Indonesia Insurance TPA Market by Type (Health Insurance, Property and Casualty Insurance, Workers' Compensation Insurance, Disability Insurance, Travel Insurance, and Others), by Services (Claims Management and Risk Control Management), by Claim Processing (Hospitals, Clinics (Utama/Pratama), Puskesmas, and Pharmacies), and by End User (Healthcare, Construction, Real Estate and Hospitality, Transportation, Staffing, and Other End User) – Opportunity Analysis and Industry Forecast, 2025–2030

Industry: ICT & Media | Publish Date: 17-Feb-2025 | No of Pages: 66 | No. of Tables: 114 | No. of Figures: 59 | Format: PDF | Report Code : IC2639

US Tariff Impact on Indonesia Insurance TPA Market

Trump Tariffs Are Reshaping Global Business

Indonesia Insurance TPA Market Overview

The Indonesia Insurance TPA Market size was valued at USD 1.66 billion in 2024 and is predicted to reach USD 5.32 billion by 2030, registering a CAGR of 20.6% from 2025 to 2030.

The Indonesia insurance third party administrator (TPA) market refers to the industry that provides administrative services to insurance companies including claims processing, policy management, and risk management. TPAs act as intermediaries between insurers and policyholders that streamline operations and improving the efficiency. This market plays a crucial role in enhancing customer experiences and ensuring compliance with regulatory requirements while allowing insurers to focus on core business activities.

The market for insurance provider network spans various sectors including health insurance, property and casualty insurance, and workers' compensation, and others that reflects its diverse applications and growing importance in the insurance landscape. The rise of digitalization leads many TPAs to integrate advanced technologies such as artificial intelligence (AI) and data analytics tools to streamline processes, reduce costs, and enhance service delivery. This evolution positions the TPA market as a critical component of the insurance industry’s future that is fueled by the need for increased operational efficiency and adaptability in a competitive landscape.

Increasing Demand for Insurance Policies Accelerates TPA Market

The increasing demand for insurance policies in Indonesia is propelling the growth of the insurance TPA sector. As there is rising interest among individuals and organizations to obtain and provide better coverage necessitates the need for efficient and reliable TPA services. According to the Financial Services Authority report 2022, the number of microinsurance policyholders in Indonesia accounted for 30 million in 2021 as compared to 18 million in 2015, an increase of 66.7% within six years. This rising necessity compels TPAs to enhance their capabilities and broaden their service offering that creates a more vibrant and competitive insurance market.

Moreover, the expanding insurance sector in Indonesia further drives the growth of the market. As the insurance industry continues to develop and offer a wider range of coverage options, the demand for efficient and reliable TPA services increases. According to the Financial Services Authority report 2022, premiums for the insurance sector for the period of January to November reached USD 18.12 billion in 2022 that is a growth of 0.44% compared to 2021. This expansion drives TPAs to improve their capabilities and diversify their services that leads to a more dynamic and competitive insurance market in country.

Rising Healthcare Expenditure Fuels the Growth of the Market

The increasing healthcare expenditure is driving in the Indonesia insurance TPA market growth. As more individuals and businesses invest in health insurance to cover rising medical costs it surges the demand for efficient and reliable TPA services.

According to the latest World Bank Group report 2024, Indonesia’s healthcare expenditure per capita stood at USD 160.6 in 2021 as compared to USD 97.1 in 2015, an increase of 65.4% in the span of six years. Moreover, the country’s healthcare expenditure accounted for 3.7% of GDP in 2021 as compared to 2.9% of GDP in 2015, an increase of 27.6% from 2015 to 2021. This trend is prompting TPAs to enhance their offerings and expand their networks that ultimately fosters a more competitive and robust insurance market.

Furthermore, the Indonesian government is also implementing necessary measures to enhance healthcare sector that further supports the growth of the market. For instance, in 2022, the Social Insurance Administration Body (BPJS) conducted two programs in the country, health insurance and employment social security and the health insurance program covered 248.77 million people. This initiative increases the demand for TPA solutions that effectively manage the complexities of insurance claims and services such as claims processing, patient management, risk assessment, and others.

Growing Aging Population Increases the Demand for Insurance TPA Services

The growing aging population is driving in the Indonesia insurance TPA market demand for services. As the number of elderly individuals rises, there is a greater need for comprehensive insurance solutions that cater to age-related health and financial needs. TPAs are essential in managing and streamlining insurance claims, processing, and benefits for senior citizens, ensuring they receive timely and effective support.

According to the World Bank Group latest report, the Indonesia’s population aged over 65 years accounted for 19.4 million as compared to 15.7 million in 2014, an increase of 22.9% in the span of 9 years. This demographic shift amplifies the need for specialized services, prompting TPAs to enhance their offerings and adapt to the evolving requirements of an aging population.

The Regulatory Challenges and Cybersecurity Threats Hinders the Market Growth

The Indonesia insurance TPA industry faces significant regulatory challenges that impede the growth and innovation. Regulatory bodies such as the Financial Services Authority (OJK) impose stringent approval processes, mandating TPAs to adhere to complex regulatory frameworks. These regulations entail extensive compliance requirements that delays market entry and escalate operational costs for TPA providers.

Moreover, the growing prevalence of cybersecurity threats present a significant challenge for the Indonesia insurance TPA industry. As TPAs increasingly rely on digital platforms and data-driven solutions, they become prime targets for cyberattacks including data breaches and ransomware.

According to the Vida Digital Identity report 2023, Indonesia ranked 3rd in the world in terms of the number of data breach accounts in 2022. Moreover, as per Information Security Media Group, Corp. report 2023, Indonesia faced the highest number of cyberattacks in the Southeast Asian region in the span of February to August with an average of 3,300 cyberattacks per week. These threats jeopardize the security of sensitive customer information and disrupt operational processes.

Integration of AI Creates Future Growth Opportunity for the TPA Market

The integration of artificial intelligence (AI) offers a significant growth opportunity for the Indonesia insurance TPA sector. AI technologies transform TPA operations by automating routine tasks, enhancing accuracy in claims processing, and providing advanced data analysis. AI-driven solutions enable TPAs to offer highly personalized insurance products and services, improving customer experiences and satisfaction.

Predictive analytics powered by AI forecasts trends, detect fraudulent activities, and optimize risk management strategies. For instance, in January 2024, Global Excel Management Inc. collaborated with Luminance to streamline contract review processes, improve contract governance, and drive efficiency across the organization with the help of AI. As TPAs adopt AI technologies, they can gain a competitive edge, drive innovation, and respond more effectively to evolving market demands, thus positioning themselves for substantial growth in the dynamic insurance landscape.

By Type, P&C Insurance the Predominating Share in the Indonesia Insurance TPA Industry

Property and casualty insurance holds the largest in Indonesia insurance TPA market share as it covers risks related with property damage and liability. TPAs play a key role in managing these types of insurance by handling claims processing, policy administration, and risk management. They streamline the claims process, oversee policy details, and ensure compliance that helps insurers and policyholders manage risks effectively. By providing expert administrative support TPAs enable efficient handling of property and casualty claims ensuring that both assets and liabilities are properly managed and protected.

By Claim Processing, Puskesmas is Projected to Witness the Highest CAGR Growth Until 2030

Puskesmas are community health centers in Indonesia that deliver essential primary healthcare services to local residents. They play a vital role in providing preventive care, managing common illnesses, and supporting community health initiatives.

In the insurance TPA market, TPAs are crucial for managing insurance policies for Puskesmas. They handle claims processing, policy administration, and risk management, ensuring efficient interactions between Puskesmas, insurers, and healthcare providers.

TPAs assist Puskesmas by addressing insurance needs such as liability coverage, employee benefits, and regulatory compliance. Their support helps Puskesmas concentrate on offering quality healthcare services, ensuring that community health centers operate effectively and continue to serve their local populations efficiently.

Competitive Landscape

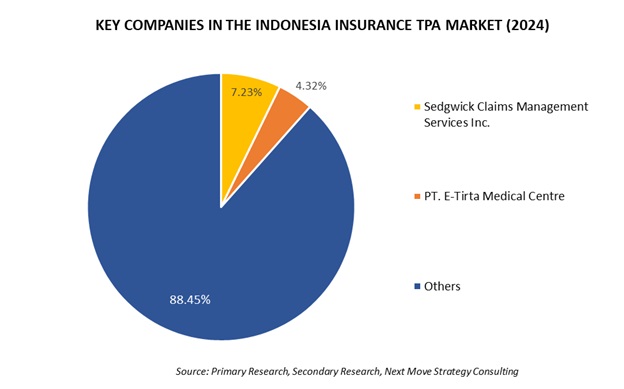

The promising key players operating in the Indonesia Insurance TPA industry include Sedgwick Claims Management Services Inc., PT. E-Tirta Medical Centre, Crawford & Co., Charles Taylor, PT Prodia Widyahusada Tbk., Global Excel, Fullerton Health Corporation Ltd., Arthur J. Gallagher & Co., Pacific Cross Group Insurance, and Aon Plc, PT Administrasi Medika, AAA Indonesia, PT Nayaka Era Husada, PT Syntech Mitra Integrasi, Mediflash Healthcare Solutions, and among others.

For updated market share, buy our latest report

These companies are engaged in various business expansion and partnership across various regions to maintain their dominance in the Indonesia insurance TPA market.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

|

May-24 |

Sedgwick |

Sedgwick expanded its marine division in Indonesia for providing comprehensive risk benefits in areas such as cargo, hull, and marine liability claims management. |

|

|

Mar-24 |

Fullerton Health |

Fullerton Health expanded its presence in Indonesia by opening new clinics and increasing its service offerings. The company provides healthcare services through over 100 medical clinics, offering medical assistance, evacuation services, and third-party administration (TPA) of corporate health benefits. |

|

|

Mar-24 |

Pacific Cross |

Pacific Cross partnered with Qantev to deploy Qantev's AI-powered claims and fraud detection solutions across five countries including Indonesia. This collaboration empowers Pacific Cross with insights into claims processing and fraud detection, transforming the way Pacific Cross approaches claim management. |

|

|

Feb-24 |

Global Excel |

Global Excel Management partnered with Appian's Connected Claims solution to modernize its insurance claims processes. Through this partnership, the company aims to expedite claim settlements, reduce costs, and enhance the customer experience. |

|

|

Oct-23 |

Aon Plc |

Aon announced its plans to digitize and automate its reinsurance claims process by utilizing the Appian Platform. By leveraging Appian's AI Process Platform, Aon successfully automated its workflows, leading to improved operational efficiency and enhanced customer experiences. |

|

Indonesia Insurance TPA Market Key Segments

By Type

-

Health Insurance

-

Disease Insurance

-

Medical Insurance

-

Senior Citizens

-

Adults

-

Minors

-

-

-

Property and Casualty Insurance

-

Workers' Compensation Insurance

-

Disability Insurance

-

Travel Insurance

-

Others

By Services

-

Claims Management

-

Risk Control Management

By Claim Processing

-

Hospitals

-

Clinics (Utama/Pratama)

-

Puskesmas

-

Pharmacies

By End User

-

Healthcare

-

Construction

-

Real Estate and Hospitality

-

Transportation

-

Staffing

-

Other End User

Key Players

-

Sedgwick Claims Management Services Inc.

-

PT. E-Tirta Medical Centre

-

Crawford & Co.

-

Charles Taylor

-

PT Prodia Widyahusada Tbk.

-

Global Excel

-

Fullerton Health Corporation Ltd.

-

Arthur J. Gallagher & Co.

-

Pacific Cross Group Insurance

-

Aon Plc

-

PT Administrasi Medika

-

AAA Indonesia

-

PT Nayaka Era Husada

-

PT Syntech Mitra Integrasi

-

Mediflash Healthcare Solutions

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size Value in 2024 |

USD 1.66 Billion |

|

Revenue Forecast in 2030 |

USD 5.32 Billion |

|

Value Growth Rate |

CAGR of 20.6% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst