Air Spring Market by Type (Convolute, Rolling Lobe, and Sleeve), Sales Channel (Original Equipment Manufacturer (OEM) and Aftermarket), and Application (Automotive, Railway, and Industrial) – Global Opportunity Analysis and Industry Forecast, 2025–2030

Industry: Automotive & Transportation | Publish Date: 11-Apr-2025 | No of Pages: 474 | No. of Tables: 370 | No. of Figures: 315 | Format: PDF | Report Code : AT498

US Tariff Impact on Air Spring Market

Trump Tariffs Are Reshaping Global Business

Air Spring Market Overview

The global Air Spring Market size was valued at USD 7.03 billion in 2024 and is predicted to reach USD 9.70 billion by 2030, registering a CAGR of 4.7% from 2025 to 2030. Also, the market is valued at 35,240 thousand unit in 2024, and is expected to reach at 52,163 thousand unit by 2030 with the CAGR of 5.7% during 2025-2030.

The air spring, also known as air bags or pneumatic springs refers to the industry focused on the production and distribution of these springs, which are components used in vehicle suspension systems to provide improved ride quality, comfort, and stability. It is a component used in commercial vehicles, passenger cars, and industrial machinery.

The component is designed to support loads, isolate vibrations and shocks, and act as a pneumatic cylinder by expanding itself. They are integral components of air suspension systems, providing improved comfort compared to traditional coil springs. These springs replaces traditional metal springs with a flexible, rubber-and-fabric bladder that contains compressed air, making them a popular choice for various applications.

Growing Automotive Industry Worldwide Boost the Market Growth

The global automotive industry's growth serves as a driver for the air spring market, as it is an essential component for vehicle air suspension systems to meet consumer expectations for smoother rides. According to the Association of European Automobile Manufacturers (ACEA), the global production of motor vehicles reached 85.4 million units in 2022, reflecting a 5.7% surge compared to the previous year 2021. Thus, the growing automotive industry serves as a driving force for the continuous expansion and development of the market on a global scale.

Rising Urbanization Propels the Air Spring Sector Globally

The increasing urbanization across the globe is another factor driving the air spring industry. As more people move to urban areas, the demand for efficient transportation solutions and comfortable electric vehicles rises which in turn increases the demand for air bags to meet the customer’s expectations. As per the data provided by the World Bank, the World population stood at 4.52 billion in 2022 and is projected to increase by 1.5 times to 6 billion by 2045. This rising urbanization is a key factor fueling the growth of the market worldwide.

Growing Industrial Production Fuels, the Demand for the Market

The worldwide growth in industrial production propels the air spring market growth as industrial activities increase globally, there is a rising demand for efficient and reliable air bags in various industrial machinery and vehicles.

According to the Federal Reserve, industrial production in the U.S. increased by 6.61% from February 2021 to February 2022. As industries scale up the production to meet growing demand, the need for high-quality air springs continues to surge, driving growth in the market on a global scale.

High Complexity in Installing Air Springs Hinders the Market Growth

The high complexity involved in installing these automotive air springs pose a significant challenge hindering the market growth. Installing air bags requires specialized knowledge and tools, which increases time and cost for manufacturers and end-users.

Additionally, the intricate nature of the installation process leads to errors or inefficiencies, impacting overall performance and reliability. As a result, the complexity in installing air springs deter potential customers from adopting these products, thereby limiting air spring market expansion.

Integration of Sensor Technology in Air Springs Creates Opportunity

The integration of sensor technology in these springs is expected to create future opportunities in the market. By incorporating sensors into air bag systems, manufacturers will be able carry real-time monitoring of pressure, temperature, and other crucial parameters. This will enable proactive maintenance, predictive analytics, and improved performance optimization, ultimately enhancing reliability and safety.

Moreover, sensor-enabled air springs is expected to pave the way for the development of smart, adaptive suspension systems that will automatically adjust to varying road conditions and driving dynamics.

As automotive and industrial sectors increasingly prioritize efficiency and automation, the demand for sensor-equipped air bags is expected to create ample growth opportunities in the coming years. For instance, key companies in this sector includes Continental AG and Vibracoustic, are integrating ultrasonic sensors inside their air bags, symbolizing the industry's commitment to innovation and advancement.

Asia-Pacific Dominates the Global Air Spring Industry Share

Asia-Pacific dominates the air spring market share due to well-established automotive industry in the countries including China, Japan, India, and South Korea. drives the market by increasing the demand for these components in automotive production.

According to the data provided by the International Trade Administration (ITA), domestic production in China reached 2.69 million units on March 2024 and is expected to reach 35 million units by 2025. This trend propels the growth of the industry as manufacturers scale up production of air springs to cater to the rising demand within the automotive sector in China.

Moreover, the rising initiatives by crucial companies towards launching advanced tractors embedded with air spring that offers high-performance suspension systems is driving the market growth.

As an example, in April 2023, UD Trucks launched their new powerful Quon GW 6x4 tractor in Japan, featuring these springs as their core component in the manufacturing process. It has 16-ton and 18-ton class 5th wheel, which is equipped with rear air suspension, providing ideal comfort for both cargo and the driver.

Additionally, the growing emphasis by government bodies to boost the manufacturing of air suspension systems within the country is driving the air springs by fostering local production capabilities. For instance, in July 2023, Hendrickson launched air and mechanical suspensions that are manufactured locally as part of the government's Make-in-India initiative which is the lightest system available, providing operating efficiency advantages to customers.

North America Region Witnesses Fastest Growth in the Air Spring Sector

North America shows steady growth in the air spring domain owing to the rising government initiatives aimed at enhancing passenger safety and implementing emergency braking systems in automotive is driving the market by absorbing shock and vibrations in emergency braking.

Notably, the U.S. Department of Transportation's National Highway Traffic Safety Administration (NHTSA) in April 2024 issued a new Federal Motor Vehicle Safety Standard that mandates automatic emergency braking (AEB) in all passenger cars and light trucks by September 2029. This regulatory focus on safety and braking performance directly stimulates demand for these springs, aligning with the broader objective of improving automotive safety standards.

In addition, the surging automotive manufacturing in Mexico is driving the air spring market by increasing the demand for these spring in newly produced vehicles. According to the International Trade Administration (ITA) report 2023, Mexico is the world’s 7th largest manufacturer of passenger vehicles and 5th largest manufacturer of heavy-duty vehicles for cargo. As automotive production in Mexico continues to grow, there is a parallel increase in the need for air bag to meet quality standards and consumer preferences.

