Europe Buy Now Pay Later (BNPL) Market by Component (Online and Point of Sale (PoS)), by Application (Consumer Electronics, Fashion & Garments, Media & Entertainment, Healthcare & Wellness, Automotive, Furnishing, and Other Application), and by End User (Millennials, GenZ, GenX, and Baby Boomers) – Opportunity Analysis and Industry Forecast, 2024–2030

Industry: BFSI | Publish Date: 27-Jan-2025 | No of Pages: 141 | No. of Tables: 94 | No. of Figures: 70 | Format: PDF | Report Code : BF2110

US Tariff Impact on Europe Buy Now Pay Later (BNPL) Market

Trump Tariffs Are Reshaping Global Business

Europe BNPL Market Overview

The Europe BNPL Market size was valued at USD 2.69 billion in 2023 and is predicted to reach USD 6.17 billion by 2030, registering a CAGR of 11.5% from 2024 to 2030.

The Europe BNPL market is rapidly expanding within the financial services sector, offering consumers the ability to make immediate purchases and defer payments over a set period, often without interest. This growth is driven by increasing demand for flexible payment options and the widespread adoption of digital and e-commerce platforms across Europe.

BNPL services are seamlessly integrated into both online and physical retail environments, providing straightforward repayment plans with minimal barriers to entry. Benefits of installment payment plans include enhanced purchasing power for consumers, improved conversion rates and average order values for merchants, and a more accessible alternative to traditional credit. As European consumers and retailers increasingly adopt these flexible payment solutions, BNPL become a key component of interest-free financing options in the region.

Surging E-Commerce Growth in Europe Drives the Demand for BNPL Services

The rapid growth of the e-commerce sector in Europe significantly boosts the demand for flexible payment options by consumers to manage their expenses more effectively that in turn propels the market growth.

According to the latest report of the International Trade Administration (ITA) 2023, Europe is ranked as the third-largest retail e-commerce market worldwide, with total revenues reaching USD 631.9 billion in 2023. This figure is projected to grow to USD 902.3 billion by 2027, reflecting an annual growth rate of 9.31%.

Deferred payment options offer a convenient way to spread payments over time without incurring interest, making them an attractive choice for consumers making frequent or high-value purchases. The expansion of the e-commerce sector in the region increases the demand for BNPL solutions, as consumers seek flexible payment options to better manage their finances and enhance their shopping experience.

Rising Partnership Among Key Players Accelerate the Europe BNPL Market Demand

The rising collaborative efforts among key players, such as Mollie, Billie, Stripe, Riverty, and others in introducing BNPL services in Europe are significantly driving the market growth by addressing the rising consumer demand for flexible payment options.

For instance, in July 2024, Mollie collaborated with Riverty to introduce a new BNPL solution in Europe. The collaboration aims to offer European merchants an advanced, seamless BNPL option that aligns with rising consumer demand for flexible payment solutions.

Additionally, in August 2024, Stripe partnered with Billie to launch a new BNPL solution in Europe, allowing European businesses to provide extended payment terms to their customers, thereby improving financial flexibility and simplifying transactions.

These partnerships enable the integration of advanced BNPL solutions into established payment platforms, offering seamless and convenient financing choices for consumers in the region. The surge in collaborative efforts among key players in the region to expand BNPL offerings, enhance the accessibility and appeal of these services, contributing to increased adoption of BNPL service across the region.

Regulatory Challenges Hinder BNPL Market Growth in Europe

Regulatory challenges significantly restrain the Europe BNPL market growth by imposing limitations and additional costs. As BNPL services gain popularity, they face heightened scrutiny, leading to the implementation of new regulations designed to protect consumers and ensure fair lending.

For instance, the European Union's updated Consumer Credit Directive (CCD), adopted in September 2023, now includes lower-value loans and interest-free credit, enhances digital transaction rules, and imposes stricter creditworthiness assessments and transparency requirements. These evolving regulations increase compliance costs and complicate operations for BNPL providers, potentially hindering Europe BNPL market expansion.

A recent case occurred in July 2024 highlighting these challenges for BNPL providers across Europe, such as Divido Financial Services Limited that went into administration due to the financial strain of meeting new regulatory standards and market conditions, underscoring the difficulties faced by industry players amid tightening rules.

Introduction Of Fee Waiver Policy for Late Payments Creates Future Market Opportunity

The waiver of late fees presents a significant opportunity for the BNPL market in Europe. Offering fee-free payment options allows BNPL providers to enhance the appeal of their services, meeting the increasing consumer demand for transparent and flexible financial solutions. This approach not only improves customer satisfaction but also attracts a broader user base by providing a more accommodating payment structure.

For example, Klarna’s 'Pay Later in 30 Days' option allows payment to be made 30 days after shipping. Klarna sends reminders via push notifications, email, and, if necessary, text or mail to ensure timely payment. There are no fees or interest for late payments, and credit scores remain unaffected.

Moreover, in October 2023, the European Union's new Consumer Credit Directive mandated that BNPL services must offer deferred payments completely free of charge, eliminating even small fees. This regulation also limits third-party involvement and enforces a repayment period of 50 days to enhance consumer protection.

By Component, Online Holds the Predominating Share in the Europe BNPL Industry

The online channel of BNPL refers to BNPL services integrated into e-commerce platforms, allowing consumers to choose flexible payment options during online transactions. As per our analysis, online channel dominates as well as estimated to witness fastest growth rate till 2030 in the channel segment of the BNPL market. This is due to its advantages that includes convenience for consumers shopping from home and easy integration with existing digital payment systems.

However, it includes potential challenges in verifying creditworthiness and lower consumer engagement compared to point-of-sale BNPL, that provides immediate financing options during in-person retail transactions and offers a more seamless checkout experience.

By Application, Fashion & Garments is Projected to Witness the Highest CAGR Growth Until 2030

The fashion and garments segment offer flexible payment solutions for apparel and accessories, including clothing, footwear, and handbags. As per our analysis, this segment is both the dominating and the fastest-growing in application. It serves consumers seeking to manage their spending on fashion items, which are generally priced lower than high-value electronics.

BNPL options in this segment often come with shorter repayment periods, reflecting the lower cost of fashion goods and the frequent nature of fashion purchases driven by seasonal trends and style updates. The flexibility offered by BNPL in the fashion segment allows consumers to make immediate purchases while spreading the cost over a few weeks or months.

This approach not only helps in managing budget constraints but also aligns with the regular buying habits in fashion, where consumers frequently update their wardrobes. Comparatively, while the fashion and garments segment benefits from BNPL’s ability to facilitate frequent, lower-cost purchases, the consumer electronics segment leverages BNPL to handle higher-cost items with longer payment terms.

Competitive Landscape

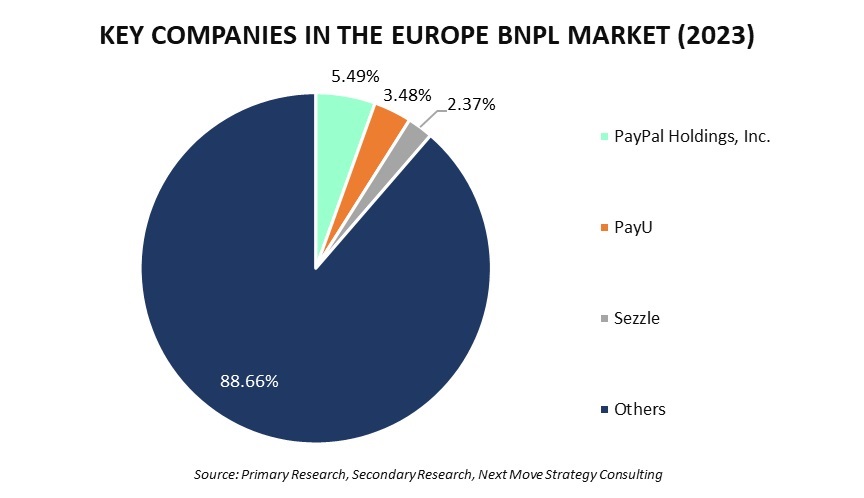

The promising key players operating in the Europe BNPL industry include Klarna Bank AB, PayPal Holdings, Inc., Block Inc., PayU, Alma, Sezzle, Ratepay GmbH, Scalapay S.R.L., Zilch Technology Ltd., and Amazon Payments, Inc., among others.

These players are engaged in partnership across various regions to maintain their dominance in the Europe BNPL market.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

|

Jul-24 |

Scalapay |

Scalapay S.R.L partnered with Adyen to integrate its BNPL service that allows thousands of merchants to offer flexible payment options. This collaboration aims to boost sales and enhance the shopping experience for consumers in Southern Europe. |

|

|

Jul-23 |

Klarna Bank AB |

Klarna Bank AB collaborated with UK-based Money Adviser Network to provide customers with fast and free access to debt advice. This initiative addresses growing concerns over financial well-being in the context of increasing consumer debt. |

|

|

Jun-23 |

PayPal |

PayPal collaborated with KKR to enhance its BNPL services in Europe and invested USD 3.26 billion to better serve its customers in the competitive BNPL landscape while optimizing its financial strategy. |

|

|

May-23 |

Alma |

Alma collaborated with Numeral, and BNP Paribas to automate and enhance the payment processes for merchants, responding to the growing demand for flexible payment options in the retail sector. |

|

|

Mar-22 |

Ratepay |

Ratepay GmbH partnered with PayPal to become the exclusive payment-by-invoice provider for "PayPal Checkout" in Germany. This collaboration allows online merchants using PayPal to offer Ratepay's white label payment solutions. Thus, it enhances customer trust and potential to increase conversion rates, as customers remain within the merchant's site during checkout. |

|

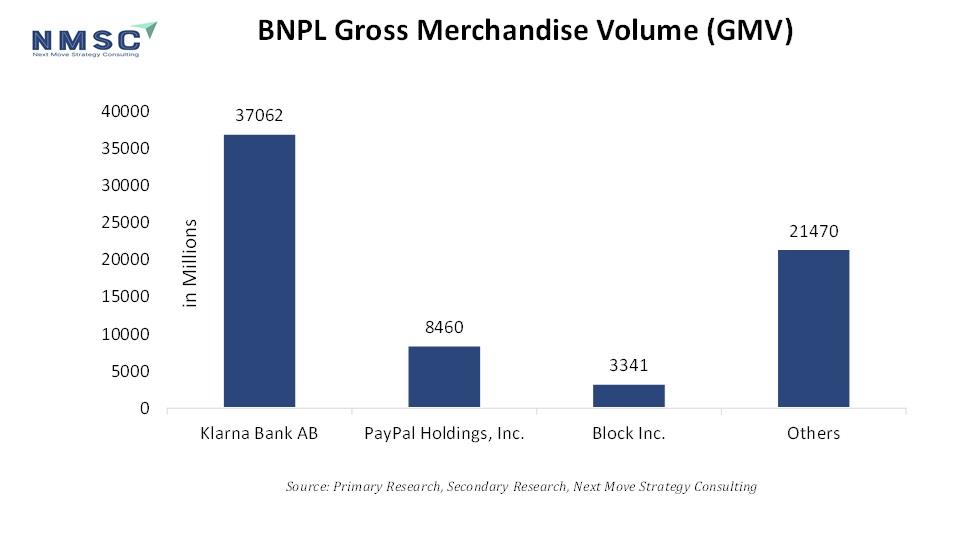

We have also evaluated companies based on their BNPL gross merchandise volume (GMV). This metric reflects the total value of goods and services processed through BNPL platforms, offering a clear indicator of each company's scale and market presence.

By analyzing GMV, we gain insights into consumer adoption, transaction volumes, and the relative performance of BNPL providers within the competitive landscape. This approach allows for a more comprehensive understanding of how these companies are positioned in the market based on their transactional throughput. For a detailed breakdown of company-wise gross merchandise volume (GMV), purchase our full report here.

Comparison of BNPL Gross Merchandise Volume (GMV) Across Key Players

Europe BNPL Market Key Segments

By Type

-

Online

-

Point of Sale (PoS)

By Application

-

Consumer Electronics

-

Fashion & Garments

-

Media & Entertainment

-

Healthcare & Wellness

-

Automotive

-

Furnishing

-

Other Application

By End User

-

Millennials

-

GenZ

-

GenX

-

Baby Boomers

Key Players

-

Klarna Bank AB

-

PayPal Holdings, Inc.

-

Block Inc.

-

PayU

-

Alma

-

Sezzle

-

Ratepay GmbH

-

Scalapay S.R.L.

-

Zilch Technology Ltd.

-

Amazon Payments, Inc.

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size Value in 2023 |

USD 2.69 Billion |

|

Revenue Forecast in 2030 |

USD 6.17 Billion |

|

Value Growth Rate |

CAGR of 11.5% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst