Robot Preventive Maintenance Market by Type (SCARA Modular Robots, Articulated Modular Robots, Collaborative Modular Robots, Cartesian Modular Robots, Parallel Modular Robots, and Others.), by Mobility (Fixed Robots and Mobile Robots), by Component (Hardware, Software, and Service) by Application (Handling, Assembly, Welding, Painting, Cutting, Pick & Place, and Others) and by End User (Logistics, Aerospace & Defense, Healthcare, Food & Beverages, Automotive & Transport, Manufacturing, Media & Entertainment, and Others)– Global Opportunity Analysis and Industry Forecast, 2024–2030

Industry: ICT & Media | Publish Date: 29-Jan-2024 | No of Pages: 577 | No. of Tables: 356 | No. of Figures: 321 | Format: PDF | Report Code : N/A

Market Overview

The global Robot Preventive Maintenance Market size was valued at 5.12 billion in 2023 and is predicted to reach USD 10.04 billion by 2030, with a CAGR of 10.1% from 2024 to 2030. Robot preventive measures" refer to proactive actions and strategies implemented to anticipate, avoid, or minimize potential issues, risks, or problems associated with the operation and performance of robots. These measures are designed to prevent problems before they occur, ensuring the efficient and safe functioning of robotic systems.

Examples of preventive measures include regular maintenance, software updates, training and education for operators, environmental monitoring, backup systems, emergency stop mechanisms, regular inspections, cybersecurity measures, documentation and reporting, and remote monitoring. Incorporating these measures helps enhance the reliability, safety, and longevity of robotic systems in various applications and industries.

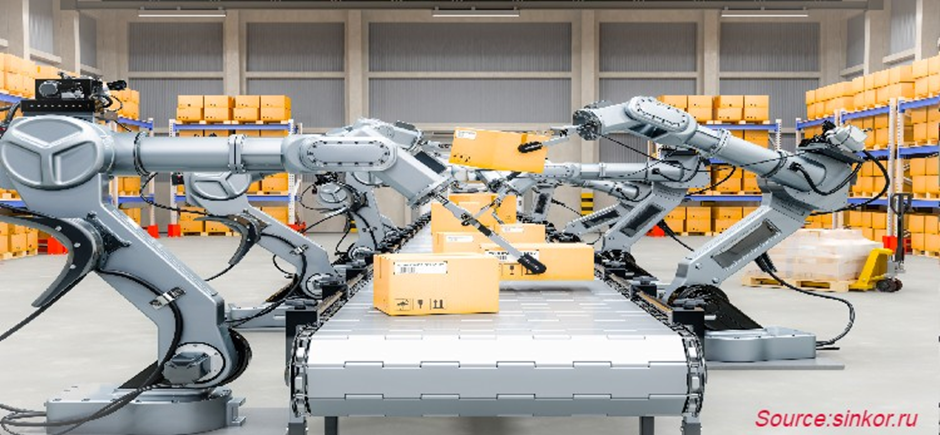

Increasing Adoption of Robotics Across the Globe Drives the Market Growth

The widespread adoption of robotic systems across industries is driving the need for effective robot preventive measures. According to the latest report from the International Federation of Robotics, there were 553,052 industrial robot installations in factories worldwide in 2022, reflecting a 5% year-on-year growth rate. As organizations increasingly depend on robots for a variety of tasks such as inventory management and material handling among others, the demand for proactive measures to safeguard operational integrity and prioritize safety has become increasingly evident. This growing requirement stems from the imperative to mitigate risks associated with technical malfunctions or unforeseen events, particularly as the reliance on robotics continues to escalate.

Integration of Artificial Intelligence (AI) in Robotics

Integrating artificial intelligence (AI) and machine learning (ML) into robotics is driving the creation of predictive maintenance solutions, the advanced versions of preventive measures. These solutions use smart technology to identify potential issues beforehand, making system failures less likely. This proactive approach helps optimize how maintenance is done, making it more efficient overall. It's like upgrading from a fixed schedule to a more flexible and data-driven way of keeping systems in good shape. This not only improves reliability but also makes maintenance more cost-effective and streamlined, reflecting the current trend toward smarter and more proactive industrial practices.

High Initial Cost and Complexity to Integrate with Traditional Systems Restrains Market Growth

The upfront expenses associated with implementing robot preventive measures is a significant restraint on their growth. Establishing preventive practices often demands substantial investments in specialized equipment, monitoring systems, and workforce training. For smaller businesses or those operating with constrained budgets, these initial costs may pose a considerable challenge, potentially slowing down the widespread adoption of preventive measures for robots.

Introduction of Smart Sensors Creates Market Opportunities

The introduction of advanced sensors and monitoring systems for robots is poised to open significant opportunities for the growth of the robot preventive measures market. These sensors can offer real-time data on various facets of robotic performance, such as temperature, vibration, and wear and tear. The enhancement of sensor technologies plays a crucial role in the early detection of potential issues, enabling timely intervention and maintenance. This advancement not only promotes the overall efficiency of robotic systems but also aligns with the proactive approach of preventive measures, ensuring that any emerging concerns are addressed promptly.

Asia Pacific Dominates the Robot Preventive Maintenance Market

The rapid expansion of the industrialization sector in the Asia-Pacific region is playing a crucial role in propelling the robot preventive maintenance market growth. As industries in Asia-Pacific continue to experience substantial growth and development, there is an increasing demand for advanced technologies, including industrial robots, to enhance efficiency and productivity. Industrial robots are becoming integral components of manufacturing processes across various industries such as automotive, electronics, and aerospace in the Asia-Pacific region.

These robots are employed for tasks ranging from assembly and welding to material handling and quality control. According to the latest report published by the International Federation of Robotics, the majority of newly deployed robots, accounting for 73%, were deployed in the Asia Pacific region. China is the largest adopter of industrial robots in the region and experienced a robust growth of 51% in installations, totaling 268,195 units shipped. As the adoption of industrial robots increases, there is a parallel need for effective preventive maintenance solutions to ensure the continuous and optimal functioning of these machines.

Moreover, the surge in government initiatives aimed at digitalization and industrial automation in the Asia-Pacific region is playing a pivotal role in fostering the growth of the robot preventive maintenance market. As governments across Asia-Pacific increasingly prioritize and invest in digital transformation and automation strategies, there is a rapid rise in the adoption of industrial robots within various sectors.

For instance, the government of China, as part of its Made in China 2025 plan, strategically prioritized smart manufacturing, underscoring its importance in transforming the country's economic model. Through this plan, the government aims at advancing industrial capabilities through the integration of cutting-edge technologies such as robots and digitalization, creating a favorable environment for the expansion of preventive maintenance solutions.

Europe is Expected to Show Steady Growth

The growing adoption of industrial automation in Europe is a key driver behind the expansion of the robot preventive maintenance market share. As industries in Europe increasingly embrace automation technologies to enhance efficiency and productivity, the demand for effective preventive maintenance solutions for industrial robots has risen correspondingly.

For instance, as per the International Federation of Robotics, the deployment of industrial robots across the European Union (EU) is rising significantly. In 2022, the EU's 27 member states installed nearly 72,000 units, marking a 6% year-on-year growth, reflecting the region's commitment to enhancing manufacturing efficiency and staying at the forefront of industrial innovation.

Moreover, the growth of the robot preventive maintenance market in Europe is propelled by the increasing industrialization in the region. With a rising emphasis on automation in various sectors, more industrial robots are being utilized. Consequently, there is a growing demand for preventive maintenance solutions to ensure the consistent and reliable performance of these robots. This reflects the acknowledgment of the importance of proactive maintenance in preventing disruptions and prolonging the operational life of industrial robots, contributing to the overall expansion of the preventive maintenance market in Europe.

For instance, industrial production in Europe increased by 8% in 2021 and continued to rise by 5% in 2022, with the value of sold production reaching about USD 6590 billion—an impressive increase from USD 5899 billion in 2021. As industries in the region prioritize automation to enhance efficiency, the demand for industrial robots is rising, driving the growth of the robot preventive maintenance market in this region.

Competitive Landscape

Several market players operating in the robot preventive maintenance industry include ABB Ltd., Yaskawa Electric Corporation, Nachi-Fujikoshi Corp, Denso Corporation, Kawasaki Heavy Industries, Ltd, KUKA AG, iRobot Corporation, Fanuc Corporation, Mitsubishi Electric Corporation, and Sony Corporation among others. These market players are adopting various strategies to remain dominant in the market.

For instance, in January 2021, ABB introduced a new Condition-Based Maintenance (CBM) service, allowing users of their robots to develop a preventive maintenance schedule for individual robots or fleets. This is based on real-time operational data, aiming to enhance productivity and reduce downtime.

Robot Preventive Maintenance Market Key Segments

By Component

-

Hardware

-

Software

-

Services

By Type

-

Articulated Robots

-

SCARA Robots

-

Collaborative Robots

-

Cartesian Robots

-

Parallel Robots

-

Other Types

By Mobility

-

Fixed Robots

-

Mobile Robots

By Application

-

Material Handling

-

Assembly/Disassembly

-

Welding

-

Painting

-

Cutting

-

Pick and Place

-

Other Applications

By End User

-

Automotive & Transportation

-

Aerospace & Defense

-

Healthcare

-

Food & Beverages

-

Logistic

-

Manufacturing

-

Media & Entertainment

-

Others

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

Rest of the World (RoW)

-

Latin America

-

Middle East

-

Africa

-

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 5.12 Billion |

|

Revenue Forecast in 2030 |

USD 10.04 Billion |

|

Growth Rate |

CAGR of 10.1% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

Increasing adoption of robotics across the globe drives the market growth Integration of artificial intelligence (AI) in robotics boosts the market |

|

Countries Covered |

28 |

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Key Players

-

ABB Ltd.

-

Yaskawa Electric Corporation

-

Nachi-Fujikoshi Corp

-

Denso Corporation

-

Kawasaki Heavy Industries, Ltd

-

KUKA AG

-

iRobot Corporation

-

Fanuc Corporation

-

Mitsubishi Electric Corporation

-

Sony Corporation

Speak to Our Analyst

Speak to Our Analyst