Japan Consumer AI Market by Component (Hardware, Software, and Services), and by End-user (Media & Entertainment, Banking and Financial Services, Healthcare, Automotive, Agriculture, IT & Telecom, Manufacturing, Education, Retail & E-commerce, Energy & Utilities, and Other End-users)– Global Opportunity Analysis and Industry Forecast, 2024–2030

Industry: ICT & Media | Publish Date: 12-Sep-2024 | No of Pages: N/A | No. of Tables: 76 | No. of Figures: 41 | Format: PDF | Report Code : IC2637

Japan Consumer AI Market Overview

The Japan Consumer AI Market size was valued at USD 1.33 billion in 2023 and is predicted to reach USD 7.18 billion by 2030, with a CAGR of 25.1% from 2024 to 2030. The market refers to the adoption of artificial intelligence (AI) technologies tailored specifically for consumer applications.

This market includes a wide range of AI-driven products and services, such as virtual assistants, personalized recommendations, smart home devices, and AI-powered customer service solutions. These technologies are designed to enhance user experiences by providing convenience, personalization, and efficiency in everyday tasks.

The consumer AI market represents a transformative force in how businesses interact with and serve their customers. By leveraging AI, companies can offer highly personalized experiences, anticipate customer needs, and deliver seamless interactions across multiple touchpoints. This is leading to the rising adoption of AI in various sectors, including retail, hospitality, finance, and entertainment, where enhancing customer engagement and satisfaction is paramount, to meet the ever-changing needs and expectations of consumers.

Investment in Advanced AI Infrastructure Fuels the Market Expansion in Japan

The substantial investment in AI infrastructure by both the Japanese government and the private sector is significantly accelerating the growth of the consumer AI market in Japan. These investments are enhancing technological capabilities and leading to broader adoption of AI-driven solutions across various consumer sectors.

For example, in May 2024, Japan's Ministry of Economy, Trade, and Industry announced that NVIDIA, in collaboration with GMO Internet Group, KDDI Corporation, and SoftBank Corp, will invest over USD 740 million to enhance cloud infrastructure and build AI supercomputers.

Similarly, in April 2024, Microsoft announced a USD 2.9 billion investment in Japan, focusing on expanding its AI and cloud infrastructure. These investments include the development of hyperscale cloud computing facilities, the construction of AI supercomputers, and the training of 3 million people in AI skills. These significant investments in Japan’s AI sector are driving major technological advancements, which in turn are fostering the widespread adoption of AI solutions across various industries in this country.

Integration of 5G and AI Drives Growth in Japan's Consumer AI Market

The rollout of 5G networks is significantly propelling the Japan consumer AI market expansion by delivering faster data transfer rates and lower latency, which are crucial for the performance of artificial intelligence-driven technologies.

This enhanced connectivity supports the development of more efficient and responsive AI services, enabling real-time applications and innovations across diverse consumer sectors. For instance, in September 2023, NTT Docomo launched Japan's first AI-integrated 5G network, which improves network efficiency and reduces costs through the use of advanced AI and GPU technology.

This cutting-edge network enhances real-time data processing and network management, directly benefiting consumer AI applications by providing faster, more reliable connectivity and enabling efficient AI solutions across various sectors. This advancement is expected to further accelerate the adoption and integration of AI technologies in everyday consumer products and services in Japan.

Data Privacy Concerns Hinder Japan Consumer AI Market Growth

Data privacy concerns represent a significant challenge to the expansion of Japan's consumer AI market. Stringent regulations, such as the Act on the Protection of Personal Information (APPI) and other rigorous data protection requirements, compel companies to meticulously manage and secure sensitive information.

Compliance with these regulations often necessitates substantial resources and investment, creating barriers for businesses and potentially impeding innovation. As companies navigate the complexities of data privacy, these concerns slow down the broader implementation and growth of AI technologies in the consumer sector. Consequently, addressing data privacy issues is crucial for enabling the seamless adoption and development of AI-driven solutions while balancing regulatory demands.

AI-Powered Edge Computing Technology Presents Significant Growth Opportunity

The expansion of edge computing technologies presents significant opportunities for the growth of the Japan consumer AI market. By enabling real-time data processing closer to the source, edge computing enhances the performance and efficiency of AI applications.

This advancement results in more responsive and efficient AI-driven solutions across smart devices and IoT systems, thereby improving user experiences. As edge computing technologies continue to evolve, they will drive the development of innovative consumer AI applications, further propelling the consumer AI market growth.

For instance, in July 2024, NTT Data, a prominent Japanese IT service provider, launched a new AI edge computing solution designed to integrate IT and OT (Operational Technology). This innovation aims to enhance real-time data processing and boost the efficiency of AI applications by leveraging edge computing capabilities.

By Component, Software Dominates the Japan Consumer AI Market Share

In the Japan consumer AI market, software holds a dominant position, commanding over 50% of the market share. This significant share reflects the widespread adoption and integration of AI-driven software solutions across various consumer applications.

Software components such as AI-driven virtual assistants, personalized recommendation systems, and advanced analytics tools are integral to enhancing user experiences and functionalities in consumer electronics and smart home devices. The prominence of software in the market underscores its crucial role in driving innovation and delivering sophisticated AI capabilities to end-users.

By End-User, Media & Entertainment Industry Holds the Largest Share of the Market

The Media & Entertainment sector holds the largest share in Japan consumer AI market trends. This dominance is attributed to the sector's extensive use of AI technologies for enhancing user experiences, such as personalized content recommendations, advanced video and audio processing, and interactive entertainment solutions.

AI-driven platforms in this sector leverage machine learning algorithms to tailor content to individual preferences, optimize media delivery, and improve engagement. As a result, Media & Entertainment emerges as the leading end-user segment in the Japan Consumer AI market, reflecting its significant investment in and reliance on AI technologies to drive growth and innovation.

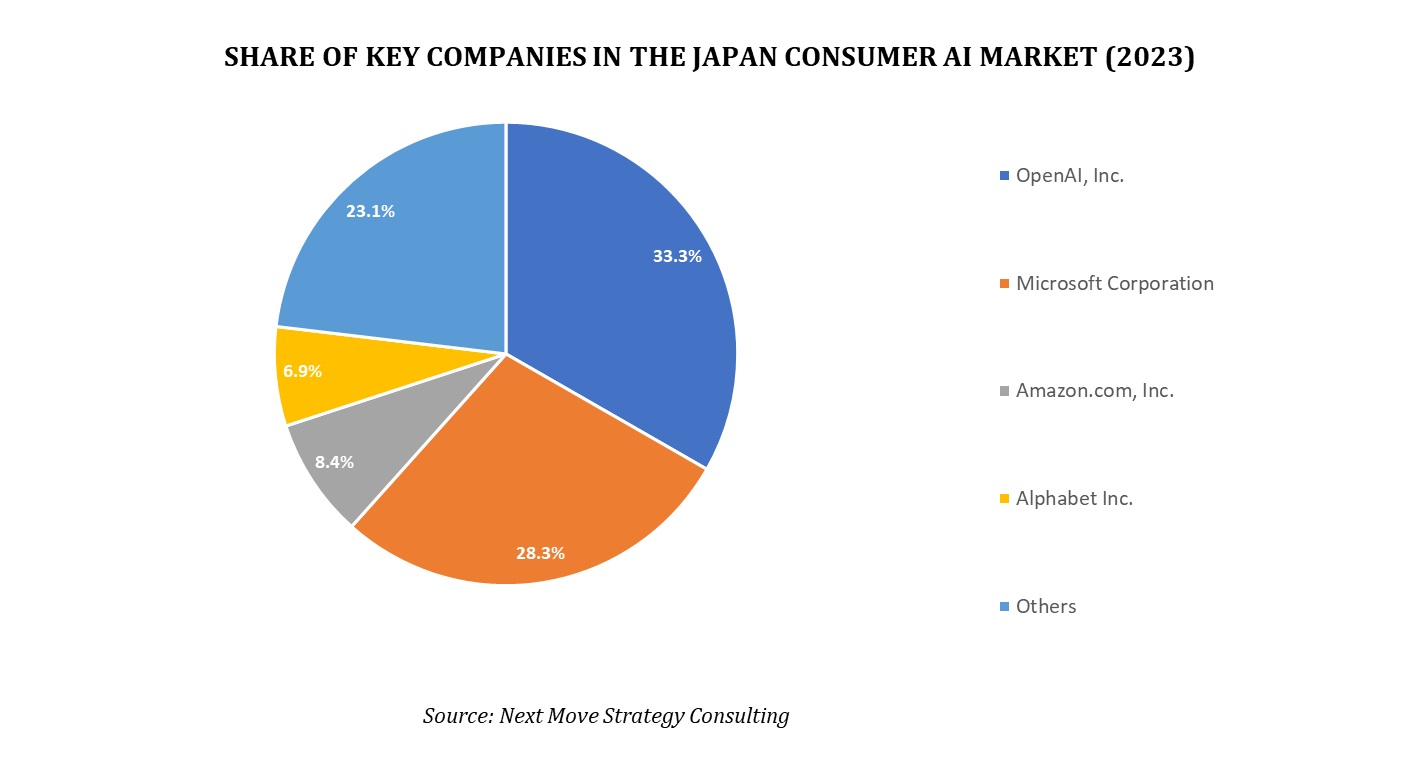

Competitive Landscape

Several market players operating in the Japan consumer AI industry include OpenAI, Microsoft Corporation, Amazon.com, Inc., Alphabet Inc., Meta Platforms, Inc., International Business Machines Corporation, NVIDIA Corporation, Oracle Corporation, Midjourney, Inc., and Anthropic, Inc. among others.

These companies are adopting various strategies, including partnerships, collaborations, mergers, acquisitions, and innovative product launches across various countries and regions to maintain their dominance in the market.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

|

June 2024 |

Meta |

Meta announced the launch of four new AI models through its Fundamental AI Research (FAIR) team to enhance the accessibility and functionality of AI technologies for research and development. The new models are designed to support a variety of applications and provide researchers with improved tools for exploring and utilizing AI technologies. |

|

|

May 2024 |

IBM Corporation |

IBM partnered with Mizuho Financial Group to launch a generative AI initiative aimed at enhancing operational efficiency in Japan's financial sector. This collaboration highlights IBM’s commitment to advancing AI solutions for the Japanese market, for efficient error handling and maintaining robust financial operations. |

|

|

May 2024 |

Midjourney |

Midjourney introduces AI-driven image generation version 6 that aims to deliver more precise and detailed images, enabling users to create visuals that better match their creative intentions and achieve higher levels of realism and artistic quality. |

|

|

April 2024 |

Oracle Inc |

Oracle Corporation expanded its cloud computing and AI infrastructure in Japan and announced to invest around USD 8 billion over the next ten years. The expansion aims to bolster Oracle's cloud services, including AI-driven solutions, to meet the growing demand for advanced technology infrastructure in Japan. |

|

|

April 2024 |

OpenAI |

Open AI expanded its operations in Asia by inaugurating its first office located in Tokyo, Japan. This expansion includes the introduction of a GPT-4 custom model optimized for Japanese, offering enhanced performance and efficiency. |

|

|

April 2024 |

Microsoft Corporation |

Microsoft invested USD 2.9 billion to expand its cloud and AI infrastructure in Japan. This initiative includes opening a new research lab in Tokyo focused on AI and robotics and providing USD 10 million in grants to prominent Japanese and international research institutions. |

|

|

April 2024 |

Amazon.com.Inc |

Amazon, the University of Washington, and Microsoft partnered with Japanese companies and universities and made an investment of USD 110 million focused on advancing AI research and innovation in the country. The investment aims to support various AI research initiatives and innovation projects, contributing to the growth of the AI ecosystem in Japan. |

|

|

August 2023 |

Alphabet Inc |

Alphabet Inc introduced generative AI to its Search tool for users in India and Japan, allowing them to receive text or visual results in response to prompts, including summaries. By leveraging generative AI, Google aims to enhance the search experience, providing more nuanced and contextually relevant information tailored to user queries. |

|

Japan Consumer AI Market Key Segment

By Component

-

Hardware

-

Software

-

Services

By End-user

-

Media & Entertainment

-

Banking and Financial Services

-

Healthcare

-

Automotive

-

Agriculture

-

IT & Telecom

-

Manufacturing

-

Education

-

Retail & E-commerce

-

Energy & Utilities

-

Other End Users

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 1.33 Billion |

|

Revenue Forecast in 2030 |

USD 7.18 Billion |

|

Growth Rate |

CAGR of 25.1% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Key Players

-

OpenAI, Inc.

-

Microsoft Corporation

-

Amazon.com, Inc.

-

Alphabet Inc.

-

Meta Platforms, Inc.

-

International Business Machines Corporation (IBM)

-

NVIDIA Corporation

-

Oracle Corporation

-

Midjourney, Inc.

-

Anthropic PBC

Speak to Our Analyst

Speak to Our Analyst