Temperature Sensor Market Size by Type (Wired and Wireless), by Technology (Thermistor, Resistance Temperature Detector (RTD), Temperature Transmitters, Thermocouple, Temperature Sensor IC, Fiber Optics, and Non-Contact Sensors), by Output (Analog and Digital), and by End-Users Industry (Oil and Gas, Consumer Electronics, Chemical and Petrochemical, Energy & Power, Food and Beverages, Healthcare, Automotive, Metal and Mining, Aerospace and Defense, and Others)- Global Opportunity Analysis and Industry Forecast 2022-2030

Market Definition:

The Temperature Sensor Market was valued at USD 5.74 billion in 2021 and is predicted to reach USD 8.55 billion by 2030 with a CAGR of 4.8% from 2022 to 2030.

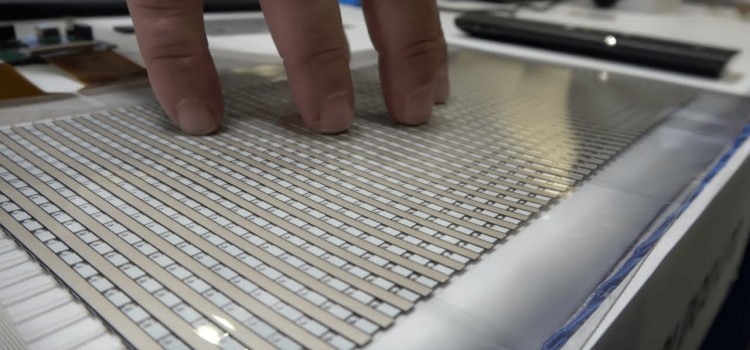

A temperature sensor, typically a thermocouple, is instrumentation equipment used to measure temperature in a readable form through an electrical signal. The basic principle of the temperature sensors is the voltage across the diode terminals. The temperature rises along with the increase in the voltage that is followed by a voltage drop between the transistor terminals of the base and emitter in a diode. The significant features of temperature sensors are low power consumption, durability, and accuracy as well as their efficient use in automotive applications such as cylinder head temperatures, air intake, and coolant.

Market Dynamics and Trends

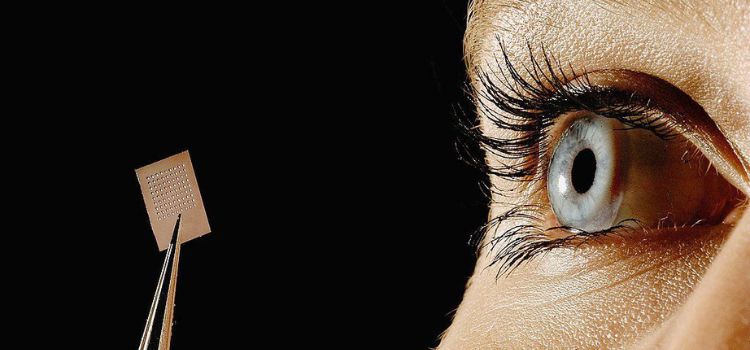

The demand for temperature sensors is rising due to the digitalization in the sensor industry, which supports large manufacturers such as Texas Instruments and Analog Devices Incorporation to develop and design new temperature sensors, utilizing a digital interface. Also, continuous demand for devices such as smartwatches to measure the body or skin temperature for keeping a constant check on health and smartphones to measure the temperature of the battery and chips are further propelling the sensors market. Moreover, factors such as innovation and utilization of temperature sensors in medical devices such as the F-micro miniature thermistor sensor and Semitec’s JT ultra-thin thermistor are fueling the market growth

The high initial cost involved in the manufacturing of advanced sensors and the lack of technical awareness regarding sensors are factors expected to restrain the growth of the market. On the contrary, high demand for temperature sensors in manufacturing industries such as oil & gas and metal & mining, among others as they are suitable for use in critical industrial locations and conditions, including boiler units, energy & power stations, and others are expected to create lucrative growth opportunities for the temperature sensor market players in the coming years.

Market Segmentations and Scope of the Study:

The temperature sensor market has been segmented based on type, technology, end-user, and geography. Based on type, the market is bifurcated into wired and wireless. Based on technology, the market is categorized into thermistor, resistance temperature detector (RTD), temperature transmitters, thermocouple, temperature sensor IC, fiber optics, and non-contact sensors. Based on output, the market is divided into analog and digital. The digital output sub-segment is further bifurcated into single-channel and multi-channel. Based on end-use, the market is classified into oil and gas, consumer electronics, chemical and petrochemical, energy & Power, food and beverages, healthcare, automotive, metal & mining, aerospace & defense, and others. Geographic breakdown and analysis of each of the aforesaid segments include regions comprising North America, Europe, Asia-Pacific, and RoW.

Geographical Analysis

North America region held the lion’s share of the temperature sensor market in 2021 and is expected to continue its dominance in the market during the forecast period. This is attributed to factors such as the presence of several established manufacturers in the region such as Honeywell International Inc., Texas Instruments Incorporated, and others, that steer the development and advancements of temperature sensors.

For instance, in February 2020, Texas Instruments expanded its temperature sensing portfolio with the introduction of linear thermistors that offer up to 50% higher accuracy compared to negative temperature coefficient (NTC) thermistors. Also, the well-established healthcare sector and extensive investments in healthcare, with wide applications of temperature sensors for continuous cardiac output monitoring and thermal dilution catheters are likely to augment the market growth.

For instance, as per the estimation of the Centers for Medicare and Medicaid Services, the national healthcare expenditure in the U.S. reached $4.1 trillion in 2020, or $12,530 per person, and is estimated to reach USD 6.2 trillion by 2028, thereby boosting the growth of temperature sensor market.

Asia Pacific is expected to show a steady rise in the temperature sensor market during the forecast period, due to their rising adoption in numerous growing industries such as oil & gas, chemical, energy, manufacturing, and others. These industries incorporate temperature sensors for measuring high reliability and performance in harsh environments.

For instance, in March 2022, China’s Petroleum & Chemical Corp, known as Sinopec planned to invest USD 31 billion in gas in 2022 for upstream exploration, especially the crude oil bases in Shunbei and Tahe fields, and natural gas fields in Sichuan province and the Inner Mongolia region.

Also, the developed pharmaceutical sector in countries such as China and India that deploy temperature sensors for sterilization, chemical processing, separation, and fermentation has resulted in increasing penetration of manufacturing facilities in the region.

According to Invest India, India ranks 3rd in terms of pharmaceutical production by volume and 14th by value, which includes a network of 3,000 drug companies and 10,500 manufacturing units. These factors are expected to accelerate the demand for temperature sensors in the Asia-Pacific region.

Competitive Landscape

The temperature sensor market comprises various players such as Honeywell, Denso Corporation, OMRON Corporation, Texas Instruments, Robert Bosch GmbH, NXP Semiconductors, Analog Devices, ABB Ltd, Emerson Electric Co., and STMicroelectronics among others. These manufacturers are actively indulging in R&D initiatives, product & technology innovations, and industrial collaborations to enhance their product portfolios and increase their sales growth as well as geographical reach.

For instance, in May 2021, Honeywell announced that dnata USA introduced the Honeywell Thermo Rebellion temperature monitoring solution to support domestic as well as international passengers at Boston Logan International Airport. This solution offers ground handling, cargo, travel, and flight catering services across five continents while protecting the health and safety of air travelers.

Also, in February 2020, Texas Instruments expanded its temperature sensing portfolio to include linear thermistors that deliver up to 50% higher accuracy compared to NTC thermistors. These thermistors support engineers to maximize performance while reducing bill-of-materials (BOM) and total solution cost. Such initiatives are projected to create new growth avenues for the market.

KEY BENEFITS

-

The temperature sensor market report provides a quantitative analysis of the current market and estimations through 2022-2030 that assist in identifying the prevailing market opportunities to capitalize on.

-

The study comprises a deep dive analysis of the temperature sensor market trend including the current and future trends for depicting the prevalent investment pockets in the market.

-

The information related to key drivers, restraints, and opportunities and their impact on the temperature sensor market is provided in the report.

-

The competitive analysis of the market players along with their market share in the temperature sensor market

-

The SWOT analysis and Porter’s Five Forces model are elaborated in the study.

-

Value chain analysis in the market study provides a clear picture of the stakeholders’ roles.

KEY MARKET SEGMENTS:

By Type

-

Wired

-

Wireless

By Technology

-

Thermistor

-

Resistance Temperature Detector (RTD)

-

Temperature Transmitters

-

Thermocouple

-

Temperature Sensor IC

-

Fiber Optics

-

Non-Contact Sensors

By Output

-

Analog

-

Digital

-

Single-channel

-

Multi-channel

-

By End-User

-

Oil and Gas

-

Consumer Electronics

-

Chemical and Petrochemical

-

Energy & Power

-

Food and Beverages

-

Healthcare

-

Automotive

-

Metal and Mining

-

Aerospace & Defense

-

Others

By Geography

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Italy

-

Germany

-

Spain

-

Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Taiwan

-

Vietnam

-

Rest of Asia Pacific

-

-

RoW

-

Latin America

-

Middle east

-

Africa

-

KEY PLAYERS:

-

Honeywell

-

Denso Corporation

-

OMRON Corporation

-

Texas Instruments

-

Robert Bosch GmbH

-

NXP Semiconductors

-

Analog Devices, Inc.

-

ABB Lt

-

Emerson Electric Co.

-

STMicroelectronics

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Analysis Period |

2021–2030 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Market Segmentation |

By Type (Wired, Wireless) By Technology (Thermistor, Resistance Temperature Detector (RTD), Temperature Transmitters, Thermocouple, Temperature Sensor IC, Fiber Optics, Non-Contact Sensors) By Output (Analog, Digital) By End-User (Oil and Gas, Consumer Electronics, Chemical and Petrochemical, Energy & Power, Food and Beverages, Healthcare, Automotive, Metal and Mining, Aerospace & Defense, Others) |

|

Geographical Segmentation |

North America (U.S., Canada, Mexico) Europe (Germany, UK, Spain, Italy, Netherlands, Rest of Europe), Asia-Pacific (Australia, China, India, Japan, South Korea, Vietnam, Taiwan, Rest of Asia-Pacific), Rest of the World (Latin America, Middle East, Africa) |

|

Companies Profiled |

Honeywell, Denso Corporation, OMRON Corporation, Texas Instruments, Robert Bosch GmbH, NXP Semiconductors, Analog Devices, Inc., ABB Ltd, Emerson Electric Co., STMicroelectronics |

Speak to Our Analyst

Speak to Our Analyst