India EV Charging Market by Type of Charger (AC Chargers (Mode 1 (2.3 kW), Mode 2 (2.3 kW), & Mode 3 (3.7 kW to 22 kW) and DC Chargers), By Charging Speed (Level 1, Level 2, and Level 3), By Connector Type (Type 1, Type 2, CCS, CHAdeMO, and Others), by Installation (Fixed and Portable), and by End-Users – Opportunity Analysis and Industry Forecast, 2025–2030

Industry: Automotive & Transportation | Publish Date: 22-Apr-2025 | No of Pages: 214 | No. of Tables: 172 | No. of Figures: 97 | Format: PDF | Report Code : AT868

US Tariff Impact on India EV Charging Market

Trump Tariffs Are Reshaping Global Business

India EV Charging Market Overview

The India EV Charging Market size was valued at USD 787.3 million in 2024, and is expected to be valued at USD 1059.9 million by the end of 2025. The industry is projected to grow further, hitting USD 5695.6 million by 2030, with a CAGR of 41.2% between 2026 and 2030. In terms of volume, the market size was 179 thousand units in 2024 and is projected to reach 1610 thousand units in 2030, with a CAGR of 45.1% from 2025 to 2030.

The India EV charging market is witnessing robust growth, driven by strong government initiatives such as PM E-DRIVE and FAME II, rising EV sales, and active private sector investments from players such as Tata Power and BPCL. However, challenges like lack of standardization and compatibility issues among charging systems pose barriers to seamless deployment. Despite this, the integration of renewable energy sources into charging networks presents a significant opportunity for sustainable growth, especially in urban and semi-urban areas.

Government Initiatives Boost the Market Growth

The increasing governmental investment and supportive policies are demonstrably catalysing the sector's expansion. Initiatives such as the PM E-DRIVE Scheme, with its substantial allocation of USD 1.27 billion launched in September 2024, actively promote electric vehicle adoption and the development of essential infrastructure, including public EV charging stations and testing facilities.

Complementary to this, the Ministry of Power have also established the Guidelines for the Installation and Operation of Electric Vehicle Charging Infrastructure that provides a crucial framework of standards and protocols. These guidelines aim to ensure the creation of a nationwide, seamless, and interoperable EV charging network, alongside simplifying the procedures for obtaining electricity connections for charging facilities.

Rising EV Sales Accelerate Infrastructure Demand

The escalating demand for electric vehicles across India is intrinsically driving the imperative for a more advanced and pervasive charging infrastructure. As the adoption rates of EVs continue to rise, a robust and reliable power infrastructure becomes essential to cater to the diverse charging requirements of a consumer base increasingly transitioning towards sustainable transportation.

The substantial annual growth rate of 70% in EV sales in India, reaching 80,000 units in 2023 according to the International Energy Agency, underscores this increasing demand and the consequent necessity for a comprehensive charging ecosystem to effectively support the ongoing EV market trends.

Private Sector Investments Fuels Market Expansion

The growing influx of private sector investments and the formation of strategic partnerships are playing a vital role in propelling the India EV charging market growth by facilitating the establishment of an extensive and efficient charging network. Notable examples include Tata Power's ambitious plans to expand its network to over 25,000 charging points across more than 450 cities by 2028.

Furthermore, major oil companies such as BPCL, HPCL, and IOCL are aiming to establish a significant presence with 22,000 charging stations, supported by government funding. Tata.ev's 'Open Collaboration 2.0' initiative further exemplifies this trend, aiming to more than double India’s EV charging points to 400,000 by 2027 through collaborations with Tata Power, ChargeZone, Statiq, and Zeon, including the deployment of a network of 500 'Mega Chargers'.

Additionally, Montra Electric's recent partnership with Steam-A to integrate AI-driven management systems into its Powerdock charging network also highlights the private sector's focus on enhancing the reliability of charging infrastructure. Hyundai Motor India also intends to install nearly 600 public fast EV charging stations across India by 2031, collaborating with service providers including ChargeZone, Statiq, and Shell India to improve accessibility, which in turn boost the market growth.

High Cost of EV Charging Hinders the Market Growth

The high upfront costs associated with setting up EV charging infrastructure—such as equipment, installation, land acquisition, and power upgrades—remain a major barrier to market growth in India.

For many operators, especially in tier-2 and tier-3 cities, the return on investment is uncertain due to lower EV penetration and usage rates. Additionally, costs related to integrating smart technologies, fast chargers, and ensuring grid stability further strain budgets, making it challenging for both public and private players to scale operations affordably.

Integration of Renewable Energy Creates Significant Growth Opportunities for the India EV Charging Market Trends

Incorporation of renewable energy sources such as solar and wind power in the EV charging systems creates ample opportunities for the market in upcoming years as it enables cleaner power delivery. Moreover, it reduces dependence on coal powered grids, and supports the development of environmentally friendly charging stations across urban and rural areas.

For example, in April 2025, India Power partnered with Charget and introduced first solar powered EV charging hub in Kolkata. As India accelerates its renewable energy capacity and businesses prioritize green solutions, this shift is poised to drive efficiency, attract investments, and fuel the long-term expansion of the EV charging market.

Charger Type Analysis: AC Chargers Lead the Market

Regarding charger type, AC chargers currently dominate the India EV charging market share. This is primarily attributed to their greater affordability in terms of production, installation, and operational costs when compared to DC chargers.

Furthermore, AC EV chargers are more commonly used for charging at home and in workplaces due to their lower cost and suitability for longer charging sessions. The report by IESA and Customised Energy Solutions also supports this, stating that the ecosystem was dominated by type-2 AC chargers, which accounted for 82 % of the market in 2021-22, followed by AC001 type chargers at 12.5 %. This makes AC chargers a more accessible and practical option for a large segment of EV users who can charge their vehicles overnight or during work hours.

Additionally, the prevalence of slower chargers like Bharat AC-001 (typically rated at 3.3kW) and DC-001 (15kW) also contributes to the dominance of the AC segment, as AC-001 is a type of AC charger. These slower chargers, taking approximately 8-12 hours to fully charge a vehicle, are best suited for overnight charging at homes or workplaces and cater to a significant portion of the current EV sector, particularly the two-wheeler and four-wheeler segments. Projections suggest that even by 2030, with EVs expected to constitute 65% of the market, slow chargers are expected to continue dominating.

Application Segment: Commercial Use Leads with Fastest Growth

Concerning the application segment, the commercial application holds the highest CAGR of 41.7% in the India EV charging market. This rapid growth is largely due to the rapid electrification of commercial fleets, which includes vehicles such as taxis, delivery vans, and buses. The increasing adoption of electric vehicles in the commercial sector necessitates a robust charging infrastructure to support their daily operations and ensure minimal downtime.

Moreover, government policies such as FAME II and the National Electric Mobility Mission Plan primarily focus on public transport electrification, which directly boosts the demand for charging infrastructure at depots and transit hubs.

Initiatives aimed at electrifying public transport and commercial logistics actively drive the deployment of charging stations specifically designed for commercial use. The partnership between Montra Electric and Steam-A to enhance charging infrastructure reliability for electric small commercial vehicles further underscores this growing focus on the commercial segment.

Strategic Analysis of Companies in the India EV Charging Industry

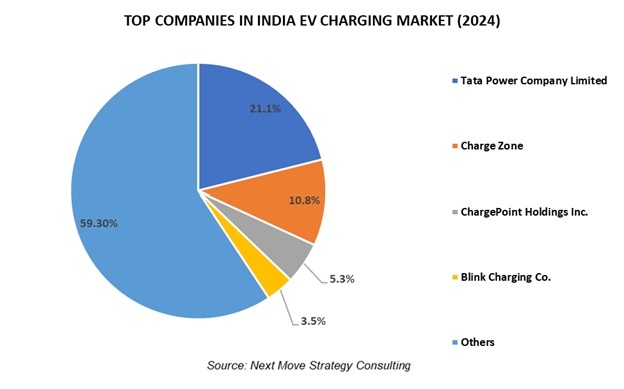

The India EV charging market demand is fueled by the strategic initiatives of key players committed to strengthening the country’s electric mobility ecosystem. Tata Power Company Limited leads the segment with over 60,000 charging points, including more than 1,000 public stations as of 2024.

The company emphasizes renewable energy integration and partnerships with oil firms to expand its presence across urban and highway corridors. Charge Zone, with 3,500 operational chargers, aims to scale to one million by 2030, prioritizing highway networks and smart app-based tracking solutions.

ChargePoint Holdings Inc., a global leader, is entering the Indian market with advanced solutions targeting fleet operators and businesses. Blink Charging Co. leverages its international expertise to establish stations in high-traffic urban zones. Exicom focuses on hardware innovation, managing over 65,000 chargers across 400+ cities, bolstered by strong collaborations with leading automakers.

Meanwhile, Fortum (operating as GLIDA in India) supports sustainability through 70+ solar-powered public charging stations. Delta Electronics Inc. provides high-efficiency AC and DC chargers, catering to both public infrastructure and fleet requirements with outputs of up to 200 kW.

Ola Electric Mobility Ltd. develops integrated charging stations for its scooter users, directly accessible through its mobile app. Ather Energy has rolled out over 1,900 fast chargers and is expanding into tier-2 and tier-3 cities post-IPO with its proprietary LECCS (Light Electric Combined Charging System) standard. Servotech Power Systems Ltd. has deployed more than 5,600 chargers and is executing large-scale projects, including 1,800-charger rollout in partnership with BPCL.

Despite challenges like high infrastructure costs, inconsistent state-level policies, and limited rural grid reliability, the market holds vast potential. Strategic investments, public-private partnerships, and localized innovation continue to drive momentum across India’s dynamic EV charging landscape.

LIST OF SELF MANUFACTURED VS WHITELABELLED CHARGER MANUFACTURERS

Below are the list of self-manufacturers and white labelled charger manufacturers. For more detail buy our latest report. BUY NOW: https://www.nextmsc.com/report/india-electric-vehicle-ev-charging-market

|

Supplier |

Own Manufacturing/Designing |

Primarily White-Label |

|

Servotech Power Systems |

Yes |

No |

|

Exicom Tele-Systems |

Yes |

No |

|

Tata Power |

Partial |

No |

|

Ather Energy |

Yes |

No |

|

Delta Electronics India |

Yes |

No |

|

Mass-Tech Controls |

Yes |

No |

|

XX |

XX |

XX |

|

XX |

XX |

XX |

|

XX |

XX |

XX |

|

XX |

XX |

XX |

|

XX |

XX |

XX |

|

XX |

XX |

XX |

|

XX |

XX |

XX |

|

XX |

XX |

XX |

|

XX |

XX |

XX |

|

XX |

XX |

XX |

|

XX |

XX |

XX |

|

XX |

XX |

XX |

|

XX |

XX |

XX |

|

XX |

XX |

XX |

|

XX |

XX |

XX |

|

XX |

XX |

XX |

Source: Primary Research, Secondary Research, NMSC Analysis

India EV Charging Market Key Segments

By Type Of Charger

-

AC Chargers

-

Mode 1 (2.3 kW)

-

Mode 2 (2.3 kW)

-

Mode 3 (3.7 kW to 22 kW)

-

-

DC Chargers (22 kW to 350 kW)

By Charging Speed

-

Level 1

-

Level 2

-

Level 3

By Connector Type

-

Type 1

-

Type 2

-

CCS

-

CHAdeMO

-

Others

By Installation

-

Fixed

-

Portable

By End User

-

Commercial

-

Commercial Public EV Charging Stations

-

Highway Charging Stations

-

Fleet Charging Stations

-

Workplace Charging Stations

-

-

Commercial Private EV Charging Stations

-

-

Residential

-

Private Homes

-

Apartments

-

Key Players

-

Tata Power Company Limited

-

Charge Zone

-

ChargePoint Holdings Inc.

-

Blink Charging Co.

-

Exicom

-

Fortum

-

Delta Electronics Inc.

-

Ola Electric Mobility Ltd.

-

Ather Energy

-

Servotech Renewable Power System Ltd

Other Notable Players

-

BluSmart Tech Pvt Ltd

-

Sharify Services Pvt. Ltd.

-

Griden Power

-

JT Mobility Pvt. Ltd

-

Charzer

-

Shell Recharge

-

VerdeMobility

-

Quench

-

Okaya Power Group

-

PLUG N GO

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 787.3 Million |

|

Revenue Forecast in 2030 |

USD 5695.6 Million |

|

Growth Rate |

CAGR of 40.0% from 2025 to 2030 |

|

Market Volume in 2024 |

179 Thousand Units |

|

Volume Forecast in 2030 |

1610 Thousand Units |

|

Growth Rate (Volume) |

CAGR of 45.1% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Market Value Estimation |

Thousand Units |

|

Growth Factors |

|

|

Companies Profiled |

20 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst