IT/OT Integration Market by Component (Control System, Field Devices, and Others), and by End-user (Manufacturing, Automotive, Aerospace & Defense, Semiconductor & Electronics, Energy, Chemical, Oil & Gas, Pharmaceuticals, Pulp & Paper, Metals & Mining, Food & Beverages, and Others)– Global Opportunity Analysis and Industry Forecast 2024-2030

IT/OT Integration Market Overview

The global IT/OT Integration Market size was valued at USD 51.90 billion in 2023 and is predicted to reach USD 133.70 billion by 2030 with a CAGR of 14.5% from 2024-2030

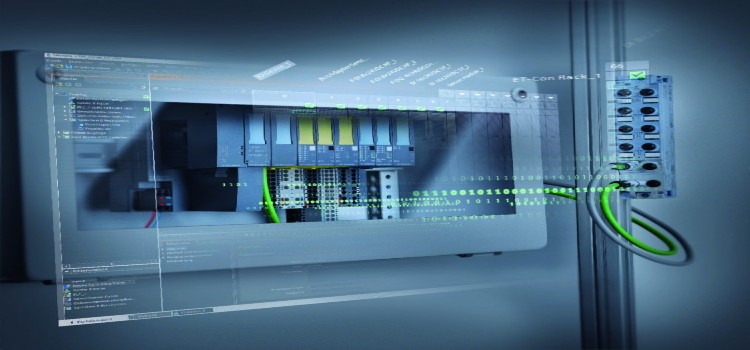

The IT/OT Integration market includes the convergence of Information Technology (IT) and Operational Technology (OT) systems to create a unified infrastructure that enhances operational efficiency, data visibility, and decision-making across industrial operations. This integration involves the alignment of IT systems, such as enterprise resource planning (ERP) and data analytics platforms, with OT systems, including industrial control systems (ICS) and supervisory control and data acquisition (SCADA) systems.

The market represents a critical evolution in how businesses manage and optimize their operations, leveraging real-time data from operational processes to drive more informed decisions, streamline workflows, and enhance productivity. Industries such as manufacturing, energy, and utilities are particularly focused on IT/OT integration due to the need for greater control over complex processes and the desire to capitalize on the benefits of Industry 4.0 technologies.

Market Dynamics and Trends

The growth of the IT OT integration market is driven by the rising Industrial Internet of Things (IoT) to enable seamless connectivity and data exchange between information technology (IT) and operational technology (OT) systems. This integration enhances real-time monitoring, predictive maintenance, and operational efficiency, leading to improved decision-making and productivity across various industries. According to a recent report by the World Bank, more than 3 out of 5 companies globally, equivalent to more than 60% of the manufacturing sector, have incorporated IoT technologies in their manufacturing or assembly processes. This widespread integration of IIoT is poised to fuels the growth of the IT-OT integration market.

Moreover, the global shift towards digitalization intensifies is further driving the adoption of digital technologies, including advanced technologies and data-driven operations to enhance efficiency. This surge in digitalization is significantly boosting the IT/OT integration market demand for IT-OT integration solutions, as companies prioritize the adoption of advanced technologies in their digital operations. According to the latest report by International Data Corporation (IDC), global spending on digital transformation is expected to reach USD 3.9 trillion by 2027, growing at a five-year compound annual growth rate (CAGR) of 16.1%. As digitalization accelerates, the need for seamless IT-OT integration becomes crucial to manage and optimize digital infrastructure effectively, driving the growth of the IT-OT integration market.

However, the high cost and complexity in integrating IT and OT systems are the major factors restraining the growth of the market. On the contrary, the introduction of Industry 5.0 and blockchain technology is expected to create significant growth opportunities for the IT-OT integration market in the coming years. Industry 5.0 focuses on the synergy between humans and machines, enhancing productivity and efficiency through advanced automation and collaborative technologies. Blockchain technology offers enhanced security, transparency, and traceability in data exchanges between IT and OT systems. Together, these innovations are set to drive advancements in IT-OT integration by improving operational efficiency, data integrity, and overall system resilience.

Market Segmentations and Scope of the Study

The IT/OT integration market share is segmented on the basis of component, end-user, and region. On the basis of component, the market is divided into control system, field devices, and others. The control system is further classified into distributed control system & SCADA, warehouse management system, plant asset management & functional safety, and human-machine interface. The field devices are further segmented into industrial sensors, industrial valves, transmitters, and actuators. On the basis of end-user, the market is divided into manufacturing, automotive, aerospace & defense, semiconductor & electronics, energy, chemical, oil & gas, pharmaceuticals, pulp & paper, metals & mining, food & beverages, and others. Regional breakdown and analysis of each of the aforesaid segments include regions comprising of North America, Europe, Asia-Pacific, and RoW.

