Semiconductor Capital Equipment Market by Type (Wafer-Level Manufacturing Equipment, Assembly and Packaging Equipment, Automated Test Equipment), by Process Type (Front-End Equipment and Back-End Equipment), and by Industry Vertical (Consumer Electronics, Automotive, Telecommunications and IT, and Others)– Global Opportunity Analysis and Industry Forecast 2024-2030

Semiconductor Capital Equipment Market Overview

The global Semiconductor Capital Equipment Market size was valued at USD 83.83 billion in 2023 and is predicted to reach USD 146.19 billion by 2030 with a CAGR of 8.3% from 2024-2030.

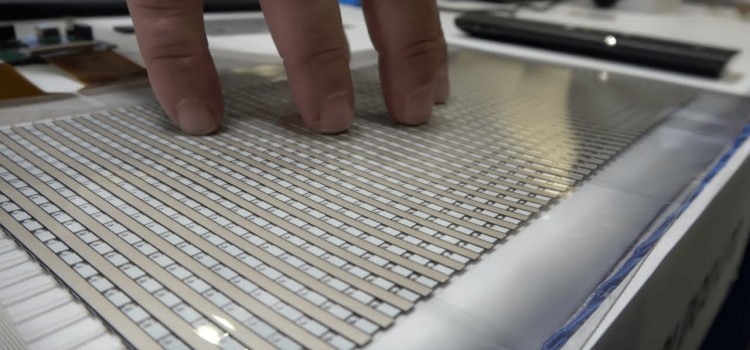

The semiconductor capital equipment market also known as semiconductor manufacturing equipment refers to the industry involved in providing equipment essential for the production and testing of semiconductor devices. The semiconductor manufacturing equipment includes specialized machinery and tools used in the manufacturing of semiconductor devices that are essential components in modern electronics.

The primary advantage of the semiconductor manufacturing equipment enables advancements and miniaturization of semiconductor technologies across various industries such as consumer electronics, automotive, telecommunication, and healthcare. The growing demand for powerful and efficient electronic devices is pivotal in supporting technological progress and maintaining the competitive edge of semiconductor manufacturers worldwide.

Market Dynamics and Trends

The increasing demand for consumer electronics such as smartphones, tablets, and wearables are driving the need for semiconductors, thereby driving the semiconductor capital equipment market growth. According to the Global System for Mobile Communications (GSMA) report as of 2023, around 4.3 billion of the global population owns a smartphone. Therefore, this widespread use of consumer electronics drives the need for semiconductor capital equipment due to the critical role that semiconductors play in powering these devices.

Also, the growth of the automotive sector including the rise of electric vehicles (EVs) and sophisticated driver-assistance technologies, such as advanced driver-assistance systems (ADAS) are further accelerating the semiconductor capital equipment market expansion. These technologies rely heavily on semiconductors components to function effectively, creating a strong need for high-performance and innovative semiconductor manufacturing equipment.

According to the latest report published by the Our World in Data, the number of new cars sold in the world as of 2022 was about 72.86 million units that increased to around 76.67 million units in 2023, marking a growth of 5%. Subsequently, this surge in vehicle sales highlights the increasing demand for semiconductor technologies, thereby propelling the need for advanced equipment capable of meeting the evolving requirements of the automotive industry.

Moreover, the rising adoption of Internet of Things (IoT) devices such as smart home gadgets, industrial sensors, wearables, and others increases the demand for advanced semiconductor components that in turn drives the market growth. This surge in demand necessitates the use of sophisticated manufacturing equipment, including photolithography machines, etching systems, and deposition tools.

According to the report published by the Information Handling Services (IHS), as of 2023, the IoT market grew from 15.4 billion devices in 2015 to 30.7 billion devices in 2020 and is expected to grow by 75.4 billion in 2025.

Thus, the rapid expansion reflects the need for continued innovation and investment in semiconductor capital equipment to meet the increasing production requirements and technological advancements in the IoT sector.

However, high investment cost required for advanced semiconductor manufacturing equipment hinders small companies from entering or expanding within the industry thereby restraining the growth of the market.

On the contrary, the advancement in 3D chip packaging is expected to create ample future opportunity as industries increasingly focus on heterogeneous integration, that involves stacking different types of chips to boost performance and functionality.

Technologies such as fan-out wafer-level packaging (FOWLP) and chip-on-wafer (CoW) are becoming crucial for producing efficient, compact, and powerful semiconductor designs. Therefore, the development and adoption of these advanced packaging methods are anticipated to drive substantial growth in the semiconductor manufacturing equipment market.

Market Segmentation and Scope of Study

The semiconductor capital equipment market report is segmented by type, process type, industry vertical, and region. On the basis of equipment type, the market is divided into wafer-level manufacturing equipment, assembly and packaging equipment, automated test equipment. On the basis of process type, the market is categorized into front-end equipment and back-end equipment. On the basis of application, the market is segmented into consumer electronics, automotive, telecommunications and IT, others. Regional breakdown and analysis of each of the aforesaid segments includes regions comprising of North America, Europe, Asia-Pacific, and RoW.

Geographical Analysis

Asia-Pacific dominates the semiconductor capital equipment market share and is expected to continue its dominance throughout the forecast period. This is attributed to the presence of key market players such as SCREEN Holdings Co., Ltd., Advantest Corporation, and Hitachi High-Tech Corporation, that are investing heavily in infrastructure and advanced manufacturing technologies to enhance production capabilities and drive innovation in the market.

For instance, in January 2024, SCREEN Holdings CO., Ltd. inaugurated its new factory the S3-5 (S-Cube 5) that is dedicated to semiconductor production equipment at the Hikone Site in Japan. It is designed to enhance the production of single wafer cleaning equipment and other related technologies.

Thus, such strategic investments and infrastructure expansions by key players in the region enhances the demand for semiconductor manufacturing equipment by driving technological advancements and expanding the capabilities of semiconductor manufacturing.

Also, the growing consumer demand for electronic devices accelerating the need for advanced semiconductors in countries such as India, China, and Japan, subsequently fueling the market growth.

According to the latest report published by the Indian Brand Equity Foundation (IBEF), the Indian appliances and consumer electronics sector was valued at USD 9.84 billion in 2021 and is expected to grow to USD 21.82 billion by the end of 2025. Consequently, this robust growth highlights the expanding demand for advanced semiconductors within the region, further propelling the need for semiconductor manufacturing equipment in the region.

On the other hand, North America region is expected to show a steady rise in the semiconductor capital equipment market growth owing to the rising government initiatives and investments to strengthen the domestic manufacturing capabilities, foster innovations, and enhance research and development activities. These initiatives help attract the global semiconductor companies to establish or expand their operations in the region.

According to a report published by Semiconductor Industry Association as of June 2024, the U.S. government invested an amount of around USD 450 billion across 25 states under the CHIPS Act of 2022 in the semiconductor industry.

These incentives are designed to stabilize the semiconductor supply chain in the U. S. Thus, rising government initiatives and investments in the semiconductor industry propels the demand for semiconductor manufacturing equipment by providing financial support and fostering innovation within the sector.

Moreover, the expansion of automotive sector in the region increases dependence on advanced semiconductor technologies including those used in infotainment systems, autonomous driving features, and electric vehicle components, that in turn propels the growth of the market.

This increasing demand necessitates the use of sophisticated manufacturing equipment that includes photolithography machines, etching systems, and deposition tools. According to the latest report published by the Our World in Data, the number of vehicles sold in Mexico as of 2023 was around 1.17 million units that was up from 94 thousand units in 2022 marking an increase of about 24%. Therefore, this surge in vehicle sales highlights the need for continued investments in advanced manufacturing equipment to support the automotive sector's expansion.

Competitive Landscape

Various key market players operating in the semiconductor capital equipment industry include Applied Materials, Inc., ASML Holding N.V., Lam Research Corporation, Tokyo Electron Limited (TEL), KLA Corporation, Advantest Corporation, SCREEN Holdings Co., Ltd., Hitachi High-Tech Corporation, Nikon Corporation, and Teradyne, Inc., and others.

These market players are opting various strategies including partnership, and product launch to maintain their dominance in the industry. For example, ASML Holding N.V. as of June 2024, partnered with Imec inaugurated the High NA EUV Lithography Lab in Veldhoven, Netherlands aimed at advancing semiconductor manufacturing technology.

This lab supports the semiconductor ecosystem by facilitating early engagement with material and equipment suppliers and advancing patterning techniques. The collaboration enhances the capabilities of optical lithography, improve manufacturing yields, and contribute to sustainability by reducing CO2 emissions associated with chip production.

Furthermore, in December 2023, Tokyo Electron Limited (TEL) launched the Ulucus G, a new water thinning system designed for 300 mm water fabrication. This system addresses the increasing demand for higher flatness in silicon wafers that are essential for advanced semiconductor manufacturing.

The system features single-wafer processing units, including a scrub cleaning unit and a spin wet etch unit that allows precise control over wafer quality. Thus, this innovation is a part of TEL's commitment towards enhancing semiconductor performance and meeting the evolving needs of wafer manufacturers.

For instance, May 2023, Applied Materials, Inc. launched a research and development (R&D) initiative by establishing the Equipment and Process Innovation and Commercialization (EPIC) center in Silicon Valley. This facility aims at advancing semiconductor manufacturing technology and also serves as a collaborative space for chipmakers allowing them early access to next generation processes and tools. The facility also partners with universities to validate new ideas on industrial-scale equipment.

Key Benefits

-

The report provides quantitative analysis and estimations of the semiconductor capital equipment market from 2024 to 2030, which assists in identifying the prevailing industry opportunities.

-

The study comprises a deep-dive analysis of the current and future semiconductor capital equipment market trends to depict prevalent investment pockets in the industry.

-

Information related to key drivers, restraints, and opportunities and their impact on the semiconductor capital equipment industry is provided in the report.

-

Competitive analysis of the key players, along with their market share is provided in the report.

-

SWOT analysis and Porters Five Forces model is elaborated on the study.

-

Value chain analysis in the market study provides a clear picture of roles of stakeholders.

Semiconductor Capital Equipment Market Key Segments

By Type

-

Wafer-Level Manufacturing Equipment

-

Assembly and Packaging Equipment

-

Automated Test Equipment

By Process Type

-

Front-end Equipment

-

Back-end Equipment

By Industry Vertical

-

Consumer Electronics

-

Automotive

-

Telecommunications and IT

-

Others

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

Applied Materials, Inc.

-

ASML Holding N.V.

-

Lam Research Corporation

-

Tokyo Electron Limited (TEL)

-

KLA Corporation

-

Advantest Corporation

-

SCREEN Holdings Co., Ltd.

-

Hitachi High-Tech Corporation

-

Nikon Corporation

-

Teradyne, Inc.

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 83.83 Billion |

|

Revenue Forecast in 2030 |

USD 146.19 Billion |

|

Growth Rate |

CAGR of 8.3% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst