Powerhouses of Intralogistics: How Honeywell and KION Are Revolutionizing the Future of Automation

28-Apr-2025

The intralogistics industry is anticipated to witness a growth from USD 50.02 billion in 2024 to USD 115.91 billion by 2030 accounting for a CAGR of 14.7% as per the analysis of Next Move Strategy Consulting that is driven by the increase in automation technologies.

Intralogistics Market Overview

A vital component of supply chain management, the intralogistics sector involves the management of internal supply chains across factory sites, distribution centers, and warehouses. One of the main factors boosting the market is technological advancements in automations.

The rise in technological development including robotics-based picking, automatic storage and retrieval systems (AS/RS), and automatic guided vehicles (AGVs), result in better working efficiency and decrease in labour costs. Analytics and integration of the Internet of Things (IoT) also help optimize supply chain operations, equipment use, and supply management by means of real-time monitoring.

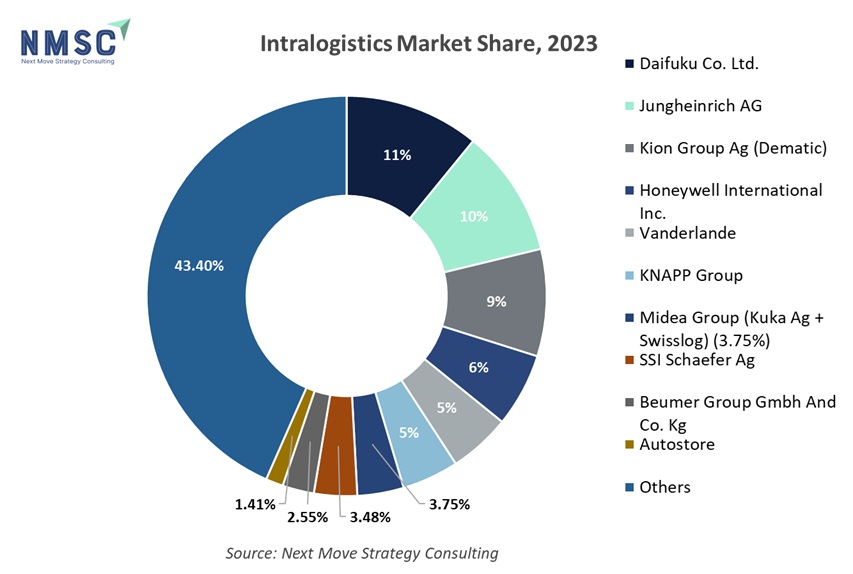

Leading companies in the intralogistics industry, includes Daifuku Co. Ltd., Jungheinrich AG, KION Group, Honeywell International Inc., Vanderlande, KNAPP Group, Midea Group (KUKA AG + Swisslog), SSI Schaefer AG, Beumer Group GmbH and Co. KG, Autostore, and others.

Start with a FREE Sample – Download Now!

For the latest market share analysis and in-depth report on Intralogistics industry insights, you can reach out to us.

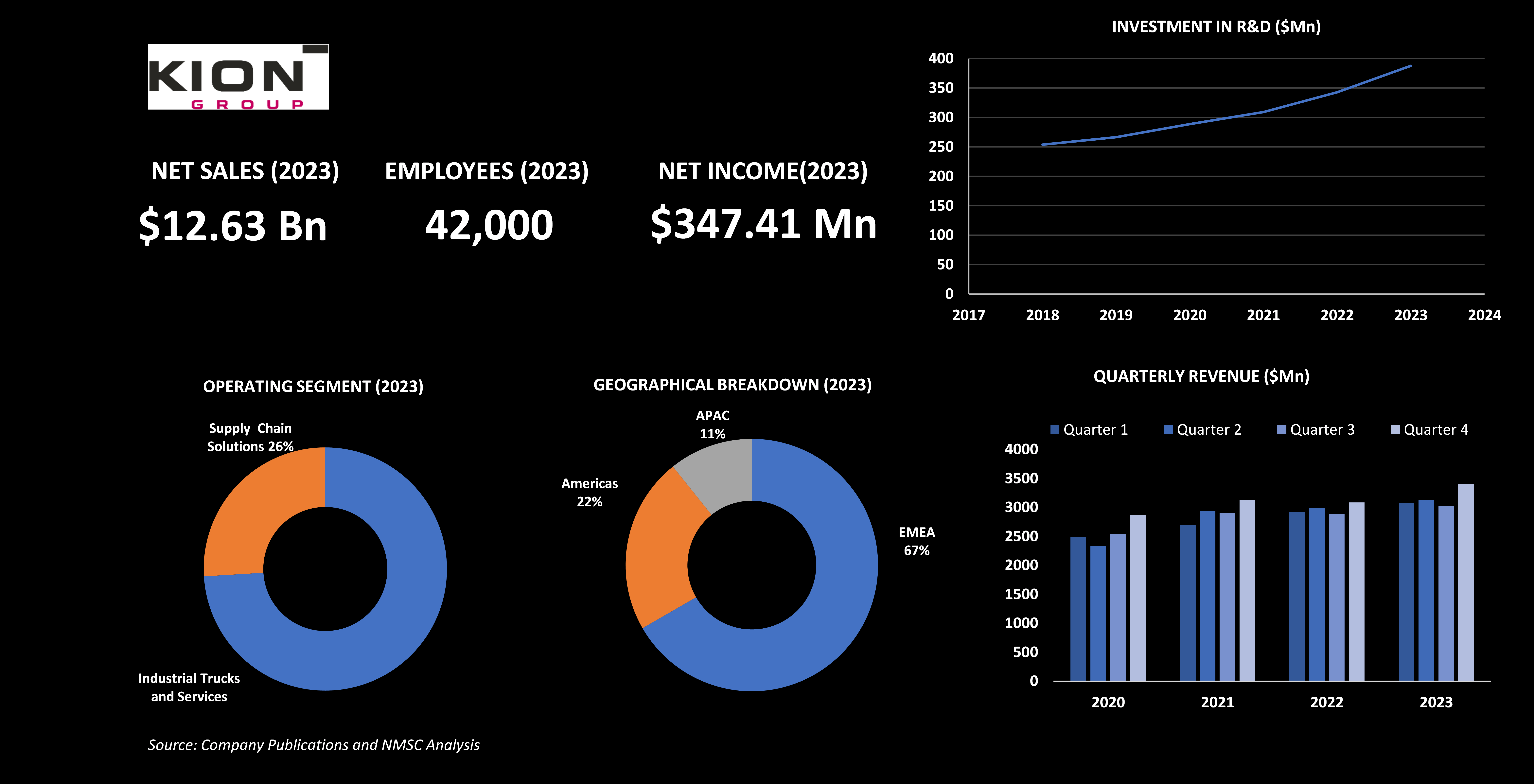

Highlights of Kion Group AG (Dematic)

The KION Group is one of the leading companies in the intralogistics business, offering a wide range of solutions designed to meet the needs of the industry. As among the world's top providers of industrial trucks and supply chain solutions, the product portfolio of KION includes high-tech warehouse trucks and forklift trucks, that form the basis for cost-effective material handling and logistic operations.

The company earned revenues of USD 12.63 billion and net income of USD 347.41 million in 2023. Their operations are segmented into three segments with industrial trucks and services accounting for 74% of their business. The company is enhancing its status as one of the leaders in the intralogistics sector by advancing integrated, automated warehouse solutions and sustainable technology.

The main milestones include setting a new Jinan, China, facility that provided 300 people employment by the end of 2024 and enlarging a Summerville, South Carolina, plant, generating close to 450 jobs by spring 2024.

Through partnerships with other organizations and planned projects such as ARIBIC, a joint Canadian-German research project to create digital twins of warehouses, and CampusOS, that is looking into open 5G networks to enhance logistics technology. KION's expanded research and development expenditure, rising by 15.6%, reflects its emphasis on automation and sustainability.

Notable artificial intelligence initiatives include AIGV in collaboration with the University of Edinburgh, that synchronizes human and autonomous robots, as well as AGENC, working on AI for the model-based representation of cyber-physical systems.

Furthermore, the LernFFZ initiative seeks to optimize autonomous forklift steering via AI observation of driver behavior. The strategic investments and innovative initiatives of the company makes it as one of the top players in the intralogistics industry, shaping future growth and technological innovation.

Highlights of Honeywell International Inc.

Honeywell Worldwide Incorporated. is among the prominent companies in the intralogistics sector due to its advanced technologies including robotics, conveyor systems, and warehouse management software. These technologies are vital in streamlining warehouse operations, that is crucial for optimizing supply chains and improving overall performance.

Honeywell Worldwide Incorporated. is among the prominent companies in the intralogistics sector due to its advanced technologies including robotics, conveyor systems, and warehouse management software. These technologies are vital in streamlining warehouse operations, that is crucial for optimizing supply chains and improving overall performance.

Through integrating Honeywell technologies, businesses transform their intralogistics processes, through enhancing accuracy and effectiveness in running their supply chain. With sales of USD 38.49 billion and operating income of USD 6.10 billion reflects the outstanding financial statements of the company in 2024.

Aerospace, Honeywell Building Technologies, Performance Materials and Technologies, and Safety and Productivity Solutions are among the major business lines of the company. Still the biggest sector by far, aerospace provides 34% of total sales.

Aerospace remains the largest segment that contributes around 40% of the total revenue. The operations of the company are mostly concentrated in the U.S., that accounts for 57% of its revenue. Honeywell allotted USD 1,317 million for research and development in 2024, up by 13% year-on-year and roughly 4. 1% of consolidated sales. This investment shows the strong commitment of the company towards technological innovation and its support for technology development in its many divisions.

Furthermore, Honeywell recently announced two significant acquisitions. The company on December, 2023, acquired Carrier Global Corporation's Global Access Solutions business for USD 5.0 billion towards third quarter in 2024.

The business is incorporated under the Honeywell Building Technologies segment. In addition, on August, 2023, Honeywell acquired SCADAfence for USD 52 million. SCADAfence, part of the Performance Materials and Technologies segment that specializes in cybersecurity for operational technology and IoT. This acquisition features USD 17 million of intangible assets and USD 42 million of non-deductible goodwill, with purchase accounting for final determination pending adjustments.

Highlights of Midea Group

Midea is a leading technology company excelling in various areas such as Smart Home, Energy Solutions, and Robotics. In 2023, the company generated around USD 52. 36 billion in total revenue and USD 5. 68 billion in net profit. The company ranked No.278 on the Fortune Global 500 and is featured in the Fortune China ESG Impact list.

Midea is a leading technology company excelling in various areas such as Smart Home, Energy Solutions, and Robotics. In 2023, the company generated around USD 52. 36 billion in total revenue and USD 5. 68 billion in net profit. The company ranked No.278 on the Fortune Global 500 and is featured in the Fortune China ESG Impact list.

The operations of the company include three primary business segments that includes the HVAC, Consumer Appliances, and Robotics and Automation Systems sectors. The HVAC segment is the largest contributor to the total revenue of the company, followed by consumer electronics.

The innovation zeal of the company is well-exemplified by its popular line of logistics robots for supporting manufacturing, warehousing, and healthcare, that reflects about the leadership of the company in industrial automation sector.

In terms of revenue generation, the company generated more than 80% of its revenue in China, and is expanding its global presence through strategic acquisitions and new joint venture establishment.

Additionally, Midea's global original brand manufacturing (OBM) business operations company also expanded extremely comprehensively, with its OBM product sales accounting for more than 40% of its overall global smart home sales in 2023. The strategic goals of the company include "Technology Leadership, Direct to Users, Digitization & Intelligence Driven, and Global Impact." Technology leadership is an initiative that is aided by massive spending on research and development operation.

Furthermore, the company is advancing technology leadership through substantial research and development investments through collaboration with the United Nations Global Compact (UNGC) to support global sustainable development. Through incorporating robotics and automation into its products and services, Midea is well placed to transform the intralogistics sector, simplifying complexity and driving innovation in supply chains.

Highlights of Daifuku Co. Ltd.

Daifuku Co., Ltd., one of the leading names in material handling, excels in providing comprehensive solutions for the movement of goods and work-in-progress. With revenues of USD 4,044.3 million and operating profit earnings amounting to USD 4.04 billion in 2023 that reflects about the financial growth of the company.

Daifuku integrates conveying, storage, sorting, and picking technologies to serve diverse industries, including food and beverage, pharmaceuticals, machinery and metal processing, and electrical appliances. The advanced logistics solutions support various manufacturing and distribution requirements with its dominant global presence, making it a prominent company of supply chain optimization.

The company’s largest share of operations is in the United States, contributing 35% of its global presence, followed by Japan at 30%. Daifuku’s robust performance is fueled by trends in automation, the expansion of e-commerce, and continuous technological advancements. At the heart of its long-term success, the company is well placed to address growing demand for efficient material handling solutions, warehouse automation innovation, and supply chain optimization end-to-end.

The state-of-the-art facility occupies 225,000 square feet and integrates operations of three earlier locations. Jervis B. Webb Company, now a part of Daifuku, operates it and specializes in manufacturing sophisticated airport bag handling systems as well as auto-guided cars, thereby increasing the capacity of production to meet rising demand in such priority areas. The shift underlines Daifuku's attention to creativity and effectiveness in the intralogistics business sector.

Highlights of Jungheinrich AG

Jungheinrich AG is one of the leading providers in the intralogistics industry, specializing in the manufacturing of industrial trucks, warehousing technology, and material flow solutions. Founded in 1953, the company became a major international market participant by offering creative goods and services that enhance logistics operations and warehouse efficiency.

Jungheinrich AG is one of the leading providers in the intralogistics industry, specializing in the manufacturing of industrial trucks, warehousing technology, and material flow solutions. Founded in 1953, the company became a major international market participant by offering creative goods and services that enhance logistics operations and warehouse efficiency.

Jungheinrich's 2023 revenue of USD 5. 5 billion and net income of USD 8 million show its market supremacy. The company operates in two main sectors that includes intralogistics and financial services, with intralogistics being the most important income source at 79% of total sales. Jungheinrich contains a global workforce of 94,605 employees, with Western Europe being its largest market, contributing to 43% of its overall revenue.

Products from Jungheinrich include electric and diesel forklifts, racking systems, AGVs, and warehouse management software. Warehouse efficiency, downtime lowering, and transport performance enhancement all depend on these items. Additionally, the company is committed towards innovation and sustainability and is devoting major capital into research and development of its energy-efficient items and technologies fit for the growing demand for environmentally friendly solutions in the logistics industry.

With its strategic emphasis on digitalization and automation, Jungheinrich is positioned to take advantage of the trends in the growth of e-commerce, Industry 4.0 transition, and growing demand for effective intralogistics solutions globally.

Summary of Intralogistics Market

Key companies such as Kion Group AG (Dematic), Honeywell International Inc., Midea Group, Ltd. Jungheinrich AG and Daifuku Co. are driving expansion in the market growth by making strategic financial commitments in automation and smart technology.

These companies are leading the way in developing advanced solutions that cut down on warehouse operations, upgrade material handling, and increase supply chain performance. By using state of the art tools including robotics, artificial intelligence systems, and IoT-based devices, they are responding to the increasing worldwide demand for effective and scalable intralogistics solutions.

Their technological focus, acquisitions, and strategic partnerships are raising moreover standards for the intralogistics sector as well as deepening their market positions. Given their strong focus on operational excellence and sustainability, these players push the market toward a next stage of innovation and efficiency.

So that businesses worldwide become more efficient and competitive, their efforts are absolutely essential in matching the growing need for effective intralogistics solutions among diverse sectors. The dynamic of the market and the scope of possible developments and advancement in supply chain management are underlined by the continuous development of intralogistics driven by these businesses.

About the Author

Sukanya Dey is a passionate and insightful writer with over three years of experience, she excels in providing clients with in-depth research and valuable insights, helping them navigate complex business challenges. She has a keen interest in various industries, including Retail and Consumer, Healthcare, Manufacturing, Automotive, and ICT & Media. Sukanya strives to offer fresh perspectives and innovative solutions through her comprehensive research. She finds immense joy in weaving her thoughts and ideas into captivating articles and blogs, where her passion for literature and art shines through. In her free time, she enjoys reading books, cooking, filming, often drawing inspiration from these activities for her creative writing endeavors. The author can be reached at [email protected]

Sukanya Dey is a passionate and insightful writer with over three years of experience, she excels in providing clients with in-depth research and valuable insights, helping them navigate complex business challenges. She has a keen interest in various industries, including Retail and Consumer, Healthcare, Manufacturing, Automotive, and ICT & Media. Sukanya strives to offer fresh perspectives and innovative solutions through her comprehensive research. She finds immense joy in weaving her thoughts and ideas into captivating articles and blogs, where her passion for literature and art shines through. In her free time, she enjoys reading books, cooking, filming, often drawing inspiration from these activities for her creative writing endeavors. The author can be reached at [email protected]

Add Comment

Related Blogs

Top 10 Companies Operating in the Global Elevator Industry

Next Move Strategy Consulting Forecasts strong growth in the global Elevator Mar...

How AI-Powered AS/RS Revolutionizing Warehouse Automation

Introduction In the contemporary fast paced global economy, the demand for ef...

TAM, SAM, VAM Insights into Germany Intralogistics Market

Introduction The Germany intralogistics market is poised for substantial grow...