Modular Robotics Market by Component (Hardware, Software, and Service), by Type (SCARA Modular Robots, Articulated Modular Robots, Collaborative Modular Robots, Cartesian Modular Robots, Parallel Modular Robots, and Others), by Payload (Upto 16 Kg, 16.1-60 Kg, 60.1-225 Kg, and More than 225 Kg), by Application (Assembly, Material Handling, Welding and Soldering, Pick and Place, and Others), and by Industry Verticals – Global Opportunity Analysis and Industry Forecast, 2025–2030

Industry: Semiconductor & Electronics | Publish Date: 07-Mar-2025 | No of Pages: 557 | No. of Tables: 386 | No. of Figures: 176 | Format: PDF | Report Code : SE415

US Tariff Impact on Modular Robotics Market

Trump Tariffs Are Reshaping Global Business

Modular Robotics Market Overview

The global Modular Robotics Market size was valued at USD 10.46 billion in 2024 and is predicted to reach USD 26.13 billion by 2030, at a CAGR of 16.5% from 2025 to 2030.

Modular robotics, also known as modular automation system includes robotic systems composed of interchangeable, self-contained modules that can be reconfigured to perform various tasks. These robots are highly versatile, offering scalability, adaptability, and cost-efficiency, making them ideal for industries like manufacturing, healthcare, and logistics.

Key features include plug-and-play functionality, ease of programming, and enhanced flexibility, allowing users to customize the robots to specific operational needs. Advantages of modular automation system include reduced downtime, simplified maintenance, and the ability to evolve alongside technological advancements, ensuring optimal performance and future-proofing investments.

The Increasing Demand for Automation is Driving the Modular Robotics Market

The rise in the adoption of automation across various industries including automotive, food and beverage, electronics and others is significantly driving the growth of the market. According to the International Robotics Federation report, the latest world robotics report recorded 553,052 industrial robot installation in factories around the world with a 5% year on year growth rate.

Also, the industrial robot market is expected to grow at 7% to more than 590,000 unit worldwide. Modular robots help in automating repetitive tasks, reduce human error, and streamline processes. Thus, the rising demand for automation is significantly creating demand for sophisticated robotics systems including modular robots.

The Rising Government Initiatives to Promote Automation Across Various Industries is Significantly Boosting the Market Growth

The Governments around the globe are actively encouraging the adoption of advanced manufacturing technologies including modular robotics through various incentives and support programs. These initiatives aim to stimulate industrial growth and foster innovation within the manufacturing sector.

Through providing financial incentives, grants, and tax benefits, governments incentivize businesses to invest in cutting-edge technologies that enhance productivity, efficiency, and competitiveness. Such support not only helps businesses mitigate initial investment costs but also accelerates the adoption of modular automation system, positioning industries to harness the benefits of automation and drive economic growth.

Rising Automotive Production Fuels Demand for Modular Robots

The growth of the global automotive sector significantly boosts the demand for modular robots, as manufacturers increasingly rely on advanced automation to meet the rising production volumes, customization requirements, and stringent quality standards. As per the latest data of the European Automotive Manufacturers’ Association, the global automotive production reached around 76 million units in 2023.

These robots offer the flexibility and scalability needed to adapt to rapidly changing production lines, enabling efficient assembly, welding, painting, and quality inspection processes. Such accelerating growth of the automotive sector boosts the market growth to enhance operational efficiency, reduce downtime, and ensure precision.

High Costs Associated with the Deployment of Modular Robotics Restrains the Market Growth

The high costs associated with modular robotics systems poses a significant restraint on market growth. Initial investments in modular robots can be substantial, including costs for hardware, software, customization, and integration into existing systems.

These expenses deter small and medium-sized enterprises (SMEs) from adopting this technology, limiting modular robotics market expansion. While modular robots offer long-term benefits such as increased efficiency and flexibility, the upfront costs remain a barrier for many businesses, delaying widespread adoption and inhibiting market growth.

Integration of Artificial Intelligence (AI) and Machine Learning (ML) in Modular Robots Creates Opportunity

The integration of artificial intelligence (AI) and machine learning (ML) presents significant growth opportunities for the modular robotics market. AI and ML enable modular robots to analyze data, make autonomous decisions, and adapt to changing environments and tasks dynamically.

This capability enhances their efficiency, accuracy, and versatility in various applications such as manufacturing, logistics, and healthcare. AI-powered modular robots can optimize production processes, predict maintenance needs, and even collaborate safely with human workers. As advancements in AI and ML continue, modular robots are poised to revolutionize industries by offering smarter, more adaptive solutions that improve productivity and operational outcomes.

Asia-Pacific Dominates the Modular Robotics Market Share

The growing adoption of advanced manufacturing technologies including modular robots in countries such as China, Japan and India, is further fueling the growth of the modular robotics market. According to the International Federation of Robotics report 2022, China surpassed the U.S. in term of robot density with 322 units of robot per 10,000 employees in the manufacturing industry.

This rapid adoption is driven by the desire to increase productivity and maintain competitiveness in global markets. By embracing advanced automation solutions such as modular robots, these nations aim to streamline production processes, reduce operational costs, and improve product quality.

Also, the governments throughout the Asia-Pacific region are actively promoting the adoption of automation in industries by implementing supportive policies and initiatives. These measures include offering financial incentives, tax breaks, and grants to companies that invest in advanced technologies including modular robotics.

The Government of India’s Ministry for Heavy Industries & Public Enterprises launched the Smart Advanced Manufacturing and Rapid Transformation Hubs (SAMARTH Udyog Bharat 4.0) initiative to boost competitiveness in the capital goods industry.

Under this initiative the government build multiple demonstration centers or hubs named as common engineering facility centers (CEFCs) to promote awareness about industry 4.0 among Indian manufacturing companies.

This supportive environment encourages businesses to adopt modular automation system, leading to increased efficiency and competitiveness in various sectors, and ultimately driving the growth of the modular robotics sector in the region.

North America is Expected to Show Steady Growth in the Modular Robotics Sector

The U.S. and Canada are at the forefront of adoption of electric vehicles that accelerates the demand for modular robots as manufacturers adopt advanced automation to meet the unique production challenges of EVs, such as battery assembly, lightweight component handling, and precise electronic integration.

As per the report of the International Energy agency, new electric car registrations reached 1.4 million in 2023, marking a growth of over 40% compared to the previous year in the U.S. Modular automation system offer the flexibility to adapt quickly to evolving EV designs and production processes, enabling efficient scaling of operations and seamless reconfiguration for new models.

As a result, automotive companies in the region are more inclined to integrate modular automation system into their production processes to stay competitive and take advantage of the latest advancements in automation technology.

Moreover, the presence of key market players such as ABB Ltd, Fanuc Corporation, and Cisco Systems Inc. that are adoption various strategies including product launches is further boosting the market growth in the region. For instance, in May 2024, ABB launched IRB 5710-IRB 5720 and IRB 6710-IRB 6740 modular robots, focusing on improving flexibility and efficiency in manufacturing.

This development included the introduction of new models designed to be easily integrated into existing systems, enhancing automation capabilities. This growth in modular robotics reflects key players' commitment to advancing the market with versatile and adaptable solutions, thereby boosting the modular robotics market growth.

Competitive Landscape

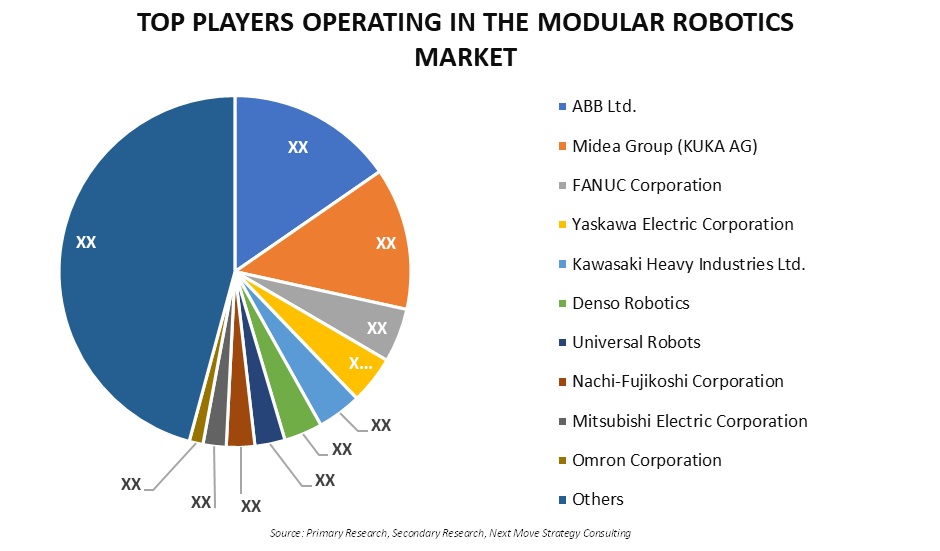

The modular robotics industry comprises various key market players, such as ABB Ltd., Midea Group (KUKA AG), FANUC Corporation, Yaskawa Electric Corporation, Kawasaki Heavy Industries Ltd., Denso Robotics, Universal Robots, Nachi-Fujikoshi Corporation, Mitsubishi Electric Corporation, Omron Corporation, RobCo GmbH, Comau, Doosan Robotics Inc., Staubli International AG, Epson America, Inc., and others.

Access Modular Robotics Market Insights

Modular Robotics Market Key Market Segments

By Component

-

Hardware

-

Controllers

-

Actuators

-

Sensors

-

-

Software

-

Programming Platforms

-

Simulation and Testing Software

-

-

Services

-

Integration Services

-

Maintenance and Support

-

Training and Consulting

-

By Type

-

SCARA Modular Robots

-

Articulated Modular Robots

-

Collaborative Modular Robots

-

Cartesian Modular Robots

-

Parallel Modular Robots

-

Others

By Payload

-

Upto 16 Kg

-

16.1-60 Kg

-

60.1-225 Kg

-

More than 225 Kg

By Application

-

Assembly

-

Material Handling

-

Welding and Soldering

-

Pick and Place

-

Others

By Industry Vertical

-

Logistics

-

Aerospace & Defense

-

Healthcare

-

Food & Beverages

-

Automotive & Transportation

-

Manufacturing

-

Media & Entertainment

-

Others

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

ABB Ltd.

-

Midea Group (KUKA AG)

-

FANUC Corporation

-

Yaskawa Electric Corporation

-

Kawasaki Heavy Industries Ltd.

-

Denso Robotics

-

Universal Robots

-

Nachi-Fujikoshi Corporation

-

Mitsubishi Electric Corporation

-

Omron Corporation

-

RobCo GmbH

-

Comau

-

Doosan Robotics Inc.

-

Staubli International AG

-

Epson America, Inc.

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 10.46 Billion |

|

Revenue Forecast in 2030 |

USD 26.13 Billion |

|

Growth Rate |

CAGR of 16.5% from 202 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst