Europe Industrial Process Automation Market by Component (Hardware, Software, and Services), by Deployment Mode (On-Premise, Cloud-Based, and Hybrid), by Organization Size (Large Enterprises, and Small and Medium Enterprises (SMEs)), by Application (Process Monitoring, Quality Control, Material Handling, Maintenance and Asset Management, and Others), by End User (Oil & Gas, Chemicals & Refining, Energy & Power, and Others) – Global Opportunity Analysis and Industry Forecast 2024-2030

Industry: Semiconductor & Electronics | Publish Date: 17-Feb-2025 | No of Pages: 277 | No. of Tables: 186 | No. of Figures: 131 | Format: PDF | Report Code : SE981

Europe Industrial Process Automation Market Overview

The Europe Industrial Process Automation Market size was valued at USD 22.01 billion in 2023, and is predicted to reach USD 31.22 billion by 2030, at a CAGR of 4.6% from 2024 to 2030. The industrial process automation sector encompasses the industry that delivers technologies and systems aimed at monitoring, controlling, and optimizing industrial operations.

It integrates advanced computer technologies, hardware, and software to automate essential processes such as inventory management, manufacturing, production, and quality control. Key technologies driving this market include sensors, programmable logic controllers (PLCs), human-machine interfaces (HMIs), and supervisory control and data acquisition (SCADA) systems.

This market caters to industries such as oil and gas, chemical processing, food and beverage, and pharmaceuticals, where automation plays a critical role in enhancing efficiency, product quality, and workplace safety. By reducing costs and minimizing human errors, industrial process automation allows companies to streamline production, resulting in higher output with greater accuracy.

As businesses increasingly seek to boost productivity and stay competitive in a rapidly automating global manufacturing landscape, the demand for automation software continues to rise.

Advancements in Automation Technology Drives the Market Growth

The rapid advancements in automation technology are significantly driving the adoption of industrial process automation market across various industries in Europe, including chemical, petrochemical, paper, and pharmaceutical sectors.

Key innovations such as collaborative robots, 5G networks, and edge computing are enabling businesses to automate increasingly complex tasks. Collaborative robots enhance operational flexibility by working alongside human operators, while 5G networks offer faster and more reliable data transmission, crucial for real-time process control.

Edge computing allows for efficient data processing at the source, reducing latency and improving decision-making. These technological advancements collectively enhance efficiency and productivity, allowing industries to streamline their operations and maintain a competitive edge in the market. By integrating these advanced technologies, companies can optimize their processes, achieve higher performance levels, and respond more effectively to evolving Europe industrial process automation market demand.

Stringent Environmental Regulations Boost the Market Growth

The stringent environmental regulations are driving the adoption of automation technologies that assist businesses in reducing waste, lowering emissions, and conserving energy. For instance, energy-efficient sensors and smart building systems are increasingly being used to minimize environmental impact while simultaneously boosting profitability.

These advanced technologies enable companies to optimize their operations, align with sustainability objectives, and achieve better financial outcomes. By implementing such solutions, businesses not only comply with regulatory requirements but also enhance their operational efficiency and economic performance. This dual benefit underscores the importance of automation in meeting both environmental and financial goals.

Lack of Standardization Hinders the Growth of Industrial Process Automation Market

The lack of standardization presents a significant challenge to the Europe industrial process automation market growth. Without established standards, vendors may create proprietary systems that are difficult to replace or upgrade. This can lead to vendor lock-in, where companies become reliant on a particular vendor's technology, limiting their ability to switch to alternative solutions.

Vendor lock-in often results in higher costs, reduced flexibility, and decreased innovation, that hinder market growth. Concerns about being restricted to a single vendor's technology may cause companies to hesitate in investing in automation systems, further impeding the Europe industrial process automation market expansion.

Industry 4.0 Technologies Paving the Way for Future Automation Opportunities

Advancements in Industry 4.0 technologies, such as the Internet of Things (IoT), cloud computing, and artificial intelligence (AI), are opening up significant opportunities for the Europe industrial process automation market trends.

These technologies allow companies to gather and analyze large amounts of data in real-time, offering valuable insights into their operations and highlighting areas for improvement. As technology evolves quickly, market participants are partnering with tech-focused companies to create new solutions based on established technologies.

Germany Holds the Dominant Market Share in Europe Industrial Process Automation Market

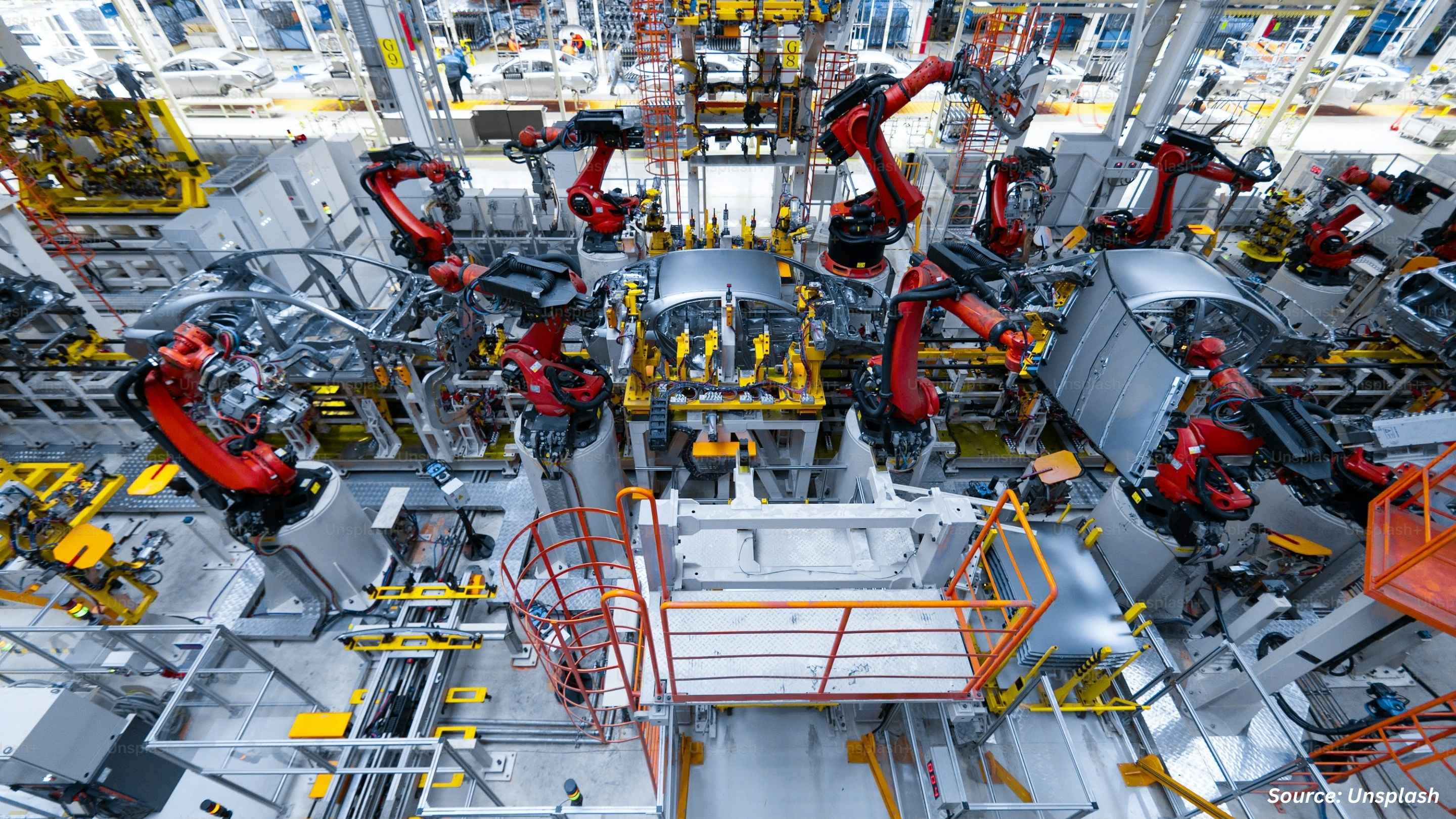

A global leader in industries such as chemical, electrical, automotive, and mechanical engineering, the demand for industrial automation solutions is rising, particularly in the automotive sector.

Major automakers such as Volkswagen, Mercedes-Benz, Audi, and Porsche are increasingly adopting automation technologies, including Human-Machine Interface (HMI) systems and industrial robots, to streamline internal logistics and meet growing consumer demand.

This trend is part of a broader rise in automation across Europe, driven by increased industrialization. With 2.9% of its GDP invested in manufacturing innovation, well above the OECD average of 2.4%, the country has solidified its leadership in global automotive manufacturing and the industrial process automation sector in Germany.

The technological advancements are playing a key role in driving the Europe industrial process automation market expansion as leading companies such as Siemens, Schneider Electric SE, and Emerson Electric Company are heavily investing in emerging technologies such as cloud computing, artificial intelligence (AI), and advanced robotics.

These innovations aim to optimize factory operations and boost productivity, showcasing the transformative impact of cutting-edge technology on the industry. As businesses increasingly adopt these technologies to enhance efficiency and remain competitive, the Europe industrial process automation market is set to experience significant growth.

Italy to Witness Substantial Growth in the Europe Industrial Process Automation Market

The diverse manufacturing sector is seeing significant growth, supported by the government's strong focus on advancing Industry 4.0. In March 2022, the Italian government allocated USD 1.01 billion through the National Recovery and Resilience Plan (PNRR) to promote Industry 4.0 initiatives. This funding aims to integrate technologies such as the Internet of Things (IoT), machine learning, and big data with physical operations, creating a more connected and efficient industrial ecosystem.

By encouraging innovative and sustainable industrial research, this governmental support is driving the adoption of industrial process automation solutions across various sectors, further strengthening the market's growth in Italy.

Some of the key players in the industrial process automation sector are strengthening their presence through strategic partnerships. For instance, in June 2021, Siemens Italy signed a Memorandum of Understanding with Tecnimont, a prominent EPC contractor, to deliver advanced digital predictive maintenance services.

This collaboration focuses on leveraging predictive maintenance technology to monitor critical plant assets, enhance operational efficiency, and reduce maintenance costs. These strategic alliances are expected to drive the growth of the industrial process automation industry by offering innovative solutions and improving industrial performance across various sectors in Italy.

Competitive Landscape

Several key players operating in the Europe industrial process automation industry include ABB Ltd., Siemens AG, Schneider Electric SE ,General Electric Co., Mitsubishi Electric Corporation, Rockwell Automation Inc., Emerson Electric Co., Honeywell International Inc, Yokogawa Electric Corporation, OMRON Corporation, Fanuc Corporation, Toshiba Corporation, KUKA AG, Bosch Rexroth AG, Delta Electronics, Inc., and others.

Europe Industrial Process Automation Market Key Segments

By Component

-

Hardware

-

Sensors and Transmitters

-

Controllers

-

Programmable Logic Controllers (PLCs)

-

Distributed Control Systems (DCS)

-

SCADA Systems

-

-

Actuators

-

Drives

-

Robotics

-

-

Software

-

Process Control Software

-

Manufacturing Execution Systems (MES)

-

Enterprise Resource Planning (ERP)

-

Simulation and Modelling Software

-

-

Services

By Deployment Mode

-

On-Premise

-

Cloud-Based

-

Hybrid

By Organization Size

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

By Application

-

Process Monitoring

-

Quality Control

-

Material Handling

-

Maintenance and Asset Management

-

Others

By End User

-

Oil & Gas

-

Chemicals & Refining

-

Energy & Power

-

Pulp & Paper

-

Metals & Mining

-

Pharmaceutical

-

Automotive

-

Others

By Country

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherland

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

Key Players

-

ABB Ltd.

-

Siemens AG

-

Schneider Electric SE

-

General Electric Co.

-

Mitsubishi Electric Corporation

-

Rockwell Automation Inc.

-

Emerson Electric Co.

-

Honeywell International Inc

-

Yokogawa Electric Corporation

-

OMRON Corporation

-

Fanuc Corporation

-

Toshiba Corporation

-

KUKA AG

-

Bosch Rexroth AG

-

Delta Electronics, Inc.

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 22.01 Billion |

|

Revenue Forecast in 2030 |

USD 31.22 Billion |

|

Growth Rate |

CAGR of 4.6% from 2024 to 2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

15 |

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst