Australia ERP Software Market by Component (Software and Service), by Deployment (On-premise, Cloud, and Hybrid), by Business Function (Finance, Human Resource (HR), Supply Chain, Customer Management, inventory Management, Manufacturing Module, and Others), by Industry Vertical (Manufacturing, BFSI, Healthcare, Retail & Distribution, and Others), by End User (Small and Medium Sized Enterprise, and Large Enterprise)– Opportunity Analysis and Industry Forecast, 2025–2030

Industry: ICT & Media | Publish Date: 27-Feb-2025 | No of Pages: 107 | No. of Tables: 81 | No. of Figures: 46 | Format: PDF | Report Code : IC3007

US Tariff Impact on Australia ERP Software Market

Trump Tariffs Are Reshaping Global Business

Australia ERP Software Market Overview

The Australia ERP Software Market size was valued at 930.2 million in 2024 and is predicted to reach USD 1170.6 million by 2030, with a CAGR of 3.6% from 2025 to 2030.

The factors such as the rising adoption of digitalization, increase service industry and growing initiatives by the key market players drives the growth of the market. However, the complexity in integrating these devices with existing system restrains the growth of the market. On the contrary, advancement in AI based ERP software creates future growth opportunities. Moreover, the top players such as Microsoft Corporation and SAP SE among others are adopting various strategies in order to enhance their market expansion.

Growing Focus on Digitalization in Australia Boosts the Growth of the Market

The increase in IT expenditure among businesses drives the need for ERP software, as companies focus on digital transformation to improve performance and competitiveness. This rise in the IT budgets allows businesses to invest in advanced ERP solutions that automates business processes and real time analytics to make informed decisions. A report by the Gartner states that IT expenditure in Australia is expected to reach USD 95.6 billion by 2025. Such growth in IT investments drives companies to implement new technologies including ERP, thus driving market growth.

Expanding Service Industry in Australia Boosts the Growth of the Market

The growing service industry in Australia driven by the rise in the adoption of advanced solutions to manage their operations and improve workflows. As sectors such as healthcare, finance, and real estate continue to expand in the country, ERP systems are becoming essential for making informed decisions. This helps businesses stay competitive and run smoothly. The World Bank Group states that Australia service sector accounted for a substantial 64.2% of the nation's GDP in 2023. This growth in the service sector boosts the Australia ERP software market expansion.

Rise in Initiatives by Key Market Players Boosts Market Expansion

The rising initiative by key players drives the Australia ERP software market growth by providing customized solutions that address specific regional business needs. These companies offer ERP systems designed for Australian businesses, offering features such as supply chain management, resource planning, and business intelligence to meet industry-specific requirements.

For example, Pronto Software launched its new ERP solution Pronto Xi 780 for businesses. It features improved user experience, enhanced analytics capabilities, and better automation to streamline processes and optimize workflows. As more companies actively participate in this industry, the ERP market is poised to grow in the future.

Complexity in Integration with Existing Software Restrains the Market Growth

The integration of ERP solutions with existing systems presents a significant barrier to the growth of the ERP software market. The complex and time consuming process requires substantial resources and expert support that disrupt daily operations, discouraging businesses from adopting new ERP systems.

Advancement In AI Technology Creates Future Growth opportunities

The integration of artificial intelligence in ERP software is poised to future opportunities in the market. AI powered ERP solutions enhance decision making by streamlining operations, reducing manual errors, and optimizing supply chain management, driving efficiency across business functions.

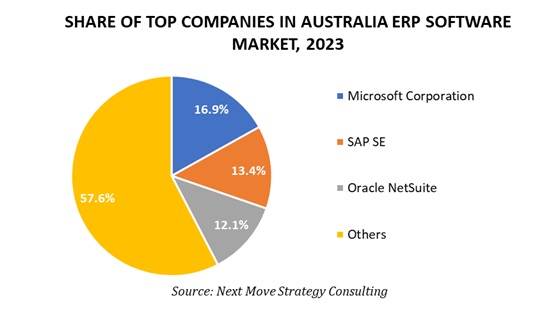

Competitive Landscape

Several key players operating in the Australia ERP Software industry include Microsoft Corporation, SAP SE, Oracle NetSuite, Salesforce, Inc., Xero Limited, Sage Group, MYOB Australia Pty Ltd, Workday, Inc., ECI Software Solutions, Odoo, CIBIS International Pty Limited, Abel Software Limited, Q6 Pty Ltd., Pronto Software Limited, Asana, Inc., and others.

Note: For the latest market share analysis and in-depth Australia ERP Software industry insights, you can reach out to us at: Proceed to Checkout

These companies are adopting various strategies including product launch and partnerships to remain dominant in the market.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

March 2024 |

Workday |

Workday launched its integrated payroll solution in Australia for all sized businesses. The ERP system integrates with its ERP suite to enhances operational efficiency, and automating other tasks. |

|

July, 2024 |

MYOB |

MYOB partnered with Acumatica launch its cloud ERP solutions in Australia and New Zealand. This collaboration aims to enhance medium sized companies with advanaced ERP software, enhancing their operational efficiency. |

|

March 2024 |

Oracle |

Oracle Fusion Cloud ERP partnered with South Australian Government to enhance financial processes across 51 agencies, aiming to standardize operations, improve efficiency, and support digital transformation in response to growing demands. |

Australia ERP Software Market Key Segment

By Component

-

Software

-

Service

By Deployment

-

On-premise

-

Cloud

-

Hybrid

By Business Function

-

Finance

-

Human Resource (HR)

-

Supply Chain

-

Customer Management

-

inventory Management

-

Manufacturing Module

-

Others

By Industry Vertical

-

Manufacturing

-

BFSI

-

Healthcare

-

Retail & Distribution

-

Others

By End User

-

Small and Medium Sized Enterprise

-

Large Enterprise

Key Market Players

-

Microsoft Corporation

-

SAP SE

-

Oracle NetSuite

-

Salesforce, Inc

-

Xero Limited

-

Sage Group

-

MYOB Australia Pty Ltd

-

Workday, Inc

-

ECI Software Solutions

-

Odoo

-

CIBIS International Pty Limited

-

Abel Software Limited

-

Q6 Pty Ltd

-

Pronto Software Limited

-

Asana, Inc.

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 930.2 Million |

|

Revenue Forecast in 2030 |

USD 1170.6 Million |

|

Growth Rate (Value) |

CAGR of 3.6% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst