Netherlands Intralogistics Market by Component (Hardware, Software, and Services), and by End User Industry (Logistics, Food & Beverages, Retail & E-commerce, Automotive, Chemicals, Pharmaceuticals, Airport, and Mining) – Opportunity Analysis and Industry Forecast 2023–2030

Industry: Construction & Manufacturing | Publish Date: 05-Dec-2023 | No of Pages: 74 | No. of Tables: 50 | No. of Figures: 21 | Format: PDF | Report Code : N/A

Market Definition

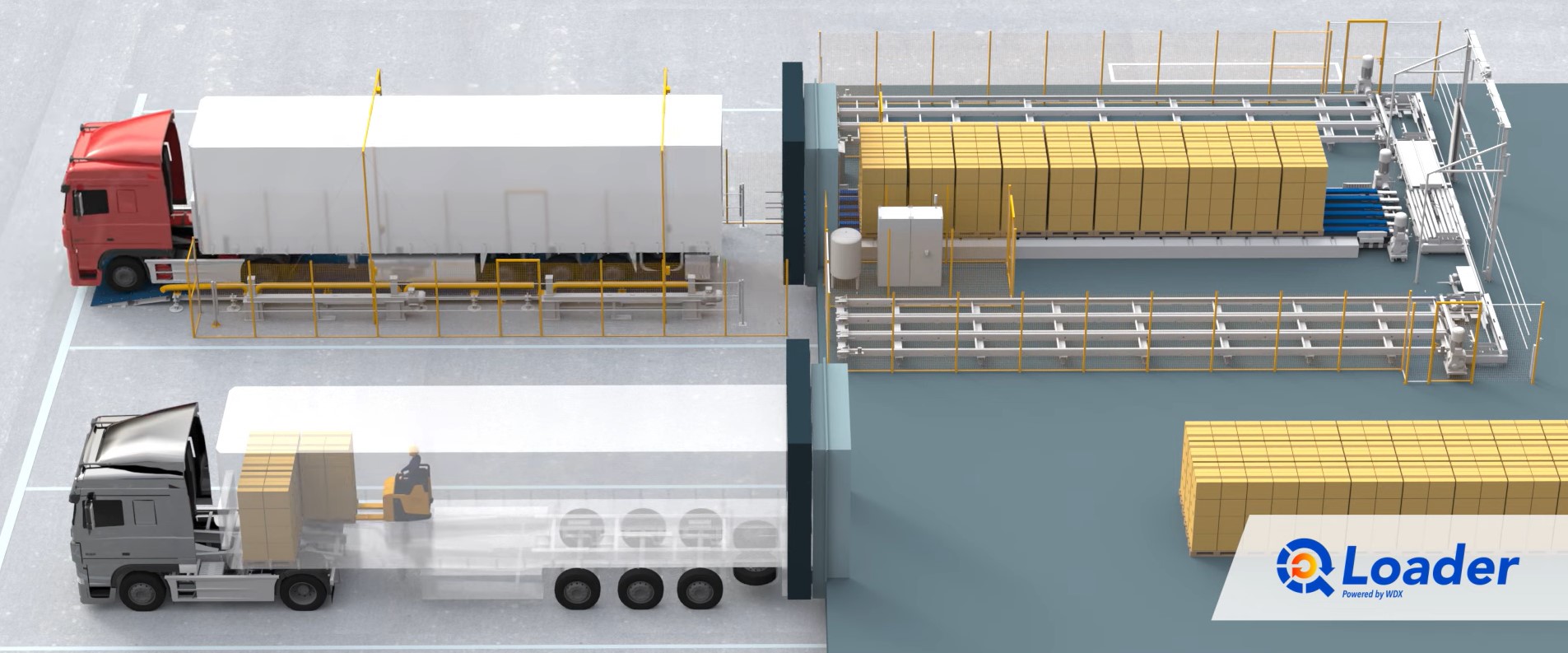

Netherlands Intralogistics Market was valued at USD 611.9 million in 2022, and is predicted to reach USD 1958.4 million by 2030, with a CAGR of 15.5% from 2023 to 2030. Intralogistics is a vital aspect of supply chain management, and its market is focused on the design, implementation, and maintenance of internal logistics systems. In order to maximise the flow of materials and effectively and economically meet the company's demands, it entails the movement, storage, and management of commodities within an organisation, such as a factory, warehouse, or distribution centre.

The intralogistics market involves the design, implementation, and maintenance of factory and warehouse systems and includes various industries such as manufacturing, retail, e-commerce, and healthcare. Material handling, inventory control, order fulfilment, and reverse logistics are some of the most frequent applications of intralogistics. The intralogistics industry is expanding as a result of rising need for quick and effective delivery, rising demand for automation, and rising demand for sustainable and environmentally friendly solutions.

Netherlands' Logistic Revolution: Robotic Intralogistics Reshaping the E-Commerce Landscape

The Netherlands is known for its advanced logistics infrastructure and e-commerce industry, making it one of the leading countries in terms of the adoption of automated intralogistics solutions such as AMRs and robotic sortation systems. Due to increasing e-commerce rivalry and the need to meet client demands for quick and efficient delivery; the deployment of these robots has increased significantly across the nation.

The Netherlands places a high value on innovation and technology, which helps the intralogistics business expand. Companies operating in the Netherlands are taking advantage of the benefits offered by automation, such as reduced labor costs, increased speed and efficiency, and improved accuracy. The use of automated intralogistics solutions such as industrial robots reduces the time and effort needed for tasks such as scanning and updating inventory, packing packages, and organizing items on shelves.

Thus, the combination of a favourable business environment and a strong e-commerce industry is driving the growth of the intralogistics market in the Netherlands. For example, GXO Logistics introduced a robotic arm for automation at its fashion e-commerce warehouse in Tilburg, the Netherlands, in December 2021.

Logistical Brilliance: Netherlands' Strategic Intralogistics Imperative for Global Supply Chain Excellence

In the context of the Netherlands, the demand for intralogistics solutions is intricately tied to the imperative for efficient supply chain management. With its strategic position as a logistical gateway in Europe, companies in the Netherlands are particularly focused on adopting advanced intralogistics systems to streamline and enhance their supply chain processes.

The need for optimized inventory management, swift order fulfillment, and overall logistics efficiency is accentuated by the country's role as a key player in international trade and distribution. Intralogistics solutions in the Netherlands, therefore, play a crucial role in ensuring that businesses can navigate the complexities of global supply chains with agility, precision, and competitiveness, reflecting the nation's commitment to maintaining a cutting-edge and efficient logistics infrastructure.

High Installation Cost of Intralogistics Systems Can Gloom the Market Prospects

The high installation cost of intralogistics systems can be a significant barrier to adoption and can limit the market prospects for these systems. Intralogistics systems typically require significant investments in technology and infrastructure, including specialized equipment, software, and hardware, as well as the cost of installation and maintenance.

Some organisations, especially small and medium-sized enterprises (SMEs), which may have limited resources to invest in these technologies, may find this high upfront cost to be prohibitive. The scale and complexity of the operation, the level of customization needed, and the level of automation requested can all have an impact on how much intralogistics systems cost. As a result, some businesses may opt for less expensive and less efficient alternatives, which can limit the growth and adoption of intralogistics systems in the market.

Unlocking Opportunities: Introduction of Drones in Intralogistics Industry to Create Future Market Prospects

The introduction of drones in intralogistics has the potential to create significant growth opportunities for businesses that rely on efficient supply chain operations. Drones, also known as unmanned aerial vehicles (UAVs), are being used in intralogistics to automate a range of tasks, including inventory management, order picking, and delivery. Businesses may increase the accuracy and speed of their operations while cutting the time and expense of manual labour and transportation by utilising drone technology. Drones can also increase the flexibility and scalability of intralogistics, allowing businesses to quickly adjust to fluctuations in demand.

Moreover, drones can improve efficiency and reduce the risk of accidents or injuries for workers who might otherwise need to use ladders or other equipment to access these areas. In addition, drones can gather information on inventory levels, product quality, and other key metrics, providing businesses with valuable insights into their operations by using sensors and cameras. This data can be used to optimize processes, improve forecasting, and reduce waste, leading to cost savings and improved efficiency. All these above-mentioned factors are expected to create growth opportunities for the intralogistics market in the near future.

Competitive Landscape

The Netherlands intralogistics industry includes several market players such as Daifuku Co. Ltd., Jungheinrich AG, Kion Group AG, Honeywell International Inc., Midea Group, Vanderlande Industries B.V., SSI Schaefer AG, KNAPP AG, Beumer Group Gmbh and Co. KG, and Autostore.

Key Benefits

-

The Netherlands intralogistics market report provides a quantitative analysis of the current market and estimations through 2023-2030 that assists in identifying the prevailing market opportunities to capitalize on.

-

The study comprises a deep dive analysis of the market trend including the current and future trends for depicting the prevalent investment pockets in the market.

-

The information related to key drivers, restraints, and opportunities and their impact on the market is provided in the report.

-

The competitive analysis of the market players along with their market share in the Netherlands intralogistics market.

-

The SWOT analysis and Porter’s Five Forces model are elaborated in the study.

-

Value chain analysis in the market study provides a clear picture of the stakeholders’ roles.

Netherlands Intralogistics Market Key Segments

By Component

-

Hardware

-

Automated Storage and Retrieval Systems (AS/RS)

-

Unit-Load AS/RS

-

Mini-Load AS/RS

-

Vertical Lift Modules (VLMs)

-

Carousel AS/RS

-

-

Industrial Robots

-

Mobile Robots

-

Automated Guided Vehicles (AGV)

-

Autonomous Mobile Robots (AMR)

-

-

Conveyor Systems

-

Sortation Systems

-

-

Software

-

Services

By End User Industry

-

Logistics

-

Food And Beverages

-

Retail And E-Commerce

-

Automotive

-

Chemicals

-

Pharmaceuticals

-

Airport

-

Mining

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2022 |

USD 611.9 Million |

|

Revenue Forecast in 2030 |

USD 1958.4 Million |

|

Growth Rate |

CAGR of 15.5% from 2023 to 2030 |

|

Analysis Period |

2022–2030 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

Demand for intralogistics solution. Growing e-commerce industry. |

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

KEY PLAYERS

-

Daifuku Co. Ltd.

-

Jungheinrich AG

-

Kion Group AG

-

Honeywell International Inc.

-

Midea Group

-

Vanderlande Industries B.V.

-

SSI Schaefer AG

-

KNAPP AG

-

Beumer Group Gmbh and Co. KG

-

Autostore

Speak to Our Analyst

Speak to Our Analyst