Commercial Cooking Equipment Market by Product Type (Broilers, Grills & Griddles, Cook-chill System, Refrigerators, Ovens, Dishwashers, and Other Products), by Size (Small-scale Equipment, Medium-scale Equipment, and Large-scale Equipment), and by End-user (Full-Service Restaurants, Quick Service Restaurants, Catering, Railway Dining,Institutional Canteen, Resorts & Hotel, Hospitals, and Other End Users) – Global Opportunity Analysis and Industry Forecast 2024-2030

Industry: Retail and Consumer | Publish Date: 23-Jan-2025 | No of Pages: 679 | No. of Tables: 470 | No. of Figures: 415 | Format: PDF | Report Code : RC549

US Tariff Impact on Commercial Cooking Equipment Market

Trump Tariffs Are Reshaping Global Business

Commercial Cooking Equipment Market Overview

The global Commercial Cooking Equipment Market size was valued at USD 13.95 billion in 2024, and is predicted to reach USD 18.80 billion by 2030, with a CAGR of 4.8% from 2025 to 2030.

The market for smart kitchen equipment is growing at a high speed due to growing tourism industry worldwide along with the rise in Quick Service Restaurant. The stringent regulations concerning food safety and emissions hinders the market growth. However, the integration of smart cooking appliances, IoT-enabled kitchen equipment, and automation solutions creates future opportunity for the upcoming years.

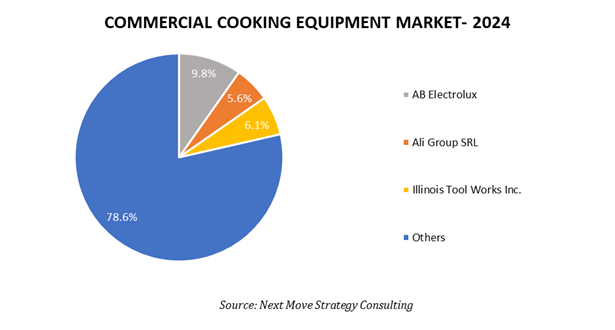

The top companies operating in the market are AB Electrolux, Ali Group SRL, Illinois Tool Works Inc (Vulcan), John Bean Technologies Corp. These companies are revolutionizing the commercial cooking equipment industry by introducing innovative products to meet the evolving consumer needs, which in turn boost the market growth.

Growth of the Tourism Sector Propels the Expansion of the Market

The growth of travel and tourism sector increases the need for advanced cooking equipment in hotels, resorts, and restaurants. To meet travelers need for diverse dining options, the hospitality industry focuses on reliable and advanced cooking tools.

The World Travel and Tourism Council reports tourism industry contributes 9 % to the global GDP each year. Thus, this surge in tourism sector emphasizes the need for reliable commercial cooking tools that support large-scale food preparation that in turn accelerates the commercial cooking equipment market growth.

Increase in Quick Service Restaurants Fuels the Market Expansion

The global expansion of quick-service restaurants increases the demand for food service appliances due to the quick service and high volumes of orders. The growing number of QSRs opening to meet the demand for convenient dining created a need for advanced cooking equipment capable of efficiently handling large orders.

For instance, McDonald's plans to open 50 thousand outlets by 2027 and to utilize Google cloud technology to improve customer experience and operations across thousands of locations globally starting in 2024.

Stringent Regulations Food Safety and Emissions Restrains Market Growth

Strict food safety and emission regulations such as the Internal Food Standards (IFS) and Food Safety Modernization Act (FSMA), create challenges for businesses investing in new commercial kitchen equipment. These regulations require specific procedures for food handling and extra spending on ventilation and filtration systems to meet emission standards.

For small and medium-sized businesses, the high cost of compliant equipment and maintenance makes it harder to adopt new tools. These challenges slow down the commercial cooking equipment market expansion in the food service industry.

Integration of Advanced Technologies in Commercial Cooking Equipment Creates Market Opportunity

The incorporation of advanced technologies such as smart cooking appliances, IoT-connected kitchen tools create future opportunities for the commercial cooking equipment market demand. Smart appliances with sensors and connectivity allow for better control, improving cooking and food quality.

IoT-enabled equipment provides real-time data that helps kitchen staff to make better decisions. Automation simplifies tasks such as food preparation and cleaning that allows staff to focus on other important tasks. This technology not only enhances smoother operations but actually leads to less energy use, less wastage, and promotes the ever-expanding need for eco-friendly operation within the food industry.

By Product, Ovens Dominates the Commercial Cooking Equipment Market Share

Ovens hold the dominant share in the product segment of the commercial cooking equipment industry as it essential for baking, roasting, and cooking in professional kitchens. Ovens such as convection and combi ovens helps to make kitchen operations more efficient while maintaining food quality. As restaurants, hotels, and creating services adopt advanced equipment to meet customer needs for consistent and timely meals, ovens play a role in these operations.

By Size, Large-scale Equipment Exhibits the Highest CAGR in the Commercial Cooking Equipment Market

Large-scale equipment exhibits the highest CAGR in the size segment of the commercial cooking equipment industry due to the increasing demand for high-capacity solutions in large food preparation.

As places such as banquet halls, industries kitchens, and large catering services need to handle bigger volumes efficiently that adopt large-scale equipment is becoming necessary. Equipment such as industrial ovens and high-capacity steamers help improve cooking efficiency and maintain consistent output.

North America Dominates the Commercial Cooking Equipment Market Share

The increasing demand of fast food in North America due to growing everyday life and the presence of major QSR companies are providing a particularly lucrative growth opportunity for the quick service restaurants in North America.

For instance, the U.S. is one of the largest consumers of fast food, averaging about USD 1,200 a year for ready-made meals, which amounts to about USD 110 billion a year. With fast food consumption and demand climbing higher, the demand for Hospitality cooking appliances is also expected to take an upward turn in this region.

Moreover, the growing tourism industry drives the expansion of the hotels and restaurants in the U.S. and Canada. Redberry, a major Canadian franchise opened 27 new locations, renovated 20, and plans to add 300 more Burger King and Taco Bell outlets by 2031. Likewise, Wyndham Hotels & Resorts, the hotel franchise added 265 hotels in 2023 in United States and Canada. The rapid growth in the hospitality industry produced a greater demand for the market.

Asia-Pacific Shows Steady Growth in the Market

The tourism sector in countries including Japan and South Korea is growing at a significant rate in the recent times. For instance, Japan accommodated 25.06 million tourists, while South Korea registered about 10 million tourists in 2023 from across the globe.

The rise of domestic and international tourists visiting Asian countries increases the need for food, shelter, and entertainment amenities that drives the demand for the heavy-duty kitchen equipment Market in this region.

In addition, QSR and FSR companies are growing at a significant rate in the Asia-Pacific region, driven by the growing demand for convenient dining options and experiencing diverse cuisine from across the globe. For instance, IHG announced to build 24 new hotel projects in various regions of China. These agreements cover multiple IHG brands in the Chinese market where the demand for high quality hospitality services remains important.

Moreover, the American food company Wendy’s plans to open 200 restaurants in Australia by the end of 2034. This development of the hospitality industry increases the demand for commercial cooking equipment industry in this area.

Competitive Landscape

Several key market players operating in the commercial cooking equipment industry include AB Electrolux, Ali Group SRL, Illinois Tool Works Inc (Vulcan), John Bean Technologies Corp, The Middleby Corporation, Haier Group, Hoshizaki America Inc, Alto-Shaam, Inc, Marmon Foodservice Technologies, Duke Manufacturing Company, Fagor Professional, Rational AG, UNOX S.p.A., GEA Group Aktiengesellschaft, Twothousand Machinery Co., Ltd., and others

These companies are adopting various strategies such as acquisition and product launches to remain dominant in the commercial culinary appliances market.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

|

April 2024 |

Hoshizaki |

Hoshizaki acquired a major stake in Turkish food service equipment manufacturer Oztiryakiler. This acquisition is part of Hoshizaki's strategy to strengthen its global product supply capabilities and expand its presence in the European, Middle Eastern, African, and Asian markets. |

|

|

March 2024 |

JBT |

JBT launched the SeamTec 2 Evolute technology for infant formula powders to meet market demands and enhance efficiency. This new powder seamer aims to address the specific needs of the powder market, providing advanced technology for infant formula production. |

|

|

September 2023 |

Big Red Rooster Flow |

Big Red Rooster Flow, a provider of tech-enabled retail project and program management services from Marmon, launched a new brand identity and website. This rebranding initiative highlights the importance of a strong brand identity in the commercial kitchen industry, where customized equipment and uniforms enhance brand recognition, loyalty, and overall customer experience. |

|

|

April 2023 |

Duke Manufacturing |

Duke Manufacturing launched the Duke Waterless Hot Food Well cooking equipment which maintains a precise temperature control, keeping starchy foods such as rice and mashed potatoes hot without scorching. Additionally, it features a patent-pending removable non-stick liner for easy cleaning, reducing operational costs and increasing efficiency over time. |

|

|

July 2022 |

Electrolux |

Electrolux launched the GRO kitchen system concept designed to encourage more sustainable and plant-forward eating. This system is comprised of a collection of interconnected modules that utilize sensors and AI to provide personalized eating and nutrition recommendations to users. |

Source: Primary Research, Secondary Research, NMSC Analysis

Commercial Cooking Equipment Market Key Segments

By Product Type

-

Broilers

-

Grills and Griddles

-

Cook-Chill Systems

-

Refrigerators

-

Ovens

-

Dishwashers

-

Other Products

By Size

-

Small-scale Equipment

-

Medium-scale Equipment

-

Large-scale Equipment

By End-User

-

Full Service Restaurants

-

Quick-Service Restaurants

-

Catering

-

Railway Dining

-

Resorts & Hotel

-

Hospitals

-

Other End Users

By Geography

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia Pacific

-

-

Rest of World

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

AB Electrolux

-

Ali Group SRL

-

Illinois Tool Works Inc (Vulcan)

-

John Bean Technologies Corp

-

The Middleby Corporation

-

Haier Group

-

Hoshizaki America Inc

-

Alto-Shaam, Inc

-

Marmon Foodservice Technologies

-

Duke Manufacturing Company

-

Fagor Professional

-

Rational AG

-

UNOX S.p.A

-

GEA Group Aktiengesellschaft

-

Twothousand Machinery Co., Ltd.

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 13.95 Billion |

|

Revenue Forecast in 2030 |

USD 18.80 Billion |

|

Growth Rate |

CAGR of 4.8% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst