Oil Immersed Power Transformer Market by Component (Transformer Core, Windings, Insulating Oil, Tank, and Others), by Type (Power Transformer and Distribution Transformer), by Cooling Type (Oil Natural Air Natural (ONAN), Oil Natural Air Forced (ONAF), Oil Forced Air Natural (OFAN), and Others), and by End User (Transmission and Distribution Utilities, Industrial Sector, Commercial Sector, Residential Sector, and Others) - Global Opportunity Analysis and Industry Forecast 2024-2030

Market Definition

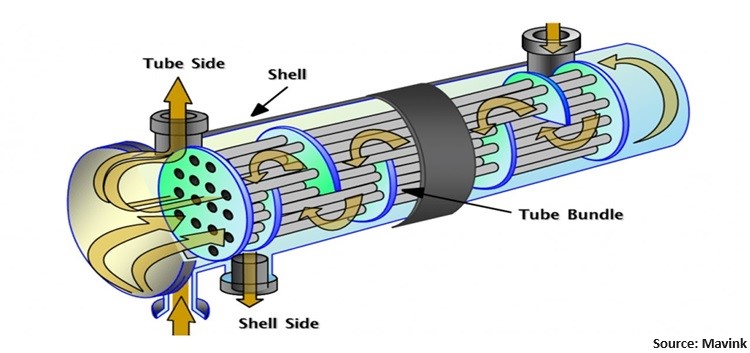

The Oil Immersed Power Transformer Market size was valued at USD 16.37 billion in 2023 and is predicted to reach USD 24.73 billion by 2030 with a CAGR of 6.1% from 2024-2030. The oil immersed power transformer is an essential element in electrical distribution and transmission systems that serves a crucial role in diverse industrial settings, such as oil and gas facilities. Renowned for their resilience to high temperatures and dependable power distribution, these transformers are indispensable. They are integral to substations and power grids, enabling efficient long-distance electricity transmission and local distribution to industrial sites. Furthermore, their adaptability through customization offers tailored solutions to address unique industrial requirements. With a sturdy build and lasting durability, these transformers excel in demanding industrial conditions where continuous power supply is essential.

Market Dynamics and Trends

The growth of oil immersed power transformer market is driven by the rising electricity demand across the globe. According to the International Energy Association (IEA), the global energy demand increased by 4% in 2022. This rise in electricity demand drives the adoption of oil immersed power transformer market as they are employed in power grids to increase or decrease the voltage levels for efficient electricity transmission, ensuring safe and reliable power distribution.

Moreover, the increasing focus towards the production of renewable energy globally is further propelling the growth of the oil immersed power transformer market. As per World in Data, the renewable electricity generation around the world is rising significantly, with an overall surge in production by 7.3% in the year 2022 compare to 2021. This increase in production boosts the demand for oil immersed power transformer as they are widely use to integrate the energy source into an existing power grid from the renewable energy sources, thereby propelling the growth of the market.

In addition, the expansion of industrial sectors such as manufacturing, mining, and construction increases the demand for power transformers to support industrial processes and operations. Therefore, driving the demand for the oil immersed transformer market. According to the latest data published by United Nations Industrial Development Organization (UNIDO), the global manufacturing production increased by 9.4% in 2021, after the pandemic-related drop of 4.2% in 2020.

However, the upfront expenses associated with oil immersed transformers, encompassing installation and maintenance costs, act as a deterrent for utilities and end-users considering investments in new or replacement units, particularly in price-sensitive markets. This factor is anticipated to impede the market's growth.

On the contrary, the integration of digital sensors, IoT (Internet of Things), and advanced analytics enables real-time monitoring of transformer health and performance, facilitating predictive maintenance and optimization. This is expected to create ample growth opportunity for the oil immersed power transformer market in the coming years.

Market Segmentations and Scope of the Study

The oil immersed power transformer market share is segmented on the basis of component, type, cooling type, end user, and region. On the basis of component, the market is divided into transformer core, windings, insulating oil, tank, and others. On the basis of type, the market is segmented into power transformer and distribution transformer. On the basis of cooling type, the market is further bifurcated into oil natural air natural (ONAN), oil natural air forced (ONAF), oil forced air natural (OFAN), and others. On the basis of end user, the market is segmented into transmission and distribution utilities, industrial sector, commercial sector, residential sector, and others. Regional breakdown and analysis of each of the aforesaid segments includes regions comprising of North America, Europe, Asia-Pacific, and RoW.

Geographical Analysis

Asia-Pacific holds the dominant share of oil immersed power transformer market at present and is expected to continue its dominance during the forecast period, due to the rising manufacturing sector within the region. According to the India Brand Equity Foundation (IBEF), the manufacturing sector in India is growing rapidly, contributing around 17% of the total GDP, which is expected to reach 25% by 2025. This increasing manufacturing sector consequently boosts the growth of the oil immersed transformers, as they play crucial role to provide seamless electric supply within the industries, thus propelling the growth of the market.

Moreover, the rising energy demand within the Asia-Pacific region is further propelling the growth of the market in countries such as China, India, and Japan. According to a report published by International Energy Agency (IEA), the electricity demand in China is surging rapidly with an increase in demand by 5.3% in 2023, and 5.1% in 2024. The surge in energy demand boosts the expansion of energy infrastructure, including transmission and distribution networks, thereby propelling the demand for oil immersed power transformers to effectively generate adequate electric energy.

On the other hand, North America is showing a steady rise in the oil immersed power transformer market due to the rising grid modernization initiatives within the region. For instance, in February 2024, Tantalus Systems, a company specializing in grid modernization, introduced the TRUGrid Transformer. This innovative product incorporates a data analytics solution designed to enhance grid reliability and resilience, enabling utilities to monitor and manage transformers with greater efficiency.

Moreover, rapid urbanization in the North American countries is further propelling the growth of the market. According to a report published by Central Intelligence Agency, urbanization in the U.S reached 83.3% of the total population in 2024. With such a rapid growth in the urban population, the demand for electricity is growing at a significant rate, leading to a surge in the demand for oil immersed power transformers.

Competitive Landscape

The oil immersed power transformer market comprising of various market players such as General Electric, Schneider Electric, ABB Ltd., Mitsubishi Electric Corporation, Toshiba Corporation, Hyundai Electric Co., Ltd., Eaton, Wilson Power Solutions, Power Tech India, and China XD Electric Co., Ltd. among others. These market players are adopting various product launch and expansion of business across various regions to maintain their dominance in the oil immersed power transformer market.

For instance, in February 2024, Schneider Electric launched EcoStruxure Transformer Expert to enhance the lifespan of oil transformers. The new system includes an IoT sensors along with software analysis which provides real time health update of the transformer in which it is embedded within.

Moreover, in August 2023, Eaton expanded its Nacogdoches manufacturing facility by 200,000 square feet, effectively increasing productivity. This expansion aims to double the production capacity of Eaton's voltage regulators, catering to utility customers across North America and aiding in the acceleration of grid modernization and resilience projects.

KEY BENEFITS

-

The report provides quantitative analysis and estimations of the oil immersed power transformer market from 2024 to 2030, which assists in identifying the prevailing market opportunities.

-

The study comprises a deep-dive analysis of the oil immersed power transformer market including the current and future trends to depict prevalent investment pockets in the market.

-

Information related to key drivers, restraints, and opportunities and their impact on the oil immersed power transformer market is provided in the report.

-

Competitive analysis of the players, along with their market share is provided in the report.

-

SWOT analysis and Porters Five Forces model is elaborated in the study.

-

Value chain analysis in the market study provides a clear picture of roles of stakeholders.

KEY MARKET SEGMENTS

By Component

-

Transformer Core

-

Windings

-

Insulating Oil

-

Tank

-

Others

By Type

-

Power Transformer

-

Distribution Transformer

By Cooling Type

-

Oil Natural Air Natural (ONAN)

-

Oil Natural Air Forced (ONAF)

-

Oil Forced Air Natural (OFAN)

-

Others

By End-Users

-

Transmission and Distribution Utilities

-

Industrial Sector

-

Commercial Sector

-

Residential Sector

-

Others

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 16.37 Billion |

|

Revenue Forecast in 2030 |

USD 24.73 Billion |

|

Growth Rate |

CAGR of 6.1% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

KEY PLAYERS

-

General Electric

-

Schneider Electric

-

ABB Ltd.

-

Mitsubishi Electric Corporation

-

Toshiba Corporation

-

Hyundai Electric Co., Ltd.

-

Eaton

-

Wilson Power Solutions

-

Power Tech India.

-

China Xd Electric Co., Ltd.

Speak to Our Analyst

Speak to Our Analyst