Europe Aluminium Market by Product Type (Flat-Rolled, Castings, Extrusions, Forgings, Powder & Paste, and Other Types), by Type (Primary and Secondary), and by End-User Industry (Transport, Consumer Goods, Machinery & Equipment, Construction, Foil & Packaging, Electrical Engineering, and Others) – Opportunity Analysis and Industry Forecast, 2024–2030

Industry: Materials and Chemical | Publish Date: 20-Mar-2025 | No of Pages: 214 | No. of Tables: 151 | No. of Figures: 96 | Format: PDF | Report Code : MC1343

US Tariff Impact on Europe Aluminium Market

Trump Tariffs Are Reshaping Global Business

Europe Aluminium Market Overview

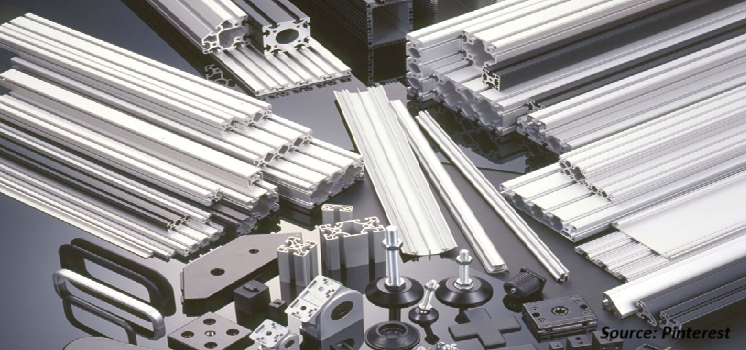

The Europe Aluminium Market size was valued at USD 54.59 billion in 2023, and is predicted to reach USD 71.27 billion by 2030, at a CAGR of 3.9% from 2024 to 2030. The aluminum market includes the industry involved in the production, distribution, and use of aluminum, a lightweight, silvery-white metal. Aluminum constitutes about 8% of the Earth's crust and is known for its low density, high strength, and natural corrosion resistance due to an oxide layer. These features make it highly useful in sectors such as aerospace, automotive, construction, packaging, and electronics. Its low weight is especially beneficial for improving efficiency in transportation. The production process involves extracting aluminum from bauxite ore using the Bayer process and electrolysis.Advances in technology and recycling have improved the environmental sustainability of production, supporting industry growth.

High Aluminum Recycling Rate Boosts Market Growth in Europe

The high recycling rate of aluminum in Europe significantly influences the market by providing a steady supply of recycled material. This is due to the region's strong commitment to sustainability and circular economy practices. Since recycling aluminum uses less energy compared to primary production, it lowers carbon emissions and supports the region's environmental goals. This efficient recycling process conserves resources and ensures a steady supply of recycled aluminum for various industries. As environmental responsibility becomes increasingly prioritized, reliance on recycled aluminum grows, reducing the demand for primary production and further supporting the expansion of the aluminum market across Europe.

Growing Automotive and Renewable Energy Sectors Drive Aluminum Market Growth

The automotive and increasing focus on renewable energy are significantly driving the growth of the aluminum market in the region. The automotive sector's demand for aluminum is rising due to its lightweight properties, which enhance fuel efficiency and support environmental sustainability goals. Concurrently, the emphasis on renewable energy sources, such as wind and solar power, is contributing to Europe aluminium market expansion. The European Union has set ambitious targets to increase its renewable energy share to 20% by 2020 and 32% by 2030, according to the International Renewable Energy Agency. This commitment to renewable energy and the automotive industry's growth are boosting aluminum demand, as aluminum is essential in manufacturing renewable energy infrastructure and automotive components.

Environmental and Regulatory Constraints Hinders the Growth of Aluminium Market

The Europe aluminium market report encounters significant challenges due to environmental regulations and sustainability requirements. These include emissions control, waste management, and energy efficiency standards, that increases operational costs for some producers. Meeting stringent emissions standards, adhering to waste management rules, and achieving energy efficiency goals often requires considerable investment and effort. These measures aim to reduce environmental impact by minimizing emissions, managing waste responsibly, and enhancing energy efficiency. While crucial for promoting a greener and more sustainable industry, these regulations also add to the overall costs and complexities of aluminum production.

Sustainable Packaging Creates Future Opportunities

The growing focus on sustainable packaging is expected to provide significant growth opportunities for the aluminium market in the future. Aluminium is ideal for packaging applications such as cans, bottles, and foils due to its recyclability and ability to preserve product quality and freshness. Eco-conscious consumers and brands looking to reduce their environmental impact increasingly choose aluminium as a preferred packaging material. By selecting aluminium, they help reduce waste and support sustainability, aligning with their commitment to a greener future. This rising demand for sustainable packaging solutions is a key driver of the Europe aluminium market growth.

Germany Holds the Dominant Market Share in Europe Aluminium Market

The machinery and equipment manufacturing sector significantly drives the Europe aluminium market demand due to its reliance on aluminum for various applications. Technological advancements, automation, and the need for lightweight yet durable machinery contribute to this demand. In 2022, Germany emerged as the leading importer of aluminum in Europe, with imports reaching 45 million metric tons, according to the International Trade Administration. The high demand for aluminum within this sector accelerates market growth and highlights the sector's crucial role in boosting the aluminum market.

Moreover, the expanding automotive industry in Germany is a major factor driving the aluminum market. This growth is driven by the industry's emphasis on lightweighting to improve fuel efficiency and meet stringent emissions standards. Leading automotive manufacturers, including Volkswagen, BMW, Mercedes-Benz, and Audi, prioritize the use of aluminum to reduce vehicle weight while maintaining safety and performance. This focus on aluminum as a critical material for advanced vehicle design further accelerates the demand for aluminum in the market.

Norway to Witness Substantial Growth in the Europe Aluminium Market

The aluminum industry benefits greatly from access to abundant natural resources, including hydroelectric power and bauxite. These resources are critical for aluminum production, providing both clean, renewable energy and essential raw materials. Hydroelectric power, being a sustainable and efficient energy source, supports a more environmentally friendly production process. Meanwhile, bauxite reserves ensure a steady supply of raw material for aluminum manufacturing. This advantageous resource availability significantly enhances the aluminum export capacity.

The focus on renewable energy, particularly hydroelectric power, plays a crucial role in advancing the aluminum industry by making production processes more sustainable. Hydroelectricity, as a clean and abundant energy source, not only reduces the carbon footprint associated with aluminum production but also lowers operational costs due to its efficiency and reliability. This sustainable energy approach positions the aluminum industry favorably against other energy-intensive industries that rely on fossil fuels, offering a distinct competitive advantage in the global market.

Competitive Landscape

Several key players operating in the Europe aluminium industry include Norsk Hydro ASA, Constellium SE, AMAG Austria Metall, TRIMET France, RusAL, Aludium,Impol Group, ElvalHalcor Hellenic Copper and Aluminium Industry S.A., Granges AB, Alro S.A, ProfilGruppen AB, Eural Gnutti S.p.A., Aluminiumwerk Unna AG, Hammerer Aluminium Industries, Group Baux and others.

Europe Aluminium Market Key Segments

By Product Type

-

Flat-Rolled

-

Castings

-

Extrusions

-

Forgings

-

Powder & Paste

-

Other Types

By Type

-

Primary

-

Secondary

By End-User Industry

-

Transportation

-

Aerospace

-

Automotive

-

Marine

-

-

Consumer Goods

-

Machinery & Equipment

-

Construction

-

Packaging

- Food & Beverage

- Cosmetics

- Others

-

Electrical Engineering

-

Others

By Country

-

The U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherland

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

Key Players

-

Norsk Hydro ASA

-

Constellium SE

-

AMAG Austria Metall

-

TRIMET France

-

RusAL

-

Aludium

-

Impol Group

-

ElvalHalcor Hellenic Copper and Aluminium Industry S.A.

-

Granges AB

-

Alro S.A

-

ProfilGruppen AB

-

Eural Gnutti S.p.A.

-

Aluminiumwerk Unna AG

-

Hammerer Aluminium Industries

-

Group Baux

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 54.59 Billion |

|

Revenue Forecast in 2030 |

USD 71.27 Billion |

|

Growth Rate |

CAGR of 3.9% from 2024 to 2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

12 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst