Lubricants Market by Base Oil (Group I Base Oil, Group II Base Oil, Group III Base Oil, Group IV Base Oil, and Group V Base Oil), by Oil Type (Mineral Oil, Synthetic Oil, and Bio-based Oil), by Product Type (Engine Oil, Turbine Oil, Hydraulic Fluid, Metalworking Fluid, Gear Oil, Compressor Oil, Grease, and Others), by Distribution Channel (Online, and Offline), by End User (Transportation, and Industrial) – Global Opportunity Analysis and Industry Forecast, 2024 – 2030

US Tariff Impact on Lubricants Market

Trump Tariffs Are Reshaping Global Business

Lubricants Market Overview

The global Lubricants Market size was valued at USD 142.44 billion in 2023 and is predicted to reach USD 174.74 billion by 2030 with a CAGR of 3.0% from 2024-2030.

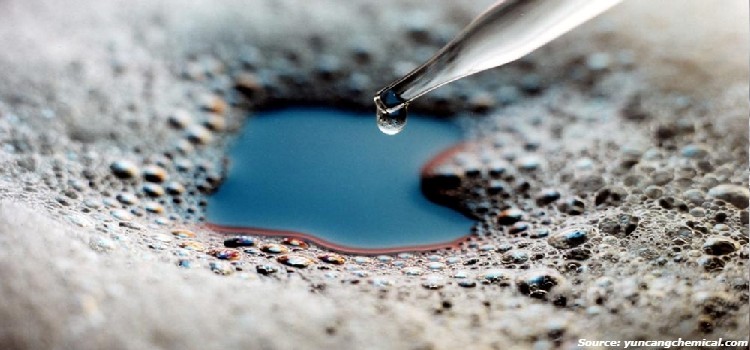

The lubricants market revolves around substances that reduce friction and wear between moving surfaces, ensuring smooth operation in machinery and equipment. Lubricants offer numerous benefits, such as improving machinery efficiency, extending equipment lifespan, and lowering maintenance costs by reducing friction, dissipating heat, and preventing corrosion.

Their importance is evident across various industries, including automotive, manufacturing, and aerospace, where they are essential for preventing breakdowns and optimizing productivity. As industrialization and technological advancements continue, the demand for high-performance and eco-friendly lubricants is expected to rise, reinforcing the lubricant market's crucial role in modern industrial operations.

Market Dynamics and Trends

Rising car sales worldwide is driving the lubricant market expansion due to the heightened demand for engine oils, transmission fluids, and other essential automotive lubricants required for regular vehicle maintenance. As per the data published in International Energy Agency (IEA), the global car sale rose from 72.86 million in 2022 to 76.67 million in 2023, marking a 5% rise within a timespan of one year. This increased vehicle ownership necessitates routine servicing to ensure optimal performance and durability, resulting in greater consumption of high-quality lubricants.

Moreover, the growing urbanization is driving growth in the market due to the heightened demand for machinery essential for urban development. The expansion of cities and rising populations lead to greater reliance on transportation and construction equipment, resulting in increased lubricant consumption to maintain optimal performance and efficiency.

According to World Bank Group data, the global urban population accounted to 57% of the total population, reflecting a 2% rise from 2021. This growing demand for lubricants plays a crucial role in supporting industries as they adapt to the needs of an increasingly urbanized population.

Also, the increasing global energy consumption drives the lubricant market demand due to increased activities in sectors such as oil and gas, power generation, and mining. The intensified exploration and production efforts creates a growing need for specialized lubricants to ensure the efficient operation of heavy machinery and equipment, including drilling rigs, turbines, and mining vehicles.

As per the data of the Energy Institute 2024, the total energy consumption in 2021 accounted to 176,840 TWh and reached 183,230 TWh by 2023, projecting a 4% rise within a span of 2 years. This surge in energy consumption emphasizes the demand for lubricants to support the efficient operation of essential machinery across key energy sectors. However, the increasing strict environmental regulations limit the use of certain chemicals, that hampers the lubricants market growth.

On the contrary, adoption of eco-friendly alternatives is expected to create ample growth opportunity for the market in the future. For instance, in September 2024, Rowe launched its sunspeed biosynthetic lubricants in the UK to reduce environmental impact while maintaining high performance. This emphasizes the potential for future growth in the industry as it embraces innovative solutions that prioritize both performance and environmental sustainability.

Market Segmentations and Scope of the Study

The lubricants market report is segmented on the basis of base-oil, product type, end-users, and region. On the basis of base-oil, the market is segmented into mineral oil, synthetic oil, and bio-based oil. On the basis of product type, the market is distributed into engine oil, turbine oil, hydraulic fluid, metalworking fluid, gear oil, compressor oil, grease, and others. On the basis of end-users, the market is classified into automotive, construction & manufacturing, aerospace, energy & power, and others. The regional breakdown includes regions such as North America, Europe, Asia-Pacific, and the Rest of the World (RoW).

Geographical Analysis

Asia-Pacific dominates the lubricants market share and is expected to continue its dominance during the forecast period. This is attributed to the increasing car sale that drives the demand for engine oils and transmission fluids necessary for vehicle maintenance. The growing number of vehicles on the roads necessitates regular servicing, making high-quality lubricants essential for ensuring optimal performance and reliability.

As per the International Energy Agency, the car sale in 2022 accounted to 20.34 million and it reached 21.32 million by 2023, projecting a 5% rise from previous year. Therefore, the surge in car sale highlights the demand for lubricants to improve efficiency and minimize wear and tear of automotive components.

Moreover, the rise in electricity production in this region fuels the need for automotive lubricants due to efficient operation and maintenance of power generation equipment such as turbines and generators.

According to the data published by International Energy Agency, the electricity production in India reached 1814 062 GWh in 2022 from 1059155 GWh in 2011, representing a substantial 71% rise over this period. This trend in electricity production highlights the crucial role of lubricants in enhancing the efficiency and reliability of power generation equipment, thereby driving growth in the lubricant market.

On the other hand, Europe is the fastest growing region in lubricants market driven by the increasing investments in infrastructure such as roads and rails that requires heavy machinery, vehicles, and equipment relying on high-performance lubricants for efficient operation.

As per European Commission, European Union invested USD 7.83 billion in sustainable, safe, and smart transport infrastructure. This surge in infrastructure investment is expected to significantly boost the demand for high-performance lubricants in this region.

Also, the presence of key market players in this region such as Telko Ltd. and Shell plc are adopting various business including business expansion that in turn boosts the market growth in this region.

For instance, in March 2024, Telko ltd. expanded its lubricants business in Western Europe enhancing its position as a leading distributor of premium industrial specialty and high-performance lubricants in France, Belgium, Luxembourg, and the Netherlands. Consequently, such expansions streamline lubricant supply, boosting market efficiency and supporting overall growth in the region.

Competitive Landscape

Various key market players operating in the lubricants industry are Shell plc, BP p.l.c., Chevron Corporation, PetroChina Company Limited, TotalEnergies SE, Sinopec Limited, ENEOS Corporation, Idemitsu Kosan Co.,Ltd., Fuchs SE, Telko Ltd., Exxon Mobil Corporation, Carl Bechem GmbH, PETRONAS Lubricants International, Phillips 66, PJSC Lukoil Oil Company, and others. These market players continue to adopt various strategies such as acquisitions and partnerships to maintain their dominance in the market.

For instance, in July 2024, TotalEnergies SE acquired Tecoil for its expertise in producing Re-Refined Base Oils (RRBOs) to enhance its production of sustainable lubricants. This acquisition enhances the companies lubricants offerings with high-quality recycled oils to meet the increasing market demand for environmentally friendly products.

Furthermore, in May 2024, Shell plc partnered with Xuzhou Construction Machinery Group Co (XCMG) to launch a new range of lubricants. This partnership merges Shell's lubrication expertise with XCMG's technology to deliver advanced lubricant solutions that optimize equipment performance and efficiency.

Also, in October 2023, Chevron Corporation partnered with HPCL to launch the Caltex lubricants brand in India. This partnership expands both companies market presence to capture the growing demand in the lubricant sector.

Key Benefits

-

The report provides quantitative analysis and estimations of the lubricants market from 2024 to 2030, which assists in identifying the prevailing industry opportunities.

-

The study comprises a deep-dive analysis of the current and future lubricants market trends to depict prevalent investment pockets in the market.

-

Information related to key drivers, restraints, and opportunities and their impact on the lubricants market provided in the report.

-

Competitive analysis of the key players, along with their market share is provided in the report.

-

SWOT analysis and Porters Five Forces model is elaborated on the study.

-

Value chain analysis in the market study provides a clear picture of roles of stakeholders

Lubricants Market Key Segments

By Base Oil

-

Group I Base Oil

-

Group II Base Oil

-

Group III Base Oil

-

Group IV Base Oil

-

Group V Base Oil

By Oil Type

-

Mineral Oil

-

Synthetic Oil

-

Bio-based Oil

By Product Type

-

Engine Oil

-

OW-20

-

OW-30

-

OW-40

-

5W-20

-

5W-30

-

5W-40

-

10W-60

-

10W-40

-

15W-40

-

Others

-

-

Turbine Oil

-

Hydraulic Fluid

-

Metalworking Fluid

-

Gear Oil

-

Compressor Oil

-

Grease

-

Others

By Distribution Channel

-

Online

-

Offline

By End User

-

Transportation

-

Passenger Vehicles

-

Commercial Vehicles

-

Aviation

-

Marine

-

Railways

-

-

Industrial

-

Construction

-

Metal Mining

-

Power Generation

-

Automotive Manufacturing

-

Chemical

-

Oil & Gas

-

Textile

-

Food Processing

-

Others

-

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

Shell plc

-

BP p.l.c.

-

Chevron Corporation

-

PetroChina Company Limited

-

TotalEnergies SE

-

Sinopec Limited

-

ENEOS Corporation

-

Idemitsu Kosan Co.,Ltd.

-

Fuchs SE

-

Telko Ltd.

-

Exxon Mobil Corporation

-

Carl Bechem GmbH

-

PETRONAS Lubricants International

-

Phillips 66

-

PJSC Lukoil Oil Company

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 142.44 Billion |

|

Revenue Forecast in 2030 |

USD 174.74 Billion |

|

Growth Rate |

CAGR of 3.0% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst