Norsk Hydro Asa, Leading the Aluminium Sector With Around 28 Percentage Share – Here is Why

07-Oct-2024

The aluminium market is expected to see a remarkable growth of around 1.5X, expanding from USD 202.04 billion in 2023 to approximately USD 302.04 billion by 2030, as per the Next Move Strategy Consulting analysis. This significant increase is driven by technological advancements, innovations in manufacturing, rising demand for lightweight materials, and a strong focus on sustainability, all reshaping the aluminium industry.

ALUMINIUM MARKET OVERVIEW

The aluminium market is a vital and expanding sector, propelled by increasing demand across various industries such as automotive, construction, packaging, and aerospace. Aluminium’s lightweight, corrosion-resistant, and recyclable properties make it a preferred material in these sectors, driving its widespread adoption. The market includes a diverse range of products such as primary aluminium, rolled products, extrusions, and castings.

Key factors driving the aluminium market include the growing focus on sustainability and energy efficiency, which led to increased use of aluminium in electric vehicles and renewable energy infrastructure. Additionally, urbanization and industrialization in emerging economies also contribute to the rising demand for aluminium in construction and transportation. Notably, technological advancements in production processes, such as the use of inert anode technology that is improving the efficiency and environmental footprint of aluminium manufacturing.

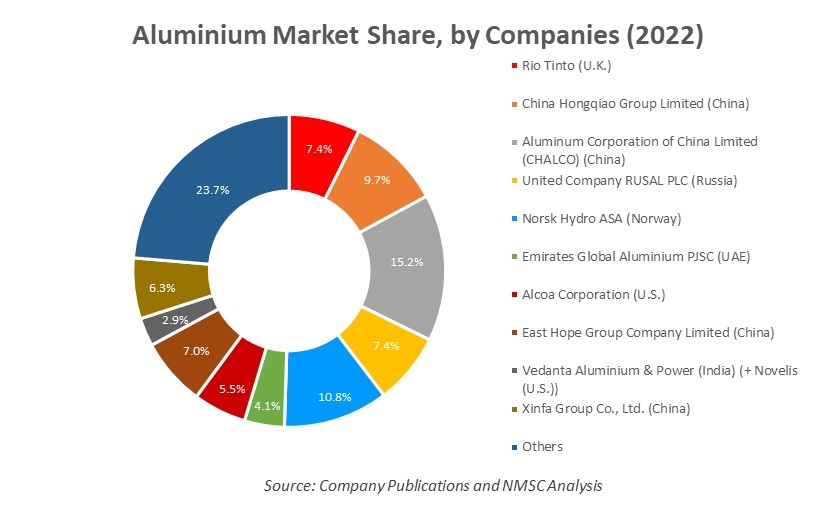

Several major companies operating in the aluminium market, includes Rio Tinto, China Hongqiao Group Limited, United Company Rusal Plc, Norsk Hydro ASA, and Alcoa Corporation among others. These companies are leaders in production capacity, innovation, and sustainability initiatives, playing a crucial role in shaping the industry's future. With ongoing investments in research and development, these key players are well-positioned to meet the growing global demand for aluminium while addressing environmental concerns.

For the latest market share analysis and in-depth travel aluminium industry insights, you can reach out to us at https://www.nextmsc.com/aluminum-market/request-sample

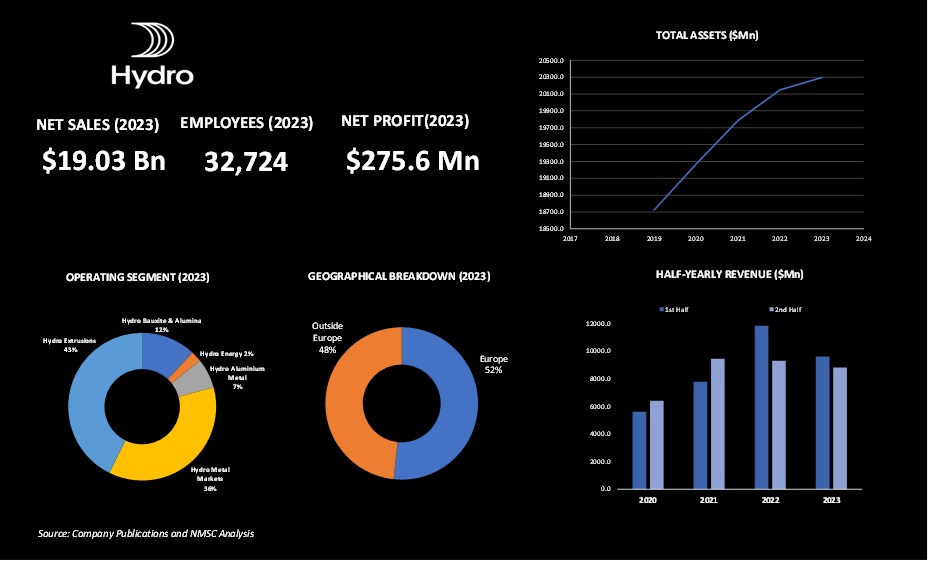

HIGHLIGHTS OF NORSK HYDRO ASA

Norsk Hydro ASA is one of the leading aluminium and renewable energy company committed to a sustainable future, reported a revenue of USD 19.03 billion, a decrease from USD 20.44 billion in 2022. The company operates in over 40 countries with 32,724 employees, making it a significant force in the aluminium and renewable energy sectors.

Additionally, the company’s gross profit for 2023 declined to USD 1.74 billion, down from USD 2.0 billion in 2022, primarily due to increased costs and strategic reallocations towards growing its recycling and extrusion businesses. Hydro’s operations are divided into several reportable segments, including Hydro Bauxite & Alumina, Hydro Energy, Hydro Aluminium Metal, Hydro Extrusions, and Hydro Metal Markets, which are managed alongside Hydro Aluminium Metal.

Hydro’s strategic moves in 2023 underscored its focus on enhancing its aluminium market position. One notable example of it includes, Hydro made substantial adjustments within its portfolio, including selling a 30% share of its Alunorte alumina refinery to Glencore in 2023. This move unlocked financial resources for investment in Hydro's recycling and extrusions segments. Notably, the acquisition of the Polish aluminium recycling company Alumetal bolstered Hydro’s recycling capabilities in Europe. Additionally, Hydro opened a new aluminium recycling plant in Cassopolis, Michigan, with an annual capacity of 120,000 metric tonnes.

Hydro’s ongoing improvement program, which began in 2019 with a target of USD 700 million by 2023, achieved accumulated improvements of USD 840 million, surpassing the goal. The company set a new target of USD 1.34 billion in accumulated improvements by 2030. In line with its commitment to sustainability, Hydro introduced several initiatives in 2023, including producing the world’s first batch of recycled aluminium using hydrogen-fueled production. This aligns with Hydro’s aim to expand its portfolio of low-carbon aluminium products.

Hydro also strengthened its position in the recycling sector through strategic investments. The company acquired Alumetal in Poland and purchased land in Torija, Spain, for a new aluminium recycling plant. Furthermore, Hydro announced a partnership with WAVE Aluminium to explore the use of bauxite residue as a resource, with plans to build a processing plant at Alunorte. Hydro’s dedication to reducing its carbon footprint is evident in its operations, with more than 70% of its primary aluminium production powered by renewable energy. The company’s HalZero technology and other advancements contribute to its goal of achieving net-zero emissions by 2050 or earlier. Hydro’s efforts have been recognized with the Mercedes-Benz sustainability supplier award in June 2023, reflecting its high standards in human rights and sustainability.

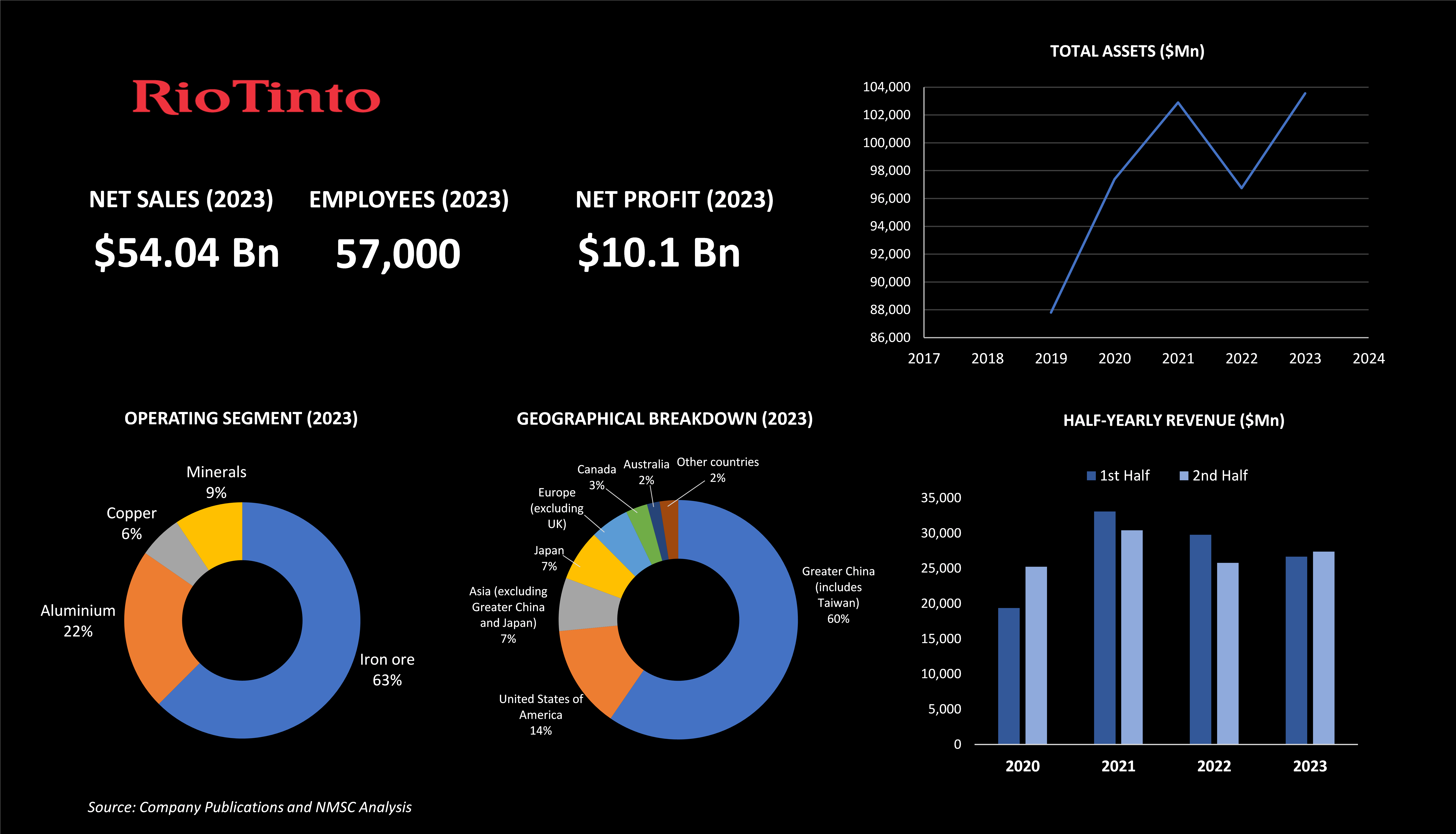

HIGHLIGHTS OF RIO TINTO

Rio Tinto, a leading global mining company, plays a significant role in the aluminium market. Established as a major player in the industry, Rio Tinto is headquartered in London, UK, and operates in 35 countries worldwide, employing around 57,000 people. For the year, 2023, Rio Tinto reported consolidated sales revenue of USD 54.04 billion, with its aluminium segment contributing USD 12.29 billion. The company’s group operating profit for 2023 was USD 14.82 billion, with significant contributions from its iron ore, copper, and mineral segments as well.

The operations of the company are spread across key regions, including Greater China (which includes Taiwan), the United States, Asia (excluding Greater China and Japan), Japan, Europe (excluding the UK), Canada, Australia, other countries (including United Kingdom). These diverse operational destinations underscore the company’s global reach and influence in the aluminium market. In terms of sustainability, Rio Tinto is deeply committed to reducing its carbon footprint. In 2023, the company invested USD 94 million in various decarbonization projects, a significant increase from the USD 86 million invested in 2022. Despite recent acquisitions that caused a temporary rise in emissions, Rio Tinto is committed to investing in projects that reduce emissions. The company aims to cut its overall emissions by more than 15% by 2025.

Rio Tinto is focusing on strategic joint ventures, acquisitions, and partnerships to enhance their market position, meet growing demands, and drive sustainability. For example, Rio Tinto’s Matalco joint venture in December 2023 and the acquisition of Turquoise Hill Resources highlight how companies are consolidating strengths and optimizing resources to meet industry demands. Additionally, their engagement in cultural initiatives, like the JawunTM secondments, reflects a broader trend of integrating social responsibility into business operations. These actions exemplify how companies are leveraging collaboration, innovation, and social responsibility to maintain leadership in their respective markets.

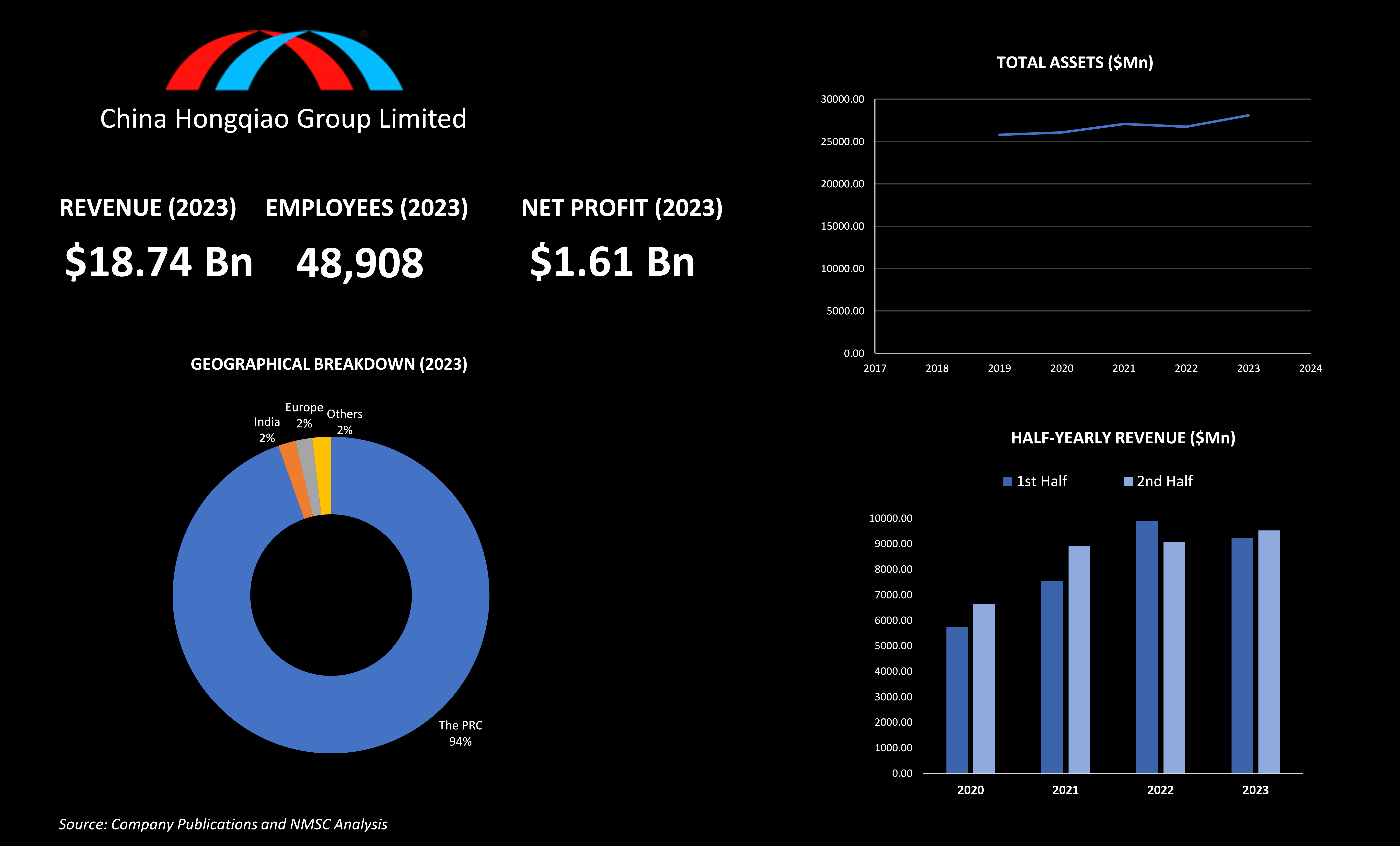

HIGHLIGHTS OF CHINA HONGQIAO GROUP LIMITED

China Hongqiao Group Limited is one of the major players in the global aluminium industry, known for its extensive operations in aluminium manufacturing and sales. Headquartered in the People's Republic of China, the company established itself as one of the leading producers through consistent growth and innovation. For the year ending December, 2023, China Hongqiao reported a revenue of approximately USD 18.74 billion, marking a 1.5% increase from the previous year. This growth was driven by higher sales volumes of aluminium alloy products and alumina. The company achieved a net profit of USD 1.61 billion, reflecting strong financial performance and operational efficiency.

Notably, the company operates in a single reportable segment that includes the manufacture and sale of aluminium products. This focused approach enabled China Hongqiao to optimize its operations and strengthen its market position. Additionally, in December 2023, China Hongqiao made a strategic acquisition by securing land use rights from Weiqiao Chuangye Group through its subsidiary, Hongxu Thermal & Power. This acquisition is expected to enhance the company's capacity and operational capabilities.

Innovation remains a key priority for China Hongqiao, with USD 140 million allocated to research and development (R&D) in 2023. This investment supports the company's efforts to advance aluminium production technologies and improve product quality, maintaining its competitive edge in the industry. As of December, 2023, China Hongqiao employed 48,908 people, an increase of 2,261 employees from the previous year. Moreover, China Hongqiao's contributions to the aluminium industry include driving advancements in production techniques and expanding its operational scale, reinforcing its role as one of the leading forces in the global aluminium market.

HIGHLIGHTS OF THE UNITED COMPANY RUSAL PLC.

United Company Rusal Plc, is one of the leading global aluminium producers that plays a significant role in the aluminium market through its extensive operations and innovative advancements. As the world’s largest producer of low-carbon aluminium, RUSAL oversees the entire production cycle from bauxite extraction to the creation of high value-added products, ensuring maximum control over product quality at every stage. Over 90% of the company’s aluminium is produced using renewable energy sources. RUSAL is committed to reducing greenhouse gas emissions by implementing innovations and energy-saving technologies, positioning itself as a pioneer in ‘green’ aluminium production, marketed under the ALLOW brand.

In 2023, RUSAL reported revenue of USD 12.21 billion and a gross profit of USD 1.76 billion, down from the previous year’s revenue of USD 13.97 billion and net profit of USD 282 million. The company operates through four reportable segments: aluminium, alumina, energy, and mining and metals, with a diversified sales geography spanning Europe, CIS, Asia and other countries. In 2023, RUSAL’s net cash spent on acquiring property, plant, and equipment totalled USD 1.05 billion, compared to USD 1.24 billion in 2022.

RUSAL’s contributions to the aluminium market are marked by significant technological advancements and investments. For example, in 2023, the company developed the RA-550 super-high amperage pots, which are highly energy-efficient, consuming less than 12,800 kWh per tonne of aluminium and reducing fluorine emissions to below 0.15 kg per tonne. These advancements set high standards for environmental sustainability in the industry.

Company is engaged in blending social responsibility with strategic growth to drive industry progress. RUSAL’s community-focused initiatives, like the "Support Matters" grants, alongside its acquisition of land use rights from Weiqiao Chuangye Group, illustrate this trend. These actions reflect how businesses are combining social investments with strategic expansions and technological advancements to enhance sustainability and set new industry standards.

HIGHLIGHTS OF ALCOA CORPORATION

Alcoa Corporation, one of the leading global players in the aluminium industry, reported a revenue of USD 10.55 billion in 2023, showcasing its strong market presence. With operations spread across 17 countries with approximately 13,600 employees, Alcoa plays a pivotal role in the aluminium industry, contributing significantly through its comprehensive portfolio that includes bauxite mining, alumina refining, aluminium smelting, and casting operations. The company is one of the major producers of value-add primary aluminium products, including billet, foundry, rod, and slab, and it offers a range of patented cast alloys and low-carbon aluminium through its Sustana line of products.

Alcoa continued to strengthen its leadership in sustainable aluminium production and integrated supply chain management. For instance, the company’s aluminium smelting portfolio was powered by 87% renewable energy in 2023, significantly exceeding its sustainability targets and reinforcing its commitment to reducing carbon emissions. The company’s bauxite production reached 41.0 million dry metric tons, making it one of the world’s largest bauxite miners, which supports its alumina refineries that were reorganized under the Alumina segment in 2023. The integrated supply chain, long-term energy arrangements, and diverse product offerings have strengthened Alcoa's position in the primary aluminium market.

Notably, Alcoa's mines and partnerships provided 83% of the materials to its refineries, while the remaining 17% was sold to other customers. The company also secured bauxite offtake agreements with South32 to ensure continued supply for long-term contracts. Additionally, Alcoa’s operations span across key locations such as Australia, Brazil, Spain, Netherlands, the United States, and the United Kingdom among others. The company owns and operates 27 locations across nine countries on six continents, including energy assets in Brazil, Canada, and the United States that supply power internally and generate revenue from third-party sales.

Through its strategic initiatives, such as the ongoing portfolio review aimed at optimizing capacity utilization and further reducing emissions, Alcoa continues to drive the aluminium industry toward a more sustainable and efficient future. In 2023, Alcoa completed the sale of its investment in MRN and announced the full curtailment of the Kwinana refinery in 2024 as part of its ongoing portfolio review. This review, expected to be completed in 2024, aims to position Alcoa as a first-quartile producer across its alumina and aluminium segments, with a goal of having up to 85% of smelting production powered by renewable energy sources.

Have questions? Inquire before purchasing the full report: https://www.nextmsc.com/aluminum-market/inquire-before-buying

SUMMARY OF ALUMINIUM MARKET

The global aluminium market is set for substantial growth, driven by a combination of rising demand across various sectors and a strong emphasis on sustainability. In recent years, the market experienced a surge in demand due to increased production in electric vehicles (EVs), which leverage aluminium for its lightweight benefits and energy efficiency. Additionally, the construction industry continues to adopt aluminium for its durability and aesthetic appeal, contributing to market expansion. A significant trend shaping the aluminium market is the push towards sustainability. Companies are increasingly adopting sustainability goals and strategies to reduce their environmental footprint. This includes investing in energy-efficient production processes, utilizing recycled aluminium, and implementing circular economy practices. The emphasis on reducing greenhouse gas emissions and improving resource efficiency is driving innovation and attracting investments in more sustainable practices. As companies align with global sustainability targets and enhance their production methods, the aluminium market is set to thrive, meeting the needs of a more eco-conscious world while contributing to the broader goals of reducing environmental impact and promoting resource efficiency.

About the Author

Sukanya Dey is a passionate and insightful writer with over three years of experience, she excels in providing clients with in-depth research and valuable insights, helping them navigate complex business challenges. She has a keen interest in various industries, including Advanced Materials, Industrial Metals, Manufacturing, Automotive, and ICT & Media. Sukanya strives to offer fresh perspectives and innovative solutions through her comprehensive research. She finds immense joy in weaving her thoughts and ideas into captivating articles and blogs, where her passion for literature and art shines through. In her free time, she enjoys reading books, cooking, filming, often drawing inspiration from these activities for her creative writing endeavours. The author can be reached at info@nextmsc.com

Sukanya Dey is a passionate and insightful writer with over three years of experience, she excels in providing clients with in-depth research and valuable insights, helping them navigate complex business challenges. She has a keen interest in various industries, including Advanced Materials, Industrial Metals, Manufacturing, Automotive, and ICT & Media. Sukanya strives to offer fresh perspectives and innovative solutions through her comprehensive research. She finds immense joy in weaving her thoughts and ideas into captivating articles and blogs, where her passion for literature and art shines through. In her free time, she enjoys reading books, cooking, filming, often drawing inspiration from these activities for her creative writing endeavours. The author can be reached at info@nextmsc.com

Add Comment

Related Blogs

Industry Giants Securing 70 percentage of the Cold Pipe Insulation Market – What Sets Them Apart

Next Move Strategy Consulting forecasts a notable upsurge in...

Exploring Closed Cell Crosslinked Foams: Advancements in Aerospace Applications

Introduction: Closed cell crosslinked foams have emerged as...

Green Innovation: Environmental Benefits Of Advanced Phase Change Materials

Introduction Advanced phase change materials (PCMs) are s...