Property and Casualty (P&C) Insurance Core Platform Market by Platform (Policy Management, Billing Management, and Claims Management), by Insurance Type (Personal, Commercial, and Specialty), by Deployment (Cloud and On-premise), and by Enterprise Size (Small and medium-sized enterprises (SMEs) and Large Enterprises) – Global Opportunity Analysis and Industry Forecast, 2024–2030

US Tariff Impact on Property and Casualty (P&C) Insurance Core Platform Market

Trump Tariffs Are Reshaping Global Business

P&C Insurance Core Platform Market Overview

The global Property & Casualty (P&C) Insurance Core Platform Market size was valued at USD 7.81 billion in 2023 and is predicted to reach USD 14.33 billion by 2030, with a CAGR of 8% from 2024 to 2030.

Property and casualty insurance core platform refers to a comprehensive technological infrastructure designed to support the fundamental operations of property and casualty insurance companies. It serves as the backbone for managing policies, claims, billing, and other critical functions within the insurance ecosystem.

This insurance software platform integrates various modules and systems to streamline processes, enhance efficiency, and improve customer service. It generally includes features such as policy administration, rating engines, claims management, document management, and analytics capabilities, providing insurers with the tools they need to effectively manage risks, process claims, and deliver insurance services to policyholders.

The platform offers insurers the advantage of centralized management of policies, claims, and underwriting processes, leading to streamlined operations and increased efficiency. Moreover, it also enables better risk management through advanced analytics, empowering insurers to make data-driven decisions and adapt to changing market conditions effectively.

Increasing Gross Written Premium (GWP) in P&C Insurance Drives the Market Growth

The increasing GWPs in the insurance sector is one of the crucial factors influencing the P&C insurance core platform market demand. As it allows insurance companies to invest in cutting-edge technologies that enhance their core platforms, these advanced risk assessment solutions are crucial for scaling operations and maintaining a competitive edge in the industry.

According to the latest data by Organization for Economic Cooperation and Development (OECD), the total GWP in the U.S. ranked 1st with USD 3.5 trillion in 2022, while followed by Japan's total GWP stood at USD 324.9 billion, and Germany's total GWP was USD 367.3 billion in 2022.

The substantial scale of the insurance industry in these major economies underscores the importance of investing in advanced core platforms to drive growth and maintain competitiveness.

Growing Digital Transformation is Propelling the Market Growth

The insurance industry's rapid digitalization driven by InsurTech advancements is propelling a substantial demand for property and casualty insurance core platforms that provide efficient data management and analysis capabilities.

P&C insurance core platform market plays a pivotal role in enabling this digital evolution by providing the foundation for integrating InsurTech solutions, managing complex underwriting and claims processes, ensuring regulatory compliance, and facilitating seamless customer interactions across multiple touchpoints.

According to the recent report by Swiss Re, South Korea consistently excels in the insurance digitalization index, often ranking first and consistently placing in the top three, due to high scores in access, use, and innovation. The U.S. also performs well, ranking 4th in the index, with improvements in access, use, and market openness.

Moreover, China has made significant progress, rising from 26th out of 29 countries to 16th, driven by a strong increase in digital insurance penetration. These trends highlight the critical role of digitalization in transforming the global insurance industry.

Companies' Emphasis on Personalized Customer Experiences Boosts the Market Growth

The insurance industry's growing emphasis on delivering personalized experiences to customers has driven the launch of P&C insurance core platforms by companies operating across this market. These platforms are crucial for personalized service, providing the necessary infrastructure and capabilities to integrate customer data, apply advanced analytics, and automate interactions.

For instance, in March 2024, Insurity partnered with OIP Robotics to enhance data processing in the property and casualty insurance sector, prioritizing personalized customer experiences. By integrating OIP's AI with Insurity's SaaS solutions, the collaboration streamlines operations, reduces errors, and addresses standardization challenges.

This enables insurance teams to focus on customer relationships and growth, while customers benefit from faster, more accurate processing of claims and policies, leading to improved service quality.

High Cost Associated with the Implementation of Core Platform Solutions Hinders the Market Growth

Implementing and customizing P&C insurance core platforms for insurance often involves significant initial costs, such as licensing fees, customization, data migration, staff training, and ongoing maintenance.

For smaller insurers with limited finances, these expenses can be daunting, leading to delays or reluctance to adopt new systems. Additionally, the return on investment (ROI) for implementing a new core platform may not be immediately clear, making decision-making more complex.

Furthermore, the insurance industry's reliance on traditional methods and legacy systems presents another challenge. Insurers may hesitate to switch to modern core platforms due to familiarity with current processes, concerns about compatibility with existing systems, and perceived risks associated with adopting new technologies. This resistance to change can hinder platform adoption, despite the evident benefits of modernization.

Integration of Data Analytics and AI in P&C Insurance Core Platforms Creates Market Opportunities

The integration of data analytics and artificial intelligence (AI) is transforming the property and casualty insurance core platform industry, creating a significant market opportunity for advanced core platforms.

These technologies empower insurers to harness vast amounts of data, enhancing risk assessment accuracy, claims processing efficiency, and customer engagement. Advanced data analytics and AI algorithms enable insurers to personalize offerings, optimize pricing strategies, and detect fraudulent activities.

For instance, in January 2024, Insurity launched an AI-powered analytics solution for P&C insurance carriers, enhancing predictive analytics to improve loss ratios and support strategic decisions. This innovative tool provides real-time insights, helping insurers better understand their portfolios and manage their businesses proactively.

By Platform, Policy Management Dominates the P&C Insurance Core Platform Market Share

Policy management holds the dominant share of approximately 54% in the property and casualty insurance core platform market segment as it essential in managing policy lifecycles, integrating with other systems, and offering advanced features such as automation and analytics, crucial for competitive advantage and operational efficiency.

It streamlines administrative tasks such as policy issuance, underwriting, policy servicing, endorsements, renewals, and cancellations. These management systems within the P&C insurance analytics facilitate efficient communication between insurers and policyholders, ensure accuracy, and compliance with regulations.

By Insurance Type, Specialty Holds the Highest CAGR of 10.5% in the Market

Specialty insurance stands out as the fastest-growing segment due to its tailored coverage for specific industries and distinctive risks. Rising demand, coupled with regulatory changes and technological advances, is propelling its growth, making it a priority for insurers aiming to seize new opportunities and meet evolving customer demands.

It is designed to handle the complexities of these unique insurance products, offering specialized functions for policy administration, underwriting, claims management, and risk assessment. These platforms help insurers manage the specific needs of their clients, reduce specialized risks, and provide insurance solutions that meet the requirements of niche industries or exposures.

North America Dominates the P&C Insurance Core Platform Market

The North American region holds more than 40% of the global P&C insurance core platform market share due to the concentration of large number of insurance companies along with new companies entering the industry that fuels the demand for cloud-based insurance core platforms.

According to the National Association of Insurance Commissioners (NAIC) report 2022, the number of insurance companies in the U.S. experienced a significant increase in 2022, rising to 2,456 from 2,422 in the preceding year of 2021.

Moreover, the rising adoption of insurtech within the insurance sector coupled with the introduction of new insurance platforms, is propelling the P&C insurance core platform market growth.

For instance, in July 2023, Duuo, a division of Co-operators, launched an embedded insurance API, enhancing embedded insurance services by enabling seamless integration for partners. This initiative aims to make insurance more accessible in the digital economy by bridging the gap between insurance services and technology.

In addition, the adoption of fintech solutions, including open finance, big data analytics, cloud computing, and machine learning, is driving significant growth in Mexico P&C insurance core platform market, by enhancing operational efficiency, customer experiences, and industry competitiveness.

According to the International Trade Association (ITA), Mexico's fintech sector, with over 650 startups, is led by open finance and APIs (60% market share), big data and analytics (54%), cloud computing (49%), and machine learning (44%).

Europe is Expected to Show Steady Growth in the P&C Insurance Core Platform Market Share

The European region is anticipated to experience the highest growth rate primarily due to the escalating gross written premiums in the UK insurance sector is a significantly driving the property & casualty insurance core platforms market demand. This growth enables insurance companies to invest in cutting-edge technologies that enhance their core platforms, thereby facilitating the scaling of operations and maintaining a competitive edge in the industry.

According to the Organisation for Economic Co-operation and Development (OECD) report, the gross written premium for the UK insurance market reached USD 446.3 billion in 2022, representing a marginal increase of 0.20% from the USD 445.4 billion recorded in 2021.

Moreover, the rising growth in the information and communication technology (ICT) in Germany is impacting the demand for the adoption of advanced solutions which fuels the demand for the P&C insurance core platforms.

Germany ranks 9th globally among the 134 economies, and 6th within Europe in the Network Readiness Index (NRI) 2023, which evaluates the world's economies based on their information and communication technology (ICT) infrastructure. The country's notable strength lies in its advanced technology sector, which is a significant contributor to its overall ranking.

Additionally, the investment in AI development and regulatory support significantly boosts opportunities within the P&C insurance core platform market. In 2024, the Danish Government introduced a new digitalization strategy, supported by approximately USD 107 million from all parliamentary parties. Specifically focusing on AI, the strategy sets aside around USD 8.82 million for the 2024-2027 period to develop and implement AI frameworks.

Competitive Landscape

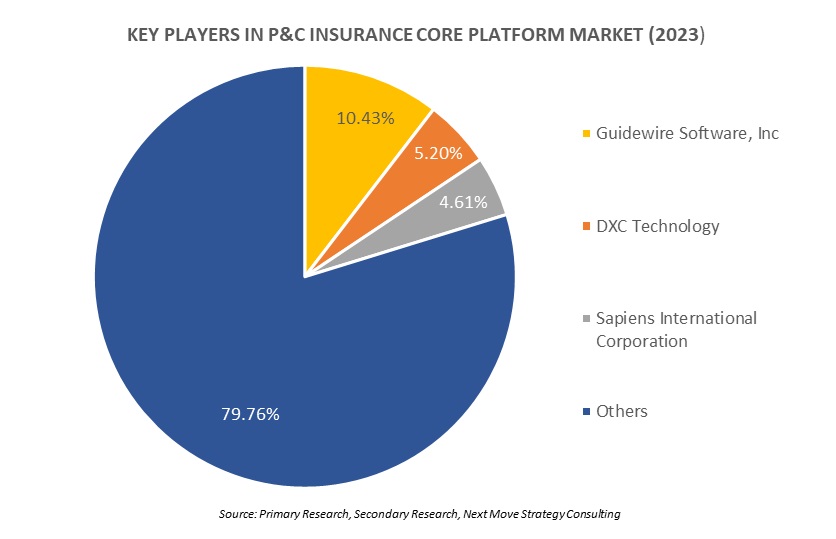

Several market players operating in the P&C insurance core platform industry include Guidewire Software, Inc, DXC Technology, Sapiens International Corporation, Duck Creek Technologies, Insurity LLC, Majesco, EIS Software Limited, OneShield, Mphasis, Appian Corporation, Mendix Technology BV, EIS Software Limited, Capgemini, Quantiphi, HCL Tech, and others.

Note: we have also analyzed the companies include Insuresoft, Mendix Technology BV, Quantiphi, BriteCore, Maple Technologies, LLC., Jarus Technologies, and many more.

These companies are adopting various strategies, including product launches, collaborations, and acquisition across various regions to maintain their dominance in the market. These strategies are crucial due to the rapidly evolving technological landscape and the increasing demand for advanced insurance solutions.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

|

May-2024 |

DXC Technology |

DXC Technology collaborated with Ferrovial to develop a revolutionary generative artificial intelligence (AI) platform named Quercus. This platform is designed to integrate secure and responsible AI solutions into business processes. |

|

|

May-2024 |

Appian Corporation |

Appian and Swiss Re extend partnership to introduce connected underwriting for life insurance in Asia Pacific and EMEA. This partnership aims to enhance compliance with financial services regulations by providing better visibility and auditability. |

|

|

Apr-2024 |

Insurity LLC |

Insurity announced significant enhancements to its claims management capabilities. The company focuses on personal lines insurers, offering improved efficiency and integration capabilities to streamline claims processing and enhance customer experiences. |

|

|

Apr-2024 |

Sapiens International |

Sapiens International Corporation launched IntegrateAI, in its DecisionAI portfolio, integrating machine learning models into the business-friendly decision model workbench. |

|

|

Apr-2024 |

OneShield |

OneShield partnered with One Inc, a leading provider of digital payment solutions, to enhance the payment capabilities of its clients in the insurance industry. This partnership integrates One Inc's digital payment solutions with OneShield's core insurance platforms. |

|

|

Apr-2024 |

Mphasis |

Mphasis collaborated with Amazon Web Services (AWS) to launch the Gen AI Foundry focusing on the financial services industry. This initiative will leverage artificial intelligence (AI) to modernize core platforms and enhance intelligent document processing, streamlining workflows and reducing errors. |

|

|

Mar-2024 |

Duck Creek Technologies |

Duck Creek Technologies launched Duck Creek Payments, a cutting-edge, cloud-based Software as a Service (SaaS) solution, in the North American market. This innovative solution aims to transform the insurance industry by offering unparalleled access to any global payment provider or technology for premium collections and claims disbursements. |

|

|

Mar- 2024 |

Guidewire Software, Inc |

Guidewire launched “Jasper”, which enhances commercial lines agility for property and casualty insurers. |

|

|

Mar-2024 |

EIS Software |

EIS launched ClaimSmart, an intelligent cloud solution designed to redefine the claims management landscape. ClaimSmart leverages artificial intelligence and machine learning to help insurers dramatically reduce the cost of claims while significantly increasing the quality of the customer experience. |

|

|

Jan-2024 |

Majesco |

Majesco acquired Decision Research Corporation (DRC), a SaaS-based insurance software company, to expand its P&C solutions. The acquisition brings DRC's market-leading enterprise rating, reinsurance solution, and core platform tailored for the rapidly growing MGA/MGU market and smaller insurers.

|

|

P&C Insurance Core Platform Market Key Segments

By Platform

-

Policy Management

-

Billing Management

-

Claims Management

By Insurance Type

-

Personal

-

Commercial

-

Specialty

By Deployment

-

Cloud

-

On-Premise

By Enterprise Size

-

Small and medium-sized enterprises (SMEs)

-

Large enterprises

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

Guidewire Software, Inc

-

DXC Technology

-

Sapiens International Corporation

-

Duck Creek Technologies

-

Insurity LLC

-

Majesco

-

EIS Software Limited

-

OneShield

-

Mphasis

-

Appian Corporation

-

Mendix Technology BV

-

EIS Software Limited

-

Capgemini

-

Quantiphi

-

HCL Tech

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 7.81 Billion |

|

Revenue Forecast in 2030 |

USD 14.33 Billion |

|

Growth Rate |

CAGR of 8% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst