Automotive Aluminium Market by Product Type (Aluminium Alloys, Slab, Coil, Rolled Product, Ingot, and Others), Vehicle Type (Commercial and Passenger), by Application (Body Panels, Structural Parts, Wheel Hub, Engine, and Others) – Global Opportunity Analysis and Industry Forecast 2025-2030

US Tariff Impact on Automotive Aluminium Market

Trump Tariffs Are Reshaping Global Business

Automotive Aluminium Market Overview

The global Automotive Aluminium Market size was valued at USD 74.34 billion in 2024 and is predicted to reach USD 87.13 billion by 2030, with a CAGR of 2.7% from 2025-2030.

The rise in vehicle adoption in the entire world boost the growth of the automotive aluminium market as aluminium are used for various application when the vehicle is being manufactured. However, the presence of alternative materials slows down the overall growth of the market. On the contrary, the advancement in aluminium including engineered plastics is anticipated to create future opportunity for the market.

Additionally, the various market players operating in the market are as Alcoa Corporation and Rio Tinto among others are adopting various business strategies including acquisition and partnership to maintain their market presence and expand their product offering. As the technologies expand, the market is on the way to expand its reach as engineered plastics offer sustainability and durability without compromising the vehicles performance and safety standards.

Rapidly Growing Automotive Industry Globally Fuels the Market Growth

The expanding automotive landscape across the globe, accompanied by the increasing of automotive aluminium market demand for lightweight vehicles, drives aluminium to give fuel efficiency and conform to stringent emission standards. The quest is further intensified by the aim for lighter vehicles without compromising strength and safety, which only serves to increase the demand for aluminium in that particular metier. In 2023, a total of around 93 million vehicles were produced in 40 countries, including China, the U.S., India, and Japan, an increase of 9.4% over 2022 levels, according to figures reported by the International Organisation of Motor Vehicle Manufacturers.

Increased Use of Aluminium for Vehicle Parts Fuels Market Growth

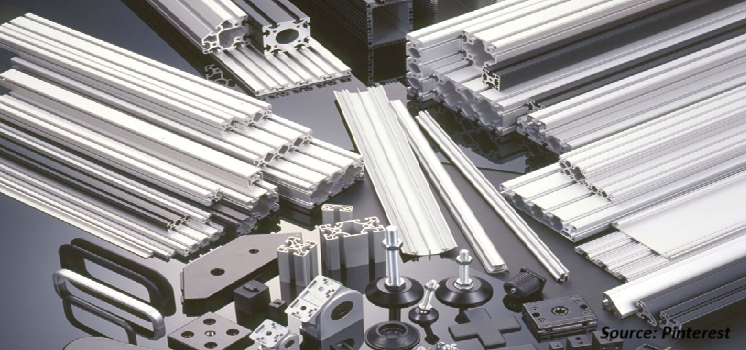

Increased use of aluminium to manufacture vehicle parts fuels the automotive aluminium industry as automobile makers put aluminium to use in engine parts, body panels, chassis, and wheels. This is due to its lightweight properties coupled with strength. This is due to its lightweight properties coupled with strength. The flexibility of transforming alloys into aluminium creates a wider application as they are applied in sustainable and efficient solutions in the vehicle production.

Strict Regulations to Reduce Environmental Impact Drives Market Growth

The strict regulations to reduce environmental impact globally drives manufacturers to adopt advanced materials including aluminium in vehicle production. Aluminium reduces vehicle weight and leads to lower fuel consumption and decreased carbon emissions.

According to a report by the United Nations, more than 140 countries including highly polluted China, the U.S., India, and the EU, take account for 88 percent of global emissions, have enacted net-zero targets. Further, more than 9,000 companies, 1,000 cities, 1,000 educational institutions, and 600 financial institutions joined the Race to Zero and committed to halving global emissions by the year 2030. These global practices toward sustainability and fierce emission regulations keep driving the automotive industry to increasingly adopt aluminium which substantiates its improving environmental performance.

Presence of Alternative Materials Hinders Market Growth

The presence of alternative materials such as carbon fiber and advanced composites hinders the growth of the market as they are utilized in vehicle manufacturing due to their superior strength-to-weight ratios and potential for enhanced performance.

Engineered Aluminium Creates Future Opportunity for the Market Growth

The engineered aluminium is anticipated to create future opportunity for the market as it offers enhanced properties designed for specific applications. Its lightweight yet strong characteristics make it ideal for various industries, including automotive and aerospace, where performance and efficiency are important.

Market Segmentation and Scope of the Study

The automotive aluminium market report is segmented on the basis of product type, vehicle type, application, and region. On the basis of product type, the market is segmented into aluminium alloys, slab, coil, rolled product, ingot, and others. On the basis of vehicle type, the market is bifurcated into commercial and passenger. On the basis of application, the market is divided into body panels, structural parts, wheel hub, engine, and others. Regional breakdown and analysis of each of the aforesaid segments include regions comprising North America, Europe, Asia-Pacific, and RoW.

Geographical Analysis

Asia-Pacific holds the dominant automotive aluminium market share and is projected to maintain its dominance throughout the forecast period. This is attributed to the presence of the largest automotive industry in the countries such as China, India and Japan that produces modernized and light weight vehicles that drives the demand for advanced materials including aluminium to improve the overall performance of the vehicle.

As per the World Population Review, the production of vehicles among countries such as China, Japan and India reached 27 million, 7.8 million and 5.5 million in the year 2022. This surge in vehicle production drives the demand for the aluminium to enhance the vehicle efficiency fuelling of the automotive aluminium market growth.

The government support for electric vehicles (EVs) increases the need for aluminium, which is used in battery enclosures and support structures. Aluminium's good thermal conductivity is ideal for heat dissipation in battery systems. The Indian government has started the PM E-Drive scheme for electric buses with an investment of 520 million USD. Such schemes and large investment plans in India, which specifically promote the aluminium that goes into making electric vehicles, reflect a demand for aluminium in the race towards sustainable transportation.

On the other hand, North America region is expected to show a steady rise in the automotive aluminium market. The growing usage of aluminium in car components to achieve fuel efficiency along with meeting tough emission requirements leads to higher aluminium consumption because of its lightweight characteristics. The Aluminium Association report states that aluminium content per vehicle is rising, with an expected gain of 56 pounds from 2020 to 2025 and nearly 100 pounds by 2030, totalling 550 pounds.

Moreover, the presence of key players such as Alcoa Corporation and Novelis Inc. among others, are adopting numerous business tactics such as product launch that in turn boost the growth of the market in this region. For instance, in September 2022, Alcoa Corporation launched two innovative alloys, the A210 ExtruStron, a high-strength 6000 series alloy suitable for lightweight applications, and the C611 EZCast, designed for automotive megacasting without the need for heat treatment. These developments increase the market's capacity and facilitate its growth.

Competitive Landscape

The automotive aluminium industry comprises of various key players such as Alcoa Corporation, Hindalco Industries Limited, Rio Tinto, Aluminium Corporation of China Ltd, United Company RUSAL PLC, Norsk Hydro ASA, UACJ Corporation, Emirates Global Aluminium, Vedanta Aluminium & Power, Arconic, Inc., and others. These companies are adopting various strategies including acquisition, partnership and business expansion to stay competitive and maintain their market positions.

In May 2024, the company strengthened its role as a major bauxite and alumina producer by acquiring Alumina Limited. It aimed to improve operational efficiency and lessen dependency on suppliers.

In February 2023, Rio Tinto teamed up with BMW Group to create sustainable aluminium car parts by merging Rio Tinto's aluminium techniques with BMW's designs.

In June 2022, Hindalco Industries Limited opened a new aluminium extrusion plant in India to meet rising demand for extruded aluminium products in western and southern India.

Key Benefits

-

The report provides quantitative analysis and estimations of the automotive aluminium market from 2025 to 2030, which assists in identifying the prevailing market opportunities.

-

The study comprises a deep dive analysis of the current and future automotive aluminium market trends to depict prevalent investment pockets in the industry.

-

Information related to key drivers, restraints, and opportunities and their impact on the automotive aluminium market is provided in the report.

-

Competitive analysis of the players, along with their market share is provided in the report.

-

SWOT analysis and Porters Five Forces model is elaborated in the study.

-

Value chain analysis in the market study provides a clear picture of roles of stakeholders.

Automotive Aluminium Market Key Segments

By Product Type

-

Aluminium Alloys

-

Slab

-

Coil

-

Rolled Product

-

Ingot

-

Others

By Vehicle Type

-

Commercial

-

Passenger

By Application

-

Body Panels

-

Structural Parts

-

Wheel Hub

-

Engine

-

Others

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

Alcoa Corporation

-

Hindalco Industries Limited

-

Rio Tinto

-

Aluminium Corporation of China Ltd

-

United Company RUSAL PLC

-

Norsk Hydro ASA

-

UACJ Corporation

-

Emirates Global Aluminium

-

Vedanta Aluminium & Power

-

Arconic, Inc.

-

AMG ALUMINIUM

-

Constellium N.V.

-

Kaiser Aluminium

-

YK LONGSHUN Aluminium

-

Jindal Aluminium

REPORT SCOPE AND SEGMENTATION

|

Parameters |

Details |

|

Market Size in 2024 |

USD 74.34 billion |

|

Revenue Forecast in 2030 |

USD 87.13 billion |

|

Growth Rate |

CAGR of 2.7% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst