Wearable Plant Sensors Market by Sensor Type (Motion, Temperature, Moisture, and Nutrient), by Application (Agriculture Farm, Greenhouse, and Research Institutes), and by End Users (Agriculture, Research Institutes, and Others)– Global Opportunity Analysis and Industry Forecast, 2025-2030

US Tariff Impact on Wearable Plant Sensors Market

Trump Tariffs Are Reshaping Global Business

Wearable Plant Sensors Market Overview

The global Wearable Plant Sensors Market size was valued at USD XXX billion in 2024 and is predicted to reach USD XXX billion by 2030 with a CAGR of X.X% from 2025 to 2030. The market is driven by the escalating global population's demand for increased food production, necessitating innovative technologies to enhance crop yields sustainably.

These smart plant sensors enable non-destructive, real-time monitoring of plant health, growth, and environmental conditions, offering precise data for optimized resource use, such as water and fertilizers, and early detection of stresses or diseases, thus supporting precision agriculture.

The push for sustainable farming further fuels market growth by promoting efficient resource management and reducing environmental impact. However, challenges in ensuring sensor robustness and long-term stability in harsh agricultural environments, such as extreme weather and signal drift, hinder widespread adoption.

A key opportunity lies in developing scalable, cost-effective, and user-friendly sensor systems using low-cost manufacturing, wireless communication, and biodegradable materials, enabling broader deployment and market expansion for a more efficient global food system.

Escalating Global Population Drives the Demand for Wearable Plant Sensors

The escalating global population and the consequent rise in food demand are primary drivers propelling the wearable plant sensors market demand. With the United Nations projecting a 70% increase in food production needed by 2050, innovative agricultural technologies are crucial.

Plant biosensors offer a direct and real-time method for monitoring plant health and growth, providing invaluable data for optimizing crop management and ultimately enhancing yields.

For instance, by continuously tracking plant hydration and nutrient uptake, farmers can make informed decisions about irrigation and fertilization, ensuring that crops receive the precise resources needed for optimal growth. This data-driven approach, facilitated by wearable sensors, is essential for meeting the demands of food security in a sustainable manner, contributing significantly to the market size and market share of the precision agriculture sector.

The ability of these agricultural sensors to provide a theoretical reference for optimising the crop growth environment and resisting biotic and abiotic stresses directly addresses the challenge of increasing crop productivity.

The Power of Non-Destructive Monitoring Present in Wearable Plant Sensors Fuels the Growth of the Market

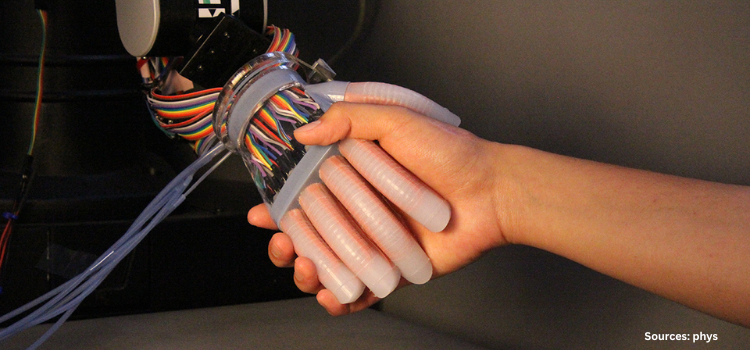

Traditional methods of plant monitoring often involve destructive sampling or complex instrumentation, which can be time-consuming and may not provide a continuous, real-time understanding of plant status. Wearable plant sensors offer a significant advantage by enabling non-destructive and in-situ monitoring of various phytometric parameters and microclimate conditions.

These sensors can be placed directly on plant leaves or stems to gather information on parameters such as plant growth deformation, nutrient levels, physiological responses, and even volatile organic compound (VOC) emissions. For example, sensors can monitor leaf elongation in real-time, providing insights into growth rates and responses to environmental changes.

Similarly, VOC sensors can offer early detection of plant diseases or stress by identifying characteristic compounds released by the plant. This ability to collect high-resolution data in real-time, without harming the plant, is a key driver for the adoption of wearable sensors in agriculture, enhancing the efficiency and accuracy of crop monitoring and contributing to the market's growth potential.

Sustainable Farming Propels the Demand for Wearable Plant Sensors

The increasing focus on environmental sustainability in agriculture is another significant driver for the wearable plant sensor market growth. These sensors empower farmers to optimise the use of resources such as water, fertilizers, and pesticides by providing precise data on plant needs.

For instance, real-time monitoring of soil moisture and plant hydration levels through wearable sensors can help farmers apply water only when and where it is needed, reducing water waste and improving water use efficiency.

Similarly, by detecting nutrient deficiencies early, farmers can apply fertilizers in a targeted manner, minimizing overuse and the associated environmental pollution. Furthermore, early detection of pests and diseases through VOC sensors can reduce the reliance on broad-spectrum pesticides, promoting more sustainable pest management practices.

This drive towards minimal input and maximized high-quality crop production, which is central to precision agriculture, strongly supports the market expansion and the increasing industry size of wearable plant sensor technology.

Long-Term Stability in the Harsh and Unpredictable Agricultural Environment Hinders the Market Growth

A significant restraint on the widespread adoption of wearable plant sensors is their robustness and long-term stability in the harsh and unpredictable agricultural environment. Outdoor farming conditions can involve extreme temperatures, high humidity, strong sunlight, and even storms, which can damage sensors, affect their performance, and lead to signal drift over time.

Current research often focuses on short-term monitoring in controlled laboratory or greenhouse settings, and the transition to large-scale, long-term deployment in open fields presents considerable challenges.

Issues such as the melting of coating materials, changes in the internal stress of sensing layers, and the loosening of sensor adhesion to plants due to physiological effects or environmental changes need to be addressed.

Overcoming these technical hurdles through the development of new, durable, and biocompatible materials, as well as robust packaging and self-calibration mechanisms, is crucial for realizing the full potential of wearable plant sensors.

Development of Scalable and Affordable Smart Sensing Presents Lucrative Opportunity for the Market Growth

A significant opportunity for key players in the wearable plant sensors industry lies in the development of cost-effective, scalable, and user-friendly sensor systems. While technological advancements in wearable sensors are promising, their practical application on a large scale requires solutions that are affordable and easy for farmers to implement and maintain. This includes the development of low-cost manufacturing processes, such as roll-to-roll screen printing, and the use of readily available and inexpensive materials.

Furthermore, the integration of wireless communication and energy harvesting technologies can reduce the need for complex infrastructure and frequent battery replacements, making the systems more practical for widespread deployment. The focus on creating "set and forget" solutions that are biocompatible and biodegradable can also address concerns about environmental impact and long-term usability.

For instance, in March 2025, PlantSense Technologies, a leading innovator in agricultural IoT, launched its BioSense Pro sensor series, designed specifically for scalable and affordable deployment in diverse agricultural settings. These sensors incorporate advanced biocompatible materials and energy-harvesting capabilities, reducing maintenance needs and costs for farmers.

The BioSense Pro also integrates AI-driven on-site data processing, providing instant insights to optimize crop health and yield. This launch strengthens the industry's push towards accessible smart sensing, enabling broader adoption across global farming communities. By making smart sensing technology more user-friendly and sustainable, the industry can unlock significant market growth, contributing to a more efficient and sustainable global food system.

Market Segmentations and Scope of the Study

The wearable plant sensors market report is segmented on the basis of sensor type, application, end users and region. On the basis of sensor type, the market is divided into motion, temperature, moisture, and nutrient. On the basis of application, the market is classified into agriculture farm, greenhouse, and research institutes. On the basis of end users, the market is segmented into agriculture, research institutes, and others. Regional breakdown and analysis of each of the aforesaid segments include regions comprising North America, Europe, Asia-Pacific, and RoW.

Geographical Analysis

North America, particularly the United States, appears to be a significant hub for research and development in this field. The high percentage of publications indexed in the Web of Science originating from the USA (19% between 2018-2023) indicates a strong academic and potentially industrial interest.

Furthermore, the mention of a researcher from Identify Sensus by Logics Corp USA participating in a webinar on wearable electrochemical sensors suggests active involvement from private sector entities. While the sources don't explicitly detail the market size or share in North America, this strong research presence hints at substantial growth potential and a developing market trend towards adopting advanced sensor technologies in precision agriculture (PA). The focus likely includes applications in large-scale farming, given the agricultural landscape of the region.

In Europe, countries like Italy (10%) and Spain (7%) also show a notable contribution to the research landscape in precision agriculture sensors based on Web of Science indexing. This suggests a considerable level of expertise and ongoing development within the Europe market.

The general emphasis on sustainable agriculture and environmental concerns across Europe could be a strong driver for the adoption of wearable plant sensors, aligning with the technology's potential for optimized resource management. The industry trends in Europe may lean towards integrating these sensors into existing sustainable farming practices and potentially within the framework of the European Union's agricultural policies.

The Asia-Pacific (APAC) region is demonstrating rapid expansion in the research and deployment of plant sensor networks, driven by a need to enhance regional food security and agricultural sustainability. Countries like China (14%) and India (13%) show significant academic output in sensor-related research. Specific examples highlight practical applications in this region, such as CSIRO's partnership with GPAus in Australia for early stress detection in wheat, Singapore's leveraging of IoT sensors for urban vertical farming, and Malaysian government initiatives supporting real-time crop monitoring systems.

Furthermore, research in India is exploring IoT-enabled monitoring systems and the application of these sensors under local, sometimes extreme, environmental conditions. This strong emphasis and practical implementation indicate a significant growth potential and a dynamic market trend in APAC, with both large-scale and small-scale farmers as target markets.

Finally, the Rest of the World category encompasses regions with potentially emerging interest and activity in the wearable plant sensor market share. While the sources provide less specific detail, the inclusion of Brazil (8%) in the list of countries with significant research publications suggests a developing presence in South America. The mention of a case study in Ghana utilizing open-source remote sensing for precision agriculture indicates an awareness and exploration of advanced agricultural technologies in Africa.

As the technology matures and costs potentially decrease, it can be anticipated that the increasing growth potential in these and other regions within the 'Rest of the World' category, driven by similar needs for enhanced crop productivity and sustainable agricultural practices is seen globally.

Strategic Analysis of the Companies Operating in the Market

Within the burgeoning global wearable plant sensor industry, key players, including research institutions and emerging AgTech companies, are strategically focusing on developing sophisticated, minimally invasive devices for real-time crop monitoring. A significant trend involves the creation of flexible wearable sensors fabricated from biocompatible materials to ensure high-resolution data acquisition without impeding plant growth.

Recent developments highlight the integration of multi-sensing platforms capable of simultaneously monitoring various plant parameters such as moisture levels, temperature, and volatile organic compound (VOC) emissions, crucial for early disease detection.

For instance, researchers have demonstrated VOC sensors with high accuracy in identifying plant stress. Electrochemical sensors are also gaining prominence for their ability to detect nutrient concentrations, hormone levels, and pesticide residues directly on plants.

Despite the considerable growth potential driven by the need for enhanced crop productivity and sustainable agricultural practices, the industry faces several challenges. These include the high cost of deployment and maintenance, the necessity for farmer training to effectively utilise the generated data, and ensuring the robustness and long-term stability of sensors in harsh field environments.

Furthermore, concerns regarding the biocompatibility of new sensor materials and their potential environmental impact need careful consideration. The opportunities ahead are vast, with the technology poised to revolutionize precision agriculture (PA) by providing farmers with actionable insights to optimize resource management, reduce crop losses, and ultimately contribute to global food security.

The increasing adoption of IoT and AI in agriculture further amplifies these opportunities, enabling intelligent data analysis and autonomous decision-making in smart farming systems. While specific market size and share data for individual players are still evolving in this nascent field, the overall trajectory indicates a significant wearable plant sensor market expansion in the coming years.

Key Benefits

-

The report provides quantitative analysis and estimations of the industry from 2025 to 2030, which assists in identifying the prevailing wearable plant sensors market opportunities.

-

The study comprises a deep dive analysis of the current and future wearable plant sensors market trends to depict prevalent investment pockets in the sector.

-

Information related to key drivers, restraints, and opportunities and their impact on the market is provided in the report.

-

Competitive analysis of the players, along with their market share is provided in the report.

-

SWOT analysis and Porters Five Forces model is elaborated in the study.

-

Value chain analysis in the market study provides a clear picture of roles of stakeholders.

Wearable Plant Sensors Market Key Segments

By Sensor Type

-

Motion

-

Temperature

-

Moisture

-

Nutrient

By Application

-

Agriculture Farm

-

Greenhouse

-

Research Institutes

By End Users

-

Agriculture

-

Research Institutes

-

Others

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

SenseGrass Inc.

-

Semios

-

CropX

-

PlantLink

-

Monnit

-

Arable Labs

-

SeeTree

REPORT SCOPE AND SEGMENTATION

|

Parameters |

Details |

|

Market Size in 2024 |

USD XX.XX Billion |

|

Revenue Forecast in 2030 |

USD XX.XX Billion |

|

Growth Rate |

CAGR of X.X% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

7 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst