Top Companies Shaping The Future Of Aluminium Production And Supply

12-Mar-2025

The aluminium sector is expected to see a mind-boggling growth of around 1.5X, from USD 222.59 billion in 2024 to about USD 302.04 billion by 2030 with a CAGR of 4.6% as per NMSC analysis. The phenomenal growth is driven by technology advancements, innovations in manufacturing, rising need for lightweight material, and an unprecedented focus on sustainability, all transforming the aluminium industry.

ALUMINIUM MARKET OVERVIEW

The aluminium market is driven by increasing demand in many sectors including aerospace, automotive, construction, and packaging. The increasing priority of sustainability and energy efficiency drives the aluminium industry and increased aluminium consumption in electric cars and renewable energy projects. Rising need for aluminium in construction and transportation is also propelled by industrialization and urbanization in developing nations.

Additionally, technical advancement in manufacturing processes including the use of inert anode technology is improving the output and environmental impact of aluminium production. Through consistent investments in research and development, these dominant firms are well-poised to capitalize on the expanding global demand for aluminium while dealing with environmental issues.

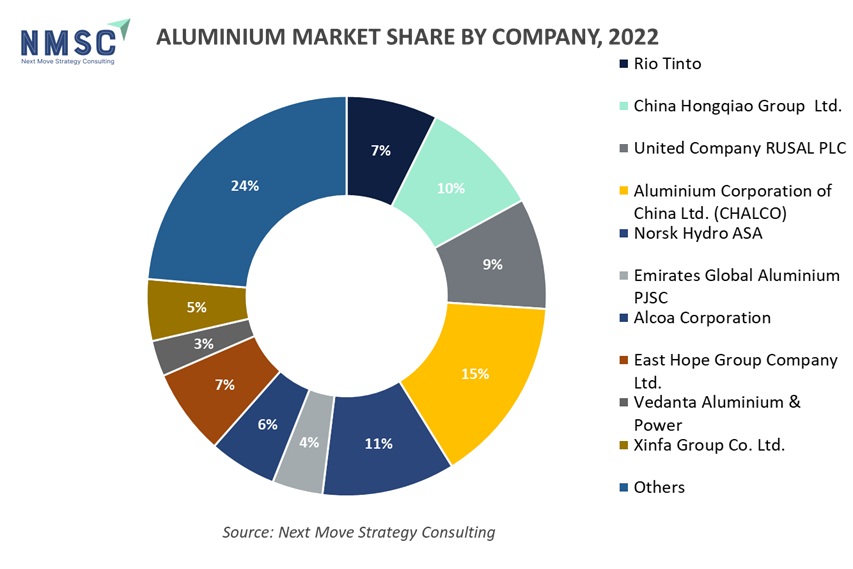

Several major companies operating in the aluminium market, includes Rio Tinto, China Hongqiao Group Limited, United Company Rusal Plc, Norsk Hydro ASA, and Alcoa Corporation among others. These companies are leaders in production capacity, innovation, and sustainability initiatives, playing a crucial role in shaping the industry's future. With ongoing investments in research and development, these key players are well-positioned to meet the growing global demand for aluminium while addressing environmental concerns.

Start with a FREE Sample – Download Now!

For the latest market share analysis and in-depth travel aluminium industry insights, you can reach out to us.

HIGHLIGTS OF RIO TINTO

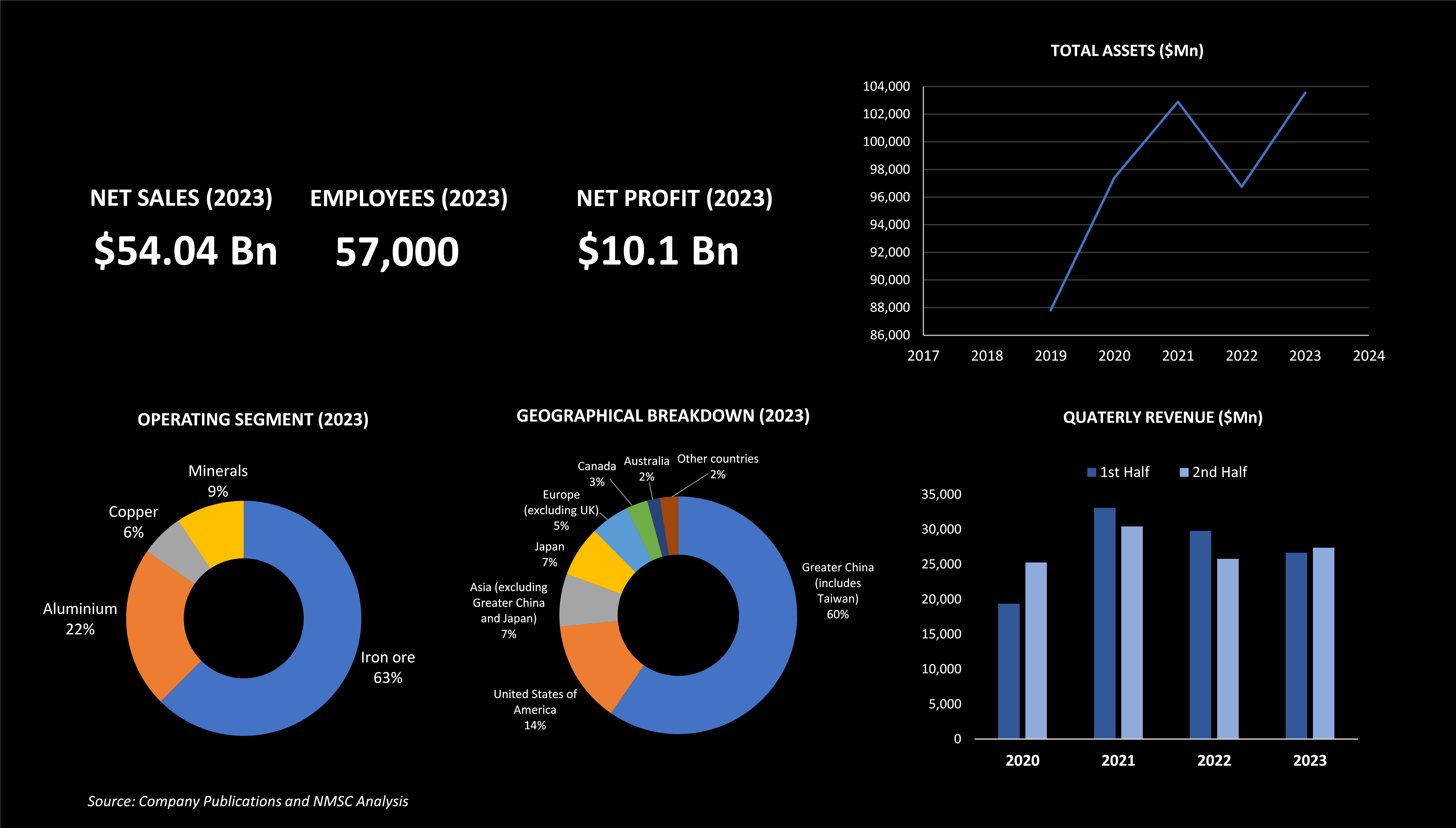

Rio Tinto is one of the global mining leaders with an important position in the aluminium market. Established as an industry giant, Rio Tinto operates from its head office at London, UK, and also operates in 35 countries throughout the world with a workforce of nearly 57,000 staff members. On the consolidated sale's revenue scale, for 2023 year, Rio Tinto recorded sales worth USD 54.04 billion, including a contribution from its aluminium unit amounting to USD 12.29 billion. The company's group operating profit for 2023 was USD 14.82 billion with significant contribution from all its iron ore, copper, and minerals segments as well.

Rio Tinto is one of the global mining leaders with an important position in the aluminium market. Established as an industry giant, Rio Tinto operates from its head office at London, UK, and also operates in 35 countries throughout the world with a workforce of nearly 57,000 staff members. On the consolidated sale's revenue scale, for 2023 year, Rio Tinto recorded sales worth USD 54.04 billion, including a contribution from its aluminium unit amounting to USD 12.29 billion. The company's group operating profit for 2023 was USD 14.82 billion with significant contribution from all its iron ore, copper, and minerals segments as well.

The operations of the company are spread over major geographies, including Greater China (Taiwan), the United States, Asia (excluding Greater China and Japan), Japan, Europe (excluding the UK), Canada, Australia, and other countries (including United Kingdom).

The operational locations of the company make its global reach and influence in the aluminium sector more diversified. On its part, Rio Tinto in sustainability is most dedicated to limiting its carbon intensity. The company spent USD 94 million on decarbonization efforts in 2023, up from USD 86 million in 2022. It aims to cut total emissions by over 15% by 2025.

A notable development in Rio Tinto's aluminium operations is the completion of the Matalco joint venture in December 2023. Additionally, Rio Tinto is progressing with the Simandou project through the Simfer joint venture. Moreover, the company involvement in cultural immersion secondments with JawunTM in Australia shows its commitment to social accountability and cooperation with Aboriginal groups and businesses.

With these strategic initiatives and ongoing funding, Rio Tinto positioned itself as one of the top players in the aluminium sector and significantly affecting the world supply of this vital material, therefore driving industry sustainability and innovation.

HIGHLIGTS OF CHINA HONGQIAO GROUP LIMITED

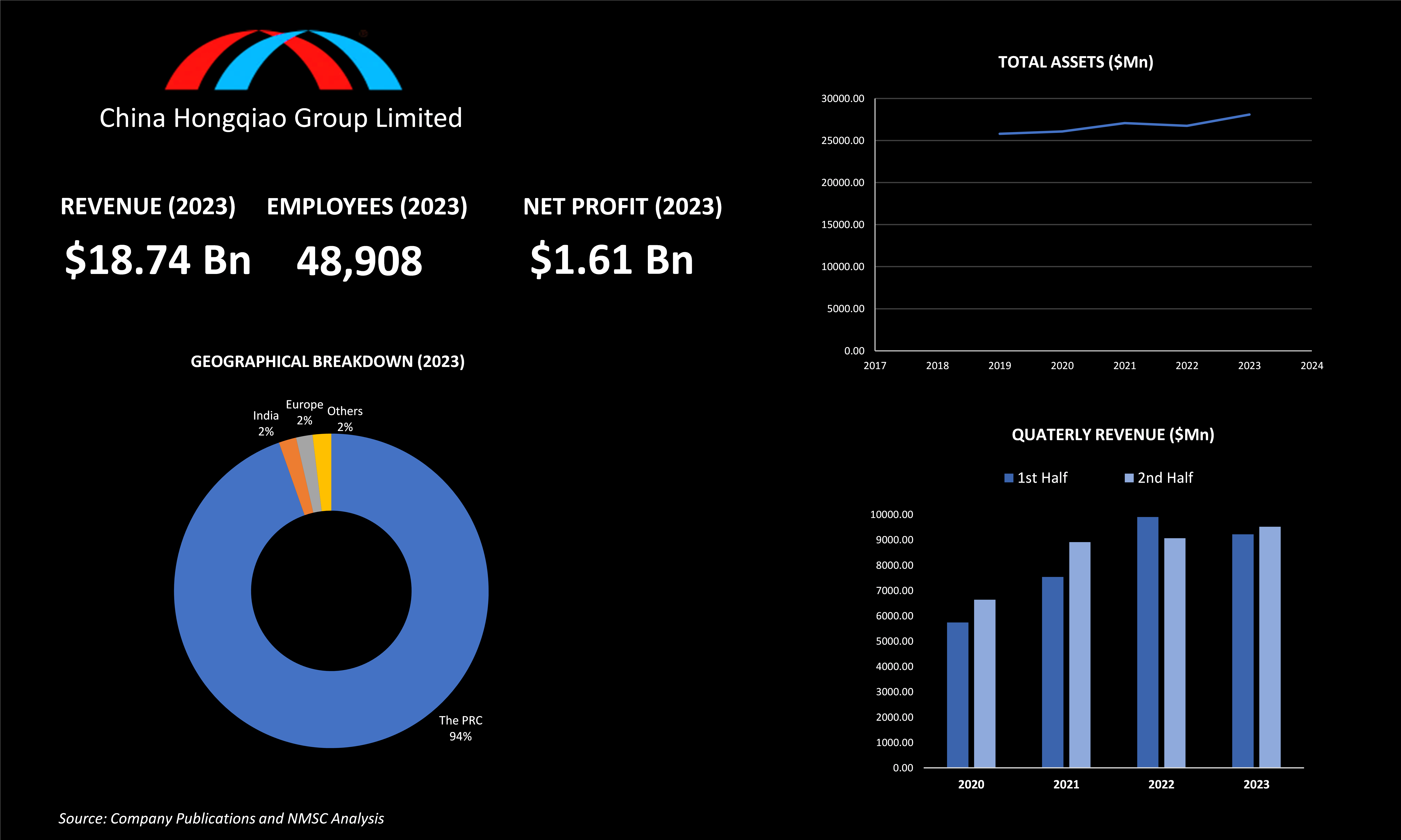

China Hongqiao Group Limited is one of the globally leading aluminium companies with a production and marketing outreach across the globe. The group is located in China and became a leading manufacturer through consistent growth and innovation. As of December 2023, revenues reached about USD 18. 74 billion, up 1. 5% from last year, driven by increased sales of alumina and aluminium alloy products. The company's business is conducted in a single reportable segment, that is, producing and selling aluminium products. Such a specialized business helped China Hongqiao improve its operations and enhance its position in the market.

China Hongqiao Group Limited is one of the globally leading aluminium companies with a production and marketing outreach across the globe. The group is located in China and became a leading manufacturer through consistent growth and innovation. As of December 2023, revenues reached about USD 18. 74 billion, up 1. 5% from last year, driven by increased sales of alumina and aluminium alloy products. The company's business is conducted in a single reportable segment, that is, producing and selling aluminium products. Such a specialized business helped China Hongqiao improve its operations and enhance its position in the market.

Furthermore, in December 2023, China Hongqiao strategically acquired land use rights from Weiqiao Chuangye Group in favor of its subsidiary, Hongxu Thermal & Power. This acquisition is expected to improve the company's ability and capacity. China Hongqiao also prioritizes innovation, investing USD 140 million in 2023.

This investment enables the company to enhance aluminium manufacturing technology and product quality, staying ahead of competitors. Besides, China Hongqiao's contribution to the aluminium industry also involves increasing the construction of production processes and increasing its scale of production in the global aluminium industry.

HIGHLIGTS OF NORSK HYDRO ASA

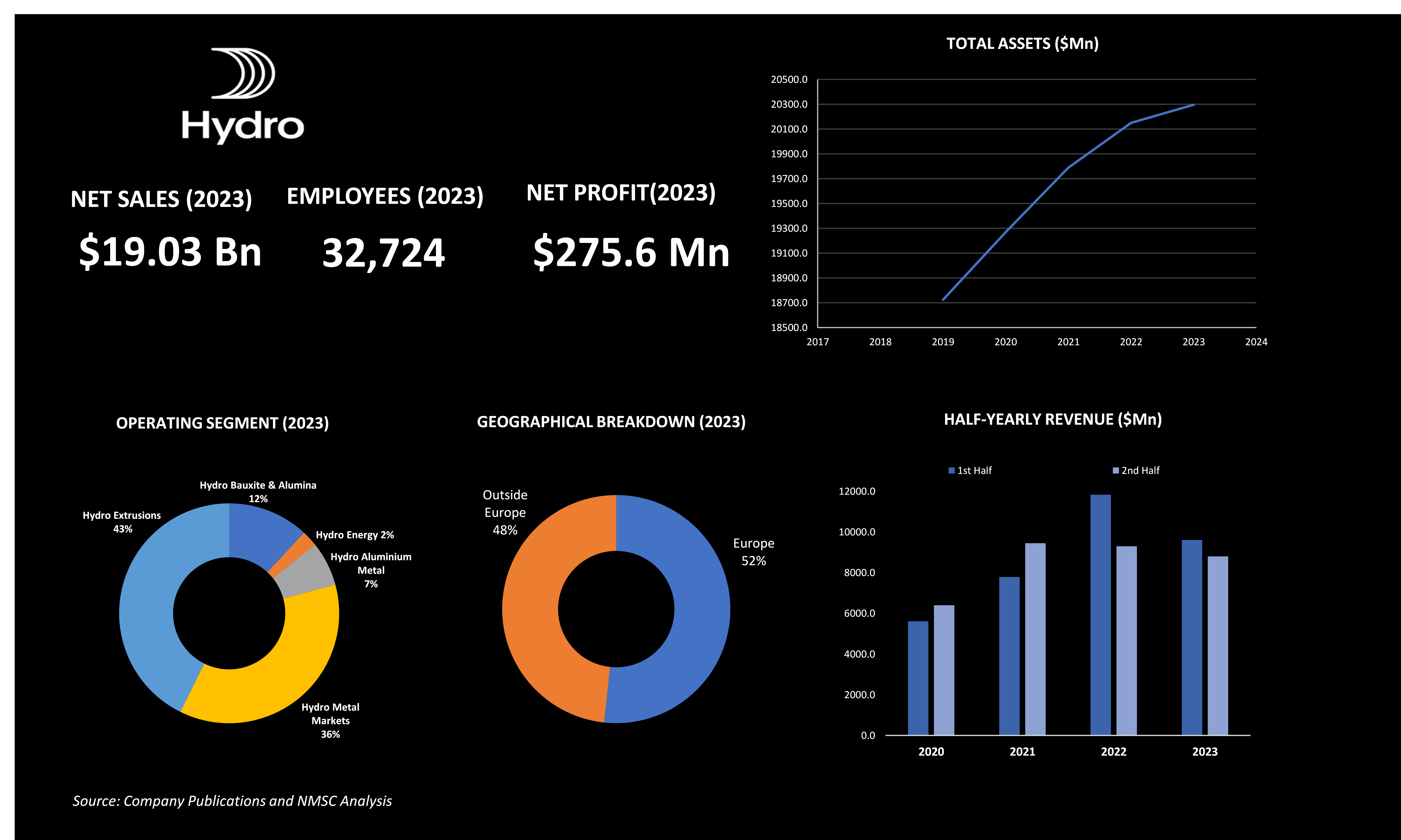

Norsk Hydro ASA, a major aluminium and renewable energy company focused on sustainability, generated a revenue of USD 19. 03 billion in 2023 compared to USD 20. 44 billion in 2022. It operates in 40 countries with 32,724 employees. Furthermore, owing to the inflated costs and strategic investments in expanding its recycling and extrusion business, the gross profit of the firm reduced from USD 2.0 billion in 2022 to USD 1.74 billion in 2023.

Hydro also completed establishment of a new aluminium recycling plant located in Cassopolis, Michigan, that includes a possible high output of 120,000 metric tonnes annually. Hydro will demonstrate its value as a multinational investing in aluminium recycling with Alumetal in Poland acquisition; land procurements for a new aluminium recycling plant in Torija, Spain; and partnership with WAVE Aluminium which will include bracing possible means of utilizing bauxite residue.resource with plans for building a processing plant at Alunorte.

The company's commitment to lowering its carbon footprint is reflected from its over 70% of its primary aluminium production uses renewable energy. Its HalZero technology aids in reaching net-zero emissions by 2050. Notably, the company advances the aluminium industry through innovation and strategic investments, emphasizing sustainability, efficiency, and recycling to shape the market's future.

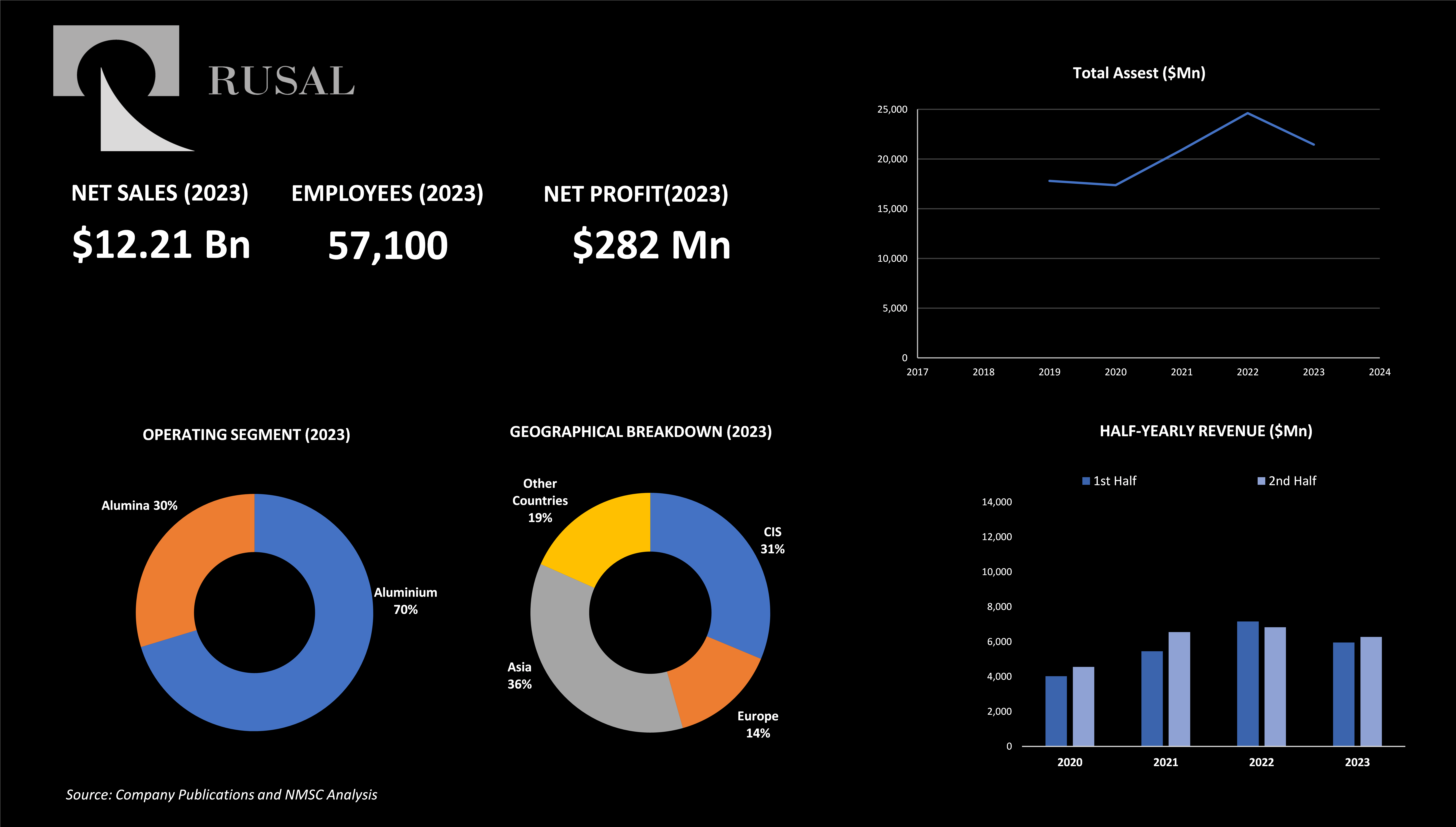

HIGHLIGTS OF THE UNITED COMPANY RUSAL PLC.

United Company Rusal Plc, is one of the top international aluminium producers that plays an important role in the aluminium industry with its far-spread operations and cutting-edge advancements. The world's largest low-carbon aluminium producer, RUSAL, controls the entire production chain from the extraction of bauxite to producing high value-added products with complete control over product quality at all stages.

More than 90% of the aluminium produced by the company comes from renewable energy resources. RUSAL is focused on minimizing greenhouse emissions through the deployment of innovations and energy-saving solutions, becoming one of the vanguard producers of 'green' aluminium, with the ALLOW trademark.

In 2023 RUSAL generated USD 12.21 billion in revenue and USD 1.76 billion in gross profit with respect to the revenue of USD 13.97 billion and a net profit of USD 282 million for the past year. The company's operation presents four major reportable segments that includes aluminium, alumina, energy, and mining and metal sectors, with a sale-oriented geographical distribution in Europe, CIS, Asia, and other regions.

Technological advancements and investments made RUSAL's success possible in the aluminium industry. In 2023 alone, RUSAL developed the RA-550 super-high amperage pots that consume about less than 12,800 kWh per ton of aluminium with respect to the energy-efficient parameters through decreased fluorine emissions of under 0.15 kg per ton.

Additionally, RUSAL is expanding its capabilities and supporting industry development through strategic investments and acquisitions. Notably, the company acquired land use rights from Weiqiao Chuangye Group in December 2023. The company is also working on a coordinated measurement system in alumina production to improve accuracy and data quality.

RUSAL’s dedication to energy-efficient technologies, research and development, and social initiatives drives the evolution of the aluminium market. Its contributions not only enhance its own operations along with it also boosts industry standards, fostering progress and sustainability within the global aluminium sector.

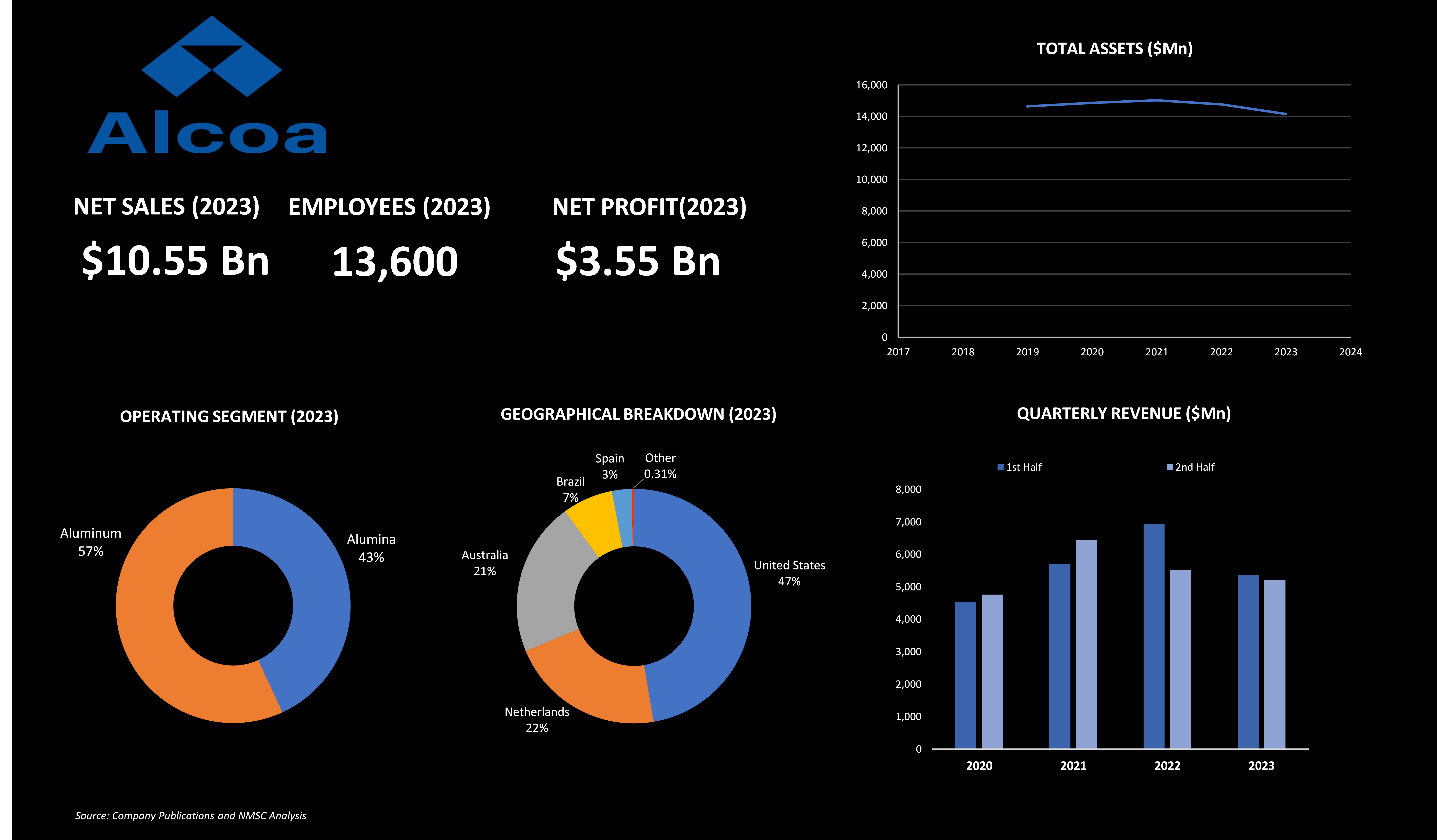

HIGHLIGTS OF ALCOA CORPORATION

Alcoa Corporation, one of the top aluminium companies, reported sales of USD 10. 55 billion in 2023. Operating in 17 countries, it dominates the industry with a complete production chain, offering various aluminium products and low-carbon options from its Sustana line.

Alcoa Corporation, one of the top aluminium companies, reported sales of USD 10. 55 billion in 2023. Operating in 17 countries, it dominates the industry with a complete production chain, offering various aluminium products and low-carbon options from its Sustana line.

Notably, Alcoa went on to hedge its place among the leaders in responsible aluminium production and integrated supply chain management. For example, aluminium smelting in 2023 saw 87% of its power supplied from renewable energy sources, far outstripping anything in terms of self-set sustainability targets, and reinforcing the company further in its focus on carbon emissions reduction.

From bauxite mining, the company produced 41.0 million dry metric tons, making it one of the largest bauxite miners in the world, serving its realigned alumina refiners under the Alumina segment in 2023.

Additionally, Alcoa's joint ventures and mines supplied 83% of the materials to its refineries, with the remaining 17% sold to other customers. Alcoa also acquired bauxite offtake agreements with South32 to guarantee long-term supply.

Furthermore, Alcoa's operations also spread across important locations such as Australia, Brazil, Spain, Netherlands, the United States, and the United Kingdom among others. The firm operates in 27 sites in nine nations on six continents, including energy properties in Brazil, Canada, and the United States that provide power internally and generate third-party sale revenue.

With its strategic programs, including its current portfolio review process to maximize capacity utilization and lower emissions further, Alcoa is pushing the aluminium sector towards a more efficient and sustainable future.

SUMMARY OF ALUMINIUM MARKET

The global aluminium market is anticipated to witness a period of tremendous growth due to the demand from a lot of industries and also due to the very strong efforts to develop sustainability. The market is experiencing very high demand in recent years, attributed primarily to the rising production of electric cars that use aluminium for not only its lightness but also its capability to save energy. Additionally, the construction industry continues to increase the use of aluminium that helped increase the market further.

On the other hand, sustainability measures adopted by business organizations, promotion of the energy effectiveness in production through the implementation of energy-saving techniques, the existence of recycled aluminium, and the contracts concluded by the companies to use the principles of the circular economy and how they re-utilize already available materials that otherwise can be emitted inside the atmosphere. Moreover, the aluminium sector, closely connected with global environmental objectives, will thrive as more companies develop their equipment and products made out of it.

About the Author

Sukanya Dey is a passionate and insightful writer with over three years of experience, she excels in providing clients with in-depth research and valuable insights, helping them navigate complex business challenges. She has a keen interest in various industries, including Retail and Consumer, Healthcare, Manufacturing, Automotive, and ICT & Media. Sukanya strives to offer fresh perspectives and innovative solutions through her comprehensive research. She finds immense joy in weaving her thoughts and ideas into captivating articles and blogs, where her passion for literature and art shines through. In her free time, she enjoys reading books, cooking, filming, often drawing inspiration from these activities for her creative writing endeavours. The author can be reached at [email protected]

Sukanya Dey is a passionate and insightful writer with over three years of experience, she excels in providing clients with in-depth research and valuable insights, helping them navigate complex business challenges. She has a keen interest in various industries, including Retail and Consumer, Healthcare, Manufacturing, Automotive, and ICT & Media. Sukanya strives to offer fresh perspectives and innovative solutions through her comprehensive research. She finds immense joy in weaving her thoughts and ideas into captivating articles and blogs, where her passion for literature and art shines through. In her free time, she enjoys reading books, cooking, filming, often drawing inspiration from these activities for her creative writing endeavours. The author can be reached at [email protected]

Add Comment

Related Blogs

Impact of Green Policies and Carbon Regulations on Aluminum Market

The aluminium market is undergoing significant transfor...

Cold Pipe Insulation Market: Why Giants Hold 70% Share

Next Move Strategy Consulting forecasts a notable upsurge in the Cold Pipe Insul...

Why Norsk Hydro Leads the Aluminium Market with 28% Share

The aluminium market is expected to see a remarkable growth of around 1.5X,...