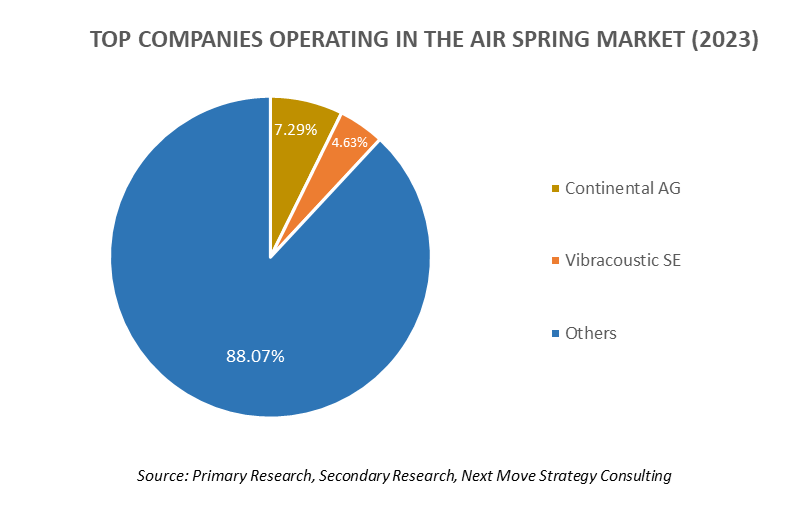

Competitive Landscape

The promising key players operating in the global air spring industry include Continental AG, Bridgestone Industrial, Vibracoustic SE, Sumitomo Electric Industries, Ltd., Trelleborg AB, VDL Groep, Airtech (Aktaş Holding), Hendrickson USA, L.L.C., BWI Group, Stemco, Wabco Holdings Inc., ThyssenKrupp Automotive AG, SAF-Holland SE, SABO, and Meritor, Inc., among others.

For an updated market share, buy our latest report

These players are engaged in various partnership, product launch, and innovation across various regions to maintain their dominance in the global pneumatic spring market.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

|

Apr-24 |

Vibracoustic |

Vibracoustic partnered with XPENG to develop and produce switchable two-chamber air springs for the XPENG G9 battery electric vehicle (BEV). These springs provide two stiffness settings, enabling the vehicle to adjust to different loads and road conditions and it represents the debut of Vibracoustic's cutting-edge air bag technology with a Chinese OEM. |

|

|

|

|||

|

|

|||

|

|

|||

|

Mar-24 |

Hendrickson |

Hendrickson launched ROADMAAX Z, a drive axle suspension system featuring Zero Maintenance Damping technology, designed for heavy-duty trucks and tractors. This system improves air spring technology by providing a consistent and smooth ride throughout the air spring's lifespan, aiming to enhance ride comfort for both on- and off-highway operations. |

|

|

|

|||

|

|

|||

|

Jan-24 |

Bridgestone Industrial |

FirestoneAride launched smartphone-controlled air springs, which enables users to manage their springs through a Bluetooth-enabled smartphone app or a wireless remote. The system offers single- and dual-path controls, and when equipped with dual-path control to balance uneven loads. |

|

|

May-23 |

Vibracoustic |

Vibracoustic launched its upgraded Centronics cabin air springs which features 45mm shock absorber, enhanced jounce bumper, and advanced leveling control unit. The enhanced air springs improve cabin comfort, stability, and NVH management, reducing driver fatigue and operating costs. |

|

|

Mar-23 |

Continental |

Continental developed a smart sensor air spring which is a digital monitoring system designed to enhance efficiency and safety in construction and mining applications. This innovative system integrates an ultrasonic height and pressure sensor to provide real-time operational status data. |

|

|

|

|||

|

|

Air Spring Market Key Segments

By Type

-

Convolute

-

Single

-

Multi

-

-

Rolling Lobe

-

Sleeve

By Sales Channel

-

Original Equipment Manufacturer (OEM)

-

Aftermarket

By Application

-

Automotive

-

Passenger Cars

-

Buses

-

Trailer and Trucks

-

-

Railways

-

Industrial

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Finland

-

Netherlands

-

Norway

-

Russia

-

Sweden

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

Rest of World

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

Continental AG

-

Bridgestone Industrial

-

Vibracoustic SE

-

Sumitomo Electric Industries, Ltd.

-

Trelleborg AB

-

VDL Groep

-

Airtech (Aktaş Holding)

-

Hendrickson USA, L.L.C.

-

BWI Group

-

Stemco

-

Wabco Holdings Inc.

-

ThyssenKrupp Automotive AG

-

SAF-Holland SE

-

SABO

-

Meritor, Inc.

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size Value in 2024 |

USD 7.03 Billion |

|

Revenue Forecast in 2030 |

USD 9.70 Billion |

|

Market Size Volume in 2024 |

35,240 (‘000 Units) |

|

Volume Forecast in 2030 |

52,163 (‘000 Units) |

|

Value Growth Rate |

CAGR of 4.7% from 2025 to 2030 |

|

Volume Growth Rate |

CAGR of 5.7% from 2025-2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Market Volume Estimation |

Thousand Unit |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst