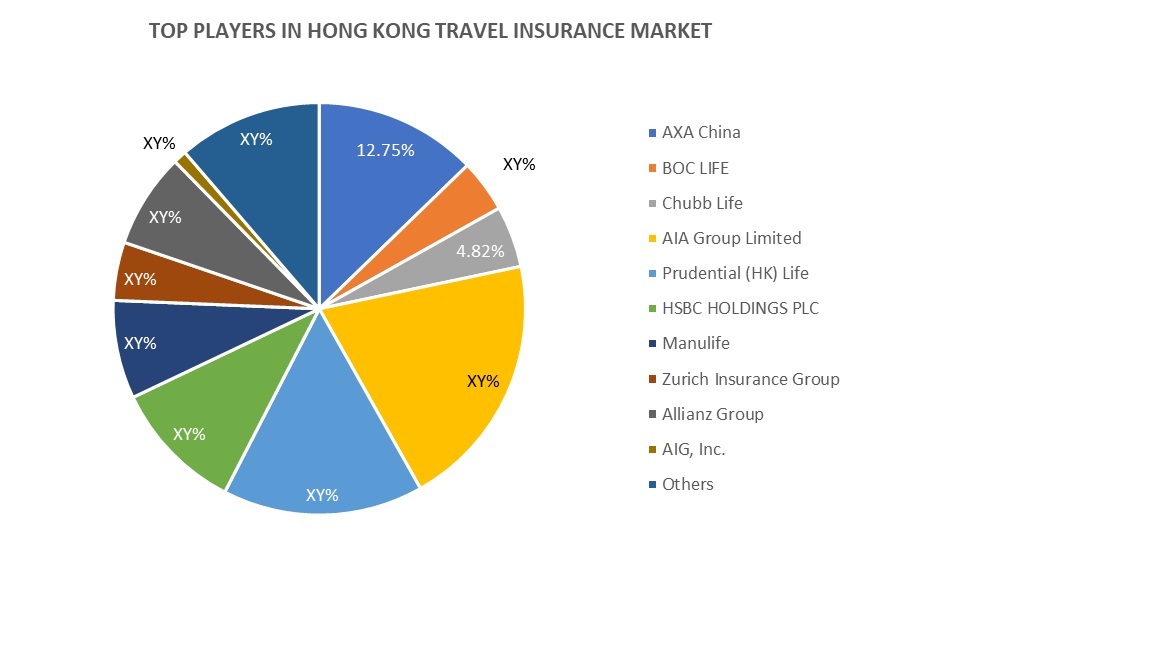

Competitive Landscape

Several market players operating in the Hong Kong Travel Insurance market include AXA China, Allianz Group, HSBC Holdings PLC, Chubb Insurance Hong Kong Limited, AIG Insurance Hong Kong Limited, AIA Group Limited, Zurich Insurance Group, Manulife, Prudential (HK) Life, BOC LIFE and others. These market players are adopting strategies, such as product launches, to maintain their dominance in the nation.

For instance, in February 2024, Prudential Hong Kong Limited, a subsidiary of Prudential Plc announced new strategic collaboration with Shenzhen New Frontier United Family Hospital to enhance health services coverage in the Greater Bay Area. This collaboration is done for the growing number of people traveling frequently between Hong Kong and the Chinese Mainland.

Moreover, in January 2024, Zurich Insurance partnered with Hutchison Telecommunications Hong Kong (HTHK) to enhance digital services by offering Zurich's insurance products through HTHK's new service brand, Domain 5, which provides seamless operations to customers.

Key Market Segments

By Age

-

Millennials

-

Generation X

-

Baby Boomers

By Income Level

-

Low-income travelers

-

Middle-income travelers

-

High-income travelers

By Coverage

-

Medical Coverage

-

Trip Cancellation Coverage

-

Baggage and Personal Belongings Coverage

-

Accidental Death and Dismemberment (AD&D) Coverage

By Days of Coverage

-

Short-Trip Insurance

-

Standard Trip Insurance

-

Extended Trip Insurance

-

Multi-Trip Insurance

By End User

-

Pilgrim Travelers

-

Education Travelers

-

Business Travelers

-

Family Travelers

By Distributional Channel

-

Insurance Companies

-

Banks

-

Airlines

-

Online Platforms

-

Insurance Aggregators and Comparison Websites

-

Travel Agents and Tour Operators

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 143.22 Million |

|

Revenue Forecast in 2030 |

USD 694.57 Million |

|

Growth Rate |

CAGR of 23.8% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

KEY PLAYERS

-

Allianz Group

-

HSBC Holdings PLC

-

Chubb Insurance Hong Kong Limite

-

AIG Insurance Hong Kong Limited

-

AIA Group Limited

-

Zurich Insurance Group

-

Manulife

-

Prudential (HK) Life

-

BOC LIFE

-

AXA China

Speak to Our Analyst

Speak to Our Analyst

_Insurance.png)