Mexico Waste Management Market by Waste Type (Municipal Solid Waste (MSW) or Household, Industrial, and Commercial), and by Disposable & Treatment (Composting, Controlled Landfill, Uncontrolled Landfill, Open Dump, Recycling, and Sanitary Landfill) – Opportunity Analysis and Industry Forecast, 2024–2030

Industry: Energy & Power | Publish Date: 01-Oct-2024 | No of Pages: 106 | No. of Tables: 51 | No. of Figures: 32 | Format: PDF | Report Code : EP1242

Mexico Waste Management Market Overview

The Mexico Waste Management Market size was valued at USD 18.75 billion in 2023 and is predicted to reach USD 30.47 billion by 2030, registering a CAGR of 6.1% from 2024 to 2030.

The Mexico waste management, also known as waste treatment or handling market involves a wide range of services and activities aimed at managing and mitigating the impact of waste generated by various sectors including residential, commercial, and industrial. It includes the collection, transportation, processing, recycling, and disposal of waste materials in a manner that is environmentally responsible and sustainable.

The market also involves the development and implementation of technologies and practices that promote waste reduction, resource recovery, and the safe handling of hazardous materials. Key components of the waste management market include waste collection services, recycling facilities, waste-to-energy plants, landfill operations, and environmental consulting services. As awareness of environmental issues grows, the waste management market continues to expand, driven by growing population and increasing public demand for sustainable waste solutions.

Growing Population Necessitates the Need for Effective Waste Management Solutions

The rising population in Mexico increases the need for effective waste management solutions. As the population surge the amount of waste generation also increases that creates the demand for efficient and scalable waste management solutions to ensure environmental sustainability and public health.

According to the latest report of World Bank Group, the population of Mexico accounted for 128 million in 2023 as compared to 125 million in 2019, an increase of 2.40% during four years. Thus, the population growth is intensifying the need for robust waste management solutions to maintain environmental health and sustainability in the country.

Moreover, the increasing population directly leads to a rise in residential waste generation thus propelling the demand for waste management industry. According to the Promotora Ambiental (PASA) annual report 2023, about 76% of Mexico's total waste is generated from residential homes, while 24% comes from industrial settings. This high percentage of residential waste generation is driving the growth of the waste management market to maintaining cleanliness and quality of life across the country.

Rapidly Growing Industrial Sector Fuels the Demand For Waste Management Solutions

The rapidly growing industrial sector in Mexico leads to higher levels of waste generation. As industrial activities expand, the volume of waste produced increases accordingly that underscores the importance of implementing effective waste management solutions to mitigate environmental impact.

According to the latest report of the International Trade Administration (ITA), Mexico is the world’s seventh-largest passenger vehicle manufacturer, producing 3.5 million autonomous vehicles annually and fifth-largest manufacturer of heavy-duty vehicles for cargo, hosting 14 manufacturers and assemblers of buses, trucks, and tractor trucks, and two manufacturers of engines. The significant presence in automotive manufacturing and industrial activities require effective waste management solutions to maintain environmental sustainability and regulatory compliance.

Furthermore, the industrial sector's contribution to plastic and e-waste generation highlights the critical need for enhanced waste management strategies. As per the Promotora Ambiental (PASA) annual report 2023, Mexico experienced a substantial increase in waste generation from 61.9 million tons in 2020 to 118 million tons in 2023, an increase of 90.6% within three years.

Moreover, Mexico generates approximately 1,032 million metric tonnes of electronic waste annually and ranks among the largest e-waste generators and Mexico City alone generates 312 tonnes of e-waste per day and 123 tonnes of plastic waste per day. Due to the growth in the industrial activities particularly in sectors such as manufacturing and construction the volume of waste produced also surged. This highlights the critical need for enhanced waste management strategies to manage the growing environmental impact associated with industrial growth.

Infrastructural Limitations & Stringent Government Regulations Hinders the Market

The waste management market faces significant challenges due to infrastructural limitations and investment constraints. Inadequate waste management infrastructure limits the implementation of effective waste disposal and recycling processes that hinders the market growth.

Furthermore, the market is hindered by stringent regulations enforced by bodies such as the Secretariat of the Environment and Natural Resources (SEMARNAT) and the Office of the Federal Prosecutor for Environmental Protection (PROFEPA).

These regulatory bodies impose rigorous standards on waste disposal practices that requires compliance with environmental impact assessments and waste management protocols. Such stringent requirements increase operational costs and regulatory compliance burdens for waste management entities that limits the Mexico waste management market growth.

Rising Adoption of Waste-To-Energy Technologies Creates Opportunities for the Market

The adoption of waste-to-energy technologies such as incineration, anaerobic digestion, and gasification presents a significant opportunity for the waste management market as these technologies convert waste materials into usable energy, reducing landfill dependency and contributing to sustainable energy generation.

By transforming waste into a valuable resource, waste-to-energy solutions promote environmental sustainability and drive the Mexico waste management market expansion. This innovative approach aligns with global trends toward circular economy practices and offers economic benefits by generating energy from waste, thus creating a promising avenue for growth in Mexico's waste management sector.

By Waste Type, MSW Holds the Predominating Share in the Mexico Waste Management Industry

Municipal solid waste (MSW), commonly known as household waste includes the everyday items discarded by the public, including food scraps, packaging, yard waste, and household items. Household waste is primarily non-hazardous while industrial waste includes hazardous materials and bulky industrial by-products.

As per research conducted by Next Move Strategy consulting, household waste is the dominating and fastest growing segment in waste type. Around 76% of waste collected in Mexico is generated from household waste.

In contrast to industrial waste that demands specialized handling and treatment due to its diverse and often hazardous composition. Household waste management emphasizes convenience, community participation in recycling efforts, and environmental stewardship through waste reduction and resource recovery initiatives.

By Disposable & Treatment, Composting is Projected to Witness the Highest CAGR Growth Until 2030

Composting involves the biological decomposition of organic waste materials, such as food scraps and yard trimmings, into nutrient-rich compost through microbial activity. Its feature lies in producing a beneficial soil amendment while diverting organic waste from landfills.

According to the analysis of the Next Move Strategy Consulting, composting disposal treatment is the fastest growing segment in the disposal treatment segment with a projected CAGR of 8.9% by 2030.

The advantage of composting is its ability to reduce methane emissions compared to controlled and uncontrolled landfills. However, it requires space, proper management to avoid odor issues, and specific environmental conditions for effective decomposition.

Competitive Landscape

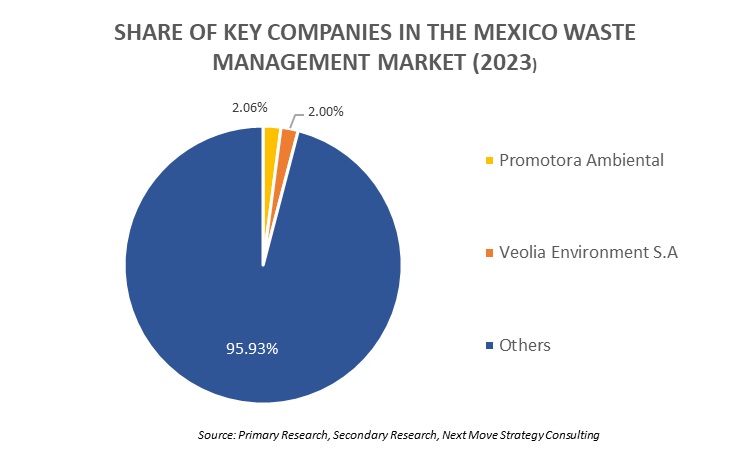

The promising key players operating in the global Mexico waste management industry include Promotora Ambiental, Veolia Environment S.A, Republic Services, Inc., PetStar, Clean Harbors, Inc., VLS RS Mexico, Urbaser, Samex Environmental Services, Mexican Environmental Corporation, and Triumvirate Environmental, among others.

These players are engaged in various business expansion merger across various regions to maintain their dominance in the Mexico waste management market.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

|

Nov-23 |

PetStar |

PetStar expanded its PET bottle recycling capacity from 58 kilotons per year to 110 kilotons per year by investing USD 167 million. This investment aims to recover and recycle every Coca-Cola PET bottle sold in Mexico by 2027. |

|

|

Mar-22 |

Veolia |

Veolia North America merged with Suez to form a single entity company while impacting the waste management industry across North America. The merger enhances capabilities in waste management, energy efficiency, and water reclamation, pivotal for advancing environmental goals and supporting carbon neutrality targets by 2030, benefiting municipalities and industries region-wide. |

|

Mexico Waste Management Market Key Segments

By Waste Type

-

Municipal Solid Waste (MSW) or Household

-

Industrial

-

Manufacturing Waste

-

Construction & Demolition Waste

-

Agriculture Waste

-

Chemical Waste

-

Other Industrial Waste

-

-

Commercial

By Disposable & Treatment

-

Composting

-

Controlled Landfill

-

Uncontrolled Landfill

-

Open Dump

-

Recycling

-

Sanitary Landfill

Key Players

-

Promotora Ambiental

-

Veolia Environment S.A

-

Republic Services, Inc.

-

PetStar

-

Clean Harbors, Inc

-

VLS RS Mexico

-

Urbaser

-

Samex Environmental Services

-

Mexican Environmental Corporation

-

Triumvirate Environmental

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size Value in 2023 |

USD 18.75 Billion |

|

Revenue Forecast in 2030 |

USD 30.47 Billion |

|

Value Growth Rate |

CAGR of 6.1% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst