Travel Insurance Market by Age (Millennials, Generation X, and Baby Boomers), by Income Level (Low-income travelers, Middle-income travelers and High-Income Travelers), by Coverage (Medical Coverage, Trip Cancellation Coverage, Baggage and Personal Belongings Coverage, Accidental Death and Dismemberment (AD&D) Coverage), by Days of coverage, by End User and Others – Global Opportunity Analysis and Industry Forecast, 2025–2030

Industry: BFSI | Publish Date: 17-May-2025 | No of Pages: 304 | No. of Tables: 409 | No. of Figures: 354 | Format: PDF | Report Code : BF74

US Tariff Impact on Travel Insurance Market

Trump Tariffs Are Reshaping Global Business

Travel Insurance Market Overview

The global Travel Insurance Market size was valued at USD 26.54 billion in 2024 and is predicted to reach USD 58.40 billion by 2030, with a CAGR 13.2% of from 2025 to 2030.

The market for travel insurance is rising due to factors such as rising number of outbound tourists, expansion in online platforms related to travel insurance, and integration of AI with the travel insurance platforms. However, the market is hindered due to regulatory challenges in that include diverse and complex regulations imposed by governmental authorities across county. In contrast, merger of blockchain technology offers opportunity by enhancing transparency and security within the industry.

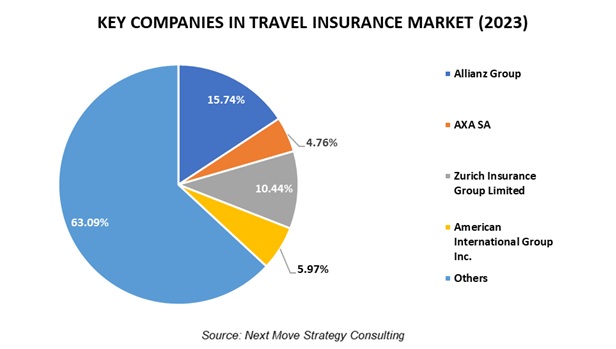

Moreover, the key players of the industry such as Allianz Group, AXA SA, and others are taking up various developmental strategies to maintain their dominance in the market.

Rising Number of Outbound Tourists Drive the Travel Insurance Market Growth

The rise in number of travel activities across the world fuels the growth of the market as more people take domestic and foreign trips there is an increasing need of travel protection against unexpected situations.

As per National Travel and Tourism Office, in 2023, international air passenger travel was 19.7 million, rising 41.7% from March 2022. This increase in traveling activity propels the market of the travel insurance providers, thereby developing market growth and expansion opportunities.

The Growing Number of Online Platforms for Travel Insurance Drives the Industry

The expansion of online platforms fuels the growth of the industry as consumers are able to easily access to a variety of online channels for purchasing trip insurance that offer convenience, and transparency thereby allowing travellers to compare different insurance options and make informed decisions.

For instance, in January 2024, Allianz Partners launched a digital platform allyz that aims to provide travellers with trusted advice and expertise as well as access to the full collection of insurance benefits available to customers. Likewise, in October 2024, Insubuy launched new my account mobile app that allows customers to manage travel insurance coverage from mobile devices. These advancements towards digitalization enhances the overall customer experience and accessibility and this in turn is driving travel insurance market demand.

AI Integration Within Travel Insurance Platforms Drives Market Expansion

The integration of travel insurance platforms with latest technologies drives market expansion by offering highly efficient solutions. By integrating advanced technologies such as machine learning and real-time analytics AI enables insurers to create tailored policies that meet the demand of the unique needs of the travellers. For example, in February 2025, Simplifai launched Agentic AI to transform insurance automation. The advancement aims to optimize critical processes such as claims handling for travel, motor insurance, and others. By integrating AI Agents, insurers improve customer experience and reduces costs thereby paving the way towards more efficient insurance industry.

Regulatory Challenges Hinder the Market Growth

Regulatory challenges inhibit market growth as insurance providers operating globally face significant administrative implication and costs in establishing compliance with these regulations such as licensing and policy terms.

Integration of Blockchain Technology Creates Ample Opportunity for the Travel Insurance Market Trends

Blockchain technology offers a notable opportunity for intensifying transparency and security within the industry. By integrating decentralized digital ledgers insurers are able to establish unchangeable records of transactions and claims lowering the risk of fraud and ensuring data integrity. This transparency builds a sense of trust between insurers and policyholders.

Medical Coverage Dominates the Coverage Segment in Travel Insurance

This is the leading segment holding approximately 36% of the share within the coverage sector of the travel coverage industry. This segment focuses on providing complete coverage for medical emergencies and expenses incurred during travel including. As travellers prioritize their health and safety during their journeys medical coverage remains an important component of travel insurance policies that ensure individuals and families are adequately protected against unexpected medical emergencies while traveling.

By age, Baby Boomer Segment Is Expected to Boost the Highest Growth Rate 15.5%

The baby boomer travellers emerged as a crucial segment within the travel insurance market, boasting the highest growth rate during the forecast period. This demographic represents a significant portion of travellers who seek insurance coverage to meet their specific needs and concerns. According to the data by Gitnux, baby boomers are collectively spending over USD 120 billion on leisure travel each year accounted for the year 2023 that represents 80% of luxury travel expenditure and nearly the majority of the population takes at least one journey annually. Insurance providers recognize the unique requirements of older travellers such as pre-existing medical conditions and the need for extended coverage durations.

North American Region Dominates the Travel Insurance Market Share

The North American region holds 41.7% share of the global market due to rising number of travellers in the region for career opportunities, thereby raising the growth of the travel insurance industry. According to a data published by The U.S. Department of Commerce, the outbound travellers reached approximately 80.7 million in 2023 in the U.S.

Moreover, the development initiatives implemented by leading industry participants in the North America travel insurance industry underscore a vibrant and evolving marketplace, characterized by innovation and adaptation to meet the diverse needs of travellers worldwide.

For example, in January 2024, AXA partnered with Kiwi.com to offer comprehensive coverage for travellers to secure journey through their trip in the region. It offers different insurance plans including each with varying levels of coverage to suit different travel needs.

Asia-Pacific is the Fastest Growing Region of the Market

The region is expected to witness a steady growth in the market due to significant increase in demand among travellers particularly the elderly segment seeking medical care and treatments abroad. For example, in March 2024, the TATA AIG General Insurance Company introduced Travel Guard Plus that shows an important development in the region. The product offers complete coverage that includes both travel medical and non-medical contingencies and addresses a range of potential risks faced by travellers.

Also, the existence of major regional and global players including Income, Seedly, and MSIG Singapore, among others, propels market growth. These established players engage in innovations and developments within the country by introducing new products and features to meet the evolving needs and preferences of consumers. For example, Seedly introduced travel insurance product in November 2023 that aims to cater to a wide range of customers in Singapore including families and adventure enthusiasts.

Competitive Landscape

Several market players operating in the global travel insurance industry include Zurich Insurance Group Limited, Berkshire Hathaway Specialty Insurance, Chubb Limited, Aviva PLC, Generali Group, AIA Group Limited, Allianz Group, American International Group, Inc., AXA S.A., Travel Insured International, Nationwide, Prudential PLC, Manufacturers Life Insurance Company (Manulife), HSBC Holdings PLC, and BOC Group Life Assurance Company Limited. and others.

Other companies include Seven Corners Inc., Alfa Tour, Travelex International Limited, and others.

These players are engaged in various product launch, acquisition and collaborations across various regions to maintain their dominance in the market.

|

Date |

Company |

Recent Developments |

|

March 2024 |

Zurich |

Zurich collaborated with Klook and introduced FlyEasy service that is aiming to ease the inconvenience of flight delays for travellers by providing free access to airport lounges globally when flights are delayed for over two hours. |

|

January 2024 |

Aviva |

Aviva introduced a complete wellness package to enhance its group accident and travel insurance offerings providing added value to customers. |

|

October 2023 |

Travel Insured International |

Travel Insured International collaborated with Robin Assist in October 2023 to enhance customer claims and emergency travel assistance services with streamlined claims processing and comprehensive emergency assistance. |

|

April 2023 |

Generali Group |

Generali Group acquired AXA Affin joint ventures in Malaysia and the complete purchase of MPI Generali Insurance. The company aims to enhance customer experience and provide comprehensive protection solutions across various insurance sectors. |

Travel Insurance Market Key Segments

By Age

-

Millennials

-

Generation X

-

Baby Boomers

By Income Level

-

Low-income travelers

-

Middle-income travelers

-

High-income travelers

By Coverage

-

Medical Coverage

-

Trip Cancellation Coverage

-

Baggage and Personal Belongings Coverage

-

Accidental Death and Dismemberment (AD&D) Coverage

By Days of Coverage

-

Short-Trip Insurance

-

Standard Trip Insurance

-

Extended Trip Insurance

-

Multi-Trip Insurance

By Distributional Channel

-

Insurance Companies

-

Banks

-

Airlines

-

Online Platforms

-

Insurance Aggregators and Comparison Websites

-

Travel Agents and Tour Operators

By End User

-

Pilgrim Travelers

-

Education Travelers

-

Business Travelers

-

Family Travelers

By Region

- North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

- RoW

-

Latin America

-

Middle East

-

Africa

-

Travel Insurance Market Key Players

-

Zurich Insurance Group Limited

-

Berkshire Hathaway Specialty Insurance

-

Chubb Limited

-

Aviva PLC

-

Generali Group

-

AIA Group Limited

-

Allianz Group

-

American International Group, Inc.

-

AXA S.A.

-

Travel Insured International

-

Nationwide

-

Prudential PLC

-

Manufacturers Life Insurance Company (Manulife)

-

HSBC Holdings PLC

-

BOC Group Life Assurance Company Limited

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 26.54 Billion |

|

Revenue Forecast in 2030 |

USD 58.40 Billion |

|

Growth Rate |

CAGR of 13.2% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst