Europe Anti-foaming Agents Market by Type (Silicone-Based, Oil-Based, Water-Based, and Others), and by Application (Pulp & Paper, Water Treatment, Paints & Coatings, Oil & Gas, Chemical Manufacturing, Food & Beverage, and Others)– Regional Opportunity Analysis and Industry Forecast, 2025–2030

Industry: Materials and Chemical | Publish Date: 05-Apr-2025 | No of Pages: 218 | No. of Tables: 158 | No. of Figures: 83 | Format: PDF | Report Code : MC2914

US Tariff Impact on Europe Anti-foaming Agents Market

Trump Tariffs Are Reshaping Global Business

Europe Anti-foaming Agents Market Overview

The Europe Anti-foaming Agents Market size was valued at USD 1.24 billion in 2024 and is predicted to reach USD 1.64 billion by 2030, registering a CAGR of 4.4% from 2025 to 2030.

The antifoaming agents market or defoamers market refers to the manufacturing and utilization of chemicals aimed at managing and inhibiting foam generation in different industrial activities. These agents function by dismantling the foam structure and enhancing the stability of liquid that promotes smoother and more efficient processing.

They are frequently utilized in sectors such as chemicals, food and drink, pharmaceuticals, water treatment, and others for ensuring product quality. The main advantages of these agents consist of increased process efficiency, lower production expenses, and better product quality. In contrast to other solutions such as physical foam control techniques foam suppression chemicals provide more accurate and economical outcomes, making them an excellent option for industries that need reliable performance.

Expansion of Oil and Gas Sector Drives the Europe Anti-foaming Agents Market Growth

The rise in oil and gas industry drives demand for antifoaming solutions during drilling and refining processes, thereby accelerating market expansion. Eurostat states that oil and petroleum consumption in the country reached 331.7 million tonnes in 2022. The rise in the sector boosts the market growth for ensuring formulation and operational efficiency.

Government Regulations and Sustainability Goals Drive the Europe Anti-foaming Agents Market Trends

The adoption of stricter government regulations to meet environmental and operational standards on emissions and chemical safety drives the demand for antifoaming agents to control foam formation.

For example, the Detergents Regulation introduced in February 2024 in Europe enforces biodegradability requirements and limits the use of phosphates and phosphorus compounds, prompting manufacturers to adopt eco-friendly solutions. These regulatory measures increase the demand for antifoaming agents that ensure compliance while providing efficient foam control across various sectors.

Growth of the Chemical Sector in Europe Drives the Europe Anti-foaming Agents Market Expansion

The rise in expansion of chemical sector increases the demand for antifoaming agents as these solutions are essential in reducing foam formation and maintaining smooth processes and improving processing speeds.

As per European Chemical Industry Council, chemical sales in Europe reached USD 802.71 billion in 2022, increasing from USD 548.17 billion in 2012. The growth in chemical sales strengthens the need for antifoaming agents to enhance product quality, supporting the market expansion.

Impact of Residual Antifoaming Agents Limits Market Growth

Concerns over product quality pose hinders the growth of the anti-foaming agents market, as improper or excessive use alter the physical or chemical properties of end products. Residual defoamers cause discoloration or haze in transparent materials such as glass or plastics, diminishing their aesthetic appeal, raising quality concerns, and non-compliance with safety standards. These challenges make industries hesitant to adopt antifoaming agents.

Adoption of Bio-Based Antifoaming Agents Creates Future Opportunities

The shift towards sustainability is driving the usage of bio-based antifoaming agents and presenting significant market prospects in the future. These agents, derived from renewable resources provide eco-friendly alternatives and address environmental concerns.

For example, Sarex Chemicals Ltd. offers 100% active, non-silicone defoamers for various textile processes, while Evonik Industries AG introduced TEGO Foamex 8820 and 8850 that feature organic content. This shift toward green practices aligns with evolving consumer preferences and fostering innovation and positioning brands for future growth.

By Type, Silicone-Based Holds the Dominant Share in the Market

Silicone-based antifoaming agents hold the largest share in the market mainly due to better performance and widespread applicability within a wide spread of industries. These agents maintain superior foam control even in challenging conditions and offer excellent effectiveness in operations such as in oil and gas, food processes, and the treatment of wastewaters. Their stability, temperature resistance, and compatibility with various materials contribute to their widespread adoption.

By Application, Water Treatment Holds the Highest CAGR of 6.3%

The application of water treatment is expected to be the fastest growing application in the market due to the need for clean water and effective management of wastewater. As urbanization and industrial activities expand the need for advanced water treatment technologies strengthens, boosting the demand for antifoaming agents to ensure smooth operations and prevent foam related disruptions.

Germany Dominates the Europe Anti-foaming Agents Market Share

The growing pulp and paper industry rises the demand of antifoaming agents to diminish foam formation and ensure product homogeneity and rapid processing. According to the Coalition for Epidemic Preparedness Innovations, German paper and board production in 2022 added up to 21.6 million tonnes. Expansion in the sector drives demand for antifoaming agents to ensure smooth operations and consistent product quality.

Also, the expanding chemical sectors in Germany also boost demand for antifoaming agents to minimize foam, improve product consistency, and reduce equipment damage. The European Chemical Industry Council reports that the chemicals industry in Germany generated USD 238.17 billion in 2023. This growth in the chemical and pharmaceutical industries accelerates the need for effective foam control solutions, contributing to the overall market growth.

Sweden is Expected to Show Steady Growth in the Anti-foaming Agents Market Demand with a CAGR of 8.3%

The rising pharmaceutical sector creates a high demand for antifoaming agents in the country, driven by foam formation during critical processes such as fermentation, mixing, and filtration.

The Government of Sweden states that the pharmaceutical exports in the country accounted for USD 12.93 billion in 2022 that is 7.5% of exports of all product groups. This growth in production highlights the essential role of defoamers in protecting equipment and ensuring product quality, leading to increased market demand.

Additionally, the expansion of paper and pulp sector is fueling the demand for antifoaming agents driven by higher production activities and water heavy processes that lead to increased foam formation during stages such as pulping, washing, and papermaking.

The coalition for epidemic preparedness innovations states that Sweden produced 8.5 million tonnes paper and board in 2022. The surge in paper production accelerates the demand for defoamers to optimize production processes and maintain high quality paper products, further propelling market growth.

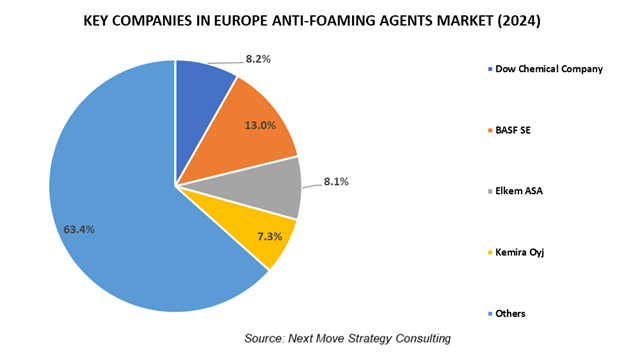

Competitive Landscape

The promising key players operating in the Europe anti-foaming agents industry include Dow Chemical Company, BASF SE, Elkem ASA, Kemira Oyj, Clariant AG, Shin-Etsu Chemical Co., Ltd., Wacker Chemie AG, Ashland Global Holdings Inc., Ecolab Inc., Evonik Industries AG, Croda International Plc, Solenis, Schill+Seilacher "Struktol" GmbH, BYK Additives, Momentive Performance Materials, Univar Solutions LLC, Arkema, Allnex Italy s.r.l,, Concentrol Chemical Solutions, CHT Silicones, and others.

These players are engaged in product launch across the region to maintain dominance in the Europe anti-foaming agents industry.

For instance, in April 2024, Evonik launched two sustainable defoamers TEGO Foamex 16 and TEGO Foamex 11 for architectural coatings. These products made with low VOC and bio-based ingredients helped address the demand for eco-friendly solutions. The defoamers improved the quality of coatings by reducing foam during production and enhancing performance.

Europe Anti-foaming Agents Market Key Segments

By Type

-

Silicone-Based

-

Oil-Based

-

Water-Based

-

Others

By Application

-

Pulp & Paper

-

Water Treatment

-

Paints & Coatings

-

Oil & Gas

-

Chemical Manufacturing

-

Food & Beverage

-

Others

Europe Anti-Foaming Agents Market Key Players

-

Dow Chemical Company

-

BASF SE

-

Elkem ASA

-

Kemira Oyj

-

Clariant AG

-

Shin-Etsu Chemical Co., Ltd.

-

Wacker Chemie AG

-

Ashland Global Holdings Inc.

-

Ecolab Inc.

-

Evonik Industries AG

OTHER NOTABLE PLAYERS

-

Croda International Plc

-

Solenis

-

Schill+Seilacher "Struktol" GmbH

-

BYK Additives

-

Momentive Performance Materials

-

Univar Solutions LLC

-

Arkema

-

Allnex Italy s.r.l

-

Concentrol Chemical Solutions

-

CHT Silicones

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 1.24 Billion |

|

Revenue Forecast in 2030 |

USD 1.64 Billion |

|

Growth Rate |

CAGR of 4.4% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

20 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst