Ultrasonic Fingerprint Sensors Market by Component (Hardware and Software), by Technology (2D Ultrasonic Fingerprint Sensors, and 3D Ultrasonic Fingerprint Sensors), by Application (Smartphones, Tablets, Laptops, Wearable Devices, Digital Dashboard, Access Control Systems and Other Applications), and by End User (Consumer Electronics, Automotive Industry, and Other) - Global Opportunity Analysis and Industry Forecast 2024-2030

US Tariff Impact on Ultrasonic Fingerprint Sensors Market

Trump Tariffs Are Reshaping Global Business

Market Definition

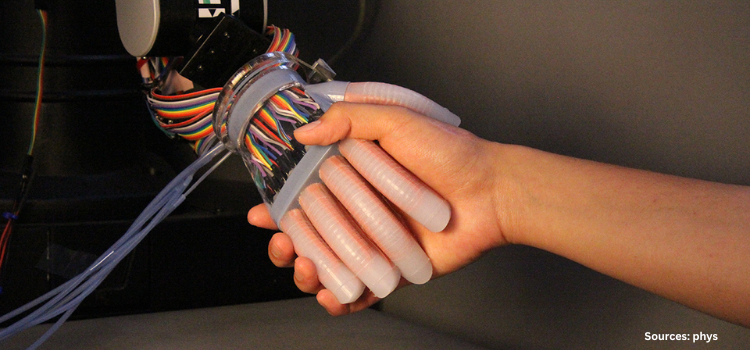

The Ultrasonic Fingerprint Sensors Market size was valued at USD 227.5 million in 2023 and is predicted to reach USD 333.1 million by 2030 with a CAGR of 5.6% from 2024-2030. An ultrasonic fingerprint sensor is a biometric technology that uses high-frequency ultrasonic waves to capture a detailed 3D image of a person's fingerprint. The sensor sends out ultrasonic waves that penetrate the skin and bounce back, creating a detailed image of the fingerprint's unique ridges and valleys.

Ultrasonic fingerprint sensor technology is considered more secure than traditional optical fingerprint sensors as it can detect deeper layers of the skin and is less affected by external factors such as dirt or sweat. It can also detect fingerprints on non-flat surfaces, such as curved glass or metal allowing for more accurate and reliable fingerprint recognition as the sensor can capture details such as sweat pores and ridges. Ultrasonic fingerprint sensors are often used in smartphones and other mobile devices for user authentication.

Market Dynamics and Trends

The increasing adoption of smartphones and other electronic devices equipped with ultrasonic fingerprint sensors is fueling the growth of the ultrasonic fingerprint sensors market. As per the latest report from the International Telecommunication Union, approximately 5.3 billion people were using the internet globally in 2022.

This widespread connectivity has led to a surge in the demand for secure and convenient authentication methods as compared to traditional authentication methods such as passwords or PINs, as consumers seek devices with enhanced security and usability features.

Moreover, the expanding banking and financial sector worldwide are driving the demand for advanced security solutions, boosting the growth of the market. With a growing number of transactions conducted online daily, there is a heightened need for robust identity verification measures to ensure secure financial transactions, protect sensitive customer information, and prevent fraudulent activities.

For example, global credit card transactions reached 678 billion in 2022, with an estimated 1.86 billion transactions per day, highlighting the critical importance of implementing advanced security solutions to safeguard financial transactions. However, the concerns regarding the security and privacy of biometrics databases are the major factors restraining the growth of the market.

On the contrary, the integration of ultrasonic fingerprint technology with other biometric methods such as facial recognition and iris scanning is expected to create ample opportunities in the coming years in the ultrasonic fingerprint sensors market. These technologies together will provide an additional layer of security in scanning and access control in a wider range of devices.

Market Segmentations and Scope of the Study

The ultrasonic fingerprint sensors market share is segmented on the basis of component, technology, application, end-user, region. On the basis of component, the market is divided into hardware and software. On the basis of technology, the market is classified into active ultrasonic fingerprint sensors and passive ultrasonic fingerprint sensors. On the basis of application, the market is segmented into smartphones, laptops, tablets, and others. On the basis of end user, the market is divided into consumer electronics, automotive, healthcare, defence, government, IT & telecommunication, and others. Regional breakdown and analysis of each of the aforesaid segments include regions comprising of North America, Europe, Asia-Pacific, and RoW.

Geographical Analysis

Asia Pacific holds the dominant share of the ultrasonic fingerprint sensors market and is expected to continue its dominance during the forecast period. This is attributed to factors such as the growing penetration of consumer electronics such as smartphones and tablets in countries such as China, India, and Japan.

According to the Indian Ministry of Information and Broadcasting, the number of mobile users reached 1.2 billion in India in 2022. With such a large consumer base, the adoption of ultrasonic fingerprint sensors is expected to witness significant growth in this region.

Moreover, the growing automotive industry in this region along with the increasing use of fingerprint sensors in the automation of vehicles such as keyless entry and is further driving the growth of the ultrasonic fingerprint sensors market.

According to the Ministry of Industry and Information Technology, China is the largest automotive manufacturing country in the world with a sale of 25 million vehicles in 2020 and it is expected to reach 35 million vehicles by 2025.

On the other hand, North America is expected to show a steady rise in the ultrasonic fingerprint sensors market due to the growing defense & research sector in developed countries such as the U.S. and Canada and the need for identification and authentication to secure access to military bases, facilities, and sensitive information, as well as to restrict access to weapons systems to authorized personnel. According to the latest report published by the World Bank, the military and defense expenditure by the government of the U.S. reached USD 800.67 billion in 2021.

Moreover, the developed healthcare infrastructure in this region and the increasing use of fingerprint sensors is further driving the growth of the market. These sensors are used to confirm patient identity and to grant or restrict access to certain areas of a healthcare facility such as medication storage or patient rooms to safeguard patients’ data and medicines. According to the Center for Medicare and Medicaid Services, the healthcare industry in the U.S. reached 4.3 trillion in 2021.

Competitive Landscape

Various market players operating in the ultrasonic fingerprint sensors market include Apple Inc., Thales Group, Anviz Global Inc., BIO-Key International Inc., Synaptics Inc., Samsung Electronics, Fingerprint Cards AB, Idex Biometrics ASA, Next Biometrics, Qualcomm, Alphabet Inc., Idex Biometrix ASA, M2SYS Technology, Shenzhen Goodix Technology Co. Ltd, Egis Technology Inc., and others. These market players are adopting various strategies such as product launches to remain dominant in the ultrasonic fingerprint sensors market.

For instance, in December 2022, Samsung Electronics announced the launch of an all-screen ultrasonic fingerprint scanner. Through this launch, the company aims to provide fast and secure fingerprint reading by making the entire screen a fingerprint reader.

Moreover, in October 2022, Google Inc announced to launch of its new smartphone google pixel with an ultrasonic fingerprint scanner of Qualcomm. Through this launch, the company aims to provide its consumers with a quicker and more seamless unlocking experience even with wet or oily fingers, among others.

Furthermore, in January 2021, Qualcomm launched its new ultrasonic fingerprint sensor 3D sonic sensor Gen 2. The new fingerprint sensor comes with a larger fingerprint reader area and is suitable for rollable and foldable phones.

Key Benefits

-

The report provides quantitative analysis and estimations of the ultrasonic fingerprint sensors market from 2024 to 2030, which assists in identifying the prevailing market opportunities.

-

The study comprises a deep dive analysis of the ultrasonic fingerprint sensors market including the current and future trends to depict prevalent investment pockets in the market.

-

Information related to key drivers, restraints, and opportunities and their impact on the ultrasonic fingerprint sensors market is provided in the report.

-

Competitive analysis of the players, along with their market share is provided in the report.

-

SWOT analysis and Porters Five Forces model is elaborated in the study.

-

Value chain analysis in the market study provides a clear picture of roles of stakeholders.

Key Market Segments

by Component

- Hardware

- Sensors

- Modules

- Software

By Technology

-

2D Ultrasonic Fingerprint Sensors

-

3D Ultrasonic Fingerprint Sensors

By Application

-

Smartphones

-

Tablets

-

Laptops

-

Wearable Devices

-

Digital Dashboard

-

Access Control Systems

-

Other Applications

By End User

-

Consumer Electronics

-

Automotive Manufacturers

-

Healthcare Providers

-

Banking and Financial Services Industry

-

Government and Law Enforcement

-

Other End-users

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

Apple Inc.

-

Thales Group

-

Anviz Global Inc.

-

BIO-Key International Inc.

-

Synaptics Inc.

-

Samsung Electronics

-

Fingerprint Cards AB

-

Idex Biometrics ASA

-

Next Biometrics

-

Qualcomm

-

Alphabet Inc.

-

Idex Biometrix ASA

-

M2SYS Technology

-

Shenzhen Goodix Technology Co. Ltd

-

Egis Technology Inc.

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 227.5 Million |

|

Revenue Forecast in 2030 |

USD 333.1 Million |

|

Growth Rate |

CAGR of 5.6% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

B Million (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst