India Real Estate Market by Product Type (Residential Buildings & Dwellings, Commercial Complexes, Industrial Infrastructure, and Government Infrastructure), by Business (Sales, Rental, and Lease), by Price (Affordable, Mid End, High End, Luxury, and Ultra Luxury) – Opportunity Analysis and Industry Forecast, 2025–2030 India Real Estate Market Overview

Industry: Construction & Manufacturing | Publish Date: 14-Apr-2025 | No of Pages: 180 | No. of Tables: 113 | No. of Figures: 58 | Format: PDF | Report Code : CM1210

US Tariff Impact on India Real Estate Market

Trump Tariffs Are Reshaping Global Business

India Real Estate Market Overview

The India Real Estate Market size was valued at USD 385.18 billion in 2024, and is predicted to reach USD 1044.43 billion by 2030, at a CAGR of 16.6% from 2025 to 2030. The Indian real estate market includes a wide range of residential, commercial, and industrial properties located throughout cities and villages in the country. It forms the most essential component for developers, investors, and home buyers that enables transactional and investment possibilities in flats, office spaces, retail shops, and industrial site purchases.

The key component includes agents of real estate, property developers, and governmental structures are a part of complex regulation systems. Moreover, it plays a significant role in boosting the economy and meeting the demands of a rapidly urbanizing population.

Increasing Infrastructure Investments by Public Sector Drive the Growth of the India Real Estate Market

The rise in infrastructure investment increases the India real estate market demand in the smart cities, industrial parks, and transportation hubs. The sector attracts more funding into the real estate sector, and these regions are considered ideal for residential, commercial, and industrial projects. The report by the Morgan Stanley, the India's infrastructure investment is going to reach 6.5% by 2029. Consequently, this rise in the construction sector fuels the market by increasing property availability and accommodating the growing demand for both residential and commercial spaces.

Increase in the Demand for Estate Properties Fuels Market Expansion

The rising construction industry fuels the real estate market due to the rising demand for residential, commercial, and industrial properties. As the construction industry grows, more properties are put in place to meet the growing needs for both accommodation and business premises. As per the Indian government reports, the construction sector will reach USD 1.4 trillion by 2025. Thus, this rise in the construction sector fuels the market expansion by increasing property availability and accommodating the growing demand for both residential and commercial spaces.

High Property Prices in India Hinder the Market Growth

High property prices in India present a significant challenge for the real estate sector, making properties less affordable for buyers. This reduces the purchasing power for both residential and commercial properties, leading to fewer transactions and slower investment growth. As a result, affordability concerns hinder India real estate market growth and slow the overall development of the industry.

Initiatives Towards Smart Cities and Integration of Virtual Reality (VR) Creates Future Market Prospects

The growth of smart cities offers promising future opportunities for the India real estate market expansion. A focus on advanced infrastructure and improved connectivity is fueling demand for modern real estate projects.

For instance, in August 2024, the government of India introduced a smart city initiative under the National Industrial Corridor Development Programme, aiming to build 12 new industrial smart cities. Therefore, the focus on smart city development enhances the demand for modern real estate projects that drives the expansion of the market by fostering infrastructure advancements and improved connectivity.

By Property Type, Residential Buildings and Dwellings Holds Dominates the Market, With the Highest CAGR

Residential buildings and dwellings hold both the dominant and fastest growing share due to the rising urbanization and a growing population with higher disposable incomes. Additionally, both affordable and premium housing segments are witnessing substantial growth, fueled by rising consumer aspirations and government initiatives promoting homeownership.

Policies such as housing subsidies, low-interest loans, and tax benefits have further encouraged real estate development. Moreover, the increasing preference for nuclear families over joint family setups has amplified the need for independent living spaces, contributing to the sustained demand for residential properties.

By Business Type, Sales is Anticipated to Grow at a Fastest Rate in the Future

The sales segment is expected to grow at the highest CAGR in the Indian real estate market. The major factors for the growth are majorly urbanization, an increase in disposable income, and the increasing middle-class population. Also, the government initiatives such as PMAY along with the decreased home loan interest rates have also heightened the demand to purchase residential properties.

Moreover, demand for commercial real estate is on the rise with office spaces and retail outlets, as business is expanding, and the e-commerce industry is doing well. As digitalization digitizes the sales transaction, the sales segment will have excellent growth potential in the near future as real estate developers are now offering creditable financing options.

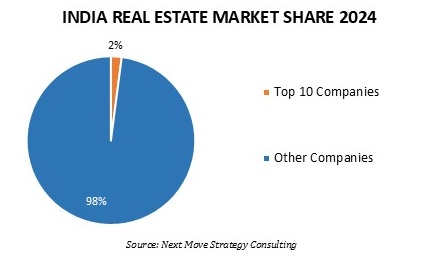

The key market players operating in the India real estate industry include Lodha Group, Prestige Estates Projects Ltd., DLF Limited, Brigade Group, Oberoi Realty Ltd., Phoenix Mills Ltd., SOBHA Limited, Godrej Properties Limited, Puravankara Limited, L&T Realty, Equinox India Developments Ltd, Mahindra Lifespace Developers Ltd., Tata Housing Development Company Limited, Sunteck Realty, Ansal Properties and Infrastructure Ltd, and others.

India Real Estate Market Key Segments

By Property Type

-

Residential Buildings & Dwellings

-

Entry-Level Properties

-

Standard Properties

-

Exclusive Properties

-

Luxury Properties

-

-

Commercial Complexes

-

Industrial Infrastructure

-

Government Infrastructure

By Business

-

Sales

-

Rental

-

Lease

By Price

-

Affordable

-

Mid End

-

High End

-

Luxury

-

Ultra Luxury

Key Players

-

Lodha Group

-

Prestige Estates Projects Ltd.

-

DLF Limited

-

Brigade Group

-

Oberoi Realty Ltd.

-

Phoenix Mills Ltd.

-

SOBHA Limited

-

Godrej Properties Limited

-

Puravankara Limited

-

L&T Realty

-

Equinox India Developments Ltd.

-

Mahindra Lifespace Developers Ltd.

-

Tata Housing Development Company Limited

-

Sunteck Realty

-

Ansal Properties and Infrastructure Ltd.

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 385.18 Billion |

|

Revenue Forecast in 2030 |

USD 1044.43 Billion |

|

Growth Rate |

CAGR of 16.6% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

|

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst