Last Mile Delivery (LMD) Robot Market by Solution (Hardware, Software, Services), by Vehicle Type (Aerial Delivery Drones, Ground Delivery Bots), by Range (Short Range, Long Range), by Application (Retail and E-Commerce, Food Delivery, Healthcare and Pharmaceuticals, Other Application) – Global Opportunity Analysis and Industry Forecast 2024-2030

US Tariff Impact on Last Mile Delivery (LMD) Robot Market

Trump Tariffs Are Reshaping Global Business

LMD Robot Market Overview

The Last Mile Delivery (LMD) Robot Market size was valued at USD 6.54 billion in 2023 and is predicted to reach USD 30.26 billion by 2030 with a CAGR of 24.5% from 2024-2030.

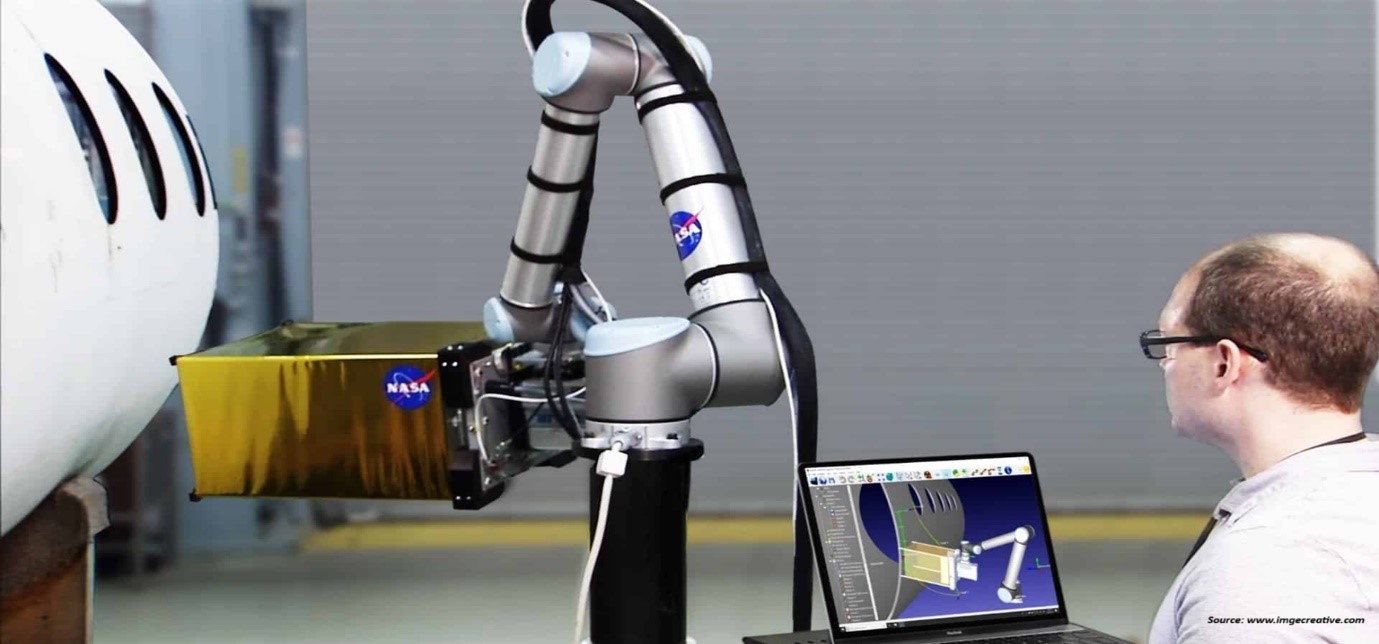

The last mile delivery robot, also known as autonomous last mile delivery robot that refers to the final phase of delivery process where a package is transported from a transportation hub to its final destination, usually in residential address or retail stores. Delivery robots are designed to navigate through these urban environments efficiently by avoiding traffic congestion and taking shorter routes. This increases the speed of last-mile deliveries, ensuring that packages reach their destinations quickly.

LMD robots are equipped with advanced technologies such as LiDAR, radar, cameras, and other sensor systems to navigate and operate autonomously in various environments. These technologies enable the robots to safely traverse sidewalks, cross streets, and interact with pedestrians. Moreover, these robots are designed to carry packages of varying sizes and weights, from small robots suitable for lightweight packages to larger ones capable of handling bulkier items.

Market Dynamics and Trends

The rapid rise of e-commerce significantly creates the demand for efficient last mile delivery solutions. These robots help streamline and automate the delivery process, reducing costs, and improving delivery times. According to the International Trade Administration, the global B2C e-commerce revenue is expected to grow to USD 5.5 trillion by 2027 as compared with 2023 with a revenue of USD 3.6 trillion.

Also, with the growing importance on sustainability and carbon footprint reduction, last-mile delivery robots present an eco-friendly alternative to conventional delivery vehicles. Electric-powered robots significantly lower carbon emissions compared to traditional trucks, making them an appealing choice for companies aiming to minimize their environmental impact.

Moreover, the rising adoption of Unmanned Aerial Vehicle (UAV) for fast and more efficient deliveries compared to traditional methods such as delivery vans is further driving the market growth. Recently, DJI launched the DJI FlyCart 30 (FC30), its first delivery drone, which is designed to overcome traditional transport challenges with its large payload capacity and long operation range. It is intended to be used for various delivery purposes, such as mountain transportation, offshore transportation and emergency rescue transportation which is expected to provide more efficiency and flexibility in these operations.

However, the high upfront cost of implementing autonomous robots into last mile delivery (LMD) is significantly impeding the overall market growth. On the contrary, the integration of artificial intelligence (AI) and machine learning (ML) algorithms tends to optimize the entire delivery process to predict demand patterns, adjust routes based on traffic or weather conditions, and improve overall operational efficiency.

For instance, in April 2023, Gently, an AI-powered logistics firm, completed its first last mile delivery in West Los Angeles, creating a more efficient and sustainable supply chain. The firm is a last-mile delivery provider that partner with retailers and leverages artificial intelligence and predictive data to store goods closer to the customer, creating a more efficient and sustainable supply chain while speeding up delivery times.

Market Segmentation and Scope of Study

The last mile delivery (LMD) robot market is divided on the basis of solution, vehicle type, range, application and region. On the basis of solution, the market is classified into software and services. On the basis of vehicle type, the market is divided into ariel delivery drones and ground delivery bots.

On the basis of range, the market is bifurcated into short range and long range. On the basis of application, the market is categorized into retail and e-commerce, food delivery, healthcare and pharmaceuticals, and others. Regional breakdown and analysis of each of the aforesaid segments includes regions comprising of North America, Europe, Asia-Pacific, and RoW.

Geographical Analysis

North America holds the dominating share of last mile delivery (LMD) robot market at present and is expected to continue its dominance throughout the forecast period. This is attributed to factors such the rise of online shopping and e-commerce platforms which led to a surge in demand for last mile delivery services among the developed countries such as the U.S. and Canada. According to the International Trade Administration, the e-commerce consumers in Canada is expected to grow at 77.6% by 2025 as compared with 2022 accounting for 75% of the Canadian population.

Also, increasing urban population density led to higher demand for quick and efficient food delivery services is further driving the overall market growth. For instance, in January 2022, Ottonomy launched its first fully autonomous delivery robot named Ottobot which is capable of operating in both indoor and outdoor environments. This robot is deployed at CVG Airport in Cincinnati for delivering retail and food items and also partnered with restaurants for last-mile food delivery.

On the other hand, Asia-Pacific is considered fastest growing region in the autonomous last mile delivery industry owing to the surge in e-commerce activities across China and Japan which significantly increased the demand for last mile delivery services. According to a report published on the International Trade Administration by eMarketer, the online retail transaction reached at USD 2.29 trillion in 2020 and is expected to reach USD 3.56 trillion by 2024.

Moreover, some of the prominent companies are adopting various business strategies including product launch which in turn is boosting the market growth. For instance, in December 2022, Hyundai Motor Group launched pilot programs to advance last-mile delivery using its Plug & Drive (PnD) based robots with integrated autonomous driving technology. These robots are designed to deliver amenities, food, and drinks directly to customer’s rooms, and to pick up restaurant orders and deliver them to consumer's doors.

Competitive Landscape

Various players in the last mile delivery (LMD) robot industry includes Starship Technologies, Nuro Inc., KEENON Robotics Co., Ltd., Ottonomy Inc., Cartken Inc., Robustel Corporation, Relay Delivery Robots, Flytrex Inc., Kiwibot, Drone Delivery Canada Corp., Caterpillar Inc., DHL Group, Boxbot, Avride Inc., Zipline Inc., and Others. These market players are opting various strategies such as partnership and product launch to maintain their dominance in the global last mile delivery AMR market.

For instance, in October 2023, Drone Delivery Canada Corp. (DDC) partnered with Halton Healthcare to deploy DDC’s patented drone delivery solution to establish a new two-way transportation link from Milton District Hospital to Oakville Trafalgar Memorial Hospital. This is used to carry a variety of critical medical supplies between the two hospitals including blood bank materials, urine cultures, small cytology containers with formalin, and blood culture bottles.

Also, in July 2023, The Co-op partnered with Starship Technologies to expanded their robot delivery service across Leeds, UK. The robots use sensors, artificial intelligence, machine learning, and a computer vision-based navigation system to make deliveries. Consumers have the option to place grocery orders through the starship food delivery app and the robot delivers the package with an environmentally friendly and economical approach.

Moreover, in December 2022, Kiwibot launched its first High-Driving Automation Campus at Loyola Marymount University (LMU), featuring 25 self-driving delivery robots with autonomous navigation capabilities. The introduction of these robots aims to provide more efficient, convenient, and sustainable food delivery services to the LMU community, reducing wait times and offering a faster and safer service at cost-effective rates.

Key Benefits

-

The report provides quantitative analysis and estimations of the last mile delivery robot market from 2024 to 2030, which assists in identifying the prevailing market opportunities.

-

The study comprises a deep-dive analysis of the last mile delivery robot market including the current and future trends to depict prevalent investment pockets in the market.

-

Information related to key drivers, restraints, and opportunities and their impact on the last mile deliver (LMD) robot market is provided in the report.

-

Competitive analysis of the players, along with their market share is provided in the report.

-

SWOT analysis and Porters Five Forces model is elaborated in the study.

-

Value chain analysis in the market study provides a clear picture of roles of stakeholders.

Last Mile Delivery Robot Market Key Segments

By Solution

-

Hardware

-

Software

-

Services

By Vehicle Type

-

Aerial Delivery Drones

-

Cargo Drones

-

Delivery Drones

-

Ground Delivery Bots

-

Delivery Bots

-

Self-Driving Vans and Trucks

By Range

-

Short Range

-

Long Range

-

By Application

-

Retail and E-Commerce

-

Food Delivery

-

Healthcare and Pharmaceuticals

-

Other Application

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

Starship Technologies

-

Nuro Inc.

-

KEENON Robotics Co., Ltd.

-

Ottonomy Inc.

-

Cartken Inc.

-

Robustel Corporation

-

Relay Delivery Robots

-

Flytrex Inc.

-

Kiwibot

-

Drone Delivery Canada Corp.

-

Caterpillar Inc.

-

DHL Group

-

Boxbot

-

Avride Inc.

-

Zipline Inc.

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 6.54 Billion |

|

Revenue Forecast in 2030 |

USD 30.26 Billion |

|

Growth Rate |

CAGR of 24.5% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst