Aluminium Powders, Pastes, and Flakes Market by Product Type (Aluminium Powders, Aluminium Pastes, and Aluminium Flakes), by End-Use Industry (Transport, Consumer Goods, Machinery & Equipment, Construction, Foil and Packaging, Electrical Engineering, and Others), Distribution Channel (Direct Sales, Retailers, and E-commerce)– Global Opportunity Analysis and Industry Forecast 2024-2030

Industry: Materials and Chemical | Publish Date: 02-Mar-2024 | No of Pages: 321 | No. of Tables: 225 | No. of Figures: 190 | Format: PDF | Report Code : N/A

US Tariff Impact on Aluminium Powders, Pastes, and Flakes Market

Trump Tariffs Are Reshaping Global Business

Market Overview

The global Aluminium Powders, Pastes, and Flakes Market size was valued at USD 5.51 billion in 2023 and is predicted to reach USD 8.79 billion by 2030 with a CAGR of 6.2% from 2024-2030.

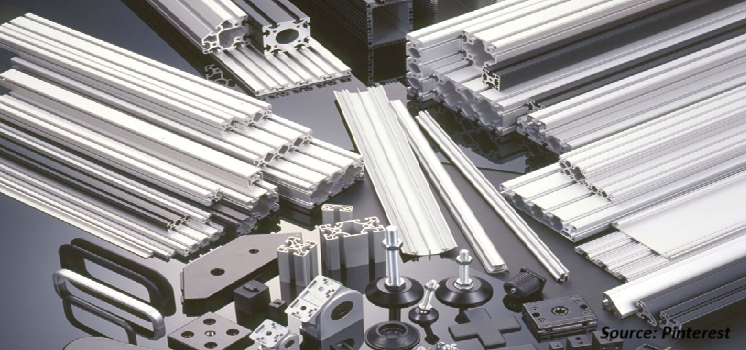

Aluminium powders, pastes, and flakes are finely divided forms of aluminum metal, characterized by their small particle size and diverse applications across various industries. These materials are produced through processes such as atomization, grinding, or milling, resulting in particles with specific shapes and sizes.

They possess unique properties including lightweight, high conductivity, corrosion resistance, and reflectivity, making them valuable in a wide range of applications such as additive manufacturing, surface coating, metallurgy, chemical synthesis, and pyrotechnics. They are utilized as raw materials or additives in the production of paints, coatings, explosives, automotive parts, electronics, and construction materials, among others.

Market Dynamics and Trends

The growing adoption of aluminium powders, pastes, and flakes in automotive paints and coatings attributed to their role in enhancing metallic effects, gloss, and durability, serves as a significant driver for the growth of the aluminium powders, pastes, and flakes market.

As the global automotive sector experiences expansion, the demand for automotive paints and coatings rises in tandem. As per the Association of European Automobile Manufacturers, global motor vehicle production reached 85.4 million units in 2022, marking a notable 5.7% increase from the preceding year, 2021. This surge underscores the growing reliance on automotive finishes, further fueling the demand for aluminium powders, pastes, and flakes.

Moreover, the increasing demand for aluminium powders and flakes within the global construction industry, particularly for applications in concrete reinforcement and thermal insulation, serves as a significant driver for the growth of the market. Aluminium flakes are applied in concrete mixtures to enhance the strength, durability, and resistance to cracking.

While, aluminium powders are also employed in thermal insulation materials to enhance their heat-reflective characteristics, thereby promoting energy efficiency in buildings. As construction industry expands worldwide, the demand for aluminum-based materials escalates in parallel, underscoring their essential role in various construction applications.

However, the high initial cost required for setting up and operating facilities for manufacturing and processing of aluminium powders, pastes and flakes presents a significant restrain for the market. This significant upfront cost can deter potential market entrants and limit the expansion of existing manufacturers, particularly smaller companies or startups.On the contrary, the emerging field of green energy technologies, that utilizes aluminium powder to produce hydrogen fuel cells, is expected to create opportunities for the market in the coming years. Aluminium powder can be utilized in the fabrication of certain catalysts or electrode materials employed within the fuel cell assembly process. This shift towards green energy technologies could open up new avenues for the utilization of aluminium powders, thereby fueling market expansion in the future.

Market Segmentations and Scope of the Study

The aluminium powders, pastes, and flakes market is segmented on the basis of product type, particle size, end-use industry, distribution channel, and region. On the basis of product type, the market is segmented into aluminium powders, aluminium pastes, and aluminium flakes. On the basis of the end-use industry, the market is divided into transport, consumer goods, machinery & equipment, construction, foil and packaging, electrical engineering, and others. On the basis of distribution channels, the market is distributed into direct sales, retailers, and e-commerce. The regional breakdown includes regions such as North America, Europe, Asia-Pacific, and the Rest of the World (RoW).

Geographical Analysis

Asia-Pacific holds the dominant share of the aluminium flakes, paste, and powder market and is expected to continue its dominance during the forecast period. This is attributed to extensive usage of aluminium paste in various stages of solar cell production for enhancing their efficiency and performance.

As per the report by Environmental Progress in 2023, the International Energy Agency (IEA) predicts that China will maintain its leading position in solar energy production, accounting for over 50 percent of solar photovoltaic (PV) projects globally by the end of 2024. This growing trend in the solar energy sector positions the Asia-Pacific region as a key growth hub for the aluminum-based materials market.

Moreover, the growth of the aluminium powders, pastes, and flakes market in the Asia-Pacific region is propelled by the increasing utilization of these materials within the region's chemical industry, spanning across countries including China and India. This preference is attributed to the range of benefits associated with aluminum-based products, such as enhanced strength, corrosion resistance, and superior thermal conductivity.

As China continues to maintain its dominating role in the global chemical sector, the demand for aluminum powders, pastes, and flakes is poised to witness a corresponding upsurge in this region. Notably, data from the European Chemical Industry Council for 2023 underscores China's significant dominance in global chemical sales, commanding over 40% of the market share, equivalent to approximately USD 2,641 billion. This robust presence within the global chemical market underscores China's pivotal role in driving the demand for the aluminum powders, pastes, and flakes market in the region.

On the other hand, in the North-American region, the aluminium powder, paste and flakes market is steadily growing, fueled by the rising utilization of aluminium powder within additive manufacturing (AM) industry in the U.S. With the U.S. holding a prominent position as a global leader in the AM industry, the demand for aluminium powder has witnessed a notable upswing in the region.

This trend is further accentuated by the continuous stream of innovations within the AM players. Notably, in November 2023, ADDiTEC's launch of two new additive manufacturing platforms serves as a prime example of such advancements. These developments not only signify the ongoing evolution within the AM industry but also underscore the significant impact on the growth of the market in the region.

Also, the expansion of the aluminium powders, pastes, and flakes market in North America is significantly driven by their expanding utilization in the production of automotive components. This trend is primarily fueled by the automotive industry's strategic shift towards employing aluminum-based materials to achieve weight reduction goals, consequently enhancing fuel efficiency and overall vehicle performance.

Subsequently, the surge in vehicle production across North America, propelled by rapid technological advancements, accelerates the growth of the market in the region. Notably, data from INEGI reveals a substantial increase in domestic sales of new light vehicles, with figures indicating a 24.4% increase in 2023 compared to 2022, reaching over 1.36 million units sold. This increase in vehicle production underscores the pivotal role of aluminum-based materials in meeting the evolving demands of the automotive industry, thereby driving the growth of the market in North America.

Competitive Landscape

Various market players operating in the aluminium powders, pastes, and flakes market include Alcoa Corporation, ECKART GmbH, Metal Powder Company Ltd. (MEPCO), Zhangqiu Metallic Pigment Co. Ltd, Henan Yuanyang Co. Ltd, VALIMET, Inc., Kymera International, Hunan Ningxiang Jiweixin New Material Co., Ltd., Toyal Group, and Hunan Goldhorse Metal Material Co., Ltd. These manufacturers and suppliers continue to adopt various market development strategies including product launches and others to maintain their dominance in the aluminium powders, pastes, and flakes market.

For instance, in February 2024, Kymera International took over most of the assets of Royal Metal Powders, a company known for producing finely powdered metals such as copper, brass, bronze, nickel/silver, tin, and aluminum. This acquisition strengthens Kymera's status as a financially robust and rapidly expanding provider of specialized materials for niche markets.

Moreover, in November 2023, Zhangqiu Metallic Pigment Co. Ltd., introduced a new product, Silver Rocket in 2023, which is a colored aluminium paste. This pigment is coated with iron oxide on the surface of aluminium sheets, providing high hiding power and color vibrancy. The product offers excellent weather resistance, low conductivity, better opacity, and is comparable to German products.

Key Benefits

-

The report provides quantitative analysis and estimations of the aluminium powders, pastes, and flakes market from 2024 to 2030, which assists in identifying the prevailing market opportunities.

-

The study comprises a deep-dive analysis of the aluminium powders, pastes, and flakes market including the current and future trends to depict prevalent investment pockets in the market.

-

Information related to key drivers, restraints, and opportunities and their impact on the aluminium powders, pastes, and flakes market is provided in the report.

-

Competitive analysis of the players, along with their market share is provided in the report.

-

SWOT analysis and Porter's Five Forces model is elaborated in the study.

-

Value chain analysis in the market study provides a clear picture of the roles of stakeholders.

Key Market Segments

By Product Type

-

Aluminium Powders

-

Aluminium Pastes

-

Aluminium Flakes

By End-Use Industry

-

Transport

-

Consumer Goods

-

Machinery & Equipment

-

Construction

-

Foil and Packaging

-

Electrical Engineering

-

Others.

By Distribution Channel

-

Direct Sales

-

Retailers

-

E-commerce

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Vietnam

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 5.51 Billion |

|

Revenue Forecast in 2030 |

USD 8.79 Billion |

|

Growth Rate |

CAGR of 6.2% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

KEY PLAYERS

-

Alcoa Corporation

-

ECKART GmbH

-

Metal Powder Company Ltd. (MEPCO)

-

Zhangqiu Metallic Pigment Co. Ltd

-

Henan Yuanyang Co. Ltd

-

VALIMET, Inc.

-

Kymera International

-

Hunan Ningxiang Jiweixin New Material Co., Ltd.

-

Toyal Group

-

Hunan Goldhorse Metal Material Co., Ltd.

Speak to Our Analyst

Speak to Our Analyst