UK Travel Insurance Market by Age (Millennials, Generation X, and Baby Boomers), by Income Level (Low-income travelers, Middle-income travelers and High-Income Travelers), by Coverage (Medical Coverage, Trip Cancellation Coverage, Baggage and Personal Belongings Coverage, Accidental Death and Dismemberment (AD&D) Coverage), by Days of Coverage (Short-Trip Insurance, Standard Trip Insurance, Extended Trip Insurance and Multi-Trip Insurance) by Distributional Channel (Insurance Companies, Banks, Airlines, Online Platforms, and Travel Agents & Tour Operators) – Opportunity Analysis and Industry Forecast, 2024–2030

Industry: BFSI | Publish Date: 07-Oct-2024 | No of Pages: 123 | No. of Tables: 90 | No. of Figures: 55 | Format: PDF | Report Code : BF1958

UK Travel Insurance Market Overview

The UK Travel Insurance Market size was valued at USD 1.88 billion in 2023 and is predicted to reach USD 3.16 billion by 2030, registering a CAGR of 6.7% from 2024 to 2030. This market refers to the industry dedicated to providing insurance coverage for travellers originating from or traveling within the UK.

The UK travel insurance market offers a variety of policies aimed at protecting against travel-related risks, such as trip cancellations, medical emergencies, lost or delayed luggage, and travel disruptions. Key aspects of the travel insurance market in the UK include customizable coverage options such as single-trip, multi-trip, and specialized policies for high-risk activities or individuals with pre-existing medical conditions.

The latest report published by the Office for National Statistics states that UK residents made 6.0 million overseas trips in May 2022, a significant increase from the 287,000 air visits recorded in May 2021. However, this figure is still 27% lower than in May 2019, when 8.2 million overseas trips were taken by UK residents. This decline highlights the importance of travel insurance as travellers continue to navigate the uncertainties of post-pandemic travel.

The UK travel insurance market provides essential financial protection against unforeseen events, helping travellers avoid substantial financial losses. The tailored coverage options also cater to specific needs, ensuring peace of mind and confidence for those exploring both domestic and international destinations.

Surge in Overseas Travel Fuels the Demand for Travel Insurance in UK

The rise in overseas travel by UK residents boosts the demand for safeguarding the journeys against unforeseen risks that in turn propels the travel insurance market. As per the latest report published by the Office for National Statistics states that the overseas visits by UK resident witnessed a substantial growth of around 23.7% from 58,536 in 2022 to 72,436 in 2023.

With more people traveling internationally in UK for leisure, business, or other purposes, the likelihood of encountering travel-related issues such as medical emergencies, trip cancellations, lost or delayed luggage, and other disruptions increases. The presence of potential risks makes holiday insurance an essential component of trip planning. Consequently, the surge in international travel increases the demand for tailored and reliable travel insurance policies in the country, driven by the desire for security and a smooth travel experience.

Digital Innovations in the UK are Fueling Growth in the Travel Insurance Market

Technological advancements by regional players in the UK, such as the development of innovative travel insurance platforms and digital tools, significantly boosts the UK travel insurance market growth by making travel protection more accessible and user-friendly. For instance, Just Insurance Agents launched Aneevo, a new travel insurance platform, specifically for UK brokers. The platform, evolving from Just Travel Cover wholesale, offers a range of baggage loss products, including parametric insurance for lost luggage.

Such apps simplify the process of purchasing and managing insurance policies, making it more accessible and convenient for travellers. Thus, technological advancement by regional players is accelerating the UK travel insurance market expansion through innovating and offering digital solutions tailored to modern travellers’ needs.

Regulatory Challenges Hinders the Market Growth

Regulatory complexities in the UK travel insurance market are slowing growth due to the numerous intricate regulations imposed by the country's authorities. Insurers operating within the UK face considerable administrative burdens and costs to ensure compliance with these diverse regulations.

For instance, the UK's Financial Conduct Authority (FCA) mandates that travel insurance policies must provide clear information on coverage limits, exclusions, and claims processes. This requirement, while designed to protect consumers, increases the operational burdens for insurers, including the need for extensive documentation and regular updates to policy information.

Consequently, these regulatory demands lead to higher costs and administrative strain, potentially restricting market entry for new players and restraining the growth of existing companies in the travel insurance sector in the UK.

Integration of Big Data Analytics Presents Lucrative Opportunity for Market Expansion

The integration of big data analytics in the UK travel insurance platforms is expected to create ample opportunities for the market growth by enabling insurers to offer highly personalized policies tailored to individual customer needs. This technology will allow for more accurate risk assessment and pricing, improving profitability and competitiveness. Enhanced data insights can lead to better fraud detection and streamlined claims processes, increasing operational efficiency. Additionally, the ability to analyze consumer behavior and trends can drive innovation in product development and customer engagement strategies.

For instance, in August, 2024, Gigasure, an insurtech platform of UK launched a new travel-focused Managing General Agent (MGA) named Travel Insurance MGA in UK. This MGA use advanced technology and data-driven insights to provide tailored travel insurance products, improve customer experiences, and enhance operational efficiency. The launch reflects a broader aspect of increased specialization and innovation within the travel insurance market trends to meet changing consumer demands and industry dynamics.

By Age, Millennials Holds the Predominating Share in the UK Travel Insurance Industry

Millennials are characterized by their strong inclination towards travel and unique experiences that significantly increase the UK travel insurance market demand. As per the analysis conducted by the Next Move Strategy Consulting, millennials are both the dominant and fastest growing segment in the age segment.

Additionally, the latest report published by the Kantar Survey states that 73% of the millennials in UK took at least one outbound holiday in 2023. This generation values the flexibility and protection that travel insurance offers, making it a common part of their travel planning. In contrast, Generation X (ages 41-56) and Baby Boomers (ages 57-75) tend to travel less frequently. As a result, their investment in trip insurance is often less pronounced, reflecting a lower perceived necessity. The higher travel frequency of millennials compared to generation X and baby boomers highlights their greater reliance on travel insurance to manage potential risks and disruptions during their trips.

By Distribution Channel, Online Platform is Projected to Witness the Highest CAGR Growth Until 2030

As per the research conducted by the Next Move Strategy Consulting, online platforms is the fastest growing segment within the distribution channel segment with a projected CAGR of 9.3% by 2030. Online platforms offer travel insurance through their digital channels, providing a convenient way for travellers to secure coverage as part of their booking process. These plans generally cover trip cancellations, medical emergencies, lost luggage, and travel delays, catering to individuals who book their travel arrangements online.

They offer travellers the convenience of browsing and comparing various insurance options from different providers in one centralized location. Additionally, many online platforms provide comprehensive information about coverage benefits, terms and conditions, and claim procedures, empowering travellers to make informed decisions.

Competitive Landscape

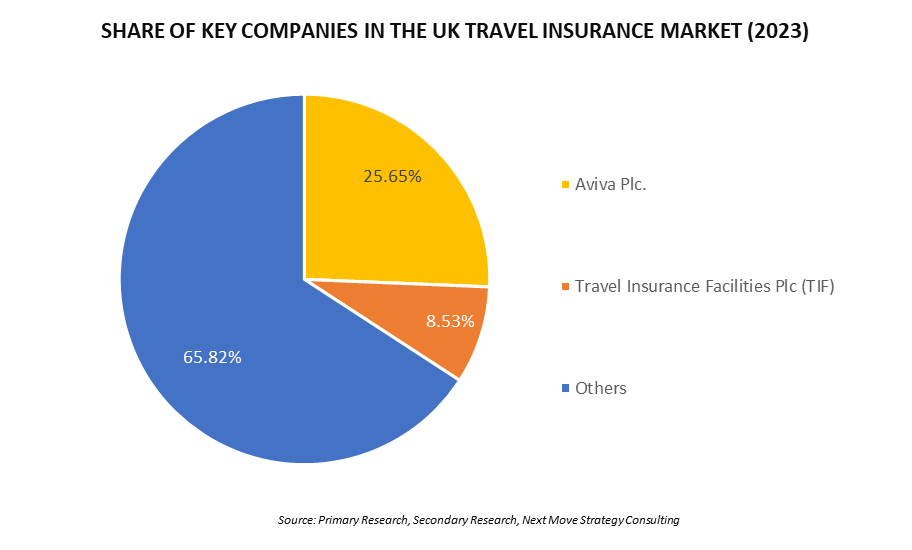

The promising players operating in the global UK travel insurance industry include Aviva Plc., Staysure Group, Travel Insurance Facilities Plc (TIF), Admiral Group Plc., AXA SA, esure Group plc, Chubb Limited, Allianz Assistance, Saga Plc, and All Clear Travel Insurance, among others.

These companies are engaged in various collaboration across various regions to maintain their dominance in the UK travel insurance industry.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

|

|

Jul-24 |

Allianz |

Allianz Partners UK partnered with Touristik Union International (TUI) as the travel insurance provider in the UK. Through this partnership, Allianz offered a range of travel insurance options to TUI customers in UK, aiming to enhance their travel experience by providing comprehensive coverage and support. |

|

|

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

May-23 |

Allianz |

Allianz Partners UK collaborated with Avid Insurance to enhance its travel insurance services in UK. This collaboration increased Allianz UK's ability to offer travel insurance by enhancing their coverage options. |

|

|

|

|

|

|||

|

|

|

|||

|

Jul-22 |

AXA |

AXA Partners U.K. collaborated with Rock Insurance Group to enhance the travel insurance offerings by providing comprehensive coverage options, including single trip and annual multi-trip insurance. The collaboration emphasizes digital innovation, ensuring a streamlined and efficient customer experience to the needs of travelers in U.K. |

UK Travel Insurance Market Key Segments

By Age

-

Millennials

-

Generation X

-

Baby Boomers

By Income Level

-

Low-income Travelers

-

Middle-income Travelers

-

High-income Travelers

By Coverage

-

Medical Coverage

-

Trip Cancellation Coverage

-

Baggage and Personal Belongings Coverage

-

Accidental Death and Dismemberment (AD&D) Coverage

By Days of Coverage

-

Short-Trip Insurance

-

Standard Trip Insurance

-

Extended Trip Insurance

-

Multi-Trip Insurance

By Distribution Channel

-

Insurance Companies

-

Banks

-

Airlines

-

Online Platforms

-

Travel Agents and Tour Operators

By End User

-

Pilgrim Travelers

-

Education Travelers

-

Business Travelers

-

Family Travelers

Key Players

-

Aviva Plc.

-

Staysure Group

-

Travel Insurance Facilities Plc (TIF)

-

Admiral Group Plc.

-

AXA SA

-

esure Group plc

-

Chubb Limited

-

Allianz Assistance

-

Saga Plc

-

All Clear Travel Insurance

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size Value in 2023 |

USD 1.88 Billion |

|

Revenue Forecast in 2030 |

USD 3.16 Billion |

|

Value Growth Rate |

CAGR of 6.7% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst

_Insurance.png)