Geographical Analysis

Asia-Pacific holds the dominant share of IT/OT integration market report and is expected to continue its dominance during the forecast period. This is attributed to factors such as the presence of one of the largest automotive industries along with the rising adoption of digital transformation in these industries to automate operations effectively.

According to the International Trade Administration, China is the largest vehicle manufacturing country in the world with domestic production expected to reach 35 million units by 2025. Such growth in the automotive industry in this region is poised to boost the IT/OT integration market growth.

Moreover, advancements in the consumer electronics industry, coupled with the adoption of artificial intelligence (AI), IoT, and big data analytics to automate and enhance manufacturing processes, are driving the growth of the market in the region. According to the Shanghai Municipal People's Government, sales in the consumer electronics industry reached USD 305 billion in 2023 and are projected to reach USD 320 billion by 2024. This growth reflects the increasing demand for integrated IT and OT solutions to optimize manufacturing efficiency and support the rapid evolution of consumer electronics.

On the other hand, North America is expected to show a steady growth in the IT/OT integration market. This is due to the highly developed healthcare industry in countries such as Canada and U.S. along with the growing adoption of electronic medical records (EMRs) and cloud-based connected healthcare systems in this region. As reported by the Centers for Medicare & Medicaid Services (CMS), the medical spendings in the U.S reached USD 4.84 trillion in 2023 as compared to USD 4.50 trillion in 2022.

Moreover, the rising investment in the renewable energy sector is boosting the growth of the IT/OT integration market. As renewable energy projects increasingly rely on advanced technologies for efficient operation and monitoring, the demand for integrated IT/OT solutions to optimize the performance of renewable energy infrastructure is on the rise. According to Clean Power, the investment in clean and renewable energy in the U.S. surpassed USD 500 billion between 2022 to 2024. Of this, approximately USD 42 billion was allocated to solar energy, and around USD 21 billion was invested in wind energy. This substantial financial commitment underscores the growing focus on sustainable energy sources, driving the expansion of the market.

Competitive Landscape

Various key players operating in the IT/OT integration industry include ABB Ltd, Siemens, Schneider Electric, Rockwell Automation, Honeywell International Inc., Emerson Electric Co., IBM Corporation, General Electric Company, Hitachi Ltd, SAP SE, and others. These companies are adopting product launches to remain dominant in the industry.

For instance, in July 2024, ABB launched the ABB Ability Field Information Manager (FIM 3.0), a digital solution aimed at enhancing engineering efficiency and productivity for field instrumentation. This latest version facilitates data-driven decision-making by bridging IT and OT with various connectivity options, enhancing data collection and management for edge and cloud applications.

Moreover, in May 2024, Siemens Digital Industries introduced the new Simatic Workstation, designed to enhance productivity and flexibility across various industries. The launched was aimed at meeting the specific needs of each sector, facilitating digital transformation of industries through innovative automation solutions.

Key Benefits

-

The IT/OT integration market report provides the quantitative analysis of the current market and estimations from 2024 to 2030. This analysis assists in identifying the prevailing market opportunities to capitalize on.

-

The study comprises of a detailed analysis of the current and future IT/OT integration market trends for depicting the prevalent investment pockets in the industry.

-

The information related to key drivers, restraints, and opportunities and their impact on the IT/OT integration market is provided in the report.

-

The competitive analysis of the market players along with their market share in the market is mentioned.

-

The SWOT analysis and Porter’s Five Forces model are elaborated in the study.

-

The value chain analysis in the market study provides a clear picture of the stakeholders’ roles.

IT/OT Integration Market Key Segments

By Component

-

Control System

-

Distributed Control System & SCADA

-

Warehouse Management System

-

Plant Asset Management & Functional Safety

-

Human Machine Interface

-

-

Field Devices

-

Industrial Sensors

-

Industrial Valves

-

Transmitters

-

Actuators

-

-

Others

By End User

-

Manufacturing

-

Automotive

-

Aerospace & Defense

-

Semiconductor & Electronics

-

Energy

-

Chemical

-

Oil & Gas

-

Pharmaceuticals

-

Pulp & Paper

-

Metals & Mining

-

Food & Beverages

-

Others

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

Rest of the World (RoW)

-

Latin America

-

Middle East

-

Africa

-

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 51.90 Billion |

|

Revenue Forecast in 2030 |

USD 133.70 Billion |

|

Growth Rate |

CAGR of 14.5% 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Key Players

-

ABB Ltd

-

Siemens AG

-

Schneider Electric SE

-

Rockwell Automation, Inc.

-

Honeywell International Inc.

-

Emerson Electric Co.

-

International Business Machines Corporation

-

General Electric Company

-

Hitachi, Ltd.

-

SAP SE

Speak to Our Analyst

Speak to Our Analyst