Ireland Travel Insurance Market by Age (Millennials, Generation X, and Baby Boomers), and Services), by Income Level (Low-income Travelers, Middle-income Travelers, and Others), by Coverage (Medical Coverage and Others), by Days of Coverage (Short-Trip Insurance, Standard Trip Insurance, and Others), by End-User (Holiday Travelers, Education Travelers, and Others), and by Distribution Channel (Insurance Companies, Banks, and Others)–Opportunity Analysis and Industry Forecast, 2025–2030

Industry: BFSI | Publish Date: 25-Mar-2025 | No of Pages: 157 | No. of Tables: 120 | No. of Figures: 65 | Format: PDF | Report Code : BF3088

US Tariff Impact on Ireland Travel Insurance Market

Trump Tariffs Are Reshaping Global Business

Ireland Travel Insurance Market Overview

The Ireland Travel Insurance Market size was valued at USD 166.3 million in 2024 and is predicted to reach USD 383.6 million by 2030, registering a CAGR of 14.2% from 2025 to 2030.

Ireland travel insurance industry is driven by numerous factors such as rising number of outbound travelers, digital innovation by regional players and government regulation that promotes legal documentation transparency planned to protect the rights of the consumer. Nevertheless, the market growth is hindered by the complicated regulatory framework that requires insurers compliance to legal regulations.

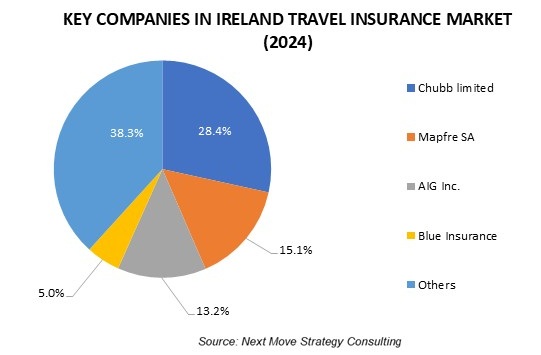

Conversely, the integration of AI-powered chatbots in the travel insurance policy is anticipated to create significant number of future opportunities. Additionally, market players such as Chubb limited, Mapfre SA, AIG Inc., and others are adopting numerous strategies to maintain their dominance in the region and domain. The strategies adopted by the players are anticipated to create competition and drive the market growth encouraging awareness and adoption of travel insurance in Ireland.

Increasing Number of Outbound Travelers Fuel the Travel Insurance Market Growth in Ireland

The rising number of outbound travelers propels the travel insurance market growth in Ireland as increasing proportion of individuals boards on domestic or international travel due to leisure, business and education purposes seek protection against unforeseen events.

As per the Visit Britain, travelers from Irish Republic made 10.2 million outbound visits in 2023 generating an international tourism expenditure of USD 10.3 billion. With surge in Irish people travelling, they encounter heightened risks of unpredicted events such as medical emergencies and flight cancellations that leads them to look for complete travel insurance plans leading to a boost in the market growth.

Digital Innovation by Regional Players Drives the Ireland Travel Insurance Market Expansion

The digital innovation by the regional players drives the market growth by enhancing user experience and simplifying the process. Companies are integrating advanced technology to manage policies that makes the entire process seamless for both agents and the consumers.

For instance, in February 2025, Blue Insurance launched its latest innovation 24/7 Travel GP Service in complimentary with its travel insurance plan. The offering provides the travelers access to medical assistance by phone or online 24/7 free of charge. Such innovative digital initiatives by the regional players builds consumer trust and makes the trip insurance plans more accessible leading to surge in the market growth.

Government Initiatives Towards Protection of Insuree’s Rights Drives the Market Growth

Government regulation drives the Ireland travel insurance market demand by initiating robust consumer protection measures that enhance transparency and trust in insurance products. In 2023, the Central Bank of Ireland signed the Individual Accountability Framework Act that led to stricter guidelines under the Insurance Act, mandating insurers to clearly disclose policy details, coverage limits, and exclusions, effectively empowering consumers to make informed choices. The regulations prompted insurers to ensure transparency and maintain financial conduct and this built trust among consumers due to heightened consumer protection rights leading to boost in the market growth.

Regulatory Challenges Hinders the Ireland Travel Insurance Market Expansion

Regulatory challenges hinder the growth of the Ireland travel insurance market by imposing stringent compliance requirements that deter potential insurers from entering the market and inhibit the ability of existing providers to innovate.

According to the Organisation for Economic Co-operation and Development, Central Bank of Ireland regulates the financials related to travel insurance and mandates complex legal documentation and financial conduct leading to delayed market response in relation to evolving consumer demands. Such intricate regulation deters potential insurers to innovate and restrain the growth of the existing travel insurance companies in Ireland.

Integration of AI-Powered Chatbots in Travel Insurance Platforms Creates Future Opportunities

Integration of AI-powered chatbots in travel assistant services is anticipated to create significant number of future opportunities in the Ireland travel insurance market trends by providing customer assistance and support 24/7.

For instance, AXA implemented virtual assistance chatbot in its insurance platform aimed at providing general information, answering queries, checking package coverage and claims eligibility. The development streamlined the process and increased the conversion rates.

Additionally, Allianz Partners SAS implemented AI-powered chatbots in their client interaction platform to answer customer queries, simplify and speed up back-office operations and claims management.

Through streamlining the claims process, the integration of AI-powered chatbot in travel insurance platforms enhances customer service availability and drives operational improvements, further contributing to the market expansion in coming years.

By Age, Generation X Dominates the Ireland Travel Insurance Market Share

Generation X is the dominant one in the age segment as they take a practical approach to travel, balancing their work commitments with family responsibilities. They understand the benefits of trip cancellation insurance for added security and this enables them to invest in complete coverage for both business and leisure travel.

By Income Level, Middle-income Travelers, Holds the Highest CAGR of 15.32%

Middle-income travelers hold the fastest growing share within the income level segmentation of the market due to increasing disposable income and rising interest in both domestic and international travel. With rising travel costs they are more cautious about financial risks, making insurance a necessary safeguard. Additionally, insurers are offering affordable, flexible policies tailored to budget-conscious travelers, thereby making middle income travellers to achieve a steady growth.

Competitive Landscape

The promising players operating in the Ireland travel insurance industry include Chubb limited, Mapfre SA, AIG Inc., Blue Insurance, FBD Holdings plc, Allianz SE, RSA Insurance Group, Aviva Plc, AXA SA, Chill Insurance, InsureandGo Ireland, An Post Insurance, Vhi Group, Allied Irish Banks, p.l.c., Switcher Limited., among others. These companies are engaged in various product launches and partnerships to maintain their dominance in the sector.

For example, in February 2025, Cover-More Insurance Services Limited launched 24/7 Travel GP Service in complimentary with its travel insurance product to provide customers access to medical professional via phone or online. The development shows the company’s commitment to support Irish travel trade with innovative products.

Also, in November 2024, Blue Insurance launched new online portal, designed to revolutionize the way to manage travel insurance bookings. The portal features effortless policy management and time saving efficiency.

In addition, in January 2024, Travel insurance provider InsureandGo Ireland, a MAWDY brand partnered with Blink Parametric to offer real-time flight disruption offering. The parametric solution will automatically offer real-time access to an executive airport lounge or a real-time cash payout alternative to eligible insureds when a flight is disrupted by more than three hours.

For instance, in December 2023, Allianz Partners partnered with Aer Lingus to multi-risk travel insurance for travellers in Ireland and other key markets. This collaboration boosts the Ireland travel insurance market by offering comprehensive coverage, including trip cancellations, medical expenses, and baggage protection, enhancing customer confidence and convenience.

Ireland Travel Insurance Market Key Segments

By Age

-

Millennials

-

Generation X

-

Baby Boomers

By Income Level

-

Low-income Travelers

-

Middle-income Travelers

-

High-income Travelers

By Coverage

-

Medical Coverage

-

Trip Cancellation Coverage

-

Baggage and Personal Belongings Coverage

-

Accidental Death and Dismemberment (AD&D) Coverage

By Days Of Coverage

-

Short-Trip Insurance

-

Standard Trip Insurance

-

Extended Trip Insurance

-

Multi-Trip Insurance

By End-User

-

Holiday Travelers

-

Education Travelers

-

Business Travelers

-

Family Travelers

-

Other Travelers

By Distribution Channel

-

Insurance Companies

-

Banks

-

Airlines

-

Online Platforms

-

Travel Agents and Tour Operators

Key Players

-

Chubb limited

-

Mapfre SA

-

AIG Inc.

-

Blue Insurance

-

FBD Holdings plc

-

Allianz SE

-

RSA Insurance Group

-

Aviva Plc

-

AXA SA

-

Chill Insurance

-

InsureandGo Ireland

-

An Post Insurance

-

Vhi Group

-

Allied Irish Banks, p.l.c.

-

Switcher Limited

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 166.3 Million |

|

Revenue Forecast in 2030 |

USD 383.6 Million |

|

Growth Rate |

CAGR of 14.2% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst