Semiconductor Market by Type (Intrinsic Semiconductor, Extrinsic Semiconductor, p-type Semiconductor, and Others), by Component (Discrete Semiconductors, Power Semiconductors, Integrated Circuits, and Others), by Material Type (Silicon, Germanium, Gallium Nitride, and Others), by End-User (Consumer Electronics, Automotive, Healthcare, Telecommunication, and Others) –Global Opportunity Analysis and Industry Forecast 2024-2030

Market Overview

The global Semiconductor Market size was valued at USD 639.10 billion in 2023 and is predicted to reach USD 1209.35 billion by 2030 with a CAGR of 9.57% from 2024-2030. A semiconductor is a material with electrical conductivity that falls between that of a conductor and an insulator, which conduct electricity under certain conditions.

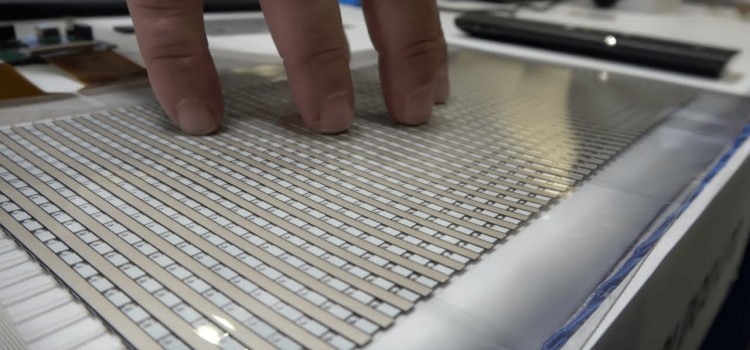

Semiconductors play a crucial role in electronics, forming the basis of devices such as diodes, transistors, and integrated circuits. The conductivity of a semiconductor can be controlled and manipulated by factors such as temperature, impurities, or an electric field.

The most commonly used semiconductor material is silicon, and germanium. These components are fundamental to modern electronics and are used in a wide range of applications, including computers, smartphones, televisions, and many other electronic devices.

Market Dynamics and Trends

The utilization of semiconductors in consumer electronic items driven by the growing adoption of smartphones, televisions, and gaming consoles globally propel the growth of the semiconductor market. The semiconductors play crucial role in manufacturing the integrated circuits (ICs) which serves as the brain of the devices, allowing numerous functions such as signal transmission, memory storage, and others.

According to the GSMA's annual State of Mobile Internet Connectivity Report 2023 (SOMIC), more than half, or 54%, of the world's population, approximately 4.3 billion individuals own a smartphone. Thus, the increasing adoption of consumer electronic goods boosts the growth of the market.

Moreover, the expanding integration of semiconductors across the automotive industry, particularly in critical components such as engine control units (ECUs), electronic stability control (ESC), and driver assistance systems, is driving significant growth in the global market.

This increased adoption is surged by the surging demand for advanced functionalities and safety features in vehicles, which rely heavily on semiconductor technology. As automobiles become more sophisticated and interconnected, the reliance on semiconductors for optimizing performance, enhancing safety, and enabling innovative features, continues to fuel the semiconductor market expansion.

Furthermore, emerging technologies such as artificial intelligence (AI), Augmented Reality (AR), and Virtual Reality (VR) is further propelling the growth of the integrated circuit market. According to a report published by Harvard Business School Publishing, in September 2021, 52% of companies around the world adopted AI into their business model, to seamless operate the business.

Emerging technologies demands for advanced semiconductor, including specialized chips such as GPUs (Graphics Processing Units) and TPUs (Tensor Processing Units) to enhance AI operations. Thus, with the increasing utilization of the advance technologies the semiconductor market demand is surging significantly.

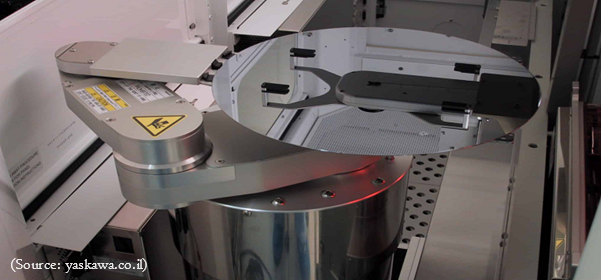

However, the high cost associated to the setting up of new semiconductor manufacturing units is expected to create hindrance for the growth of the market. On the other hand, the adoption of advanced fabrication techniques such as EUV lithography and Gate-All-Around (GAA) transistors in semiconductor manufacturing is expected to create promising growth prospects for the global market in the coming years.

These advanced techniques enable manufacturers to produce semiconductors with higher efficiency, smaller sizes, and improved performance, meeting the evolving demands of various industries such as electronics, automotive, and telecommunications. As these technologies become more widespread and refined, they are anticipated to drive innovation, enhance product capabilities, and create lucrative opportunities for the microchips companies in the future.

Market Segmentations and Scope of the Study

The semiconductor market report is segmented on the basis of type, component, material type, end-user, and region. On the basis of type, the market is segmented into intrinsic semiconductor, extrinsic semiconductor, p-type semiconductor, and others. On the basis of components, the market is divided into discrete semiconductors, power semiconductors, integrated circuits, and others. On the basis of material type, the market is bifurcated into silicon, germanium, gallium nitride, and others. On the basis of end-user, the market is further divided into consumer electronics, automotive, healthcare, telecommunication, and others. Regional breakdown and analysis of each of the aforesaid segments include regions comprising North America, Europe, Asia-Pacific, and RoW.

Geographical Analysis

Asia Pacific holds the dominant share of the semiconductor market at present and is expected to continue its dominance throughout the forecast period. This is due to the surge in adoption of electronics devises such as smart phones, laptops, and desktops in the region.

According to a report published by GSM Association, in July 2023, the smartphone adoption in Asia-Pacific region is expected to rise from 76% of the total mobile phone users to 94 % by 2030. This increase in adoption of smartphones propels the growth of the semiconductor market sector.

Moreover, the surging automotive industry is propelling the market in the region by driving demand for advanced electronic components used in vehicles. According to the International Institute for Management Development, global sales of New Energy Vehicles (NEVs) reached 10.824 million units by 2022, reflecting a remarkable 61.6% year-on-year surge.

China emerged as the dominant player in this market, with NEV sales hitting 6.884 million units, capturing an impressive 63.6% share of the global semiconductor market. Modern automobiles incorporate a wide array of semiconductor chips for various applications, including infotainment systems, driver assistance features, and powertrain control.

As automotive manufacturers continue to prioritize innovation and connectivity in vehicles, the need for high-performance semiconductors is increasing rapidly. This trend is expected to fuel the growth of the global market in the region as companies strive to meet the evolving technological requirements of the automotive sector.

On the other hand, North America is showing a steady rise in the semiconductor market share due to the presence of major companies such as Intel Corporation, Nvidia Corporation, and Broadcom Inc. that are adopting various strategies including product launches is further propelling the growth of the market.

For instance, in December 2023, Intel launched its latest processors designed for artificial intelligence (AI) -capable technology. The new processors, includes the fifth-generation Xeon processor and the Intel Core Ultra Processor, which are optimized for AI workloads in data centers and on personal computers.

Moreover, the semiconductor market is surging within the region due to the surge in investments related to carry out and promote the research and development in semiconductor. According to a report published by The White House, in August 2023, the semiconductor and electronics industries received an investment of approximately USD 231 billion.

Additionally, since President Biden enacted CHIPS into law, an additional USD 166 billion has been allocated to electronics and semiconductor sectors. Thus, with the rise in investments in the semiconductor industries the upgradation of the sector continues, boosting the growth of the market.

Competitive Landscape

The semiconductor market trends comprise of various key players such as Broadcom Inc., Intel Corporation, Qualcomm Incorporated, Nvidia Corporation, Micron Technology, Inc., Taiwan Semiconductor Co., Ltd., Samsung Semiconductor, Inc., NXP Semiconductors NV, Analog Devices Inc, Toshiba Corporation, among others. These market players are adopting various strategies including business expansion across various regions to maintain their dominance in the industry.

For instance, in November 2023, Samsung launched a new business unit dedicated to developing cutting-edge chip processing technology, aiming to lead the artificial intelligence (AI) chip market. The unit aims to integrate memory and processors required for high-performance applications. This initiative is part of Samsung's broader efforts to advance its semiconductor capabilities and compete in the global chip market.

Moreover, in June 2023, Micron Technology, one of the world's largest semiconductor companies, began construction of a new assembly and test facility in Gujarat, India, which will enable assembly and test manufacturing for both DRAM (Dynamic Random Access Memory) and NAND (Negative-And) products.

Key Benefits

-

The report provides a quantitative analysis and estimations of the market from 2024 to 2030, which assists in identifying the prevailing industry opportunities.

-

The study comprises a deep-dive analysis of the current and future semiconductor market trends to depict the prevalent investment pockets in the industry.

-

Information related to key drivers, restraints, and opportunities and their impact on the semiconductor market is provided in the report.

-

Competitive analysis of the key players, along with their market share is provided in the report.

-

SWOT analysis and Porters Five Forces model is elaborated in the study.

-

Value chain analysis in the semiconductor market study provides a clear picture of the roles of stakeholders.

Semiconductor Market Key Segments

By Type

-

Intrinsic Semiconductor

-

Extrinsic Semiconductor

-

p-type Semiconductor

-

Others

By Components

-

Discrete Semiconductors

-

Power Semiconductors

-

Integrated Circuits

-

Others

By Material Type

-

Silicon

-

Germanium

-

Gallium Nitride

-

Others

By End-User

-

Consumer Electronics

-

Automotive

-

Healthcare

-

Telecommunication

-

Others

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 639.10 Billion |

|

Revenue Forecast in 2030 |

USD 1209.35 Billion |

|

Growth Rate |

CAGR of 9.57%from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Key Players

-

Broadcom Inc.

-

Intel Corporation

-

Qualcomm Incorporated

-

Nvidia Corporation

-

Micron Technology, Inc.

-

Taiwan Semiconductor Co., Ltd.

-

Samsung Semiconductor, Inc.

-

NXP Semiconductors NV

-

Analog Devices Inc

-

Toshiba Corporation

Speak to Our Analyst

Speak to Our Analyst