Solder Paste Inspection (SPI) System Market by Type (In-line SPI System and Off-line SPI System), by Inspection Speed (Low-Speed SPI Systems, Medium-Speed SPI Systems, and High-Speed SPI Systems), by Inspection Method (Automated Inspection, and Manual Inspection), by Applications (Automotive Electronics, Consumer Electronics, Healthcare Devices, Industrials, and Others) – Global Opportunity Analysis and Industry Forecast 2025-2030

SPI System Market Overview

The global Solder Paste Inspection (SPI) System Market size was valued at USD 459.49 billion in 2024 and is predicted to reach USD 713.59 billion by 2030 with a CAGR of 6.5% from 2025-2030.

The increasing application of automation in the production of electronics and the enhanced requirement for high-performance electronic products are driving market growth. Increased printed circuit board complexity and the need for precise solder paste deposition also increase the demand for SPI systems.

Nevertheless, high initial investment requirements and technical issues surrounding system calibration could impede market growth. On the contrary, technological improvements in machine vision and artificial intelligence driven inspection solutions offer strong market growth opportunities.

Major companies, such as Koh Young Technology and CyberOptics are heavily investing in product development and strategic alliances to enhance their market positions. With the combination of AI and real time data analytics, SPI systems are set to evolve further that improves production efficiency and defect detection in PCB assembly.

Increasing Demand for Consumer Electronics Drives the SPI System Market Growth

The growing need for electronic devices such as laptops and smartphones are driving the demand for precise inspection systems. As they are moving towards miniaturization printed circuit boards are becoming intricate in nature. The complexity requires the precise application and inspection of solder paste to determine the functionality and reliability of electronic components, driving market growth.

According to World Economic Forum, the world had a mobile phone subscription of over 8.58 billion up to April 2023 and the total world population was nearly 7.95 billion. The rising need for consumer electronics reflects the requirement of advanced SPI systems to provide for the mounting market demands and thereby fuel the growth of the market.

Innovative Advancements in SPI Thrives the Market Expansion

The technology innovation like the evolution of high-resolution and high-speed inspection systems increases the efficiency and precision of solder paste inspections. Such enhancements allow more accurate and trusted quality control in the process of electronics manufacturing, thus driving the market growth.

For instance, in January 2024, Yamaha robotics launched the VP-01G-Y solder paste inspection system, that integrates high-speed and high-resolution inspection capabilities into a single unit. This system utilizes high-level algorithms in both 2D and 3D inspection modes to achieve effective focusing and contour extraction.

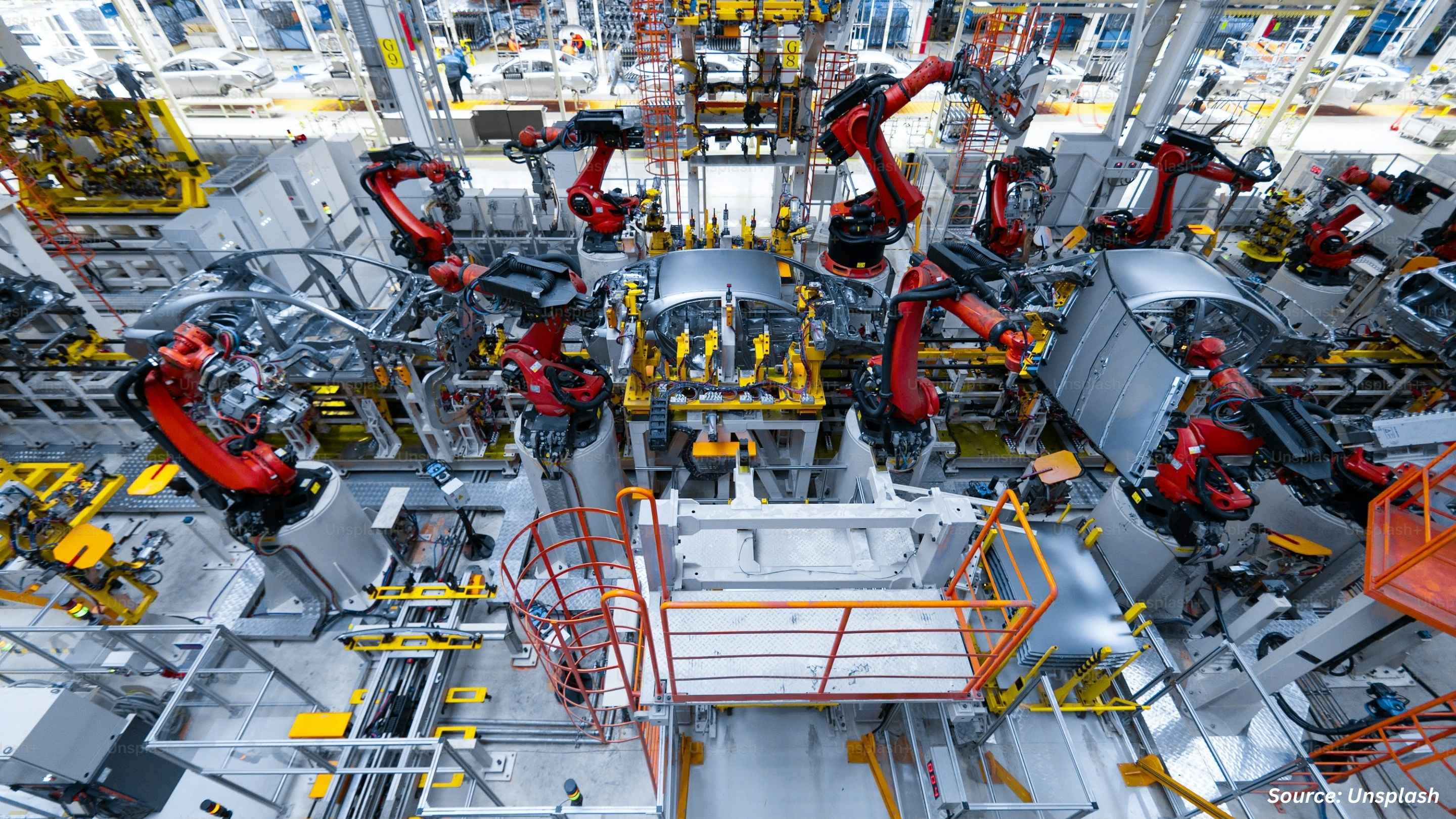

Growing Industry 4.0 Adoption Drives Solder Paste Inspection (SPI) System Market Demand

The growing application of industry 4.0 to automate and exchange data in manufacturing through the aid of sophisticated manufacturing technologies such as SPI systems to enable real time monitoring and feedback that improves efficiency and reduces the likelihood of defects during the production process is further driving the growth of the market.

High Cost Associated with SPI Devices Restraints the SPI System Market Expansion

The high cost for acquiring SPI system particularly for smaller or medium-sized enterprises is the major factor restraining the growth of the market.

Incorporation of Advanced Technologies Creates Future Opportunity

The introduction of advanced and latest inspection system such as ISO-Spector S3 series 5D Solder Paste Inspection systems is anticipated to create future opportunities for the market. This technology is set to redefine standards in electronics manufacturing by delivering advanced inspection capabilities at a highly competitive cost.

Market Segmentations and Scope of the Study

The SPI system market report is segmented on the basis of type, application and region. On the basis of type, the market is divided into in-line SPI system and off-line SPI system. On the basis of application, the market is classified into automotive electronics, consumer electronics, healthcare devices, industrials, and others. Regional breakdown and analysis of each of the aforesaid segments include regions comprising of North America, Europe, Asia-Pacific, and RoW.

Geographical Analysis

Asia-Pacific dominates the SPI system market share and is expected to remain in the lead during the forecast period. This is attributed to the expansion of the consumer electronics market in nations like China, Japan, South Korea and Taiwan that extensively utilizes SPI to check the quality of deposited solder paste on PCBs during the production of electronics.

Consumer electronics sales reached about USD 305 billion in 2023 and will grow up to USD 320 billion by 2024, according to the Shanghai Municipal People's Government report. The strong rise in consumer electronics sales reflects growing demands for quality and reliability in advance SPI systems and hence promotes growth in the market.

In addition, the growing auto industry creates the need for SPI systems because automotive electronics are getting more complex, and the requirement for accurate solder paste inspection systems increases to have reliable solder paste application and preserve high quality and performance levels.

Production of passenger vehicles, buses and trucks during 2023 was 8.1 million, as revealed by the Japan Automobile Manufacturers Association. The growth in vehicle production reflects the requirement of advanced SPI system to manage the growing complexity of automotive electronics, which in turn drives further market growth.

Conversely, North America witnesses a consistent increase in the market for SPI system and is forecasted to hold its dominance through the forecast period owing to growth in investment for robots in industrial automation. While companies embrace sophisticated robots for automation of electronics manufacturing, the need for accurate solder paste inspection systems is increasing to make solder paste deposition error-free and uphold high manufacturing standards, pushing the regional market to grow.

As per International Federation of Robotics, robot installations in the electrical industry went up by 37% in April 2024, which totaled 5120 units. This hike in robot installations for automation reflects the boosting demand for better efficiency and precision in electronics production, thereby spurring the growth of the makret.

Additionally, the availability of prominent players like CyberOptics Corporation and Vi Technology are using different business strategies that involve product launch and thereby drive the market growth in this region.

For example, in January 2023, CyberOptics Corporation introduced new dual-mode MRS sensor solder paste inspection. The new MRS sensor allows for maximum versatility for dedicated solder paste inspection uses, with a high-speed mode and a high-resolution mode.

Competitive Landscape

Various key players operating in the Solder Paste Inspection (SPI) system industry include Koh Young Technology, Inc., Jet Technology, Sinic-Tek Vision Technology, Viscom SE, Shenzhen JT Automation Equipment Co., Ltd., Test Research, Inc., CKD Corporation, PARMI Corp, Saki Corporation, ViTrox Corporation, Yamaha Motor Co., Ltd., Omron Corporation, Mycronic, Shenzhen SunzonTech Co., Ltd, GOPEL electronic GmbH, and others. These market players are adopting various strategies such as product launches to remain dominant in the market.

For instance, in August 2023, Test Research, Inc. launched TR7007Q SII a 3D SPI system that is designed to maximize production efficiency. This new system aims to enhance accuracy and stability by providing precise solder measurements and minimizing false calls, ensuring consistent and reliable inspection results.

For instance, in May 2023, Goepel electronics launched high-speed 3D solder paste inspection system designed to enhance quality control in PCB production. This system utilizes advanced 3D imaging technology to ensure precise inspection of solder paste applications, significantly improving the detection of defects and ensuring optimal solder paste deposition.

Key Benefits

-

The market report provides the quantitative analysis of the current market and estimations from 2025 to 2030. This analysis assists in identifying the prevailing market opportunities to capitalize on.

-

The study comprises of a detailed analysis of the current and future Solder Paste Inspection (SPI) system market trends for depicting the prevalent investment pockets in the market.

-

The information related to key drivers, restraints, and opportunities and their impact on the Solder Paste Inspection (SPI) system industry is provided in the report.

-

The competitive analysis of the market players along with their market share in the market is mentioned.

-

The SWOT analysis and Porter’s Five Forces model are elaborated in the study.

-

The value chain analysis in the market study provides a clear picture of the stakeholders’ roles.

Solder Paste Inspection (SPI) System Market Key Segments

By Type

-

In-line SPI System

-

Off-line SPI System

By Inspection Speed

-

Low-Speed SPI Systems

-

Medium-Speed SPI Systems

-

High-Speed SPI Systems

By Inspection Method

-

Automated Inspection

-

Manual Inspection

By Applications

-

Automotive Electronics

-

Consumer Electronics

-

Healthcare Devices

-

Industrials

-

Others

By Region

-

North America

-

U.S

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

Koh Young Technology, Inc.

-

Jet Technology

-

Sinic-Tek Vision Technology

-

Viscom SE

-

Shenzhen JT Automation Equipment Co., Ltd.

-

Test Research, Inc.

-

CKD Corporation

-

PARMI Corp

-

Saki Corporation

-

ViTrox Corporation

-

Yamaha Motor Co., Ltd.

-

Omron Corporation

-

Mycronic

-

Shenzhen SunzonTech Co., Ltd

-

GOPEL electronic GmbH

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 459.49 billion |

|

Revenue Forecast in 2030 |

USD 713.59 billion |

|

Growth Rate |

CAGR of 6.5% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 15 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst