X-Ray Security Scanner Market by Product Type (Body Scanners and Baggage Scanners), by Application (People Scanning and Product Scanning), and by End-user (Aviation & Transportation, Land Security, Commercial Malls & Multiplexes, Government & Banks, Postal Items, Ports & Border Crossings, Hospitals, and Others): Global Opportunity Analysis and Industry Forecast, 2024–2030.

Market Definition

The global X-Ray Security Scanner Market size was valued at USD 3.67 billion in 2023 and is predicted to reach USD 6.33 billion by 2030 with a CAGR of 8.1% from 2024 to 2030. X-ray security scanner is a device used to scan humans, bags, luggage, mail, and other shipments for security purposes using x-ray technology.

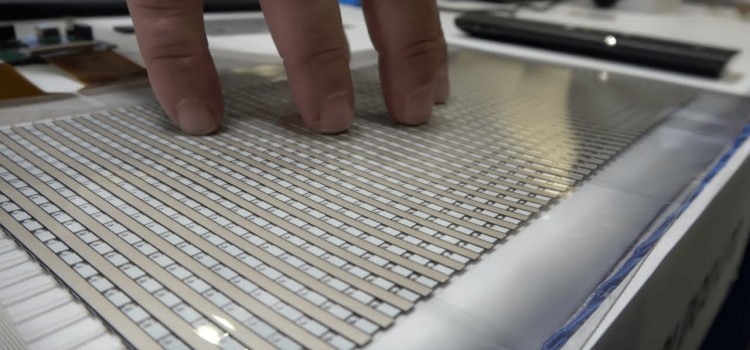

The x-ray body scanners and baggage scanners are used to detect illegal items such as smuggled goods, explosives, weapons, and narcotics that may be hidden in luggage or on a person's body. They are also capable of identifying other items, such as liquids and electronics, which may pose a security threat. These scanners are commonly used in airports, train stations, and other public places to ensure the safety and security of public.

An x-ray scanner works by passing low-level x-ray radiation through an object being scanned, which then is detected by sensors on the other side. The sensors pick up the varying levels of radiation that pass through the object and create a detailed image of its contents. X-ray security scanners are commonly used at airports, security checkpoints, prisons, and other locations where security is paramount.

Market Dynamics and Trends

The increasing need for safety and security at airports, railway stations, and other commercial places due to the rise in global terrorism and smuggling of contraband items is driving the growth of the x-ray security scanner market. Moreover, growth of the airline industry due to the increasing affordability and accessibility of air travel fosters the need for efficient and accurate security screening, thereby driving the growth of the global market.

Furthermore, stringent government regulations and guidelines to enhance security and ensure public safety particularly in high-risk areas such as airports, government buildings, and other critical infrastructure is further driving the growth of the x-ray security scanner market. However, increasing health concerns regarding the ill effects of X-ray radiation such as DNA mutations and cancer is the major factor restraining the growth of the market.

On the contrary, the introduction of AI-based x-ray scanners is expected to drive the market in the coming years. For instance, in September 2022, UCL Medical Physics & Biomedical Engineering researchers developed a new X-ray measuring technique with AI machine learning. The scanner detects illegal and dangerous items with 100% efficiency using a new X-ray approach.

Market Segmentations and Scope of the Study

The x-ray security scanner market report is segmented on the basis of product type, application, end-user, and region. On the basis of product type, the market is divided into body scanners and baggage scanners. On the basis of application, the market is classified into people scanning and product scanning. The product scanning is further divided into mail & parcel and cargo & baggage.

On the basis of end-user, the market is segmented into aviation & transportation, land security, commercial malls & multiplexes, government & banks, postal items, ports & border crossings, hospitals and others. The regional breakdown and analysis of each of the aforesaid segments include regions comprising of North America, Europe, Asia-Pacific, and RoW.

Geographical Analysis

North America holds the dominant share of x-ray security scanner market trends during the forecast period. This is attributed to factors such as the developed aviation industry and increased demand for X-ray security scanners due to surge in passenger traffic at airports to ensure the safety of passengers and their belongings. According to the Airlines of America, Commercial aviation industry in the U.S. reached USD 1.25 trillion carrying 2.3 million passengers and 66,000 tons of cargo in 2022.

Moreover, developed healthcare industry and the increasing adoption of x-ray scanners to maintain the safety of patients are further driving the growth of the X-ray security scanner market in this region. According to the U.S. Centers for Medicare & Medicaid Services, U.S. healthcare spending reached USD 4.3 trillion in 2021 as compared to 4.1 trillion in 2020.

On the other hand, Asia-Pacific is expected to show a steady rise in the x-ray security scanner market due to the increasing adoption of x-ray security scanners by BFSI industries to screen individuals and their belongings to safeguard the premises and people is further driving the growth of the global market in this region. According to the China Banking and Insurance Regulatory Commission, China's BFSI is one of the largest industries in the world with total assets of these sectors valued at USD 51.19 trillion in 2022.

Moreover, the growing retail sectors and the increasing construction of new shopping malls in countries such as India, China, and Japan are boosting the demand for x-ray scanners in this region. According to the National Investment Promotion & Facilitation Agency, the retail industry contributed USD 800 billion to India's GDP in 2020 and India ranked second in the global retail development index in 2021.

Competitive Landscape

The x-ray security scanner industry comprises various market players such as Eurologix Security, Todd Research, Auto Clear Us, Leidos, Morpho, Rapiscan, Smiths Detection, L3 Communications, American Science and Engineering Inc. (AS&E), Scannamsc, Gilardoni SPA, Astrophysics Inc., Fiscan, Shanghai Eastimage Equipment Co. Ltd., Hamamatsu Photonics, Shanghai Gaojing Radiography Technology Co. Ltd., Nuctech Company Limited, Pony Industry Co. Ltd., Vidisco Ltd., and others. These market players are adopting various strategies such as joint ventures and product launches to maintain their dominance in the market.

For instance, in October 2022, Smiths Detection announced the launch of the HI-SCAN 7555 DV dual-view X-ray scanner. The HI-SCAN 7555 DV brings better image quality, automatic detection of explosives, and eliminates the need to re-position or rescan objects.

Also, in June 2022, Thales Group launched a new x-ray scanner HELIXVIEW to improve security at airports. The new technology uses artificial intelligence (AI) to interpret threats and identifies explosives, knives, and parts of dismantled weapons without the need for passengers to remove belongings from their luggage.

Moreover, in May 2022, Astrophysics Inc., Astrophysics Asia Inc., and Ministry of Transportation and Communications entered into a joint venture contract for the supply, delivery, installation, and commissioning of a new baggage x-ray machines, walkthrough metal detectors with brand new generator sets.

Furthermore, in May 2022, Smiths Detection's HI-SCAN 100100V-2is hi-speed X-ray model was certified for use on the Transportation Security Administration's (TSA) Air Cargo Screening Technology List. The scanner comes in a compact design with a super-fast belt speed of 0.5 m/s, combined with dual-view, high-quality imaging, and can also support heavy loads up to 440 lbs.

Key Benefits

-

The report provides a quantitative analysis and estimations of the x-ray security scanner market from 2024 to 2030, which assists in identifying the prevailing market opportunities.

-

The study comprises a deep dive analysis of the x-ray security scanner industry, including the current and future trends to depict prevalent investment pockets in the market.

-

Information related to key drivers, restraints, and opportunities and their impact on the market is provided in the report.

-

Competitive analysis of the key players, along with their market share is provided in the report.

-

A SWOT analysis and the Porter's Five Forces model is elaborated on in the study.

-

Value chain analysis in the market study provides a clear picture of roles of stakeholders.

X-RAY SECURITY SCANNER MARKET KEY SEGMENTS

By Product Type

-

Body Scanners

-

Baggage Scanners

By Application

-

People Scanning

-

Product Scanning

-

Mail & Parcel

-

Cargo & Baggage

-

By End-User

-

Aviation & Transportation

-

Land Security

-

Commercial Malls & Multiplexes

-

Government & Banks

-

Postal Items

-

Ports & Border Crossings

-

Hospitals

-

Others

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Report Scope and Segmentation

|

Parameters |

Details |

|

Market Size in 2023 |

USD 3.67 Billion |

|

Revenue Forecast in 2030 |

USD 6.33 Billion |

|

Growth Rate |

CAGR of 8.1% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

Increasing need for safety and security at airports, railway stations, and other commercial places Rising airline industry across the globe Strict government regulations and guidelines regarding security |

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Key Players

-

Eurologix Security

-

Todd Research

-

Auto Clear Us

-

Leidos, Morpho

-

Rapiscan

-

Smiths Detection

-

L3 Communications

-

American Science and Engineering Inc. (AS&E)

-

Scannamsc, Gilardoni SPA, Astrophysics, Inc.

-

Shanghai Eastimage Equipment Co. Ltd.

-

Hamamatsu Photonics

-

Shanghai Gaojing Radiography Technology Co. Ltd.

-

Nuctech Company Limited

-

Pony Industry Co. Ltd.

-

Vidisco Ltd.

Speak to Our Analyst

Speak to Our Analyst