Global Positioning System (GPS) Tracking Devices Market by Technology (Standalone Tracker, OBD Device, and Advance Tracker), by Type (Data Loggers, Data Pushers, and Data Pullers), and by End-User (Automotive, Aerospace & Defense, Healthcare, Logistics, Consumer Electronics, eCommerce, Transportation, and Others)- Global Opportunity Analysis and Industry Forecast 2024-2030

Market Definition

The Global Positioning System (GPS) Tracking Devices Market size was valued at USD 3.2 billion in 2023 and is predicted to reach USD 7.4 billion by 2030 with a CAGR of 12.8% from 2024-2030. GPS tracking devices are devices that use the Global Positioning System (GPS) to determine the location of an object or person. These devices typically use a network of satellites to triangulate the exact position of the device and then transmit that data to a central server or a user's smartphone or computer. GPS tracking devices are indispensable tools for efficient asset management, logistics, and security.

These devices provide real-time location tracking of vehicles, assets, and personnel, enabling businesses to optimize routes, enhance fleet safety, prevent theft, and streamline inventory management processes. Moreover, GPS tracking devices play a crucial role in enhancing security by monitoring critical infrastructure and personnel in hazardous environments. Through integration with IoT platforms and data analytics tools, GPS trackers offer actionable insights for operational optimization and informed decision-making, empowering industries to achieve greater efficiency, security, and competitiveness in today's dynamic business landscape.

Market Dynamics and Trends

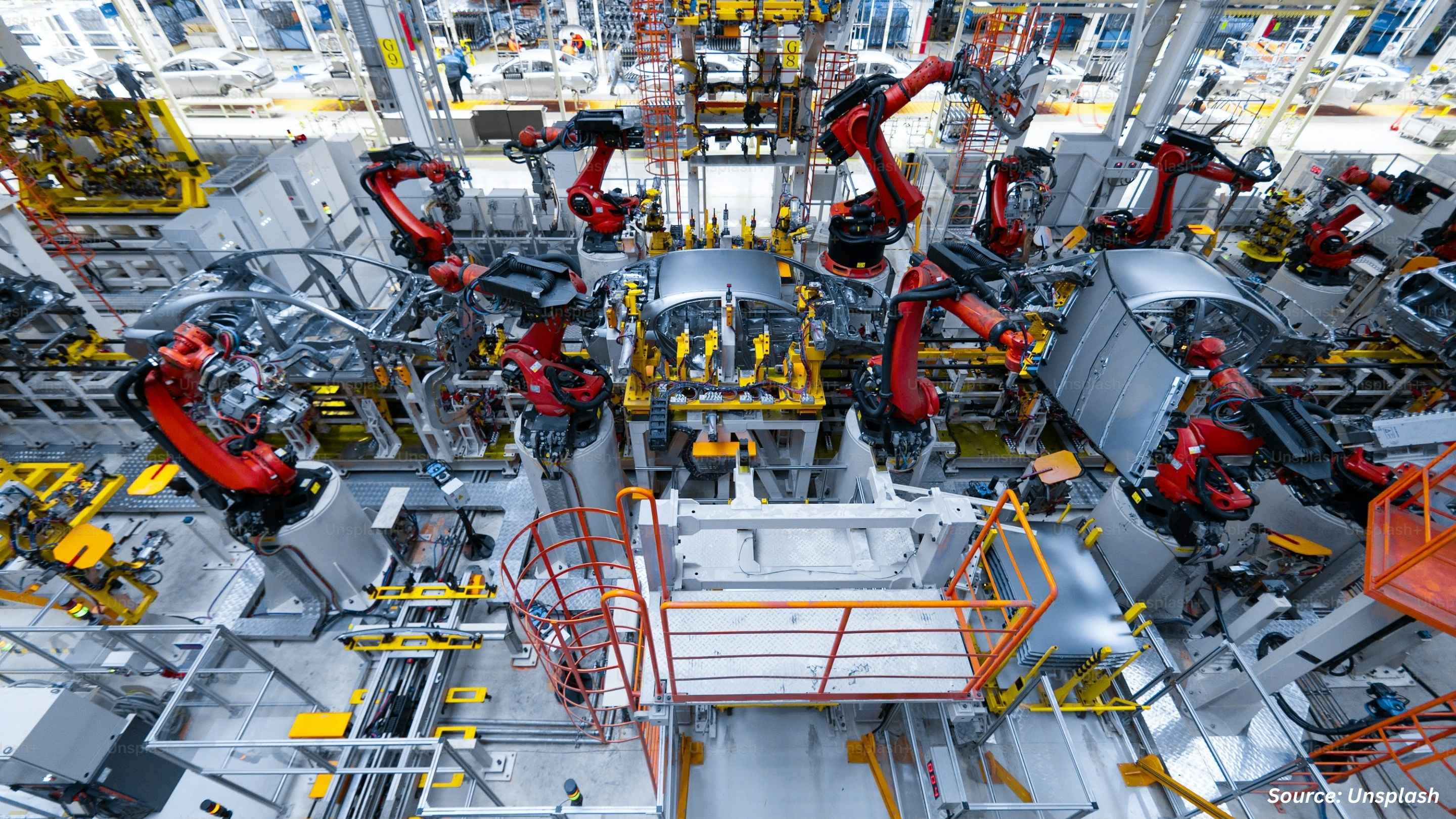

The growing adoption of GPS tracking in automobiles, aimed at monitoring the real-time location, speed, and other vital data of vehicles, is driving the expansion of the GPS-tracking devices market. This technology is increasingly being utilized to enhance the safety and security of both passengers and drivers, by allowing effective monitoring of the whereabouts and movements of their vehicles, enabling them to respond promptly to emergencies, optimize routes, and prevent unauthorized use or theft. As the demand for enhanced safety measures and efficient fleet management solutions continues to rise, the GPS-tracking devices market is experiencing significant growth and innovation to meet these evolving needs.

Moreover, with the rapid expansion of the global e-commerce and logistics industries, GPS tracking devices are becoming increasingly essential for tracking shipments and managing logistics operations. As per the latest report published by the International Trade Administration, the global e-commerce sector is experiencing substantial growth, with projections indicating a market size of USD 5.5 trillion by 2027. This surge in e-commerce activity drives the demand for efficient and reliable tracking solutions to monitor the movement of goods and ensure timely deliveries in the global marketplace.

Furthermore, the increasing adoption of smart devices such as smartwatches, fitness bands, and personal GPS trackers for various purposes such as monitoring personal fitness goals, tracking the location of children and seniors, or staying connected with friends and family is driving the growth of the GPS tracking devices market. With the rising popularity of such devices, there is a growing demand for GPS tracking capabilities to provide accurate location data and enable features including geo-fencing and emergency alerts for diverse tracking and connectivity needs.

However, concerns regarding privacy and data security along with the high initial costs associated with GPS tracking services are restraining the growth of the market. On the contrary, the integration of advanced sensors such as LIDAR and RADAR with GPS tracking devices, along with the introduction of 5G networks, is anticipated to unlock significant opportunities for the growth of the GPS tracking devices market in the foreseeable future. By combining GPS data with advanced sensors and network, tracking devices can offer more precise and reliable location information, even in challenging environments such as urban areas or adverse weather conditions.

Market Segmentations and Scope of the Study

The GPS tracking devices market share is segmented on the basis of technology, type, end-user, and region. On the basis of technology, the market is divided into standalone tracker, OBD device, and advance tracker. On the basis of type, the market is classified into data loggers, data pushers, and data pullers. On the basis of end-user, the market is segmented into automotive, aerospace & defense, healthcare, logistics, consumer electronics, ecommerce, transportation, and others. Regional breakdown and analysis of each of the aforesaid segments include regions comprising of North America, Europe, Asia-Pacific, and RoW.

Geographical Analysis

Asia Pacific holds the dominant share of GPS tracking devices market and is expected to continue its dominance during the forecast period due to the growing ecommerce industry in Asia Pacific region. According to the International Trade Administration, China is the largest e-commerce market globally as it reached USD 2.29 trillion in 2020, shipping large amount of goods everyday worldwide, and the market is expected to reach USD 3.56 trillion by 2024.

Moreover, with the increasing adoption of GPS-enabled devices such as smartphones and smart wearables to track the location of people, vehicles, and other assets in real-time, the demand for GPS tracking devices has also increased in Asia Pacific, driving the growth of the market. According to the Semiconductor Industry Association, China is the world’s largest consumer electronics manufacturing country in the world, producing 36% of the world’s consumer electronics including smartphones and wearables.

On the other hand, North America is expected to show a steady growth in the GPS tracking devices market primarily driven by the rising adoption of connected vehicles equipped with advanced features such as GPS tracking and Advanced Driver Assistance Systems (ADAS) aimed at enhancing vehicle safety. For instance, in 2023, the U.S. witnessed a notable increase in vehicle sales, with 15.6 million units sold compared to 13.9 million in 2022. This surge in connected vehicle sales underscores the growing demand for GPS tracking capabilities, as consumers seek enhanced safety and security features in their vehicles, thereby fueling market growth in North America.

Moreover, the growth of the GPS tracking devices market in this region is further propelled by increasing investments in the defense sector and the growing adoption of GPS tracking devices by military and defense organizations. These devices are utilized to enhance situational awareness, improve mission planning and execution, and ensure the safety of soldiers and assets. For instance, the U.S. Department of Defense announced a significant investment of USD 773 billion in the aerospace and defense sector for the years 2022-23, reflecting a strong commitment to modernizing defense capabilities, thus fostering the growth of the GPS tracking devices market in the region.

Competitive Landscape

Various market players operating in the GPS tracking devices market include Sierra Wireless, Orbocomm, ATrack Technology Inc, Geotab Inc., Box Telematics, Meitrack Group, Trackimo Group, Calamp Corp, Starcom System Ltd., Concox Wireless Solution, V Zone International LLC, Cyngn, Samsara Inc, TomTom Telematics, BrickHouse Security, and others. These market players are adopting various strategies such as product launches to remain dominant in the GPS tracking devices market.

For instance, in November 2022, ATrack Technology Inc. launched two OBD trackers named "AX300 OBD tracker and "AK500". Through this launch, the company aims to provide fleet managers real time insights of the vehicles and machinery such as such as fuel volume, consumption and speed, engine speed, idle time and other data.

Moreover, in October 2022, V Zone International LLC launched GPS Autopilot FO-ERP Technology. The new GPS technology allows fleet managers build smart systems for fleet operation and tools for fuel management intelligence.

Furthermore, in May 2022, Cyngn launched GPS asset tracker and IoT gateway "Infinitytracker". The new tracker can be attached to anything such as shipping containers, pallets, equipment, or vehicles and allows to view its precise location, speed, temperature, and direction of travel.

Key Benefits

-

The report provides quantitative analysis and estimations of the GPS tracking devices market from 2023 to 2030, which assists in identifying the prevailing market opportunities.

-

The study comprises a deep-dive analysis of the GPS tracking devices market including the current and future trends to depict prevalent investment pockets in the market.

-

Information related to key drivers, restraints, and opportunities and their impact on the GPS tracking devices market is provided in the report.

-

Competitive analysis of the players, along with their market share is provided in the report.

-

SWOT analysis and Porters Five Forces model is elaborated in the study.

-

Value chain analysis in the market study provides a clear picture of roles of stakeholders.

Key Market Segments

By Technology

-

Standalone Tracker

-

OBD Device

-

Advance Tracker

By Type

-

Data Loggers

-

Data Pushers

-

Data Pullers

By End-User

-

Automotive

-

Aerospace & Defense

-

Healthcare

-

Logistics

-

Consumer Electronics

-

eCommerce

-

Transportation

-

Others

By Region

-

North America

-

U.S

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

Sierra Wireless

-

Orbocomm

-

ATrack Technology Inc

-

Geotab Inc

-

Box Telematics

-

Meitrack Group

-

Trackimo Group

-

Calamp Corp

-

Starcom System Ltd

-

Concox Wireless Solution

-

V Zone International LLC

-

Cyngn

-

Samsara Inc

-

TomTom Telematics

-

BrickHouse Security

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 3.2 billion |

|

Revenue Forecast in 2030 |

USD 7.4 billion |

|

Growth Rate |

CAGR of 12.8% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst