What makes Honeywell and ABB the Giants of the DCS Market: Find Out Now

07-Oct-2024

According to Next Move Strategy Consulting analysis the global distributed control system (DCS) market valued at 29.01 billion in 2023 is expected to grow 1.5 times by reaching 44.05 billion till 2030. This growth is driven by the increasing role of DCS in managing the generation, storage, and distribution of electricity from renewable sources such as wind, solar, and hydropower. As the use of renewable energy sources rises, the power grid becomes more distributed and complex, underscoring the need for DCS to effectively integrate and manage these diverse energy inputs. Additionally, the expansion of the manufacturing and processing sectors is fuelling demand for advanced control systems that optimize production processes and enhance efficiency. Technological advancements, including the Internet of Things (IoT) and artificial intelligence (AI), are further boosting the capabilities and power of DCS systems.

DISTRIBUTED CONTROL SYSTEMS MARKET OVERVIEW

The distributed control systems (DCS) market focuses on the deployment and management of complex industrial processes and systems through distributed control architecture. A DCS integrates various components such as sensors, controllers, and actuators to monitor and control processes across different geographical locations within an industrial setup. This technology is pivotal in sectors such as manufacturing, energy, chemicals, and pharmaceuticals, where real-time monitoring, precision, and reliability are essential. The market is driven by the increasing demand for automation and process optimization, advancements in digital technologies, and the need for improved operational efficiency and safety.

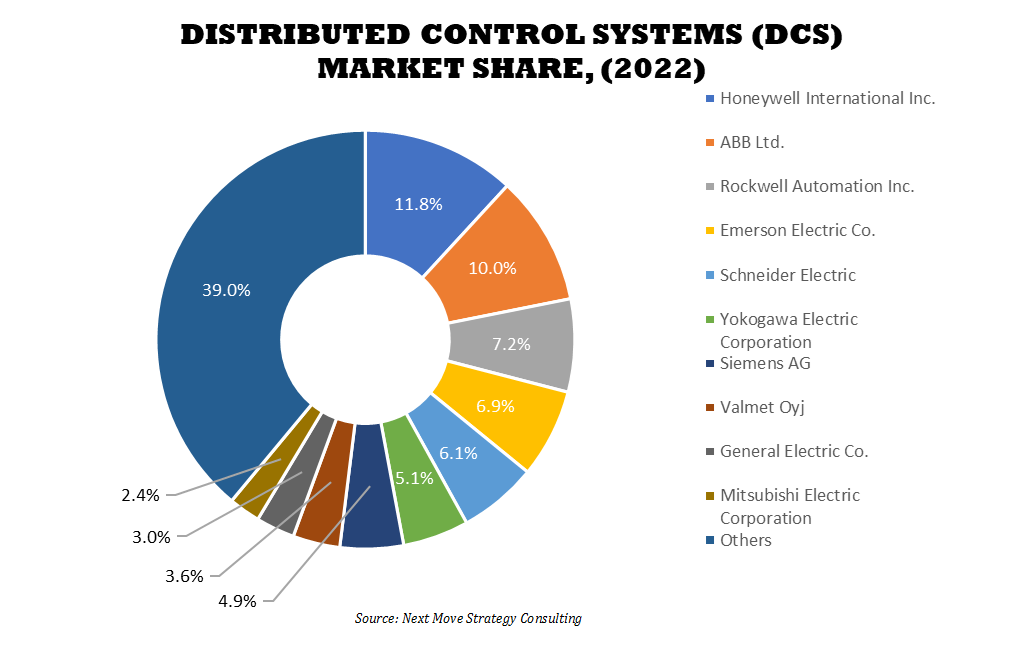

Key players within the market includes Rockwell Automation, Inc., ABB Ltd., Honeywell International, Inc., Siemens AG, Emerson Electric Co., Yokogawa Electric Corporation, Schneider Electric, Toshiba Corporation, Mitsubishi Electric Corporation, Hitachi Ltd., Valmet Oyj, Ingeteam Corporacion S.A, General Electric Co., Omron Corporation, and Azbil Corporation each contributing significantly to the industry's evolution.

For the latest market share analysis and in-depth distributed control systems industry insights, you can reach out to us at: https://www.nextmsc.com/distributed-control-system-market/request-sample

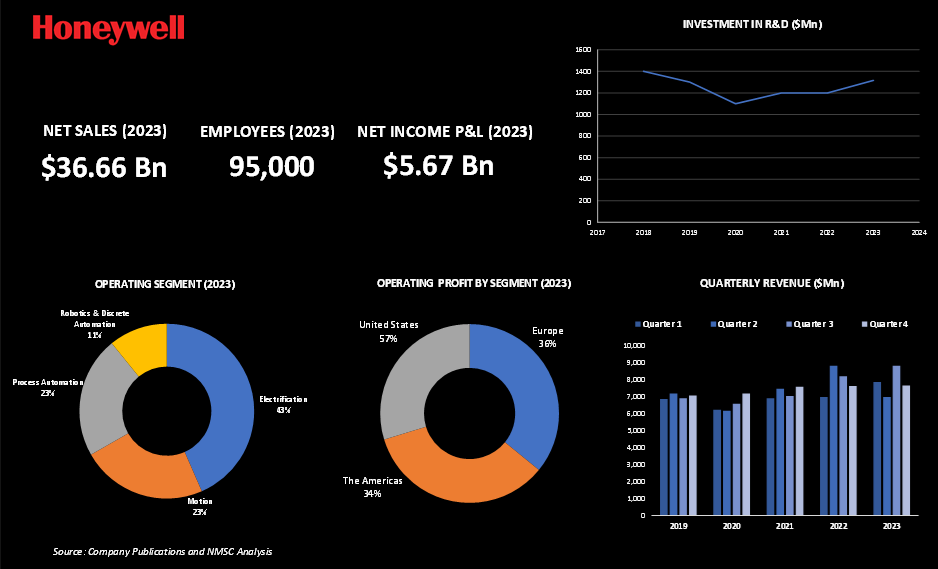

HIGHLIGHTS OF HONEYWELL INTERNATIONAL INC.

Honeywell International Inc. is one of the leading company in the DCS market, offering innovative solutions that enhance operational efficiency, safety, and productivity across various industries. The company's diverse portfolio includes advanced DCS technology, cutting-edge industrial software, and integrated automation solutions designed to meet the evolving demands of industrial enterprises. In 2023, Honeywell reported revenue of USD 36.66 billion, reflecting a 3% increase from the previous year. Demonstrating its commitment to innovation and strategic growth, Honeywell acquired U.S. Digital Designs, a public safety communications company. This acquisition bolsters Honeywell's building technologies portfolio and aligns with its ESG-focused strategy by providing enhanced situational awareness and faster response times for first responders, surpassing standard 911 calls.

Honeywell's investment in R&D reached USD 1,317 million in 2023, representing approximately 4.1% of its consolidated revenues and marking a 13% year-on-year increase. Additionally, the company allocated USD 55 million to order-related development activities. These substantial investments underscore Honeywell's dedication to advancing DCS technology and maintaining its leadership in the industrial automation sector.

The global workforce of approximately 95,000 employees across 79 countries, including 33,000 based in the United States, positions Honeywell to effectively deliver innovative DCS solutions and sustain its growth in the competitive market landscape.

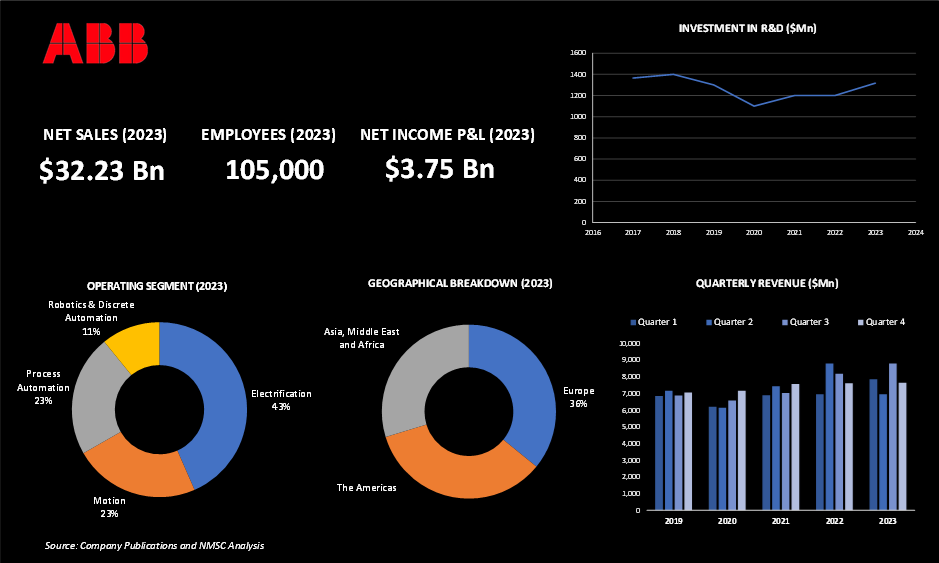

HIGHLIGHTS OF ABB LTD.

ABB Ltd., headquarter in Zurich, reported a revenue of USD 32.23 billion in 2023, marking a 9% increase from the previous year and with net income of USD 3.75 billion. This growth underscores ABB's strategic investments and expansions to address the rising demand for automation and electrification solutions. The company's portfolio includes state-of-the-art robotics, integrated automation systems, and advanced electrification technologies, all designed to meet the dynamic needs of modern industrial enterprises.

ABB's commitment to innovation and expansion is evident in its recent investments, including a USD 170 million investment in the U.S. to create approximately 400 new jobs, and a USD 280 million investment in a European robotics hub in Sweden, aimed at increasing production capacity by 50%. In 2023, ABB further strengthened its robotics & discrete automation portfolio by introducing four new robot models and 22 variants, enhancing performance and expanding its automation solutions.

The initiatives undertaken by ABB continue to solidify its position as a key player in the DCS market, driving the future of industrial automation with solutions that enhance operational efficiency and sustainability across industries globally.

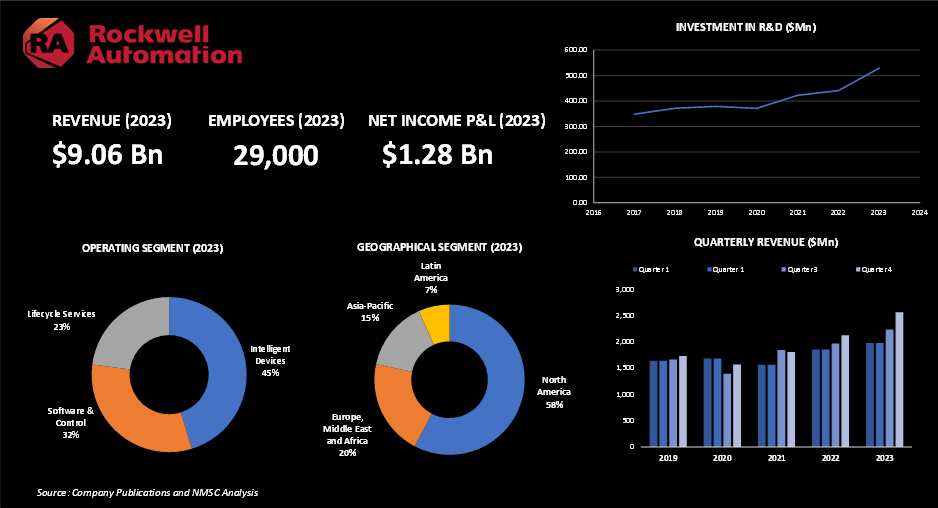

HIGHLIGHTS OF ROCKWELL AUTOMATION INC.

Rockwell Automation, Inc., headquartered in Milwaukee, Wisconsin, is one of the prominent players in the DCS industry, providing innovative industrial automation and information solutions. In 2023, the company reported significant growth with revenue reaching USD 9.05 billion, a notable increase from USD 7.76 billion in 2022. This growth reflects Rockwell Automation's strong market presence and effective strategies in delivering advanced automation solutions.

The company's operations are divided into three key segments, intelligent devices, which generated USD 4.09 billion, software & control, contributed USD 2.88 billion, and lifecycle services, bringing in USD 2.07 billion. This segmentation underscores Rockwell Automation’s comprehensive approach to serving various industrial needs, particularly in the DCS market.

Geographically, Rockwell Automation's revenue distribution in 2023 highlights its global reach, with USD 5.22 billion from North America, USD 1.87 billion from Europe, the Middle East, and Africa, USD 1.35 billion from Asia Pacific, and USD 605.4 million from Latin America. The company operates with a workforce of approximately 29,000 employees, enabling it to effectively manage its extensive operations and support its global client base.

Rockwell Automation also made significant investments in research and development, with R&D expenses reaching USD 529.5 million in 2023, up from USD 440.9 million in 2022 and USD 422.5 million in 2021. These investments reflect the company’s commitment to innovation and maintaining a competitive edge in the DCS market.

In line with its strategic growth initiatives, Rockwell Automation completed two notable acquisitions, CUBIC, a company specializing in modular systems for electrical panel construction, in October 2022, and Knowledge Lens, a services and solutions provider headquartered in Bengaluru, India, in February 2023. These acquisitions enhance Rockwell Automation’s capabilities in delivering comprehensive automation solutions and expand its reach in key markets.

The strong financial performance, ongoing investments in R&D, and strategic acquisitions position Rockwell Automation, Inc. as a leader in the industrial automation and DCS markets, offering cutting-edge solutions that drive efficiency, productivity, and innovation across various industries.

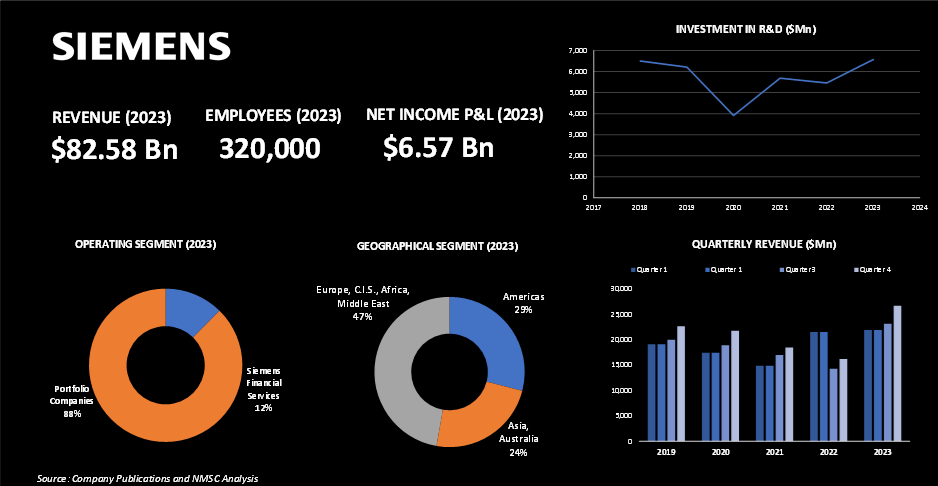

HIGHLIGHTS OF SIEMENS AG

Siemens AG headquarter in Munich, Germany is one the global leader in DCS industry, reported a revenue of USD 82.58 billion in 2023, reflecting an 8% increase from the previous year and net income of USD 6.57 billion. Siemens offers a comprehensive suite of solutions within the DCS market, including integrated automation, automation systems, industrial communication, digital enterprise services, and operator control and monitoring systems. These offerings underscore Siemens’ leadership in providing advanced and efficient DCS solutions to various industries.

In fiscal year 2023, Siemens' digital industries segment, which constitutes 57% of the company’s portfolio, launched Industrial Operations X. This innovative offering integrates IT capabilities, such as AI, low-code programming, edge computing, and cloud computing, with automation technology and digital services. Strategic collaborations, such as with Intrinsic, an Alphabet subsidiary further accelerated the integration of AI-driven robotics and automation technologies, reinforcing Siemens’ position at the forefront of DCS innovation.

Geographically, Siemens saw robust growth across key regions, with significant revenue increases in the Americas, Europe, C.I.S., Africa, and the Middle East, driven by the expansion of digital industries and smart infrastructure. In Asia and Australia, double-digit revenue growth was led by the Mobility segment, with additional contributions from digital industries and smart infrastructure.

Siemens' strategic emphasis on industrial-grade AI solutions and the integration of cutting-edge technologies into its DCS portfolio positions the company as a pivotal player in the global DCS market, driving innovation and operational efficiency in industries worldwide.

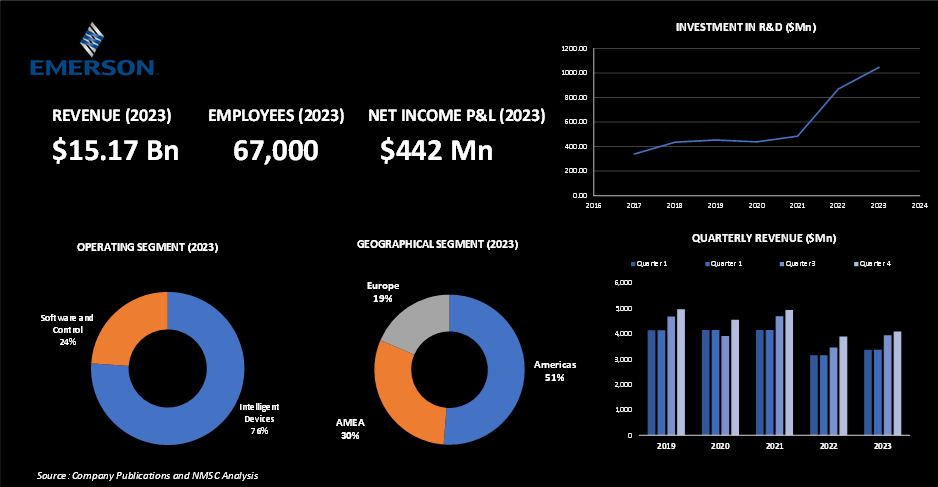

HIGHLIGHTS OF EMERSON ELECTRIC CO.

Emerson Electric Co., headquarter in Missouri, United States is one of the key players in the DCS market, reported a revenue of USD 15.17 billion in 2023, marking a 9.9% increase from USD 13.80 billion in 2022. Despite this revenue growth, the company experienced a net income loss of USD 442 million in 2023, which reflects ongoing challenges.

Emerson's operations are segmented into intelligent devices and software & control, contributing USD 11.59 billion and USD 3.64 billion respectively. Geographically, Emerson's revenue distribution in 2023 shows strong performance in the Americas (51%), followed by Asia, Middle East & Africa (30%), and Europe (19%). The company employs approximately 67,000 individuals globally.

Emerson's commitment to innovation is evident from its R&D expenses, which increased to 6.9% of sales in 2023 from 6.3% in 2022. A significant development for Emerson was the acquisition of National Instruments (NI) in October 2023, aimed at enhancing its automation capabilities and expanding its customer base in high-growth discrete industries. This acquisition aligns with Emerson's strategy to strengthen its position in the DCS market by leveraging advanced technologies and broadening its reach across various industrial sectors.

Have questions? Inquire before purchasing the full report: https://www.nextmsc.com/distributed-control-system-market/inquire-before-buying

SUMMARY OF DISTRIBUTED CONTROL SYSTEMS INDUSTRY

The DCS market is set to experience significant expansion, fueled by the increasing need for automation and the integration of renewable energy solutions. Advances in IoT and AI are playing a pivotal role, with major industry players such as Rockwell Automation, Honeywell International, ABB, Siemens, and Emerson Electric driving innovation. These companies are investing in research and development as well as strategic acquisitions to stay ahead. The market's growth underscores the growing demand for improved efficiency, process control, and digital transformation across various sectors.

ABOUT THE AUTHOR

Mrinal Deb is a dedicated and enthusiastic researcher with two years of experience. He has closely monitored several industries, such as Tech, ICT & Media, Robotics, and Electric Vehicles. He offers valuable perspectives and analysis and enjoys sharing his insights through article writing and blogging. Outside of his professional pursuits, he enjoys reading and staying informed about industry developments. The author can be reached at info@nextmsc.com

Mrinal Deb is a dedicated and enthusiastic researcher with two years of experience. He has closely monitored several industries, such as Tech, ICT & Media, Robotics, and Electric Vehicles. He offers valuable perspectives and analysis and enjoys sharing his insights through article writing and blogging. Outside of his professional pursuits, he enjoys reading and staying informed about industry developments. The author can be reached at info@nextmsc.com

Add Comment

Related Blogs

Powerhouses of Intralogistics: How Honeywell and KION are Revolutionizing the Future of Automation

The intralogistics sector is set to experience substantial g...

Flsmidth, Leading the ATLS Industry with Around 28% – Know the Reason Why

According to the NMSC, the automated truck/trailer loading s...