AC Drives Market by Type (Voltage-Frequency (V/F) Control Drives, Vector Control Drives, Sensor less Vector Control Drives, and Direct Torque Control (DTC) Drives), by Voltage (Low Voltage, Medium Voltage, and High Voltage), by Application (HVAC Systems, Pumps and Compressors, Material Handling Systems, and Elevators and Escalators), by End-User (Industries, Manufacturing, Oil & Gas, Water & Wastewater Treatment Plants, and Others) – Global Opportunity Analysis and Industry Forecast 2025-2030

AC Drives Market Overview

The global AC Drives Market size was valued at USD 16.45 billion in 2024 and is predicted to reach USD 22.03 billion by 2030 with a CAGR of 5.0% from 2025-2030.

The market is driven by factors such as rapid industrialization, the rapid growth of the mining industry, and rising technological advancements. The AC drives market also known as variable frequency drive market is however, is hindered due to the high initial investment related to the procure, install, and maintain of these drives, specifically for large-scale industrial operations. Conversely, the integration of Internet of things (IoT) with the drives to gather data presents a opportunity to the market in the long run since the integration will facilitate improved communication among devices, real-time monitoring, and decision-making based on data.

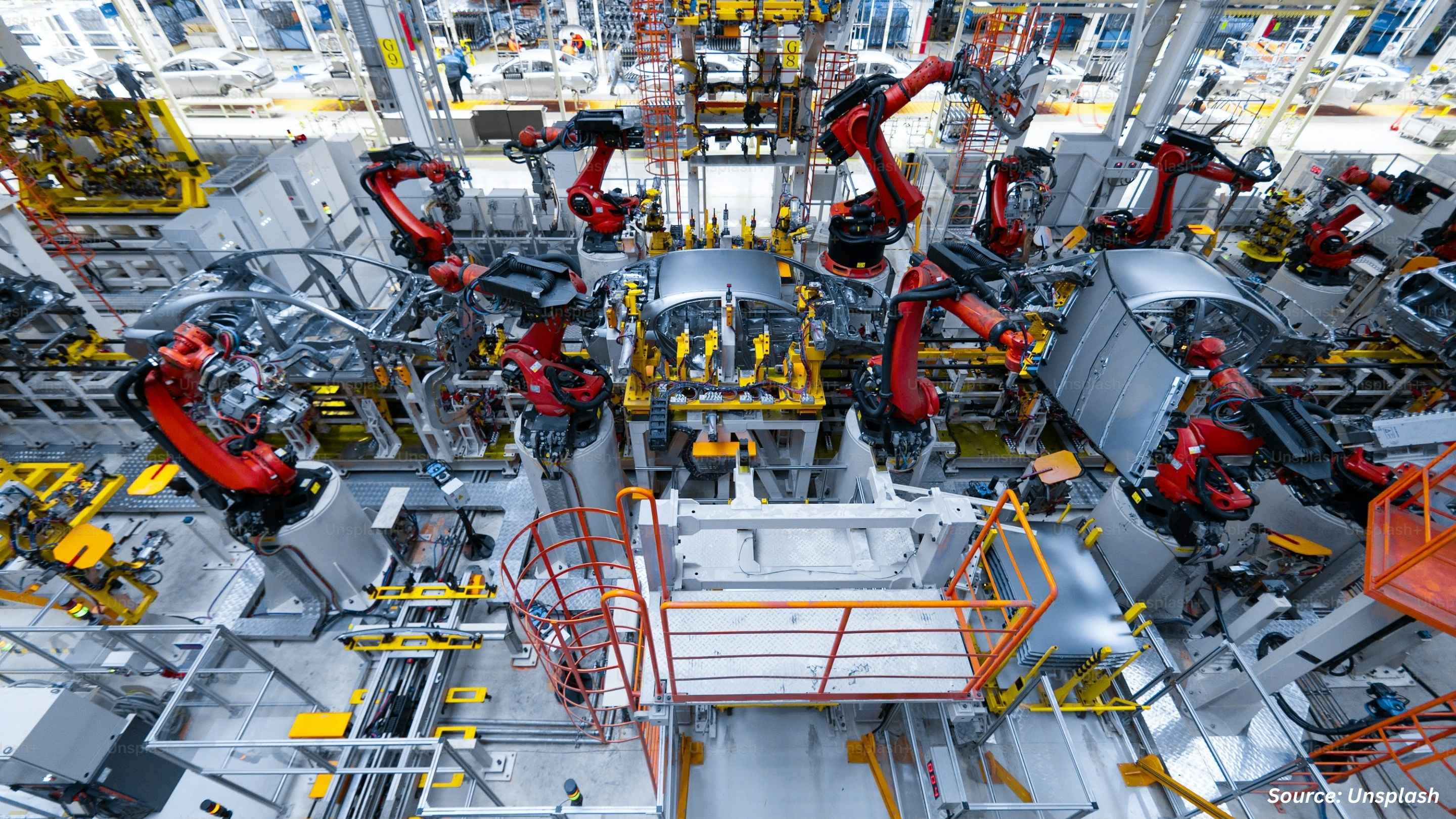

Rapid Industrialization Fuels the Growth of the Market

The rapid industrialization across the highly productive areas worldwide accelerates the growth of the market as this growth increases the demand for variable frequency drives (VFDs) as they play a vital role upgrading the efficiency and overall control of the electric AC motors. These electronic drives are integrated due to their capacity to offer precise control over torque and the speed of the motor.

According to a report published by United Nations Industrial Development Organization, in December 2023, industries around the world are growing rapidly, experiencing a significant growth of 2.3% in the year 2022 compared to the year 2021.This rapid growth of the industrialization drives the growth of the market as they provide minimal energy wastage and reduce overall operational costs.

Rapid Growth of the Mining Industries Boosts the Growth of the Market

The increase in mining activities in sectors such as gold, coal, and oil mines drive the market for AC drives as the drives are needed to minimize the consumption of energy, control the performance of the motors, and ensure guaranteed operation in machinery such as crushers and conveyor belts.

According to a report published by International Energy Agency (IEA), the production of the oil world-wide is growing at a rapid rate, as production reached 102.9 million barrels per day in 2024. The growing energy needs in energy-using industries, stresses the mounting reliance on AC drives to increase efficiency, reduce power consumption, and support operational demands of heavy-duty machinery.

Growing Technological Advancements Further Boosts the Market

The AC drive market experiences remarkable technological advancements, including enhanced energy efficiency, accuracy of control, and reliability. Contemporary AC drives are now equipped with high-end microprocessors, predictive maintenance using artificial intelligence, and Internet of Things integration for real-time monitoring.

For instance, Yaskawa Electric Corporation launched the LA700 drive in the end of 2024 for Japanese market, in order to address various challenges and customer needs regarding elevator inverters, which provides easier adjustment and improves elevator ride comfort. These technological advancements are driving increased adoption across industries further boosting the AC drives market growth.

High Initial Investment Hinder the Growth of the Market

The high initial investment involved in the purchase, implementation and maintenance especially for large-scale industrial applications is a major obstacle to the development of the industry. The expensive initial price of newer drive technology makes small and medium industries unwilling to adopt them, thus limiting their widespread usage. Thus, the expense remains a key restricting factor in the AC drives market expansion.

The Integration of IoT with the Drives Creates Future Growth Opportunities for the Market

Integration of Internet of things (IoT) with the drives to collect data is expected to create future opportunities for the growth of the market. This integration will enable better communication between devices, real-time monitoring, and data-driven decision-making.

For instance, in December 2023, Huawei partnered with State Grid Shaanxi and 20 utility partners to develop an IoT power distribution system that will optimise energy flow and allow a real time monitoring of devices and the output. This advancement enhances operational efficiency and enable predictive maintenance driving opportunities for the market growth.

Market Segmentations and Scope of the Study

The AC drive market report is segmented on the basis of type, voltage, application, end-user, and region. Based on type, the market is divided into voltage-frequency (V/F) control drives, vector control drives, sensor less vector control drives, and direct torque control (DTC) drives. On the basis of voltage, the market is segmented into low voltage, medium voltage, and high voltage. Based on application, the market is divided into, HVAC systems, pumps and compressors, material handling systems, and elevators and escalators. On the basis of end user, the market is classified into industries, manufacturing, oil & gas, water & wastewater treatment plants, and others. Regional breakdown and analysis of each of the aforesaid segments include regions comprising North America, Europe, Asia-Pacific, and RoW.

Geographical Analysis:

Asia-Pacific dominates the AC drives market share and will maintain the leading position over the forecast period. This is attributed to the growth of textile manufacturing in the region as the drives are equipped with variable motor torque and speed regulation of textile equipment including spinning equipment, looms, and dyeing machines.

India's textile sector is expected to rise by 10%, and will likely expand to USD 350 billion by 2030, as indicated in a report published by Invest India. The growth of the textile sector ignites the demand for variable frequency drives to boost efficiency, enhance the use of energy, and address the enhanced functional demands of advanced textile equipment.

Additionally, the rapid growth in the mining sector, more specifically coal mining sector of the region is driving the growth of the market since industries such as coal, and metal mining are dependent on heavy machinery to operate efficiently. Variable frequency drives are crucial to manage torque and provide proper performance.

In a report by Statistical Communique, the production of coal overall in China was found to grow by 10.5% during the year 2023. This growth in the coal mining industry is found to create higher demand for medium and high voltage drives and, therefore, enhances the market's growth.

Conversely, North America indicates a consistent growth in the AC drives industry, as a result of the increasing power generating industry, specifically nuclear power in the region since nuclear power plants need highly efficient and reliable control systems to operate several mechanical processes. As per a report released by World Nuclear Association, the U.S. is among the globe's biggest manufacturers of nuclear power energy, and its total output was 772 terawatt-hour (TWh) in 2023, that translates to approximately 18% of the country's total electricity. The output at this scale is driving the demand for VFDs, thus fuelling the market growth.

Furthermore, the VFDs market is showing linear growth in North America due to the increasing urbanization of the region as it leads to increased infrastructure development and industrialization. The urbanization requires the need for effective systems for best performance of essential machinery, such as HVAC equipment, water pumps, and elevators. In December 2023, a report by United Nations Census Bureau stated that the population of urban cities in the U.S grew 6.4% during 2010-2020. This growing rate of urbanization and increasing demand for low voltage devices is driving the growth in the overall region.

Competitive Landscape

The VFDs market industry comprising of various key market players such as ABB Ltd., Hitachi Ltd., Mitsubishi Electric Corporation, Siemens AG, Danfoss Group, Omron Corporation, Parker Hannifin Corp, Rockwell Automation, Yaskawa Electric Corporation, Johnson Controls International PLC, and others. These market players are adopting various strategies including product launch across various regions to maintain their dominance in the market.

For example, ABB Ltd. introduced its ACH180 a next-generation compact drive for HVACR heating, ventilation, air conditioning, and refrigeration systems in February 2024 for various sectors. This new drive made by ABB Ltd. is designed to deliver optimum energy efficiency and minimize emissions for effective cooling and heating solutions.

Moreover, in August 2023, Parker Hannifin introduced two new series of VFD, named AC15 and AC20, to cater to the existing requirements of the industrial market. They are meant for the mid-range industrial segment and come with functionalities like mid-range inverter which find them ideal for use in diverse applications. They perform especially efficiently to handle functions such as fan control, pump control, and conveyors which require speed monitoring and winding calculations.

Additionally, OMRON has also introduced in June 2023 the OMRON M1 Integrated Global AC Drives Solution, featuring innovative capabilities of system integration seamlessly, flexible control over motors, and support for multiple communication protocols. OMRON's M1 solution represents a significant improvement in the technology space, answering to the increased demands for high-performance and integrated VFDs solutions.

Key Benefits

-

The report provides quantitative analysis and estimations of AC drives industry from 2025 to 2030, which assists in identifying the prevailing market opportunities.

-

The study comprises a deep dive analysis of the current and future AC drives market trends to depict prevalent investment pockets in the industry.

-

Information related to key drivers, restraints, and opportunities and their impact on the AC drives industry is provided in the report.

-

Competitive analysis of the players, along with their market share is provided in the report.

-

SWOT analysis and Porters Five Forces model is elaborated in the study.

-

Value chain analysis in the market study provides a clear picture of roles of stakeholders.

AC Drives Market Key Segments

By Type

-

Voltage-Frequency (V/F) Control Drives

-

Vector Control Drives

-

Sensor less Vector Control Drives

-

Direct Torque Control (DTC) Drives

By Voltage

-

Low voltage

-

Medium voltage

-

High voltage

By Application

-

HVAC Systems

-

Pumps and Compressors

-

Material Handling Systems

-

Elevators and Escalators

By End-User

-

Industries

-

Manufacturing

-

Oil & Gas

-

Water & Wastewater Treatment Plants

-

Others

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

ABB Ltd.

-

Hitachi Ltd.

-

Mitsubishi Electric Corporation

-

Siemens AG

-

Danfoss Group

-

Omron Corporation

-

Parker Hannifin Corp

-

Rockwell Automation

-

Yaskawa Electric Corporation

-

Johnson Controls International PLC

-

Delta Electronics, Inc.

-

Amtech

-

Fuji Electric Co., Ltd.

-

STMicroelectronics

-

Invertek Drives Ltd.

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 16.45 billion |

|

Revenue Forecast in 2030 |

USD 22.03 billion |

|

Growth Rate |

CAGR of 5.0% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst