Pentane Market by Type (n-pentane, Isopentane, and Neopentane), by Application (Blowing agent, Electronic Cleansing, Chemical Solvent, and Others), and By End-User (Construction, Automotive, Pharmaceuticals, Chemicals, Electronics, Others) - Global Opportunity Analysis and Industry Forecast 2022 – 2030

US Tariff Impact on Pentane Market

Trump Tariffs Are Reshaping Global Business

Market Definition:

Global Pentane Market size was valued at USD 124.6 million in 2021 and is predicted to reach USD 190.6 million by 2030 with a CAGR of 4.7% from 2022-2030.

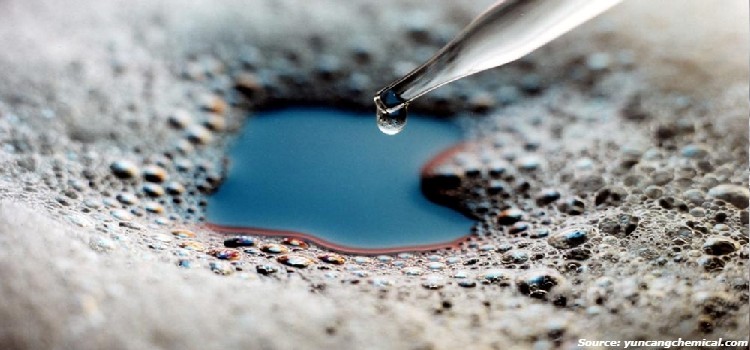

Pentane is an organic compound that belongs to alkenes group. It is non-polar, inexpensive, and miscible in almost all non-polar solvents. Pentane is a hydrocarbon that has several industrial uses including cleaning agents. In addition, it is also used to create blowing agents that are capable of producing a cellular structure via a foaming process in a variety of materials that undergo hardening or phase transition.

Market Dynamics and Trends:

The demand for pentane market is rising due to surge in transportation activities as it is widely used as a fuel across the world. In addition, factors including its chemical properties such as superior volatility as well as higher strength as compared to other alkenes group and low cost, are expected to propel the growth of the market during the forecast period. Moreover, upsurge in demand from the end-user industries such as paint, textile, agro, and others is expected to augment the growth of the market.

However, hazards associated with the production of pentane, such as high vapor explosion and stringent government regulations are factors that restrain the growth of market during the forecast period. On the other hand, growing demand for gasoline, especially in emerging economies is estimated to create lucrative growth opportunities for the pentane market players in future.

Market Segmentations and Scope of the Study:

The pentane market has been segmented on the basis of type, application, and geography. Based on type, the market is bifurcated into n-pentane, isopentane, and neopentane. Based on application, the market is classified into blowing agent, electronic cleansing, chemical solvent, and others. Geographic breakdown and analysis of each of the aforesaid segments includes regions comprising of North America, Europe, Asia-Pacific, and RoW.

Geographical Analysis:

Asia-Pacific region holds the major share of pentane market and is expected to continue its dominance throughout the forecast period. This is due to the emergence of various developing economies in this region such as India, China, Vietnam, Taiwan, and South Korea that are expected to witness high demand of pentane over the forecast period. Also, increased usage of pentane in food and construction industries is expected to propel the growth of the market during the forecast period.

North America region, on the other hand, is expected to show a steady rise due to increase in demand of pentane from various end-user industries in this region due to its low cost, and superior chemical properties, such as higher strength and superior volatility as compared to other alkanes that is expected to drive the market growth. Moreover, increased utilization of pentane in blending and formulation of fuels that help end-user industries to generate polystyrene, required to make insulation materials such as thermocol and styrofoam are further expected to drive the market growth of pentane in this region.

Competitive Landscape:

The market comprises of various players such as Shell plc, Merck KGaA, Darmstadt, Jun Yuan Petroleum Group, Gas Innovations, Haltermann Carless Group GmbH, Central Drug House, Sankyo Chemical Co., Ltd., Otto Chemie Pvt. Ltd, Maruzen Chemical Trading Co.,Ltd, Oberoi Refining Industry Pvt.ltd., Datta Hydro-Chem Private Limited, Air Liquide Global E&C Solutions GmbH, Heze Sirloong Kjemisk Co., Ltd, Spectrum Chemical Mfg. Corp., and Westmark BV. These manufacturers are actively indulging in R&D initiatives, product & technology innovations, and industrial collaborations to enhance their product as well as increase their growth and geographical reach.

For instance, in July 2021, Haltermann Carless, had completed development of its new hydrogenation plant at the Speyer site in Germany. This development would enhance the cyclopentane and cyclopentane blends market in Germany.

Key Benefits:

-

The pentane market report provides the quantitative analysis of the current market and estimations through 2022-2030 that assists in identifying the prevailing market opportunities to capitalize on.

-

The study comprises a deep dive analysis of the pentane market trend including the current and future trends for depicting the prevalent investment pockets in the market.

-

The information related to key drivers, restraints and opportunities and their impact on the pentane market is provided in the report.

-

The competitive analysis of the market players along with their market share in the pentane market

-

The SWOT analysis and Porters Five Forces model is elaborated in the study.

-

Value chain analysis in the market study provides a clear picture of the stakeholders’ roles.

Key Market Segments:

By Type

-

N-pentane

-

Isopentane

-

Neopentane

By Application

-

Blowing agent

-

Electronic Cleansing

-

Chemical Solvent

-

Others

By End-User

-

Construction

-

Automotive

-

Pharmaceuticals

-

Chemicals

-

Electronics

-

Others

By Geography

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

Australia

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle east

-

Africa

-

Key Market Players:

-

Shell plc

-

Merck KGaA, Darmstadt

-

Jun Yuan Petroleum Group

-

Gas Innovations

-

Haltermann Carless Group GmbH

-

Central Drug House

-

Sankyo Chemical Co., Ltd.

-

Otto Chemie Pvt. Ltd

-

Maruzen Chemical Trading Co.,Ltd

-

Oberoi Refining Industry Pvt.ltd.

-

Datta Hydro-Chem Private Limited

-

Air Liquide Global E&C Solutions GmbH

-

Heze Sirloong Kjemisk Co., Ltd

-

Spectrum Chemical Mfg. Corp.,

-

Westmark BV

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Analysis Period |

2021–2030 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2030 |

|

Market Size Estimation |

Million (USD) |

|

Market Segmentation |

By Type (n-pentane, Isopentane, and Neopentane), and by Application (Blowing agent, Electronic Cleansing, Chemical Solvent, and Others) |

|

Geographical Segmentation |

North America (U.S., Canada, Mexico) Europe (UK, Germany, France, Russia, Rest of Europe), Asia-Pacific (China, India, Japan, Australia, Rest of Asia-Pacific), Rest of the World (Latin America, Middle east, Africa) |

|

Companies Profiled |

Exxon Mobil Corporation, Merck KGaA, HCS Group, Ineos Group Holding S A, Maruzen Petrochemical CO. Ltd, Phillips 66 Company, Top Solvent Co. Ltd, Royal Dutch Shell Plc, Sk Innovation Co, Ltd, and TCI Chemicals Pvt. Ltd. |

Speak to Our Analyst

Speak to Our Analyst