Security Screening Market by Type (X-Ray Systems, Explosive Trace Detectors (ETD), Biometric Systems, Metal Detectors, Liquid Scanners, Shoe Scanners, and Others), by Integration level (Standalone Screening Systems, Integrated Screening Solutions, and Networked Screening Systems) and by End User (Airports, Transportation Infrastructure, Government and Public Buildings, Critical Infrastructure, Retail and Shopping Centers, Event Venues, Educational Institutions, Healthcare Facilities, and Others)- Global Opportunity Analysis and Industry Forecast 2023 – 2030

Market Definition

The Security Screening Market size was valued at USD 8.61 billion in 2022 and is predicted to reach USD 16.15 billion by 2030 with a CAGR of 8.2% from 2023-2030. Security screening refers to the systematic process of inspecting individuals, objects, or areas to identify potential security threats. It involves the use of specialized equipment to detect and prevent the unauthorized possession of weapons, explosives, or prohibited items in secure locations such as airports, government buildings, or event venues. The primary objective of security screening is to ensure the safety and protection of individuals and property within a controlled environment by mitigating potential risks and preventing unauthorized access to sensitive areas.

Market Dynamics and Trends

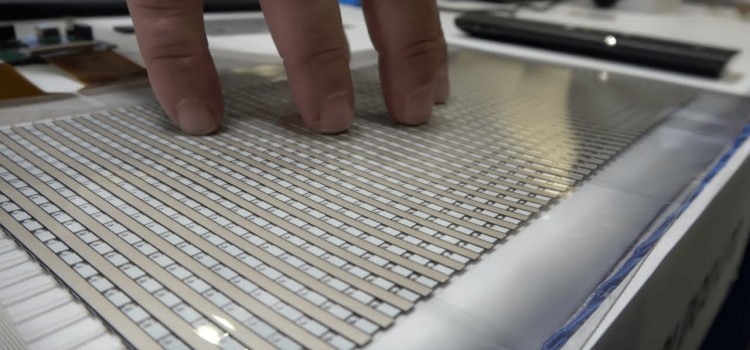

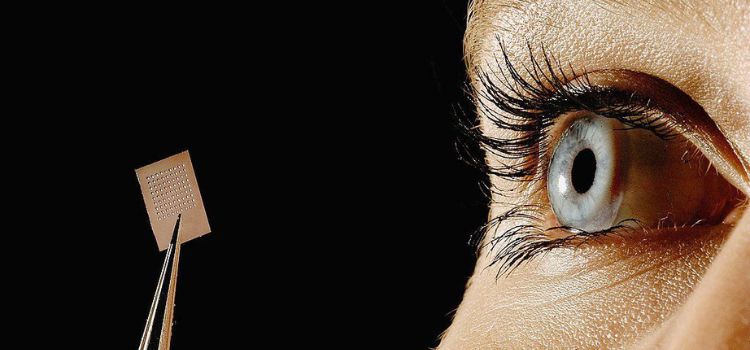

The demand for security screening is increasing due to rising incorporation of metal detectors and X-ray machines in airports & airlines for detecting illegal weapons and scanning passengers’ luggage. Also, the use of biometrics system in an airport that provides a contactless way of verification of passengers’ identity are expected to support the growth of security screening market. Moreover, the growing demand of installations of security screening devices in malls, railway stations and hospitals due to threat of terrorism drives the market growth. For instance, in March 2022, US based Pennsylvania Hospital (PAH) installed Evolv Technology security system for detecting dangerous metal item.

Also, rising government initiatives owing to the increasing illegal threat aimed at enhancing security measures, strengthening law enforcement efforts, and implementing stricter regulations to counteract criminal activities and safeguard public safety is further boosting the growth of the market. For instances, in July 2022, The Transportation Security Administration and Airports Council International (ACI) of Europe joined hands to establish open architecture for airport security systems in order to address security threats.

However, high installation costs of security screening devices are expected to restrain the growth of market during the forecast period. On the contrary, growing demand of security screening devices such as passive infrared (PIR) sensor and OV7670 camera module that can sense movement of any object within a range and capture images of intruder is expected to create ample growth opportunities for the market in the coming years.

Market Segmentations and Scope of the Study

The security screening market share is segmented on the basis of type, application, end user, and geography. On the basis of type, the market is classified into x-ray systems, explosive trace detectors (ETD), biometric systems, metal detectors, liquid scanners, shoe scanners, and others. On the basis of integration level, the market is classified into standalone screening systems, integrated screening solutions, and networked screening systems. On the basis of end user, the market is bifurcated into airports, transportation infrastructure, government and public buildings, critical infrastructure, retail and shopping centres, event venues, educational institutions, healthcare facilities, and others. Geographic breakdown and analysis of each of the aforesaid segments includes regions comprising North America, Europe, Asia-Pacific, and Row.

Geographical analysis

North America holds the predominant share of the security screening market at present and is expected to continue its dominance during the forecast period. This is due to the rising installation of advance security screening devices across several airports in the region that ensures the safety of passengers and airport personnel. For instances, in January 2023, Clear, provider of expedited identity verification services, has installed its identity verification device at Raleigh-Durham International Airport (RDU) in North Carolina, U.S. This new device allows travellers to skip ques at airport security by providing them with the ability to create an account and provide fingerprints and photos. Also in February 2022, US Transportation Security Administration (TSA) installed advanced 3D scanners to enhance their explosives detection capabilities in New York. The scanner systems use algorithms to detect explosives in baggage by creating 3D images of the objects.

In addition, presence of leading market players such as OSI Systems, Smith’s Detection Inc., and L-3 Communications Security and Detection Systems Inc. is further fuelling the growth of the market in this region. For instance, in March 2021, OSI Systems received an order of approximately USD 16 million to provide maintenance and support for US aviation checkpoint inspection systems.

On the other hand, the Asia Pacific region is poised for significant growth in the security screening market due to the increasing need for enhanced security checks in public places such as hospitals and railway stations. This is primarily driven by the growing threat of illegal emigration in countries within this region. For instance, Philippines holds the highest number of emigrants in the Asia-Pacific and ranks ninth globally in terms of total emigration. Also, increasing cases of human trafficking and smuggling in this region is further increasing the demand screening devices in turn driving the growth of the market. For instance, in June 2022, the United Nations Office on Drugs and Crime (UNODC) announced that approximately 172 tons of illegal drugs were seized in East and Southeast Asia.

Competitive Landscape

The security screening market comprises of various market players such as Smiths Detection Inc., L-3 Communications Security and Detection Systems Inc., OSI Systems Inc., 3DX-Ray Ltd, Teledyne Icm, Analogic Corporation, Nuctech Company Limited, Astrophysics Inc., CEIA Spa, and Gilardoni Spa. These market players are adopting partnership and expansion of business across various regions to maintain their dominance in the security screening market.

For instance, in May 2023, OSI Systems, received an order for USD 9 million from an international aviation customer to supply a range of inspection equipment platforms. These include the RTT 110 (Real Time Tomography) explosive detection system for checked luggage, the Orion 920CT checkpoint baggage inspection system, and the Orion 920DX dual view X-ray checkpoint inspection system. Also, in April 2022, Smiths Detection joined hands with Donggok Precision Co. Ltd, to supply a suite of leading-edge passenger baggage screening equipment at Incheon International Airport’s (ICN), South Korea.

KEY BENEFITS

-

The report provides quantitative analysis and estimations of the security screening market from 2023 to 2030, which assists in identifying the prevailing market opportunities.

-

The study comprises a deep dive analysis of the security screening market including the current and future trends to depict prevalent investment pockets in the market.

-

Information related to key drivers, restraints, and opportunities and their impact on the security screening market is provided in the report.

-

Competitive analysis of the players, along with their market share is provided in the report.

-

SWOT analysis and Porters Five Forces model is elaborated in the study.

-

Value chain analysis in the market study provides a clear picture of roles of stakeholders.

KEY MARKET SEGMENTS

By Type

-

X-Ray Systems

-

Explosive Trace Detectors (ETD)

-

Biometric Systems

-

Metal Detectors

-

Liquid Scanners

-

Shoe Scanners

-

Others

By Integration level

-

Standalone Screening Systems

-

Integrated Screening Solutions

-

Networked Screening Systems

By End User

-

Airports

-

Transportation Infrastructure

-

Government and Public Buildings

-

Critical Infrastructure

-

Retail and Shopping Centers

-

Event Venues

-

Educational Institutions

-

Healthcare Facilities

-

Others

By Region

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

KEY PLAYERS

-

Smith’s Detection Inc.

-

L-3 Communications Security and Detection Systems Inc.

-

OSI Systems Inc.

-

3DX-Ray Ltd

-

Teledyne Icm

-

Analogic Corporation

-

Nuctech Company Limited

-

Astrophysics Inc.

-

CEIA Spa

-

Gilardoni Spa

Speak to Our Analyst

Speak to Our Analyst