Coal Bed Methane Market by Technology (Hydraulic Fracturing, Horizontal Drilling, and CO2 Sequestration), and by Application (Residential, Commercial, Industrial, Power Generation, and Transportation) Global Opportunity Analysis and Industry Forecast, 2022 – 2030

US Tariff Impact on Coal Bed Methane Market

Trump Tariffs Are Reshaping Global Business

Market Definition:

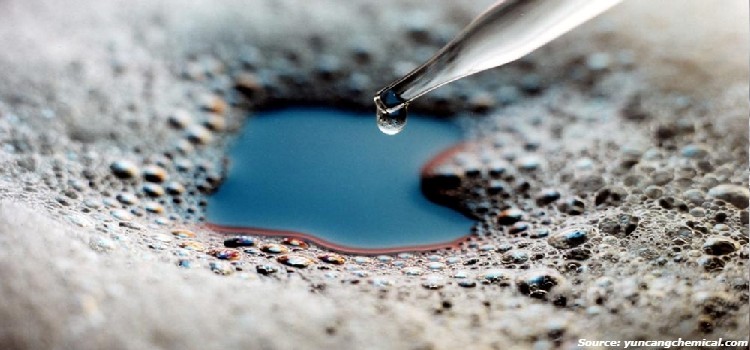

The Coal Bed Methane Market size was valued at USD 21.5 billion in 2021 and is predicted to reach USD 37.57 billion by 2030 with a CAGR of 6.4% from 2022-2030. Coal bed methane (CBM) is a form of natural gas which is recovered from coal seams or coal deposits. This gas is also known as marsh gas or sweet gas as it does not contain any hydrogen sulphide. It is usually formed during the natural conversion of plant material into coal by the process of coalification. The extraction of coal bed methane is done using vertical and horizontal drilling into the coal seams by eliminating the water content of the seam gas.

Market Dynamics and Trends:

The demand for coal bed methane is increasing due to rising use of CBM in cement production industry along with its usage in steel industries for power generation. The rising awareness related to the mitigation of greenhouse gases (GHGs) as CBM emits lesser amount of it as compared to conventional fuels such as petroleum and coal in turn drives the growth of the market.

Also, upsurge in the ongoing natural gas pipeline projects that use CBM for production of natural gas along with higher demand for eco-friendly fuels in the industrial sector are expected to boost the growth of the market during the forecast period.

However, huge capital investment and environmental concerns such as change in the level of groundwater, changes in land as well as surface water are factors that are expected to restrain the growth of market during the forecast period.

On the other hand, growing exploration and utilization of coal bed methane to increase the production of ethylene along with exploration of the unexplored areas having coal bed methane reserves are expected to create lucrative growth opportunities for the coal bed methane market players in the future.

Market Segmentations and Scope of the Study:

The coal bed methane market size has been segmented based on technology, application, and geography. On the basis of technology, the market is divided into hydraulic fracturing, horizontal drilling, and CO2 sequestration.

On the basis of application, the market is divided into residential, commercial, industrial, power generation, and transportation. The geography breakdown and analysis of each of the aforesaid segments includes regions comprising of North America, Europe, Asia-Pacific, and ROW.

Geographical Analysis:

Asia-Pacific region holds the lion share of coal bed methane market at present and is expected to continue dominating the market during the forecast period. This is attributed to factors such as increasing demand for eco-friendly fuels in the industrial sector along with prospects for GHG sequestration and increasing natural gas pipeline projects that in turn increases the demand for coal bed methane.

For instance, in June 2022, Essar Oils invested Rs 5500 crores in coal bed methane project. This investment will help in increasing the output up to 3 times in a period of 24-30 months' time. The unexplored reserves for coal bed methane in countries such as Indonesia, China, and India are the reason for new competitors such as Essar Oils, Reliance Powers, and China United Coalbed Methane Co to participate in this region.

Moreover, North America is expected to witness a rapid rise in the coal bed methane market due to huge investment by companies such as Halliburton and Weatherford, as well as government bodies of different nations such as USA and Canada.

For instance, in 2020, U.S. government announced the continuation of operations of the Alaska LNG Liquefaction Plant project worth US$ 43 billion. The Alaska LNG represents a three-train liquefaction plant, gas treatment plant, and an 800-mile pipeline. The surge in the demand for sustainable fuels in USA and Canada also drive the market growth. Moreover, increasing demand for coal bed methane (CBM) from the natural gas production sectors are expected to boost the growth of the market in this region.

For instance, in October 2021, the US Federal Energy Regulatory Commission (FERC) approved to increase the authorized LNG production at the Sabine Pass and Corpus Christi LNG terminals. These terminals had increased their LNG production by optimizing operations, including production increment, modifications, and maintenance.

Competitive Landscape:

The market comprises of various players such as Arrow Energy Holdings Pty Ltd., Baker Hughes, Inc, BG Group PLC, Blue Energy Ltd., BP PLC, China United Coal Bed Methane Corporation, ConocoPhillips, ExxonMobil, Reliance Power, Origin Energy Ltd., and Santos Ltd. These manufacturers are actively indulging in R&D initiatives, product & technology innovations, and industrial collaborations to enhance their production and increase their growth as well as geographical reach.

For instance, in Sep 2021, the National Development and Reform Commission of China approved a 960-million-yuan ($149 million) coal bed methane pipeline project linking the northern regions of Shanxi and Shaanxi. Also, in March 2021, ExxonMobil submitted a proposal to conduct a pilot project for hydraulic fracking in Colombia. This development is done to extract non-conventional energy deposits such as fracking for shale gas and coal bed methane.

Key Benefits:

-

The coal bed methane market report provides the quantitative analysis of the current market and estimations through 2022-2030 that assists in identifying the prevailing market opportunities to capitalize on.

-

The study comprises a deep dive analysis of the coal bed methane market trend including the current and future trends for depicting the prevalent investment pockets in the market.

-

The information related to key drivers, restraints and opportunities and their impact on the coal bed methane market is provided in the report.

-

The competitive analysis of the market players along with their market share in the coal bed methane market

-

The SWOT analysis and Porters Five Forces model is elaborated in the study.

-

Value chain analysis in the market study provides a clear picture of the stakeholders’ roles.

Key Market Segments:

By Technology

-

Hydraulic Fracturing

-

Horizontal Drilling

-

CO2 Sequestration

By Application

-

Residential

-

Commercial

-

Industrial

-

Power Generation

-

Transportation

By Geography

-

North America

-

U.S

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Rest of Asia-Pacific

-

-

RoW

-

UAE

-

Saudi Arabia

-

South Africa

-

Brazil

-

Remaining countries

-

Key Players:

-

Arrow Energy Holdings Pty Ltd.

-

Baker Hughes, Inc.

-

BG Group PLC.

-

Blue Energy Ltd.

-

BP PLC

-

China United Coal Bed Methane Corporation

-

ConocoPhillips

-

ExxonMobil

-

Reliance Power

-

Origin Energy Ltd.

-

Santos Ltd.

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Analysis Period |

2021–2030 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Market Segmentation |

By Technology (Hydraulic Fracturing, Horizontal Drilling, and CO2 Sequestration), and by Application (Residential, Commercial, Industrial, Power Generation, and Transportation) |

|

Geographical Segmentation |

North America (U.S., Canada, Mexico) Europe (UK, Germany, France, Italy, Spain, Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia, Rest of Asia-Pacific), Rest of the World (UAE, Saudi Arabia, South Africa, Brazil, Remaining countries) |

|

Companies Profiled |

Arrow Energy Holdings Pty Ltd., Baker Hughes, Inc, BG Group PLC, Blue Energy Ltd., BP PLC, China United Coal Bed Methane Corporation, ConocoPhillips, ExxonMobil, Reliance Power, Origin Energy Ltd., and Santos Ltd. |

Speak to Our Analyst

Speak to Our Analyst