Vietnam Aluminium Market by Product Type (Flat-Rolled, Castings, Extrusions, Forgings, Powder & Paste, and Other Types), Types (Primary and Secondary), and End User Industries (Transport, Consumer Goods, Machinery & Equipment, Construction, Foil and Packaging, Electrical Engineering, and Other End User Industries)– Global Opportunity Analysis and Industry Forecast, 2025–2030

Industry: Materials and Chemical | Publish Date: 23-Dec-2024 | No of Pages: N/A | No. of Tables: N/A | No. of Figures: N/A | Format: PDF | Report Code : MC2896

Vietnam Aluminium Market Overview

The Vietnam Aluminium Market size was valued at USD 5.01 billion in 2024 and is predicted to reach USD 7.57 billion by 2030, with a CAGR of 6.8% from 2025 to 2030. In terms of volume, the market size was 1925 thousand metric tons in 2024 and is anticipated to reach 3087 thousand metric tons by 2030, growing at a CAGR of 7.9% from 2025 to 2030.

The Vietnam aluminium market encompasses the production, processing, and distribution of aluminium and its derivatives for domestic and international markets. The industry relies on raw bauxite, refined and smelted to produce aluminium ingots, sheets, and extrusions. These products are widely used in sectors such as construction, automotive, packaging, and consumer goods, valued for their lightweight properties, corrosion resistance, and durability.

Aluminium’s recyclability and energy-efficient production contribute to its lower environmental impact compared to materials including steel and plastic. Its versatility further enables innovative design and application, establishing aluminium as a preferred material in modern architecture and product development.

Expansion of the Construction Sector Fuels the Growth of the Vietnam Aluminium Market

The growth of Vietnam’s construction sector significantly drives the aluminium market, driven by the rising demand for lightweight, durable, and corrosion-resistant materials essential for modern building and infrastructure projects. As infrastructure advances, aluminium becomes crucial in applications such as windows, facades, and roofing, which support energy efficiency and sustainability goals in Vietnam’s construction industry.

According to a recent report by the International Trade Administration (ITA), the sector reached a valuation of USD 95.8 billion in 2023, with an anticipated growth rate of 7% from 2024 to 2027. This expansion pushes aluminium suppliers and manufacturers in Vietnam to innovate and broaden their product lines to meet evolving market needs.

Rising Transportation and Logistics Sector Propels the Growth of the Vietnam Aluminium Market

Vietnam’s growing transportation and logistics sector significantly drives demand for lightweight, durable, and corrosion-resistant materials including aluminium, essential for manufacturing vehicles, shipping containers, and infrastructure components. This demand supports market growth, as companies prioritize aluminium to enhance operational efficiency and reduce vehicle weight.

According to the General Statistics Office of Vietnam, the transportation and logistics sectors contributed 4.65% to Vietnam’s GDP in 2022, with transport demand expected to rise by 6.8% to 7.35% by 2030. This sectoral expansion is anticipated to increase aluminium usage as companies seek robust, lightweight solutions for logistics efficiency.

Government Regulations Hinder Market Growth

Strict environmental regulations imposed by Vietnamese government present challenges to the aluminium market, as manufacturers must navigate complex requirements related to pollution control, waste management, and emissions reporting. For instance, the Ministry of Natural Resources and Environment (MONRE) enforces the Law on Environmental Protection, which mandates stringent frameworks for managing pollution and waste while regulating greenhouse gas emissions.

These regulatory pressures often limit growth potential for existing companies and may deter new entrants from joining the aluminium market in Vietnam, adding to operational costs and compliance burdens for market participants.

Adoption of 3D Printing in Aluminium Creates Significant Future Growth Opportunities in the Market

The adoption of 3D printing technologies in the aluminium industry presents significant growth opportunities for Vietnam’s aluminium market by enabling manufacturers to produce lightweight components with complex geometries, suitable for diverse applications. This technology not only facilitates rapid prototyping and reduces production times, boosting overall efficiency, but also supports sustainability goals by minimizing material waste and energy consumption. As Vietnam intensifies its focus on reducing environmental impact, the alignment of 3D printing's eco-friendly benefits with these objectives is anticipated to propel market expansion in the coming years.

By Product Type, Extrusions Holds the Largest Market Share in Vietnam Aluminium Market

In Vietnam's aluminium market, extrusions hold the largest market share, accounting for approximately 40% of the total market. This dominance is due to the versatility and high demand for aluminium extrusions in various applications, including construction, transportation, and manufacturing.

Aluminium extrusions are widely preferred for their lightweight, durable, and corrosion-resistant properties, making them ideal for structural components, windows, doors, and framing solutions. As infrastructure and industrial growth continue to expand, the demand for aluminium extrusions in Vietnam is expected to remain robust, reinforcing their leading position in the market.

By Type, Primary Aluminium is Anticipated to Show Fastest Growth in the Future

By type, primary aluminium is anticipated to exhibit the fastest growth in Vietnam's aluminium market, with a projected CAGR of 8.2% from 2024 to 2030. This growth can be attributed to the increasing demand for primary aluminium in various sectors, including construction, automotive, and consumer goods, driven by its lightweight, strength, and corrosion-resistant properties.

As industries seek to leverage the advantages of primary aluminium for enhanced performance and sustainability, its application across different sectors is expected to expand significantly, further propelling market growth during the forecast period.

Import and Export of Aluminium in Vietnam Over the Years

Vietnam’s aluminum import and export landscape reflects the country’s rapid industrialization and growing demand for metals in construction, electronics, and manufacturing sectors. As domestic production remains limited, Vietnam relies heavily on aluminum imports, particularly raw materials like primary aluminum, from key trading partners such as China, the UAE, and Australia to meet local manufacturing needs.

However, with advancements in processing capabilities and rising demand from neighboring markets, Vietnam has also expanded its aluminum exports, primarily in semi-finished and finished aluminum products like sheets, extrusions, and profiles.

|

Year |

Import (Metric Tons) |

YoY Change |

Export (Metric Tons) |

YoY Change |

|

2018 |

883634 |

- |

193966 |

- |

|

2019 |

990829 |

12% |

201779 |

4% |

|

2020 |

XXXXXXXXX |

XX |

XXXXXXXXX |

XX |

|

2021 |

XXXXXXXXX |

XX |

XXXXXXXXX |

XX |

|

2022 |

XXXXXXXXX |

XX |

XXXXXXXXX |

XX |

|

2023 |

XXXXXXXXX |

XX |

XXXXXXXXX |

XX |

With global demand for sustainable and recyclable materials on the rise, Vietnam's aluminum market holds significant potential for growth, positioning the country as an important player in the Southeast Asian metals industry and contributing to long-term economic development.

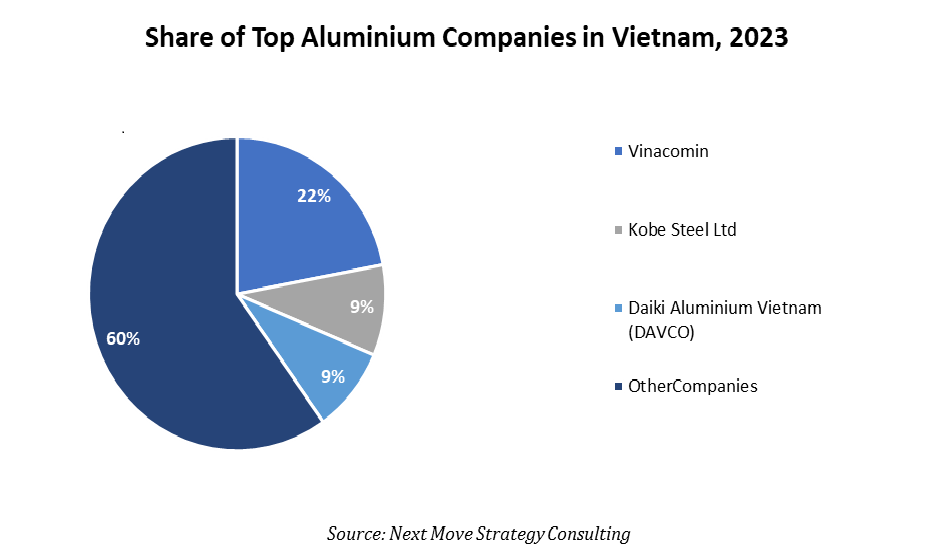

Competitive Landscape

Several market players operating in the Vietnam aluminium market include Vinacomin, Kobe Steel Ltd, Daiki Aluminium Vietnam (DAVCO), Rhine Precision Alloy (Vietnam) Co., Ltd, Garmco Metals Vietnam Co., Ltd, Global Vietnam Aluminum Co., Ltd, East Asia Aluminum Company Limited, Sapa Ben Thanh Aluminium Profile Company Limited, Song Hong Shalumi Aluminium Group Joint Stock Company, Nam Sung Aluminium Company Limited, Almine Vietnam Co., Ltd., Minh Dung Aluminum Co., Ltd, Ngoc Diep Aluminium Joint Stock Company, Mk Metal Vina, KIMSEN Industrial Corporation, and others.

Note: For the latest market share analysis and in-depth Vietnam Aluminium industry insights, you can reach out to us at: Access the Full Report

These players are adopting business expansion strategies to remain dominant in the market.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

| April 2024 |

Vinacomin |

Vinacomin announced to build two new alumina and aluminium production plants in Vietnam, aiming for a total output of approximately 600,000 tons annually. This expansion is part of the company's strategy to meet growing domestic and export demands for aluminium. |

|

March 2023 |

GARMCO |

GARMCO invested USD 24.5 million in expansion projects, including a new aluminium coil production line and a recycling facility to process local aluminium scrap. This investment supports GARMCO’s goals of boosting productivity, diversifying product offerings, and enhancing environmental sustainability. |

|

February 2022 |

East Asia Aluminum Company Limited |

East Asia Aluminum Company Limited expanded its factory, increasing the facility's area to over 100,000 square meters with an investment of USD 38 million. This expansion aims to double the company's aluminium production capacity to over 150,000 tons annually. |

Vietnam Aluminium Market Key Segment

By Product Type

-

Flat-Rolled

-

Castings

-

Extrusions

-

Forgings

-

Powder & Paste

-

Other Types

By Type

-

Primary

-

Secondary

By End-user

-

Transport

-

Consumer Goods

-

Machinery & Equipment

-

Construction

-

Foil and Packaging

-

Electrical Engineering

-

Other End User Industries

Key Market Players

-

Vinacomin

-

Kobe Steel Ltd

-

Daiki Aluminium Vietnam (DAVCO)

-

Rhine Precision Alloy (Vietnam) Co., Ltd

-

Garmco Metals Vietnam Co., Ltd

-

Global Vietnam Aluminum Co., Ltd

-

East Asia Aluminum Company Limited

-

Sapa Ben Thanh Aluminium Profile Company Limited

-

Song Hong Shalumi Aluminium Group Joint Stock Company

-

Nam Sung Aluminium Company Limited

-

Almine Vietnam Co., Ltd

-

Minh Dung Aluminum Co., Ltd

-

Ngoc Diep Aluminium Joint Stock Company

-

Mk Metal Vina

-

KIMSEN Industrial Corporation

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 5.01 Billion |

|

Revenue Forecast in 2030 |

USD 7.57 Billion |

|

Growth Rate (Value) |

CAGR of 6.8% from 2025 to 2030 |

|

Market Volume in 2023 |

1925 Thousand Metric Tons |

|

Market Volume in 2030 |

3087 Thousand Metric Tons |

|

Growth Rate (Volume) |

CAGR of 7.9% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Market Volume Estimation |

Thousand Metric Tons |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst