Air Compressor Market by Type (Portable and Stationary), by Technology (Rotary Screw, Centrifugal, and Reciprocating), by Lubrication Type (Oil-Free and Oil-Injected/Flooded), by Power Rating (0-100 kW, 101-300 kW, 301-500 kW, and 501 kW & above), by Cooling Method (Air Cooled and Water Cooled), by Industry Vertical (Manufacturing, Construction, Oil & Gas, Healthcare, and Others)– Global Opportunity Analysis and Industry Forecast, 2025–2030

Industry: Construction & Manufacturing | Publish Date: 24-Jan-2025 | No of Pages: 564 | No. of Tables: 497 | No. of Figures: 461 | Format: PDF | Report Code : CM17

US Tariff Impact on Air Compressor Market

Trump Tariffs Are Reshaping Global Business

Air Compressor Market Overview

The global Air Compressor Market size was valued at USD 25.94 billion in 2024 and is predicted to reach USD 35.34 billion by 2030, with a CAGR of 4.9% from 2025 to 2030. In terms of volume the market size was 11 million units in 2024 and is projected to reach 19 million units by 2030, with a CAGR of 8.3% from 2025 to 2030.

The air compressor market also known as compressed air system market encompasses devices designed to convert power into potential energy stored in compressed air, that is used across various industrial sectors. It functions by compressing air to increase its pressure, that can then be utilized for various applications such as powering pneumatic tools, inflating tires, and supporting industrial processes. These compressors provide numerous benefits across a wide range of industries and applications.

They efficiently convert power into pressurized air, enabling the operation of pneumatic tools and enhancing tasks in construction, manufacturing, and automotive repair with greater speed and precision. The versatility of compressed air system extends to inflating tires, powering spray guns for painting, and supplying compressed air systems for HVAC systems, thereby boosting productivity and performance.

Additionally, these compressors contribute to energy savings and environmental sustainability by offering a cleaner alternative to traditional power sources and reducing the reliance on disposable aerosol cans. These reliable and portable tools are indispensable in both industrial and residential settings, making them essential for a broad spectrum of tasks.

Rapid Expansion of Construction Industry Drives Air Compressor Market Growth

The growth of the market is attributed to the growing construction industry along with the increasing need for reliable and efficient tools necessary for various construction tasks. As infrastructure projects expand, activities such as drilling, nailing, painting, sandblasting, and concrete spraying require advanced pneumatic equipment powered by compressed air system.

According to World Bank Report, 2022, the global construction industry is growing at a flourishing rate and generated a revenue of around USD 27.76 trillion in 2022. The rapid growth in both commercial and residential construction sectors amplify the need for technologically advanced industrial air compressors solutions, that are essential for powering complex tools and machinery. As a result, the flourishing construction industry significantly boosts the market by necessitating these critical devices for efficient and effective construction operations.

Global Surge in Demand for Oil and Gas Industry Drives the Air Compressor Market Trends

The surge in oil demand drives the need for portable air compressors, as they play a critical role in the oil and gas industry, particularly in exploration, extraction, refining, and transportation processes.

According to the 2023 International Agency report, global oil demand is projected to reach 105.7 million barrels per day by 2028. These compressors are essential for powering pneumatic tools, providing compressed air. As oil production and refining activities escalate to meet growing global energy demands, the reliance on efficient and durable compressed air systems increases, fueling the air compressor market demand.

High Initial and Maintenance Cost Restrains the Market Growth

The high initial investment required for air compressors, coupled with regular maintenance needs such as filter replacements, lubrication, and inspections, contributes to the overall cost of ownership. This financial burden serves as a barrier to the expansion of the market. Consequently, many small and medium-sized enterprises are reluctant to invest in new compressed air system systems or to upgrade their existing ones, potentially hindering the air compressor market expansion.

Integration of IoT Sensors and Cloud Platforms Offers Promising Opportunities for Market Expansion

Integrating air compressors with IoT sensors and cloud platforms is expected to create future growth opportunities for the market by enabling remote monitoring, predictive maintenance, and optimization of compressor performance. IoT sensors installed on compressed air system collect real-time data on various parameters such as temperature, pressure, and energy consumption.

This data is then transmitted to cloud platforms where advanced analytics algorithms analyze it to detect potential issues, predict maintenance needs, and optimize compressor operations. By leveraging IoT and cloud technologies, companies can reduce downtime, enhance equipment reliability, and optimize energy efficiency, thus driving the demand for smart compressed air system and fostering market growth.

By Type, Stationary Air Compressor Holds the Dominant Share in the Market

Stationary holds the dominant share of approximately 59.1% in the type segment of the market as it offers higher output capacities and prolonged duty cycles compared to portable models, making them ideal for continuous and heavy-duty applications in industrial settings.

The high capacity and continuous operation capabilities of stationery compressed air system allows its application in various industries such as manufacturing, construction, and mining extensively utilize stationary air compressors for tasks such as powering assembly lines, operating heavy machinery, and running pneumatic tools.

By Industry Vertical, Construction, holds the highest CAGR of 6.9%

The construction industry boasts the highest CAGR of 6.9%, driven by the critical role air compressors play in various tasks. In painting and finishing, compressed air system provide consistent air pressure for spray painting, achieving smooth, professional finishes. They are also essential for sandblasting, offering the necessary force to clean surfaces effectively.

Furthermore, compressed air system is integral to the operation of pneumatic systems, such as air brakes in heavy machinery and equipment. Their reliability and power make them indispensable assets in the construction industry, enhancing productivity and efficiency across a spectrum of applications.

Asia-Pacific Region Dominates the Market and is Expected to Show Steady Growth with a CAGR of 6.1%

The Asia-Pacific dominates the air compressor market share due to the substantial presence of the oil and gas industry in the region. With increasing oil and gas exploration and production activities in the region, there's a heightened demand for air compressors to power essential operations such as gas compression, processing facilities, and pneumatic tools. According to the International Energy Agency report, Asia Pacific supply 24% of the oil in the total energy supply at a 61% of increasing trend from 2000-2022, 35% of the global share that accounts for 644 million terajoule (TJ).

This demand surge is directly fueled by the industry's need to optimize production efficiency, minimize downtime, and ensure compliance with safety regulations. As a result, manufacturers are ramping up production to meet these specific requirements, thereby driving growth of the market across the Asia Pacific region.

Moreover, the escalating consumption of electricity in countries such as China and India is fueling the demand for compressed air system, especially within power generation facilities. These compressors play a crucial role in turbine control and the operation of pneumatic equipment essential for power generation processes.

As per the findings of the International Energy Agency report, Asia Pacific contributed approximately 14,030,721 gigawatt-hours (GWh) of electricity in 2022, representing a substantial 49% of the global share. This significant contribution underscores the region's reliance on compressed air system to maintain efficient operations and meet the growing demand for electricity.

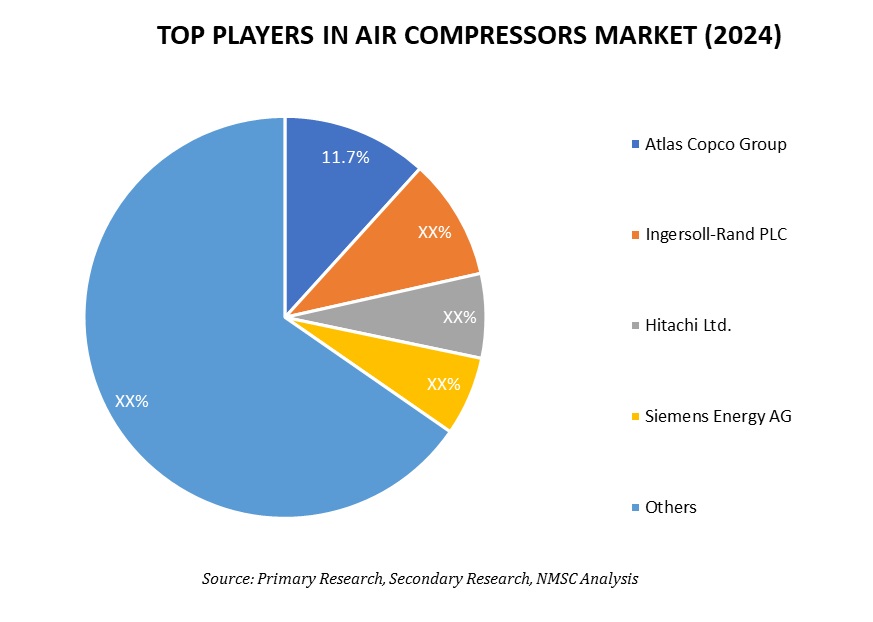

Competitive Landscape

Several key players operating in the air compressor industry includes Atlas Copco Group, Ingersoll-Rand PLC, Hitachi Ltd., Siemens Energy AG, Kaeser Kompressoren, MAT Holding, Inc., Elgi Equipment Limited, Sulzer Ltd., Mitsubishi Heavy Industries, Ltd., Anest Iwata, Doosan Bobcat, U.S. Air Compressor Inc., FS-ELLIOTT Co., LLC., CompAir, FIAC Compressors, Fusheng Group, Schulz Compressors, Eaton Corporation, BOGE Compressors Limited, DXP Enterprises Inc., and others.

These market players are adopting various strategies, including product launches, acquisition, and partnership across various regions to maintain their dominance in the market.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

|

Apr-2024 |

Ingersoll Rand |

Ingersoll Rand launched the Evolution range of air compressors, specifically designed for the Indian market. This new brand of contact cooled rotary screw air compressors includes the N-Series 4-75 kW rotary screw air-compressor that offers advanced features tailored to meet industry requirements. |

|

|

Apr-2024 |

Hitachi |

Hitachi acquired Mountain Air Compressor Incorporated to provide the sales and service of compressed air system, air treatment products, accessories, and related equipment. This acquisition is part of Hitachi Global Air Power's strategy to serve its customers and establish a presence in the Tennessee valley that caters the mining, lumber, pharmaceutical, and chemical industry customers. |

|

|

Mar-2024 |

Atlas Copco |

Atlas Copco Industrial Air launched the GA 11-30 FLX, their first dual-speed compressor, that is also their most energy-efficient fixed-speed compressor. This innovative product uses up to 20% less energy compared to traditional fixed-speed compressors that significantly reduces start-up peak, unload power, and transient losses. |

|

|

Feb-2024 |

ELGi Equipment |

ELGi Equipment launched its PG 550-215 trolley-mounted portable screw air compressor in India. The PG 550-215 is designed to enhance performance, reliability, and profitability for customers in construction and mining, featuring a 3-stage air filtration system and an integrated control panel for optimal performance, safety, and driller-friendly operations. |

|

|

Dec-2023 |

Kaeser |

Kaeser launched a new oil-free compression rotary screw compressor, the CSG.1 series, tailored for specialized engineering applications such as pharmaceuticals and chemical manufacturing. These compressors offer air flow rates from 4 to 15 cubic meters per minute and pressures up to 11 bar. |

|

|

Nov-2023 |

Siemens Energy |

Siemens Energy collaborated with Corre Energy for the deployment of multiday Compressed Air Energy Storage (CAES) technology in North America. This partnership builds on an existing strong relationship between the companies and support Corre Energy's expansion into North America, including a 280-megawatt CAES project in West Texas. |

|

|

June 2023 |

Atlas Copco |

Atlas Copco launched its first battery-driven portable screw compressor, the B-Air 185-12, that is a significant development towards a low carbon future in the global industrial marketplace. The B-Air 185-12 features 5-12 bar of pressure, a stable flow rate of 5.4-3.7 m3/min, and a 55-kWh battery storage capacity. |

Air Compressor Market Key Segments

By Type

-

Portable

-

Stationary

By Technology

-

Rotary Screw

-

Centrifugal

-

Reciprocating

By Lubrication Type

-

Oil-Free

-

Oil-Injected/Flooded

By Power Rating

-

0-100 kW

-

101-300 kW

-

301-500 kW

-

501 kW & Above

By Cooling Method

-

Air Cooled

-

Water Cooled

By Industry Vertical

-

Manufacturing

-

Construction

-

Oil & Gas

-

Healthcare

-

Others

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

Atlas Copco Group

-

Ingersoll-Rand PLC

-

Hitachi Ltd.

-

Siemens Energy AG

-

Kaeser Kompressoren

-

MAT Holding, Inc.

-

Elgi Equipment Limited

-

Sulzer Ltd.

-

Mitsubishi Heavy Industries, Ltd.

-

Anest Iwata

-

Doosan Bobcat

-

U.S. Air Compressor Inc.

-

FS-ELLIOTT Co., LLC.

-

CompAir

-

FIAC Compressors

-

Fusheng Group

-

Schulz Compressors

-

Eaton Corporation

-

BOGE Compressors Limited

-

DXP Enterprises Inc.

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 25.94 Billion |

|

Revenue Forecast in 2030 |

USD 35.34 Billion |

|

Growth Rate |

CAGR of 4.9% from 2025 to 2030 |

|

Market Volume in 2024 |

11 Million Units |

|

Volume Forecast in 2030 |

19 Million Units |

|

Volume Growth Rate |

CAGR of 8.3% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

20 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst