Optical Sensors Market by Type (Extrinsic Sensor and Intrinsic Sensor), by Sensor Type (Ambient Light Sensor, Proximity Sensor, Fiber Optical Sensor, Image Sensors, and Others), by Application (Distance Measurement, Light Detection, and 3D Mapping), and by End-user (Healthcare, Consumer Electronics, Energy & Utility, Aerospace & Defense, Automotive & Transportation, and Others) – Global Opportunity Analysis and Industry Forecast 2025-2030

US Tariff Impact on Optical Sensors Market

Trump Tariffs Are Reshaping Global Business

Optical Sensors Market Overview

The global Optical Sensors Market size was valued at USD 25.02 billion in 2024 and is predicted to reach USD 45.34 billion by 2030 with a CAGR of 8.6% from 2025-2030.

The optical sensors market is expanding due to the rise in the investment in warehouse automation to enhance efficiency and reduce manual labour. However, the presence of alternative sensing technologies that includes ultrasonic sensors hinders the growth of the market. On the contrary, the technological advancements in optical sensors are anticipated to create future opportunity for the growth of the market.

Additionally, ams OSRAM and ON Semiconductor Corporation among others are adopting various business strategies that includes collaboration and product launch to enrich their market presence and expand their product offering. With the advancement in technological advancement in optical sensors the market shapes towards revolution as these sensors will enhance the performance of various consumer electronic devices that creates curiosity among buyers to upgrade themselves with the latest consumer electronics products and follow the trend.

Investment Towards Warehouse Automation Fuels the Market Growth

The expanding investment towards warehouse automation for enhanced efficiency and reduced manual labor led to the widespread adoption of automated systems. The rise in demand for these systems increases the need for optical sensors that are essential for tasks such as object detection, distance measurement, and quality control. For instance, in April 2024, Amazon.com, Inc. announced USD 1 billion venture investment program focused on supporting emerging technology companies through direct investments. The rising investment in automation drives the demand for photoelectric sensors to ensure the efficiency and accuracy of modern warehouse operations.

Rising Demand for Consumer Electronics Boosts Market Growth

The increasing demand for consumer electronics items including smartphones and smartwatches across the globe drives the growth of the market as these devices features facial recognition, gesture control, and ambient light detection. The growing demand for these advanced features drives the need for optical sensors to provide the necessary functionality and accuracy.

Data from UN Conference on Trade & Development (UNCTAD) shows smartphones shipments totalled 1.2 billion units in 2023. The expanding worldwide need for smartphones integrated with progressive features continues strengthening the market demand for photoelectric sensors to satisfy requirements.

Advancement in Healthcare Technologies Fuels Market Growth

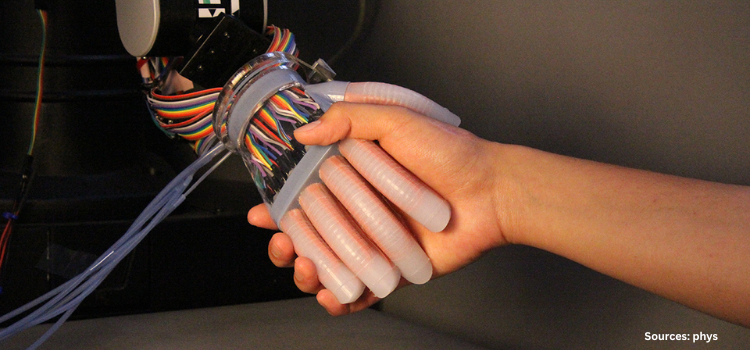

Advancement in healthcare technologies, including monitoring devices, drives the demand for optical sensors to enhance the accuracy and efficiency of patient care. Advancements in technologies especially those incorporating sign monitoring and blood oxygen detection strengthen the growing need for photoelectric sensors to obtain precise measurements and enable real-time data delivery thus enhancing healthcare effectiveness and patient results.

For example, in 2022, Royal Society of Chemistry published an article discussing the evolution of glucose monitoring technologies, highlighting the shift from traditional electrochemical sensors to emerging optical methods. The growing trend towards advancement in healthcare technologies drives the demand for photoelectric sensors that further fuels the optical sensors market growth.

Availability of Alternative Technologies Impacts the Market Growth

The presence of alternative sensing technologies, such as ultrasonic and radar sensors, hinders the growth of the market as these technologies offer specific advantages that can be more appealing in certain applications.

Technological Advancements Creates Future Opportunity

Technological advancements such as enhanced optical tracking sensors for consumer electronics in anticipated to create future opportunity for the growth of the market. This sensor would be designed specifically for use with smart devices including smartwatches, smart bands, and smart glasses, therefore improving their performance by advanced sensing technology.

Market Segmentations and Scope of the Study

The optical sensors market report is segmented on the basis of type, sensor type, application, end-user and region. On the basis of type, the market is classified into extrinsic sensor and intrinsic sensor. On the basis of sensor type, the market is divided into ambient light sensor, proximity sensor, fiber optical sensor, image sensors, and others.

On the basis of application, the market is segmented into distance measurement, light detection, and 3d mapping. On the basis of end-user, the market is classified into healthcare, consumer electronics, energy & utility, aerospace & defense, automotive & transportation, and others. Regional breakdown and analysis of each of the aforesaid segments include regions comprising of North America, Europe, Asia-Pacific, and RoW.

Geographical Analysis

Asia-Pacific holds the dominant optical sensors market share and is expected to continue its dominance during the forecast period. This is due to rise in adoption of electric vehicles that comes up with advanced automatic features such as object detection, lane departure warning systems, and adaptive cruise control in this region.

As consumers seek these safety and convenience features, manufacturers are bound to integrate complex sensors into their EV designs to meet those features. Statistics from International Energy Agency show that Chinese electric car registrations hit 8.1 million during 2023 following a 35% boost from 2022 levels. Regions experience increased vehicle demand which spurs up demand for photoelectric sensors to improve safety systems.

Moreover, the technological advancements in consumer electronic products such as smartphone and smartwatches embedded with optical sensor for real time and high-precision detection to enhance user experiences and functionality fuels the growth of the market in this region. As manufacturers continue to innovate and integrate these advanced sensors into their devices, the growing need for high-performance photoelectric sensors is on the rise.

For instance, in August 2024, Maxic launched a series of optical sensors designed for smart living, featuring innovations such as compact ambient light and proximity sensors for smartphones, advanced health monitoring capabilities for wearables, and enhanced functionalities for TWS earbuds. These advancements aim to improve device integration and user experience across various applications.

On the other hand, North America is expected to show steady growth in the optical sensor market due to expanding space sector in this region. The rise in space exploration mission and satellite technology drives the demand for these sensors to provide precise data, high-resolution imaging and enhancing communication systems.

According to report published by NASA, the government of the U.S. allocated a funds of around USD 12.8 billion to invest in its space sector for the year 2025, and enable NASA to continue exploration of earth and space. This increased investment in space sector to conduct various space missions drives the demand for photoelectric sensors for mission efficiency that further fuels the growth of market.

Apart from that, investments are increasingly growing in the defense sector, wherein up-to-date technologies in it such as high-performance surveillance, precision-guided munitions, and other situation-aware tools upgrade it; in these technologies, real-time imaging and data gathering of the sensors plays an essential role to bring efficiency into the operations and effective strategic decisions of military services.

As per the report published by the U.S. Department of Defence, the Department of Defence (DOD) spent USD 609.2 billion, in the defence sector. This heightened investment in defence sector drives the optical sensors market demand for latest technologies for effective military operations that propels the growth of the market.

Competitive Landscape

Various key players operating in the optical sensors industry include ams-OSRAM AG, ON Semiconductor Corporation, Toshiba Corporation, Texas Instruments Incorporated, Rohm Semiconductor, STMicroelectronics NV, Win Source, Analog Devices, Inc., Hamamatsu Photonics K.K., Broadcom Inc., Banner Engineering Corp., Vishay Intertechnology, Inc., Xylem Inc., SICK AG, Pepperl+Fuchs SE and others. These companies are adopting various strategies such as collaboration and product launch to remain dominant in the market.

For instance, in January 2024, ams OSRAM collaborated with Movano Health to develop the Evie Ring, a smart wearable designed for women's health monitoring. This ring utilizes advanced optical sensor technology, including a photoplethysmography (PPG) sensor solution that enhances the accuracy of vital sign measurements, particularly on smaller fingers with lower blood flow.

Moreover, in October 2023, ON Semiconductor Corporation launched the Hyperlux LP image sensor family, that offers low power consumption and high image quality for smart home and office applications. These sensors improve battery life by 40% and are available in multiple resolutions making them suitable for devices such as security cameras and doorbells.

Additionally, in July 2023, STMicroelectronics launched FlightSense multi-zone distance sensor that features a 90° field of view. This enhancement allows for better performance in applications such as robotics, smart home devices, and occupancy detection fuelling the growth of optical sensor market by providing more efficient and advanced solutions.

Key Benefits

-

The optical sensors market report provides the quantitative analysis of the current market and estimations from 2025 to 2030. This analysis assists in identifying the prevailing market opportunities to capitalize on.

-

The study comprises of a detailed analysis of the current and future optical sensors market trends for depicting the prevalent investment pockets in the industry.

-

The information related to key drivers, restraints, and opportunities and their impact on the optical sensors market is provided in the report.

-

The competitive analysis of the market players along with their market share in the optical sensors market is mentioned.

-

The SWOT analysis and Porter’s Five Forces model are elaborated in the study.

-

The value chain analysis in the market study provides a clear picture of the stakeholders’ roles.

Optical Sensors Market Key Segments

By Type

-

Extrinsic Sensor

-

Intrinsic Sensor

By Sensor Type

-

Ambient Light Sensor

-

Proximity Sensor

-

Fiber Optical Sensor

-

Image Sensors

-

Others

By Application

-

Distance Measurement

-

Light Detection

-

3D Mapping

By End-User

-

Healthcare

-

Consumer Electronics

-

Energy & Utility

-

Aerospace & Defense

-

Automotive & Transportation

-

Others

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

ams-OSRAM AG

-

ON Semiconductor Corporation

-

Toshiba Corporation

-

Texas Instruments Incorporated

-

Rohm Semiconductor

-

STMicroelectronics NV

-

Win Source

-

Analog Devices, Inc.

-

Hamamatsu Photonics K.K.

-

Broadcom Inc.

-

Banner Engineering Corp.

-

Vishay Intertechnology, Inc.

-

Xylem Inc.

-

SICK AG

-

Pepperl+Fuchs SE

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 25.02 billion |

|

Revenue Forecast in 2030 |

USD 45.34 billion |

|

Growth Rate |

CAGR of 8.6% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst