Spain Intralogistics Market by Component (Hardware, Software and Services), and by End Users (Logistics, Food and Beverages, Retail and E-commerce, Automotive, Chemicals, Pharmaceuticals, Airport and Mining) – Opportunity Analysis and Industry Forecast, 2024–2030

Industry: Construction & Manufacturing | Publish Date: 03-Mar-2025 | No of Pages: 176 | No. of Tables: 138 | No. of Figures: 63 | Format: PDF | Report Code : CM1047

US Tariff Impact on Spain Intralogistics Market

Trump Tariffs Are Reshaping Global Business

Spain Intralogistics Market Overview

Spain Intralogistics Market size was valued at USD 1.09 billion in 2024 and is predicted to reach USD 2.52 billion by 2030, registering a CAGR of 12.5% from 2025 to 2030.

The factor such as rapid growth of e-commerce, shortage of labors and presence of key players in the region drives the market growth. However, high upfront cost and the need for continuous maintenance and upgrade hinders the growth of the industry.

Additionally, the industry shows promising future with the adoption of artificial intelligence in the intralogistics sector.

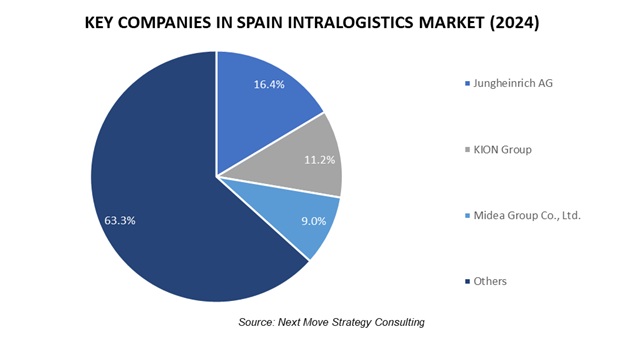

Moreover, key companies including Jungheinrich AG, KION Group, and Midea Group Co., Ltd. are adopting various strategies such as product launches and market expansion to maintain and strengthen their dominance in the region. These activities promise innovation and adoption of automated intralogistics equipment that fuels the intralogistics market. With technological integration of artificial intelligence in the sector, companies are focusing on creating a more automated environment to meet the labor shortage.

Rising Expansion of E-Commerce Fuels the Market Growth

The rapid growth of e-commerce boosts the Spain intralogistics market trends due to surge in demand for efficient warehousing, order processing, and distribution solutions. The rising online order due to boosting e-commerce users leads to the adoption of various advanced technologies such as automated storage and retrieval systems, automated guided vehicles and robots to ensure timely deliveries, maintain accuracy and enhance speed that boosts the intralogistics market.

According to the report published by the International Trade Administration, the e-commerce users in Spain accounted to 32 million in 2022 and this figure is estimated to reach to 40 million by 2025 reflecting a growth of 25%. This rise in the e-commerce users facilitates greater influx of online goods transfer that boosts the market in the region.

Growing Automotive Sector Boosts Market Expansion

The spain intralogistics market demand is further fueled by the growing automotive industry that necessitates the rely on automated guided vehicles (AGVs) and autonomous mobile robots (AMRs) to deliver raw materials, components, and tools.

The adoption of such intralogistics solutions enables reliable, flexible, and efficient production of automobiles leading to boost in the market growth. As per the report published by the ICEX-Invest in Spain in 2022, Spain rounded up in 2nd position the largest automaker in Europe and globally it positioned 8th. The Spanish automotive industry turnover represented 10% of its GDP and 18% of its exports.

Key Market Player Initiatives Further Propels the Market Growth in the Country

The market is driven by the presence of key players such as Kivnon Logistica S.L.U. and Grupo Antolin who are taking various business strategies such as partnership and product launch to maintain their dominance in the market. For instance, in October 2024, Kivnon Logistica S.L.U. partnered with ProLog Automation GmbH & Co. KG. to help companies unlock next generation efficiency and competitiveness through industrial automation.

This partnership allowed Kivnon Logistica S.L.U. to introduce AGV solutions to a broader customer base. Further in February 2024, Grupo Antolin deployed intelligent intralogistics system in its Aragusa factory in Burgos, Spain to reduce and optimise movement of components in internal logistics through autonomous mobile robots (AMRs) and collaborative robots (Cobots).

High Installation Cost of Intralogistics Systems Restrains the Growth of the Market

The high initial cost of Spain intralogistics market retards the growth of the country's market mainly because of the significant amount of capital required in the installation of sophisticated automation networks such as robots and automated conveyors. This increased cost prohibits small and medium-sized enterprises to shift to automated system for automation that hinders the market. Additionally, the need for ongoing maintenance, upgrades and staff training adds to the financial burden that possess challenge to the company for adopting advanced intralogistics solutions.

Integration of Artificial Intelligence in Intralogistics System Presents Future Growth Opportunity for the Market

Integration of artificial intelligence in spain intralogistics market growth is anticipated to create promising future opportunities by enhancing operational efficiency and achieve high level automation. AI-powered robots in industries improves efficiency and dependability serving critical for mobile operations.

For instance, in November 2023, Mecalux, S.A. developed a robotic pickup system featuring Siemens’ Simatic Robot Pick AI vision software for collision free pick-ups. The system takes decisions in milliseconds and improves operational efficiency through automated pickups. With increase in annual shipments, the adoption of such system in anticipated to increase.

By Component, Hardware Holds the Dominant Share in Spain Intralogistics Market

Hardware comprises roughly 47% of Spain intralogistics industry. The hardware segment within intralogistics includes AS/RS, conveyor systems, robotic arms, and AGVs for optimizing material handling, storage, and retrieval activities. Hardware has been the backbone to warehouse automation in terms of labour force reduction, speed, and accuracy in fulfillment and inventory control.

By End User, Retail and E-commerce, holds the highest CAGR of 14.8%

In intralogistics, the retail and e-commerce market is growing fast because of business's increasing demand for faster and efficient order fulfillment. The automation solutions covered in this segment include robotic picking, AS/RS, conveyor systems, and advanced WMS. These technologies allow the streamlined movement, storage, and retrieval of goods, thereby enabling these businesses to manage large volumes of inventory and ensure timely delivery.

Competitive Landscape

The promising players operating in Spain intralogistics industry include Jungheinrich AG, KION Group, Midea Group Co., Ltd., SSI Schafer Group, Knapp AG, Vanderlande Industries B.V., Beumer Group GmbH, Daifuku Co., Ltd., Auto Store System, TGW Logistics Group, ViaStore Systems, System Logistics, Serna Automation, Balluff Automation, Exotec Inc., Smartlog Group, Alstef Group, DLL Group, STILL GmbH, Paul Vahle GmbH & Co. KG among others.

These players are engaged in various partnership, product launches, and acquisition across various regions to maintain their dominance in the global market.

|

Date |

Company |

Recent Developments |

|

October 2024 |

Vanderlande AG |

Vnderlande acquired Siemens Logistics, a company specializing in baggage and cargo handling solutions. This acquisition aims to enhance Vanderlande's capabilities in automated logistics, particularly in airports, by leveraging Siemens' advanced technologies and expertise in intralogisticsa |

|

March 2024

|

SSI Schafer Group |

SSI SCHAEFER Group launched LOGIONE, a new stand-alone software for its vertical lift module (VLM) that is designed to enhance warehouse efficiency. |

|

July 2023 |

Jungheinrich AG |

Jungheinrich launched the EAE 212a, a mobile robot designed for low-lift applications in intralogistics, featuring a new control system for easy integration into warehouses. This agile robot can transport loads up to 1.2 tons at speeds of 6 km/h, enhancing operational efficiency and flexibility. |

|

June 2023 |

Beumer Group GmbH |

BEUMER Group acquired The Hendrik Group Inc., a prominent manufacturer of air-supported belt conveyors. This strategic acquisition allows BEUMER Group to enhance its product offerings across various regions including Spain and strengthen its position in the intralogistics market. |

|

February 2023 |

Midea Group Co., Ltd. |

KUKA a subsidiary of Media Group launched the KMP 600-S diffDrive an automated guided vehicle (AGV) designed to enhance efficiency in intralogistics to support material handling with a payload capacity of 600 kg. |

Spain Intralogistics Market Key Segments

By Component

-

Hardware

-

Automated Storage and Retrieval Systems (AS/RS)

-

Unit-Load AS/RS

-

Mini-Load AS/RS

-

Vertical Lift Modules (VLMs)

-

Carousel AS/RS

-

-

Industrial Robots

-

Mobile Robots

-

Automated Guided Vehicle (AGV)

-

Autonomous Mobile Robot (AMR)

-

-

Conveyor Systems

-

Sortation Systems

-

-

Software

-

Services

By End Users

-

Logistics

-

Food And Beverages

-

Retail And E-Commerce

-

Automotive

-

Chemicals

-

Pharmaceuticals

-

Airport

-

Mining

Key Players

-

Jungheinrich AG

-

KION Group

-

Midea Group Co., Ltd.

-

SSI Schafer Group

-

Knapp AG

-

Vanderlande Industries B.V.

-

Beumer Group GmbH

-

Daifuku Co., Ltd.

-

Auto Store System

-

TGW Logistics Group

-

ViaStore Systems

-

System Logistics

-

Serna Automation

-

Balluff Automation

-

Exotec Inc.

-

Smartlog Group

-

Alstef Group

-

DLL Group

-

STILL GmbH

-

Paul Vahle GmbH & Co. KG

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 1.09 Billion |

|

Revenue Forecast in 2030 |

USD 2.52 Billion |

|

Growth Rate |

CAGR of 12.5% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

20 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst